|

Appendices

Estimated Insured Deposits and the Deposit Insurance Fund,

A. Key Statistics

FDIC EXPENDITURES 2001 – 2010

|

|

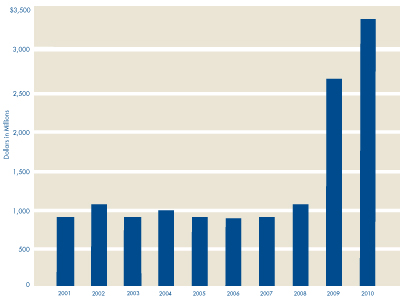

The FDIC's Strategic Plan and Annual

Performance Plan provide the basis for annual

planning and budgeting for needed resources. The

2010 aggregate budget (for corporate, receivership,

and investment spending) was $4.0 billion, while

actual expenditures for the year were $3.4 billion,

about $1.1 billion more than 2009 expenditures.

Over the past decade, the FDIC's expenditures

have varied in response to workload. During the

last two years, expenditures have risen, largely due

to increasing resolution and receivership activity.

To a lesser extent, increased expenses have resulted

from supervision-related costs associated with the

oversight of more troubled institutions.

Estimated Insured Deposits and the Deposit Insurance Fund, December 31, 1934, through December 31, 2010

Dollars in Millions (except Insurance Coverage)

|

|

Deposits

in

Insured

Institutions

|

|

Insurance

Fund

as

a

Percentage

of

|

| Year

|

Insurance

Coverage

1 |

Total

Domestic

Deposits

|

Est.

Insured

Deposits

2 |

Percentage

of

Insured

Deposits

|

Deposit

Insurance

Fund

|

Total

Domestic

Deposits

|

Est.

Insured

Deposits

|

2010

2009

2008

2007

2006

2005 |

$250,000

250,000

100,000

100,000

100,000

100,000 |

$7,887,730

7,705,329

7,505,409

6,921,678

6,640,097

6,229,823 |

$6,221,127

5,407,733

4,750,783

4,292,211

4,153,808

3,891,000 |

78.9

70.2

63.3

62.0

62.6

62.5 |

$(7,352.2)

(20,861.8)

17,276.3

52,413.0

50,165.3

48,596.6 |

(0.09)

(0.27)

0.23

0.76

0.76

0.78 |

(0.12)

(0.39)

0.36

1.22

1.21

1.25 |

2004

2003

2002

2001

2000 |

100,000

100,000

100,000

100,000

100,000 |

5,724,775

5,224,030

4,916,200

4,565,068

4,211,895 |

3,622,213

3,452,606

3,383,720

3,216,585

3,055,108 |

63.3

66.1

68.8

70.5

72.5 |

47,506.8

46,022.3

43,797.0

41,373.8

41,733.8 |

0.83

0.88

0.89

0.91

0.99 |

1.31

1.33

1.29

1.29

1.37 |

1999

1998

1997

1996

1995 |

100,000

100,000

100,000

100,000

100,000 |

3,885,826

3,817,150

3,602,189

3,454,556

3,318,595 |

2,869,208

2,850,452

2,746,477

2,690,439

2,663,873 |

73.8

74.7

76.2

77.9

80.3 |

39,694.9

39,452.1

37,660.8

35,742.8

28,811.5 |

1.02

1.03

1.05

1.03

0.87 |

1.38

1.38

1.37

1.33

1.08 |

1994

1993

1992

1991

1990 |

100,000

100,000

100,000

100,000

100,000 |

3,184,410

3,220,302

3,275,530

3,331,312

3,415,464 |

2,588,619

2,602,781

2,677,709

2,733,387

2,784,838 |

81.3

80.8

81.7

82.1

81.5 |

23,784.5

14,277.3

178.4

(6,934.0)

4,062.7 |

0.75

0.44

0.01

(0.21)

0.12 |

0.92

0.55

0.01

(0.25)

0.15 |

1989

1988

1987

1986

1985 |

100,000

100,000

100,000

100,000

100,000 |

3,412,503

2,337,080

2,198,648

2,162,687

1,975,030 |

2,755,471

1,756,771

1,657,291

1,636,915

1,510,496 |

80.7

75.2

75.4

75.7

76.5 |

13,209.5

14,061.1

18,301.8

18,253.3

17,956.9 |

0.39

0.60

0.83

0.84

0.91 |

0.48

0.80

1.10

1.12

1.19 |

1984

1983

1982

1981

1980 |

100,000

100,000

100,000

100,000

100,000 |

1,805,334

1,690,576

1,544,697

1,409,322

1,324,463 |

1,393,421

1,268,332

1,134,221

988,898

948,717 |

77.2

75.0

73.4

70.2

71.6 |

16,529.4

15,429.1

13,770.9

12,246.1

11,019.5 |

0.92

0.91

0.89

0.87

0.83 |

1.19

1.22

1.21

1.24

1.16 |

1979

1978

1977

1976

1975 |

40,000

40,000

40,000

40,000

40,000 |

$1,226,943

1,145,835

1,050,435

941,923

875,985 |

$808,555

760,706

692,533

628,263

569,101 |

65.9

66.4

65.9

66.7

65.0 |

$9,792.7

8,796.0

7,992.8

7,268.8

6,716.0 |

0.80

0.77

0.76

0.77

0.77 |

1.21

1.16

1.15

1.16

1.18 |

1974

1973

1972

1971

1970 |

40,000

20,000

20,000

20,000

20,000 |

833,277

766,509

697,480

610,685

545,198 |

520,309

465,600

419,756

374,568

349,581 |

62.4

60.7

60.2

61.3

64.1 |

6,124.2

5,615.3

5,158.7

4,739.9

4,379.6 |

0.73

0.73

0.74

0.78

0.80 |

1.18

1.21

1.23

1.27

1.25 |

1969

1968

1967

1966

1965 |

10,000

10,000

10,000

10,000

10,000 |

495,858

491,513

448,709

401,096

377,400 |

313,085

296,701

261,149

234,150

209,690 |

63.1

60.4

58.2

58.4

55.6 |

4,051.1

3,749.2

3,485.5

3,252.0

3,036.3 |

0.82

0.76

0.78

0.81

0.80 |

1.29

1.26

1.33

1.39

1.45 |

1964

1963

1962

1961

1960 |

10,000

10,000

10,000

10,000

10,000 |

348,981

313,304

297,548

281,304

260,495 |

191,787

177,381

170,210

160,309

149,684 |

55.0

56.6

57.0

57.0

57.5 |

2,844.7

2,667.9

2,502.0

2,353.8

2,222.2 |

0.82

0.85

0.84

0.84

0.85 |

1.48

1.50

1.47

1.47

1.48 |

1959

1958

1957

1956

1955 |

10,000

10,000

10,000

10,000

10,000 |

247,589

242,445

225,507

219,393

212,226 |

142,131

137,698

127,055

121,008

116,380 |

57.4

56.8

56.3

55.2

54.8 |

2,089.8

1,965.4

1,850.5

1,742.1

1,639.6 |

0.84

0.81

0.82

0.79

0.77 |

1.47

1.43

1.46

1.44

1.41 |

1954

1953

1952

1951

1950 |

10,000

10,000

10,000

10,000

10,000 |

203,195

193,466

188,142

178,540

167,818 |

110,973

105,610

101,841

96,713

91,359 |

54.6

54.6

54.1

54.2

54.4 |

1,542.7

1,450.7

1,363.5

1,282.2

1,243.9 |

0.76

0.75

0.72

0.72

0.74 |

1.39

1.37

1.34

1.33

1.36 |

1949

1948

1947

1946

1945 |

5,000

5,000

5,000

5,000

5,000 |

156,786

153,454

154,096

148,458

157,174 |

76,589

75,320

76,254

73,759

67,021 |

48.8

49.1

49.5

49.7

42.6 |

1,203.9

1,065.9

1,006.1

1,058.5

929.2 |

0.77

0.69

0.65

0.71

0.59 |

1.57

1.42

1.32

1.44

1.39 |

1944

1943

1942

1941

1940 |

5,000

5,000

5,000

5,000

5,000 |

134,662

111,650

89,869

71,209

65,288 |

56,398

48,440

32,837

28,249

26,638 |

41.9

43.4

36.5

39.7

40.8 |

804.3

703.1

616.9

553.5

496.0 |

0.60

0.63

0.69

0.78

0.76 |

1.43

1.45

1.88

1.96

1.86 |

1939

1938

1937

1936

1935 |

5,000

5,000

5,000

5,000

5,000 |

57,485

50,791

48,228

50,281

45,125 |

24,650

23,121

22,557

22,330

20,158 |

42.9

45.5

46.8

44.4

44.7 |

452.7

420.5

383.1

343.4

306.0 |

0.79

0.83

0.79

0.68

0.68 |

1.84

1.82

1.70

1.54

1.52 |

1934

|

5,000

|

40,060 |

18,075 |

45.1 |

291.7 |

0.73 |

1.61 |

- The Dodd-Frank Wall Street Reform and

Consumer Protection Act

(Dodd-Frank Act) temporarily provides unlimited

coverage for noninterest-bearing transaction accounts for two years

beginning December 31, 2010. Coverage limits do

not reflect temporary increases authorized by the Emergency Economic

Stabilization Act of 2008. Coverage for certain

retirement accounts increased to $250,000 in 2006. Initial coverage

limit was $2,500 from January 1 to June 30, 1934. back

- Beginning in

the

fourth

quarter

of

2010,

estimates

of

insured

deposits

include

the

Dodd-Frank

Act

temporary

unlimited

coverage

for

noninterest-bearing

transaction

accounts.

Prior

to

1989,

figures

are

for

the

Bank

Insurance

Fund

(BIF) only and exclude insured branches of foreign banks. For 1989 to

2005, figures represent sum of the BIF and

Savings Association Insurance Fund (SAIF) amounts; for 2006 to 2010,

figures are for DIF. Amounts for 1989 - 2010

include insured branches of foreign banks. Prior to year-end 1991,

insured deposits were estimated using percentages

determined from June Call and Thrift Financial Reports. back

Income and Expenses, Deposit Insurance Fund, from Beginning

of Operations, September 11, 1933, through December 31, 2010

Dollars in Millions

|

Income

|

Expenses

and

Losses

|

| Year

|

Total

|

Assessment

Income

|

Assessment

Credits

|

Investment

and

Other

|

Effective

Assessment

Rate

1 |

Total

|

Provision

for

Ins.

Losses

|

Administrative

and

Operating

Expenses

2 |

Interest

&

Other

Ins.

Expenses

|

Funding

Transfer

from

the

FSLIC

Resolution

Fund

|

Net

Income/

(Loss)

|

| Total |

$155,776.5 |

$101,879.8 |

$11,391.8 |

$65,877.3 |

|

$164,345.5 |

$134,894.6 |

$19,731.5 |

$9,719.4 |

$139.5

|

$(8,429.5)

|

| 2010

2009 2008 2007 2006

2005 |

13,379.9

24,706.4

7,306.3

3,196.2

2,643.5

2,420.5

|

13,611.2

17,865.4

4,410.4

3,730.9

31.9

60.9 |

0.8

148.0 1,445.9 3,088.0

0.0

0.0 |

(230.5)

6,989.0

4,341.8

2,553.3

2,611.6

2,359.6

|

0.1772%

0.2330%

0.0418%

0.0093%

0.0005%

0.0010%

|

75.0

60,709.0

44,339.5

1,090.9

904.3

809.3 |

(847.8)

57,711.8

41,838.8

95.0

(52.1)

(160.2) |

1,592.6

1,271.1

1,033.5

992.6

950.6

965.7 |

(669.8)

1,726.1

1,467.2

3.3

5.8

3.8 |

0

0

0

0

0

0 |

13,304.9

(36,002.6)

(37,033.2)

2,105.3

1,739.2

1,611.2

|

| 2004

2003 2002 2001 2000 |

2,240.3

2,173.6

1,795.9

2,730.1

2,570.1

|

104.2

94.8

107.8

83.2

64.3 |

0.0

0.0

0.0

0.0

0.0 |

2,136.1

2,078.8

2,276.9

2,646.9

2,505.8

|

0.0019%

0.0019%

0.0023%

0.0019%

0.0016%

|

607.6

(67.7) 719.6

3,123.4 945.2 |

(353.4)

(1,010.5)

(243.0)

2,199.3

28.0

|

941.3

935.5

945.1

887.9

883.9 |

19.7

7.3

17.5

36.2

33.3 |

0

0

0

0

0

|

1,632.7

2,241.3

1,076.3

(393.3)

1,624.9

|

| 1999

1998 1997 1996 1995 |

2,416.7

2,584.6

2,165.5

7,156.8

5,229.2

|

48.4

37.0

38.6

5,294.2

3,877.0 |

0.0

0.0

0.0

0.0

0.0 |

2,368.3

2,547.6

2,126.9

1,862.6

1,352.2

|

0.0013%

0.0010%

0.0011%

0.1622%

0.1238%

|

2,047.0

817.5

247.3

353.6

202.2

|

1,199.7

(5.7)

(505.7)

(417.2)

(354.2)

|

823.4

782.6

677.2

568.3

510.6 |

23.9

40.6

75.8

202.5

45.8 |

0

0

0

0

0 |

369.7

1,767.1

1,918.2

6,803.2

5,027.0 |

| 1994

1993 1992 1991 1990 |

7,682.1

7,354.5

6,479.3

5,886.5

3,855.3

|

6,722.7

6,682.0

5,758.6

5,254.0

2,872.3

|

0.0

0.0

0.0

0.0

0.0 |

959.4

672.5

720.7

632.5

983.0 |

0.2192%

0.2157%

0.1815%

0.1613%

0.0868%

|

(1,825.1)

(6,744.4)

(596.8)

16,925.3

13,059.3

|

(2,459.4)

(7,660.4)

(2,274.7)

15,496.2

12,133.1

|

443.2

418.5

614.8 3

326.1

275.6 |

191.1

497.5 1,063.1

1,103.0 650.6 |

0

0

35.4

42.4

56.1 |

9,507.2

14,098.9

7,111.5

(10,996.4)

(9,147.9)

|

| 1989

1988 1987 1986 1985 |

3,496.6

3,347.7

3,319.4

3,260.1

3,385.5

|

1,885.0

1,773.0

1,696.0

1,516.9

1,433.5

|

0.0

0.0

0.0

0.0

0.0 |

1,611.6

1,574.7

1,623.4

1,743.2

1,952.0

|

0.0816%

0.0825%

0.0833%

0.0787%

0.0815%

|

4,352.2

7,588.4

3,270.9

2,963.7

1,957.9

|

3,811.3

6,298.3

2,996.9

2,827.7

1,569.0

|

219.9

223.9

204.9

180.3

179.2 |

321.0

1,066.2

69.1

(44.3)

209.7 |

5.6

0

0

0

0 |

(850.0)

(4,240.7)

48.5

296.4

1,427.6

|

| 1984

1983 1982 1981 1980 |

3,099.5

2,628.1

2,524.6

2,074.7

1,310.4

|

1,321.5

1,214.9

1,108.9

1,039.0

951.9

|

0.0

164.0

96.2

117.1

521.1 |

1,778.0

1,577.2

1,511.9

1,152.8

879.6

|

0.0800%

0.0714%

0.0769%

0.0714%

0.0370%

|

1,999.2

969.9

999.8

848.1

83.6 |

1,633.4

675.1

126.4

320.4

(38.1) |

151.2

135.7

129.9

127.2

118.2 |

214.6

159.1 743.5 400.5

3.5 |

0

0

0

0

0 |

1,100.3

1,658.2

1,524.8

1,226.6

1,226.8

|

| 1979

1978 1977 1976 1975 |

1,090.4

952.1

837.8

764.9

689.3 |

881.0

810.1

731.3

676.1

641.3 |

524.6

443.1

411.9

379.6

362.4 |

734.0

585.1

518.4

468.4

410.4 |

0.0333%

0.0385%

0.0370%

0.0370%

0.0357% |

93.7

148.9

113.6

212.3

97.5 |

(17.2)

36.5

20.8

28.0

27.6 |

106.8

103.3

89.3

180.4 4

67.7 |

4.1

9.1

3.5

3.9

2.2 |

0

0

0

0

0 |

996.7

803.2

724.2

552.6

591.8 |

| 1974

1973 1972 1971 1970 |

668.1

561.0

467.0

415.3

382.7 |

587.4

529.4

468.8

417.2

369.3 |

285.4

283.4

280.3

241.4

210.0 |

366.1

315.0

278.5

239.5

223.4 |

0.0435%

0.0385%

0.0333%

0.0345%

0.0357% |

159.2

108.2

65.7

60.3

46.0 |

97.9

52.5

10.1

13.4

3.8 |

59.2

54.4

49.6

46.9

42.2 |

2.1

1.3

6.0 5

0.0

0.0 |

0

0

0

0

0 |

508.9

452.8

401.3

355.0

336.7 |

| 1969

1968 1967 1966 1965 |

335.8

295.0

263.0

241.0

214.6 |

364.2

334.5

303.1

284.3

260.5 |

220.2

202.1

182.4

172.6

158.3 |

191.8

162.6

142.3

129.3

112.4 |

0.0333%

0.0333%

0.0333%

0.0323%

0.0323% |

34.5

29.1

27.3

19.9

22.9 |

1.0

0.1

2.9

0.1

5.2 |

33.5

29.0

24.4

19.8

17.7 |

0.0

0.0

0.0

0.0

0.0 |

0

0

0

0

0 |

301.3

265.9

235.7

221.1

191.7 |

| 1964

1963 1962 1961 1960 |

197.1

181.9

161.1

147.3

144.6 |

238.2

220.6

203.4

188.9

180.4 |

145.2

136.4

126.9

115.5

100.8 |

104.1

97.7

84.6

73.9

65.0 |

0.0323%

0.0313%

0.0313%

0.0323%

0.0370% |

18.4

15.1

13.8

14.8

12.5 |

2.9

0.7

0.1

1.6

0.1 |

15.5

14.4

13.7

13.2

12.4 |

0.0

0.0

0.0

0.0

0.0 |

0

0

0

0

0 |

178.7

166.8

147.3

132.5

132.1 |

| 1959

1958 1957 1956 1955 |

136.5

126.8

117.3

111.9

105.8 |

178.2

166.8

159.3

155.5

151.5 |

99.6

93.0

90.2

87.3

85.4 |

57.9

53.0

48.2

43.7

39.7 |

0.0370%

0.0370%

0.0357%

0.0370%

0.0370% |

12.1

11.6

9.7

9.4

9.0 |

0.2

0.0

0.1

0.3

0.3 |

11.9

11.6

9.6

9.1

8.7 |

0.0

0.0

0.0

0.0

0.0 |

0

0

0

0

0 |

124.4

115.2

107.6

102.5

96.8 |

| 1954

1953 1952 1951 1950 |

99.7

94.2

88.6

83.5

84.8 |

144.2

138.7

131.0

124.3

122.9 |

81.8

78.5

73.7

70.0

68.7 |

37.3

34.0

31.3

29.2

30.6 |

0.0357%

0.0357%

0.0370%

0.0370%

0.0370% |

7.8

7.3

7.8

6.6

7.8 |

0.1

0.1

0.8

0.0

1.4 |

7.7

7.2

7.0

6.6

6.4 |

0.0

0.0

0.0

0.0

0.0 |

0

0

0

0

0 |

91.9

86.9

80.8

76.9

77.0 |

| 1949

1948 1947 1946 1945 |

151.1

145.6

157.5

130.7

121.0 |

122.7

119.3

114.4

107.0

93.7 |

0.0

0.0

0.0

0.0

0.0 |

28.4

26.3

43.1

23.7

27.3 |

0.0833%

0.0833%

0.0833%

0.0833%

0.0833% |

6.4

7.0

9.9

10.0

9.4 |

0.3

0.7

0.1

0.1

0.1 |

6.1

6.3 6

9.8

9.9

9.3 |

0.0

0.0

0.0

0.0

0.0 |

0

0

0

0

0 |

144.7

138.6

147.6

120.7

111.6 |

| 1944

1943 1942 1941 1940 |

99.3

86.6

69.1

62.0

55.9 |

80.9

70.0

56.5

51.4

46.2 |

0.0

0.0

0.0

0.0

0.0 |

18.4

16.6

12.6

10.6

9.7 |

0.0833%

0.0833%

0.0833%

0.0833%

0.0833% |

9.3

9.8

10.1

10.1

12.9

|

0.1

0.2

0.5

0.6

3.5 |

9.2

9.6

9.6

9.5

9.4 |

0.0

0.0

0.0

0.0

0.0 |

0

0

0

0

0 |

90.0

76.8

59.0

51.9

43.0 |

| 1939

1938 1937 1936 1935

1933-34 |

51.2

47.7

48.2

43.8

20.8

7.0 |

40.7

38.3

38.8

35.6

11.5

0.0 |

0.0

0.0

0.0

0.0

0.0

0.0

|

10.5

9.4

9.4

8.2

9.3

7.0 |

0.0833%

0.0833%

0.0833%

0.0833%

0.0833%

N/A |

16.4

11.3

12.2

10.9

11.3

10.0 |

7.2

2.5

3.7

2.6

2.8

0.2 |

9.2

8.8

8.5

8.3

8.5

9.8 |

0.0

0.0

0.0

0.0

0.0

0.0

|

0

0

0

0

0

0

|

34.8

36.4

36.0

32.9

9.5

(3.0)

|

- Figures represent only BIF-insured

institutions prior to 1990, BIF- and

SAIF-insured institutions from 1990 through 2005, and DIF-insured

institutions beginning in 2006. After 1995, all thrift closings became

the reponsibility of the FDIC and amounts are reflected in the SAIF.

The effective assessment rate is calculated from annual assessment

income (net of assessment credits), excluding transfers to the

Financing

Corporation (FICO), Resolution Funding Corporation (REFCORP) and FSLIC

Resolution Fund, divided by the four quarter average

assessment base. The effective rates from 1950 through 1984 varied from

the statutory rate of 0.0833 percent due to assessment credits provided

in those years. The statutory rate increased to 0.12 percent in 1990

and to a minimum of 0.15 percent in 1991. The effective rates in 1991

and

1992 varied because the FDIC exercised new authority to increase

assessments above the statutory minimum rate when needed. Beginning in

1993, the effective rate was based on a risk-related premium system

under which institutions paid assessments in the range of 0.23 percent

to

0.31 percent. In May 1995, the BIF reached the mandatory

recapitalization level of 1.25 percent. As a result, BIF assessment

rates were reduced

to a range of 0.04 percent to 0.31 percent of assessable deposits,

effective June 1995, and assessments totaling $1.5 billion were

refunded in

September 1995. Assessment rates for the BIF were lowered again to a

range of 0 to 0.27 percent of assessable deposits, effective the start

of

1996. In 1996, the SAIF collected a one-time special assessment of $4.5

billion. Subsequently, assessment rates for the SAIF were lowered

to the same range as the BIF, effective October 1996. This range of

rates remained unchanged for both funds through 2006. As part of the

implementation of the Federal Deposit Insurance Reform Act of 2005,

assessment rates were increased to a range of 0.05 percent to 0.43

percent

of assessable deposits effective at the start of 2007, but many

institutions received a one-time assessment credit ($4.7 billion in

total) to offset the

new assessments. On December 16, 2008, the FDIC Board of Directors (the

“Board”) adopted a final rule to temporarily increase assessment

rates for the first quarter of 2009 to a range of 0.12 percent to 0.50

percent of assessable deposits. On February 27, 2009, the Board adopted

a

final rule effective April 1, 2009, setting initial base assessment

rates to a range of 0.12 percent to 0.45 percent of assessable

deposits. On June

30, 2009, a special assessment was imposed on all insured banks and

thrifts, which amounted in aggregate to approximately $5.4 billion. For

8,106 institutions, with $9.3 trillion in assets, the special

assessment was 5 basis points of each institution’s assets minus tier

one capital; 89 other

institutions, with assets of $4.0 trillion, had their special

asssessment capped at 10 basis points of their second quarter

assessment base. back

- These expenses, which

are presented as operating expenses in the Statement of Income and Fund

Balance, pertain to the FDIC in its corporate

capacity only and do not include costs that are charged to the failed

bank receiverships that are managed by the FDIC. The receivership

expenses

are presented as part of the “Receivables from Resolutions, net” line

on the Balance Sheet. The narrative and graph presented in the

“Corporate

Planning and Budget” section of this report (page 132) show the

aggregate (corporate and receivership) expenditures of the FDIC. back

- Includes $210 million

for the cumulative effect of an accounting change for certain

postretirement benefits.back

- Includes a $106 million

net loss on government securities. back

- This amount represents

interest and other insurance expenses from 1933 to 1972. back

- Includes the aggregate

amount of $81 million of interest paid on capital stock between 1933

and 1948. back

Number, Assets, Deposits, Losses, and Loss To Funds of Insured

Thrifts Taken Over or Closed Because of Financial Difficulties,

1989 Through 19951

Dollars in Thousands

| Year

|

Total

|

Assets

|

Deposits

|

Estimated

Receivership

Loss2 |

Loss

to

Funds3 |

| Total |

748 |

$393,986,574

|

$317,501,978

|

$75,318,843

|

$81,580,645

|

1995

1994

1993

1992

1991

1990

1989 4 |

2

2

10

59

144

213

318 |

423,819

136,815

6,147,962

44,196,946

78,898,904

129,662,498

134,519,630 |

414,692

127,508

4,881,461

34,773,224

65,173,122

98,963,962

113,168,009 |

28,192

11,472

267,595

3,234,883

8,627,894

16,063,762

47,085,045 |

27,750

14,599

65,212

3,780,121

9,126,190

19,258,655

49,308,118 |

- Beginning in 1989 through July 1, 1995, all

thrift closings

were the responsibility of the Resolution Trust Corporation

(RTC). Since the RTC was terminated on December 31, 1995, and all

assets and liabilities transferred to the FSLIC

Resolution Fund (FRF), all the results of the thrift closing activity

from 1989 through 1995 are now reflected on FRF’s

books. Year is the year of failure, not the year of resolution. back

- The estimated losses

represent the projected loss at the fund level from receiverships for

unreimbursed subrogated claims

of the FRF and unpaid advances to receiverships from the FRF. back

- The Loss to Funds

represents the total resolution cost of the failed thrifts in the

FRF-RTC fund, which includes

corporate revenue and expense items such as interest expense on Federal

Financing Bank debt, interest expense on

escrowed funds, and interest revenue on advances to receiverships, in

addition to the estimated losses for receiverships. back

- Total for 1989 excludes

nine failures of the former FSLIC. back

FDIC-Insured Institutions Closed During 2010

Dollars in Thousands

| Name

and

Location |

Bank

Class

|

Number

of Deposit

Accounts

|

Total

Assets1

|

Total

Deposits1 |

Insured

Deposit Funding

and Other

Disbursements

|

Estimated

Loss to

the DIF2 |

Date

of

Closing or

Acquisition

|

Receiver/Assuming

Bank

and Location |

Purchase and Assumption - All Deposits

|

Bank of Leeton

Leeton, MO

|

NM

|

1,662

|

$20,128

|

$20,335

|

$20,091

|

$9,046

|

01/22/10

|

Sunflower Bank, N.A.

Salina, KS

|

Citizens Bank Trust Company of Chicago

Chicago, IL

|

NM

|

2,259

|

$73,490

|

$74,519 |

$71,552

|

$42,861

|

04/23/10

|

Republic Bank of Chicago

Oak Brook, IL

|

The Bank of Bonifay

Bonifay, FL

|

NM

|

10,577

|

$242,871

|

$230,190 |

$225,391

|

$78,605

|

05/07/10

|

First Federal Bank of Florida

Lake City, FL

|

Towne Bank of Arizona

Mesa, AZ

|

NM

|

1,018

|

$120,246

|

$113,243

|

$98,547

|

$44,096

|

05/07/10 |

Commerce Bank of Arizona

Tucson, AZ

|

First National Bank

Savannah, GA

|

N

|

3,856

|

$252,520

|

$231,857

|

$211,261

|

$93,989

|

06/25/10

|

The Savannah Bank, N.A.

Savannah, GA

|

The Gordon Bank

Gordon, GA

|

NM

|

2,548

|

$29,259

|

$26,867

|

$29,273

|

$8,882

|

10/22/10

|

Morris Bank

Dublin, GA

|

Whole Bank Purchase and Assumption - All Deposits

|

Horizon Bank

Bellingham, WA

|

NM

|

39,716

|

$1,188,956

|

$1,049,063

|

$1,040,135

|

$383,684

|

01/08/10

|

Washington FS&LA

Seattle, WA

|

St. Stephen State Bank

St. Stephen, MN

|

NM

|

2,347

|

$22,895

|

$23,912

|

$23,371

|

$12,197

|

01/15/10

|

First State Bank of St. Joseph

St. Joseph, MN

|

Town Community Bank & Trust

Antioch, IL

|

NM

|

1,717

|

$70,758

|

$68,323

|

$69,557

|

$26,642

|

01/15/10

|

First American Bank

Elk Grove Village, IL

|

Evergreen Bank

Seattle, WA

|

NM

|

11,116

|

$395,980

|

$340,378 |

$315,121

|

$109,168

|

01/22/10

|

Umpqua Bank

Roseburg, OR

|

Premier American Bank

Miami, FL

|

NM

|

4,865

|

$299,225

|

$285,554

|

$268,053

|

$112,344

|

01/22/10

|

Premier American Bank, N.A.

Miami, FL

|

Charter Bank

Santa Fe, NM

|

SB

|

19,945

|

$1,201,922

|

$859,933

|

$821,503

|

$246,120

|

01/22/10

|

Charter Bank

Albuquerque, NM

|

Columbia River Bank

The Dalles, OR

|

NM

|

49,744

|

$955,112

|

$908,132

|

$891,998

|

$167,875

|

01/22/10

|

Columbia State Bank

Tacoma, WA

|

First Regional Bank

Los Angeles, CA

|

NM

|

17,633

|

$2,082,684

|

$1,664,450

|

$1,540,091

|

$545,163

|

01/29/10

|

First-Citizens Bank & Trust Company

Raleigh, NC

|

American Marine Bank

Bainbridge Island, WA

|

NM

|

22,622

|

$329,246

|

$287,443

|

$269,735

|

$81,369

|

01/29/10

|

Columbia State Bank

Tacoma, WA

|

First National Bank of Georgia

Carrollton, GA

|

N

|

49,467

|

$840,633

|

$780,196

|

$751,253

|

$197,132

|

01/29/10

|

Community & Southern Bank

Carrollton, GA

|

Community Bank and Trust

Cornelia, GA

|

NM

|

99,016

|

$1,181,717

|

$1,067,957

|

$1,020,389 |

$363,060

|

01/29/10

|

SCBT, N.A.

Orangeburg, SC

|

Florida Community Bank

Immokalee, FL

|

NM

|

25,340

|

$835,701

|

$776,556

|

$794,414

|

$331,055

|

01/29/10

|

Premier American Bank, N.A.

Miami, FL |

Marshall Bank National Association

Hallock, MN

|

N

|

3,837

|

$58,566

|

$55,662

|

$49,297

|

$14,524

|

01/29/10

|

United Valley Bank

Cavalier, ND |

1st American State Bank of Minnesota

Hancock, MN

|

NM

|

1,375

|

$18,155

|

$16,327

|

$14,452

|

$5,042

|

02/05/10

|

Community Development

Bank, FSB

Ogema, MN

|

George Washington Savings Bank

Orland Park, IL

|

SI

|

15,015

|

$413,673

|

$395,310

|

$398,398

|

$91,528

|

02/19/10

|

FirstMerit Bank, N.A.

Akron, OH

|

La Jolla Bank, FSB

La Jolla, CA |

SB

|

43,243

|

$3,646,071

|

$2,799,362

|

$2,879,761

|

$1,035,182

|

02/19/10

|

OneWest Bank, FSB

Pasadena, CA

|

The La Coste National Bank

La Coste, TX |

N

|

3,052

|

$53,936

|

$49,275

|

$49,068

|

$3,684

|

02/19/10

|

Community National Bank

Hondo, TX

|

Marco Community Bank

Marco Island, FL

|

SM |

4,326

|

$119,578

|

$117,097

|

$120,435

|

$33,844

|

02/19/10

|

Mutual of Omaha Bank

Omaha, NE

|

Carson River Community Bank

Carson City, NV

|

NM

|

937 |

$51,095

|

$50,024

|

$51,024

|

$19,057 |

02/26/10

|

Heritage Bank of Nevada

Reno, NV

|

Rainier Pacific Bank

Tacoma, WA

|

SI

|

38,259

|

$717,806

|

$446,192

|

$429,154

|

$184,644

|

02/26/10

|

Umpqua Bank

Roseburg, OR

|

Bank of Illinois

Normal, IL

|

SM

|

8,050

|

$211,711

|

$198,487

|

$185,977

|

$41,856

|

03/05/10

|

Heartland Bank and Trust

Company

Bloomington, IL |

Sun American Bank

Boca Raton, FL

|

SM

|

9,845

|

$535,724

|

$443,481

|

$438,042

|

$149,588

|

03/05/10

|

First-Citizens Bank & Trust

Company

Raleigh, NC

|

LibertyPointe Bank

New York, NY

|

NM |

4,809

|

$216,500

|

$209,477

|

$198,442

|

$39,489

|

03/11/10

|

Valley National Bank

Wayne, NJ

|

The Park Avenue Bank

New York, NY

|

NM |

8,771

|

$520,146

|

$494,505

|

$477,584

|

$107,539

|

03/12/10

|

Valley National Bank

Wayne, NJ

|

Statewide Bank

Covington, LA

|

NM |

9,696

|

$243,215

|

$207,821

|

$206,074

|

$59,955

|

03/12/10

|

Home Bank

Lafayette, LA

|

Old Southern Bank

Orlando, FL

|

SM

|

6,110

|

$336,390

|

$319,746

|

$328,893

|

$87,984

|

03/12/10

|

Centennial Bank

Conway, AR

|

Century Security Bank

Duluth, GA

|

NM |

1,256 |

$96,535

|

$93,967

|

$95,230

|

$39,269

|

03/19/10 |

Bank of Upson

Thomaston, GA

|

Appalachian Community Bank

Ellijay, GA

|

NM |

40,289

|

$1,010,075

|

$917,575

|

$924,510

|

$309,652

|

03/19/10

|

Community & Southern Bank

Carrollton, GA

|

American National Bank

Parma, OH

|

N

|

1,173

|

$70,318

|

$66,752

|

$67,496 |

$26,511

|

03/19/10

|

The National Bank & Trust

Company

Wilmington, OH

|

Bank of Hiawassee

Hiawassee, GA

|

NM |

17,119

|

$377,779

|

$339,597

|

$329,792

|

$116,484

|

03/19/10 |

Citizens South Bank

Gastonia, NC

|

State Bank of Aurora

Aurora, MN

|

NM |

2,641

|

$27,801

|

$28,159

|

$26,502 |

$8,693

|

03/19/10

|

Northern State Bank

Ashland, WI

|

First Lowndes Bank

Fort Deposit, AL

|

NM |

8,621

|

$137,175

|

$131,117

|

$122,594

|

$35,314

|

03/19/10

|

First Citizens Bank

Luverne, AL

|

Desert Hills Bank

Phoenix, AZ

|

NM |

9,393

|

$496,552

|

$426,473

|

$410,763

|

$108,310 |

03/26/10

|

New York Community Bank

Westbury, NY

|

Key West Bank

Key West, FL

|

SB |

1,477

|

$88,031

|

$67,662 |

$76,254

|

$25,370

|

03/26/10

|

Centennial Bank

Conway, AR

|

McIntosh Commercial Bank

Carrollton, GA

|

NM |

7,785

|

$363,405

|

$343,339 |

$315,912

|

$141,844

|

03/26/10

|

CharterBank

West Point, GA

|

Unity National Bank

Cartersville, GA

|

N

|

13,028

|

$300,590

|

$264,286

|

$244,923

|

$70,961

|

03/26/10

|

Bank of the Ozarks

Little Rock, AR

|

Beach First National Bank

Myrtle Beach, SC

|

N |

12,329

|

$590,024

|

$516,026

|

$518,344

|

$119,396

|

04/09/10

|

Bank of North Carolina

Thomasville, NC

|

AmericanFirst Bank

Clermont, FL

|

NM

|

2,684

|

$104,034

|

$81,887

|

$92,563

|

$19,084

|

04/16/10

|

TD Bank, N.A.

Wilmington, DE

|

Butler Bank

Lowell, MA |

SI

|

8,010

|

$245,534

|

$233,222

|

$225,408

|

$27,738

|

04/16/10 |

People’s United Bank

Bridgeport, CT

|

City Bank

Lynwood, WA

|

NM

|

26,952

|

$981,913

|

$1,020,494

|

$903,819

|

$264,329

|

04/16/10

|

Whidbey Island Bank

Coupeville, WA

|

First Federal Bank of

North Florida

Palatka, FL

|

SB

|

16,768

|

$440,122

|

$324,198 |

$371,552

|

$13,095

|

04/16/10

|

TD Bank, N.A.

Wilmington, DE

|

Innovative Bank

Oakland, CA

|

NM

|

4,349 |

$266,816

|

$225,241

|

$211,111

|

$44,817

|

04/16/10

|

Center Bank

Los Angeles, CA |

Riverside National Bank of

Florida

Fort Pierce, FL

|

N

|

235,048

|

$3,393,818

|

$2,724,623

|

$2,861,518

|

$605,501

|

04/16/10

|

TD Bank, N.A.

Wilmington, DE

|

Tamalpais Bank

San Rafael, CA

|

NM

|

12,006

|

$611,504

|

$487,582

|

$462,814

|

$76,525

|

04/16/10

|

Union Bank, N.A.

San Francisco, CA

|

Amcore Bank, N.A.

Rockford, IL

|

N

|

154,667

|

$3,066,240

|

$3,421,194

|

$2,774,842

|

$320,947

|

04/23/10

|

Harris National Association

Chicago, IL

|

Broadway Bank

Chicago, IL

|

NM |

8,086

|

$1,059,194

|

$1,113,959

|

$1,021,203

|

$391,357

|

04/23/10

|

MB Financial Bank, N.A.

Chicago, IL

|

Lincoln Park Savings Bank

Chicago,IL

|

SI

|

11,153

|

$194,618

|

$162,627

|

$162,662

|

$52,020

|

04/23/10

|

Northbrook Bank and Trust Company

Northbrook, IL

|

New Century Bank

Chicago, IL

|

NM

|

6,612

|

$447,239

|

$492,046

|

$427,045

|

$125,868

|

04/23/10

|

MB Financial Bank, N.A.

Chicago, IL

|

Peotone Bank and Trust

Company

Peotone, IL

|

NM

|

8,405 |

$130,165

|

$124,676

|

$124,317

|

$46,514

|

04/23/10

|

First Midwest Bank

Itasca, IL

|

Wheatland Bank

Naperville, IL

|

NM

|

8,011 |

$441,694

|

$438,502

|

$445,153

|

$136,915

|

04/23/10

|

Wheaton Bank and Trust

Wheaton, IL |

BC National Bank

Butler, MO

|

N

|

3,382

|

$52,204

|

$43,635

|

$40,180

|

$15,798

|

04/30/10

|

Community First Bank

Butler, MO

|

CF Bancorp

Port Huron, MI |

SI

|

73,727

|

$1,599,122

|

$1,418,445 |

$1,732,557

|

$487,779

|

04/30/10

|

First Michigan Bank

Troy, MI

|

Champion Bank

Creve Coeur, MO

|

NM

|

4,242

|

$195,510

|

$153,763

|

$160,292

|

$68,999

|

04/30/10

|

BankLiberty

Liberty, MO

|

Frontier Bank

Everett, WA

|

NM |

96,539 |

$3,250,734

|

$2,846,886

|

$2,759,290

|

$1,096,211 |

04/30/10

|

Union Bank, N.A.

San Francisco, CA

|

Eurobank

San Juan, PR |

NM |

23,521

|

$2,453,138

|

$1,970,724 |

$2,313,651

|

$1,187,775

|

04/30/10 |

Oriental Bank and Trust

San Juan, PR

|

R-G Premier Bank of Puerto

Rico

Hato Rey, PR

|

NM

|

325,495 |

$5,681,177

|

$4,220,108

|

$5,496,730

|

$1,455,166

|

04/30/10

|

Scotiabank de Puerto Rico

San Juan, PR |

Westernbank Puerto Rico

Mayaguez, PR

|

NM

|

302,338

|

$10,797,345

|

$8,619,969

|

$10,274,407

|

$4,249,644

|

04/30/10 |

Banco Popular de Puerto

Rico

San Juan, PR

|

1st Pacific Bank of

California

San Diego, CA

|

SM

|

4,299

|

$335,798

|

$291,173

|

$267,981

|

$80,457

|

05/07/10

|

City National Bank

Los Angeles, CA

|

Access Bank

Champlin, MN

|

NM

|

1,602

|

$31,996

|

$31,969

|

$29,681

|

$8,644

|

05/07/10 |

Prinsbank

Prinsburg, MN

|

Midwest Bank and Trust

Company

Elmwood Park, IL

|

SM

|

78,283

|

$3,172,915

|

$2,420,738

|

$2,265,630

|

$221,301

|

05/14/10 |

FirstMerit Bank, N.A.

Akron, OH

|

New Liberty Bank

Plymouth, MI

|

NM

|

3,125

|

$111,239

|

$101,884

|

$99,290

|

$28,640

|

05/14/10 |

Bank of Ann Arbor

Ann Arbor, MI

|

Satilla Community Bank

Saint Marys, GA

|

NM

|

2,348

|

$135,688

|

$134,005

|

$122,425

|

$32,822

|

05/14/10

|

Ameris Bank

Moultrie, GA

|

Southwest Community Bank

Springfield, MO

|

NM |

1,505

|

$100,659

|

$102,463

|

$97,449

|

$32,114

|

05/14/10

|

Simmons First National Bank

Pine Bluff, AR

|

Pinehurst Bank

St. Paul, MN

|

NM |

1,597

|

$61,215

|

$58,288

|

$54,630

|

$11,474

|

05/21/10

|

Coulee Bank

La Crosse, WI

|

Bank of Florida–Southeast

Ft. Lauderdale, FL

|

NM |

7,333

|

$595,318

|

$531,752

|

$477,614

|

$77,586

|

05/28/10

|

Everbank

Jacksonville, FL

|

Bank of Florida–Southwest

Naples, FL

|

NM |

11,061

|

$640,894

|

$559,897

|

$567,536

|

$106,905

|

05/28/10

|

Everbank

Jacksonville, FL

|

Bank of Florida–Tampa Bay

Tampa, FL

|

NM |

2,628

|

$240,513

|

$224,024

|

$244,489

|

$40,273

|

05/28/10

|

Everbank

Jacksonville, FL

|

Granite Community Bank

Granite Bay, CA

|

N

|

2,920

|

$102,913

|

$94,252

|

$94,825

|

$21,447

|

05/28/10

|

Tri Counties Bank

Chico, CA

|

Sun West Bank

Las Vegas, NV

|

NM |

6,753

|

$360,662

|

$353,943

|

$331,949

|

$96,693

|

05/28/10

|

City National Bank

Los Angeles, CA

|

First National Bank

Rosedale, MS

|

N

|

2,122

|

$60,449

|

$63,483

|

$72,828

|

$25,123

|

06/04/10

|

The Jefferson Bank

Fayette, MS

|

TierOne Bank

Lincoln, NE

|

SB

|

176,888

|

$2,824,737

|

$2,185,817

|

$1,897,433

|

$313,755

|

06/04/10

|

Great Western Bank

Sioux Falls, SD

|

Washington First International Bank

Seattle, WA

|

NM

|

10,035

|

$520,887

|

$441,362

|

$396,237

|

$136,118

|

06/11/10

|

East West Bank

Pasadena, CA

|

Nevada Security Bank

Reno, NV

|

NM |

9,846

|

$492,491

|

$479,759

|

$475,638

|

$87,810

|

06/18/10

|

Umpqua Bank

Roseburg, OR |

High Desert State Bank

Albuquerque, NM

|

NM |

2,026

|

$80,343

|

$80,985

|

$73,025

|

$24,829

|

06/25/10

|

First American Bank

Artesia, NM

|

Peninsula Bank

Englewood, FL

|

NM |

13,339

|

$630,179

|

$580,140

|

$605,285

|

$226,929

|

06/25/10

|

Premier American Bank

Miami, FL

|

USA Bank

Port Chester, NY

|

NM |

2,985

|

$190,678

|

$188,644

|

$190,006

|

$65,243

|

07/09/10

|

New Century Bank

Phoenixville, PA

|

Bay National Bank

Lutherville, MD

|

N

|

2,661

|

$217,743

|

$212,612

|

$205,167

|

$23,368

|

07/09/10

|

Bay Bank, FSB

Lutherville, MD

|

Home National Bank

Blackwell, OK

|

N

|

25,726

|

$585,445

|

$514,038

|

$512,769

|

$83,213

|

07/09/10

|

RCB Bank

Claremore, OK

|

Mainstreet Savings Bank, FSB

Hastings, MI

|

SB

|

8,132

|

$96,584

|

$63,291

|

$62,759

|

$15,690

|

07/16/10

|

Commercial Bank

Alma, MI

|

Metro Bank of Dade County

Miami, FL

|

SM

|

8,766

|

$399,441

|

$375,522

|

$369,253

|

$75,556 |

07/16/10

|

NAFH National Bank

Miami, FL

|

Olde Cypress Community Bank

Clewiston, FL

|

SB

|

8,110

|

$161,355

|

$157,997

|

$160,183

|

$38,643

|

07/16/10 |

CenterState Bank of

Florida, N.A.

Winter Haven, FL

|

Turnberry Bank

Aventura, FL

|

SB |

3,888

|

$240,250

|

$179,169

|

$177,459

|

$40,535

|

07/16/10

|

NAFH National Bank

Miami, FL

|

Woodlands Bank

Bluffton, SC

|

SB |

6,554

|

$382,803

|

$364,808

|

$360,454

|

$120,068

|

07/16/10

|

Bank of the Ozarks

Little Rock, AR

|

First National Bank of the South

Spartanburg, SC

|

N

|

20,097

|

$619,374

|

$550,891

|

$540,575

|

$83,037

|

07/16/10

|

NAFH National Bank

Miami, FL

|

Community Security Bank

New Prague, MN

|

NM

|

4,984

|

$100,649

|

$95,100

|

$94,987

|

$21,438

|

07/23/10

|

Roundbank

Waseca, MN

|

Crescent Bank & Trust Company

Jasper, GA

|

NM

|

28,701

|

$970,235

|

$932,809

|

$918,107

|

$279,759

|

07/23/10

|

Renasant Bank

Tupelo, MS

|

Home Valley Bank

Cave Junction, OR

|

SM

|

13,230

|

$250,488

|

$227,935

|

$227,449

|

$44,651

|

07/23/10

|

South Valley Bank & Trust

Klamath Falls, OR

|

Southwest USA Bank

Las Vegas, NV

|

NM

|

2,068

|

$203,690

|

$183,985

|

$178,885

|

$79,904

|

07/23/10

|

Plaza Bank

Irvine, CA

|

Sterling Bank

Lantana, FL

|

SM

|

7,533

|

$354,966

|

$329,541

|

$317,657

|

$54,119

|

07/23/10

|

IBERIABANK

Lafayette, LA

|

Thunder Bank

Sylvan Grove, KS

|

SM

|

1,454 |

$28,248

|

$27,048

|

$25,813

|

$8,007

|

07/23/10

|

The Bennington State Bank

Salina, KS |

Williamsburg First National Bank

Kingstree, SC

|

N

|

8,801

|

$130,411

|

$126,993

|

$117,906

|

$10,103

|

07/23/10

|

First Citizens Bank and Trust

Company, Inc.

Columbia, SC

|

Bayside Savings Bank

Port Saint Joe, FL

|

SB

|

2,191

|

$64,344

|

$52,720

|

$49,891

|

$19,966

|

07/30/10

|

Centennial Bank

Conway, AR

|

Coastal Community Bank

Panama City Beach, FL

|

NM

|

12,152

|

$377,469

|

$370,016

|

$372,707

|

$106,767

|

07/30/10

|

Centennial Bank

Conway, AR

|

Liberty Bank

Eugene, OR

|

NM |

30,465

|

$714,574

|

$692,670

|

$679,600

|

$200,197

|

07/30/10

|

Home Federal Bank

Nampa, ID

|

NorthWest Bank and Trust

Acworth, GA

|

NM |

3,861 |

$160,763

|

$155,531

|

$152,916

|

$39,380

|

07/30/10

|

State Bank and Trust Company

Macon, GA

|

The Cowlitz Bank

Longview, WA

|

NM |

10,709

|

$489,019

|

$474,742

|

$448,186

|

$82,180

|

07/30/10

|

Heritage Bank

Olympia, WA

|

Ravenswood Bank

Chicago, IL

|

NM |

4,472

|

$264,628

|

$269,448

|

$265,043

|

$104,994

|

08/06/10

|

Northbrook Bank and

Trust Company

Northbrook, IL

|

Palos Bank and Trust Company

Palos Heights, IL

|

NM |

26,165

|

$493,391

|

$467,784

|

$462,086

|

$86,611

|

08/13/10

|

First Midwest Bank

Itasca, IL

|

Butte Community Bank

Chico, CA

|

NM |

45,195

|

$498,751

|

$471,256

|

$461,309

|

$34,729

|

08/20/10

|

Rabobank, N.A.

El Centro, CA

|

Community National Bank at Bartow

Bartow, FL

|

N |

2,804

|

$67,918 |

$63,708

|

$60,308

|

$15,429

|

08/20/10

|

CenterState Bank of Florida, N.A.

Winter Haven, FL

|

Imperial Savings & Loan Association

Martinsville, VA

|

SB |

1,363

|

$9,448

|

$10,090

|

$9,374

|

$5,062

|

08/20/10

|

River Community Bank, N.A.

Martinsville, VA

|

Independent National Bank

Ocala, FL

|

N

|

10,146

|

$156,218

|

$141,877

|

$143,569

|

$32,403 |

08/20/10

|

CenterState Bank of Florida, N.A.

Winter Haven, FL

|

Los Padres Bank

Solvang, CA

|

SB

|

22,198

|

$866,459

|

$770,899

|

$754,140

|

$120,143

|

08/20/10

|

Pacific Western Bank

San Diego, CA

|

Pacific State Bank

Stockton, CA

|

SM

|

9,957

|

$312,077

|

$278,832

|

$254,769

|

$38,909

|

08/20/10

|

Rabobank, N.A.

El Centro, CA

|

ShoreBank

Chicago, IL

|

NM |

39,039

|

$2,166,431

|

$1,547,403

|

$2,147,161

|

$570,625

|

08/20/10

|

Urban Partnership Bank

Chicago, IL

|

Sonoma Valley Bank

Sonoma, CA

|

NM

|

12,728

|

$337,113

|

$255,501

|

$251,413

|

$19,076

|

08/20/10

|

Westamerica Bank

San Rafael, CA

|

Horizon Bank

Bradenton, FL

|

SM

|

6,284

|

$187,819

|

$164,594

|

$162,893

|

$68,863

|

09/10/10

|

Bank of the Ozarks

Little Rock, AR

|

Bank of Ellijay

Ellijay, GA

|

NM

|

4,524

|

$168,820

|

$160,718

|

$172,102

|

$60,270

|

09/17/10

|

Community & Southern Bank

Carrollton, GA

|

Bramble Savings Bank

Milford, OH

|

SI

|

1,936

|

$47,523

|

$41,551

|

$41,548

|

$17,588

|

09/17/10

|

Foundation Bank

Cincinnati, OH

|

First Commerce Community Bank

Douglasville, GA

|

NM |

4,173

|

$248,151

|

$242,831

|

$228,416

|

$77,233

|

09/17/10

|

Community & Southern Bank

Carrollton, GA

|

ISN Bank

Cherry Hill, NJ

|

NM

|

1,106

|

$81,564

|

$79,652

|

$76,930

|

$27,799

|

09/17/10

|

New Century Bank

Phoenixville, PA

|

Maritime Savings Bank

West Allis, WI

|

SB |

12,973

|

$350,488

|

$248,134

|

$344,476

|

$105,372

|

09/17/10

|

North Shore Bank, FSB

Brookfield, WI

|

The Peoples Bank

Winder, GA

|

NM

|

24,437

|

$447,185

|

$398,181

|

$373,755

|

$100,169

|

09/17/10

|

Community & Southern Bank

Carrollton, GA

|

Haven Trust Bank Florida

Ponte Vedra Beach, FL

|

NM

|

2,223

|

$148,575

|

$133,561

|

$130,909 |

$36,793

|

09/24/10

|

First Southern Bank

Boca Raton, FL

|

North County Bank

Arlington, WA

|

NM

|

7,602

|

$288,776

|

$276,081

|

$258,513 |

$80,531

|

09/24/10

|

Whidbey Island Bank

Coupeville, WA

|

Shoreline Bank

Shoreline, WA

|

NM

|

4,649

|

$92,980

|

$90,644

|

$90,930

|

$40,381

|

10/01/10

|

GBC International Bank

Los Angeles, CA

|

Wakulla Bank

Crawfordville, FL

|

NM

|

26,383

|

$402,205

|

$367,228

|

$394,803

|

$109,487

|

10/01/10

|

Centennial Bank

Conway, AR

|

Premier Bank

Jefferson City, MO

|

NM |

28,804

|

$989,382

|

$869,367

|

$965,935

|

$404,596

|

10/15/10

|

Providence Bank

Columbia, MO

|

Security Savings Bank

Olathe, KS

|

SA

|

18,336

|

$453,349

|

$347,080

|

$339,787 |

$80,362

|

10/15/10

|

Simmons First National Bank

Pine Bluff, AR

|

Westbridge Bank and Trust

Chesterfield, MO

|

NM

|

1,261

|

$87,782

|

$70,131

|

$67,242

|

$18,588

|

10/15/10

|

Midland States Bank

Effingham, IL

|

First Bank of Jacksonville

Jacksonville, FL

|

NM

|

1,814

|

$73,922

|

$72,198

|

$72,037

|

$16,098

|

10/22/10

|

Ameris Bank

Moultrie, GA

|

First Suburban National Bank

Maywood, IL

|

N |

6,482

|

$143,451

|

$135,475

|

$137,665

|

$28,974

|

10/22/10

|

Seaway Bank and Trust

Company

Chicago, IL

|

Hillcrest Bank

Overland Park, KS

|

NM

|

38,922

|

$1,583,611

|

$1,488,785

|

$1,476,695

|

$318,195

|

10/22/10

|

Hillcrest Bank, N.A.

Overland Park, KS

|

Progress Bank of Florida

Tampa, FL

|

SM

|

1,882

|

$94,823

|

$86,861

|

$85,294

|

$24,996

|

10/22/10

|

Bay Cities Bank

Tampa, FL

|

The First National Bank of Barnesville

Barnesville, GA

|

N

|

6,835

|

$126,622

|

$122,880

|

$123,943

|

$32,885

|

10/22/10

|

United Bank

Zebulon, GA

|

First Vietnamese American Bank

Westminster, CA

|

NM

|

721

|

$48,000

|

$47,012

|

$38,028

|

$9,635

|

11/05/10

|

Grandpoint Bank

Los Angeles, CA

|

K Bank

Randallstown, MD

|

NM

|

23,944

|

$538,258

|

$500,056

|

$498,567

|

$196,706

|

11/05/10

|

Manufacturers & Traders Trust Co. (M&T Bank)

Buffalo, NY

|

Pierce Commercial Bank

Tacoma, WA

|

SM

|

3,356

|

$221,082

|

$193,473

|

$181,310

|

$19,814 |

11/05/10

|

Heritage Bank

Olympia, WA

|

Western Commercial Bank

Woodland Hills, CA

|

NM

|

1,241

|

$98,635

|

$101,127

|

$105,176

|

$24,310

|

11/05/10

|

First California Bank

Westlake Village, CA

|

Cooper Star Bank

Scottsdale, AZ

|

NM

|

3,321

|

$203,955

|

$190,182

|

$194,655

|

$43,169

|

11/12/10

|

Stearns Bank, N.A.

St. Cloud, MN

|

Darby Bank & Trust Co.

Vidalia, GA

|

NM

|

19,886

|

$654,714

|

$587,626

|

$582,144

|

$129,590

|

11/12/10

|

Ameris Bank

Moultrie, GA

|

Tifton Banking Company

Tifton, GA

|

NM

|

2,685

|

$143,729

|

$141,573

|

$132,992 |

$24,576 |

11/12/10

|

Ameris Bank

Moultrie, GA

|

Allegiance Bank of America

Bala Cynwyd, PA

|

NM

|

2,765

|

$106,595

|

$91,996

|

$96,741

|

$14,235

|

11/19/10

|

VIST Bank

Wyomissing, PA

|

First Banking Center

Burlington, WI

|

SM

|

44,356

|

$750,724

|

$664,752

|

$676,743

|

$139,746

|

11/19/10

|

First Michigan Bank

Troy, MI

|

Gulf State Community Bank

Carrabelle, FL

|

NM

|

7,338

|

$112,144 |

$112,193 |

$108,568

|

$42,279

|

11/19/10

|

Centennial Bank

Conway, AR

|

Earthstar Bank

Southhampton, PA

|

NM

|

4,313

|

$112,643 |

$104,505

|

$98,170

|

$22,926

|

12/10/10

|

Polonia Bank

Huntingdon Valley, PA

|

Paramount Bank

Farmington Hills, MI

|

SM

|

4,725

|

$252,744 |

$213,550 |

$187,403 |

$89,354

|

12/10/10

|

Level One Bank

Farmington Hills, MI

|

Appalachian Community

Bank, F.S.B.

McCaysville, GA

|

SA

|

2,639

|

$68,201

|

$76,360 |

$68,552

|

$25,876

|

12/17/10

|

Peoples Bank of

East Tennessee

Madisonville, TN

|

Chestatee State Bank

Dawsonville, GA

|

NM

|

10,740

|

$244,376

|

$244,476

|

$234,908

|

$75,136

|

12/17/10

|

Bank of the Ozarks

Little Rock, AR

|

Community National Bank

Lino Lakes, MN

|

N

|

2,604

|

$31,569

|

$28,916

|

$27,269

|

$3,717

|

12/17/10

|

Farmers & Merchants

Savings Bank

Manchester, IA

|

First Southern Bank

Batesville, AR

|

NM

|

3,746

|

$191,764

|

$172,514

|

$141,827

|

$22,751

|

12/17/10

|

Southern Bank

Poplar Bluff, MO

|

United Americas Bank, N.A.

Atlanta, GA

|

N

|

3,851

|

$242,339 |

$244,172

|

$198,466

|

$75,294

|

12/17/10

|

State Bank and Trust

Company

Macon, GA

|

The Bank of Miami

Coral Gables, FL

|

N

|

3,595

|

$448,150 |

$374,218

|

$344,755

|

$59,267

|

12/17/10

|

1st United Bank

Boca Raton, FL

|

Insured

Deposit Transfer |

Barnes Banking Company

Kaysville, UT

|

SM |

31,597

|

$709,171

|

$697,109

|

$660,026

|

$207,813

|

01/15/10

|

Deposit Insurance National

Bank

of Kaysville

Kaysville, UT

|

Insured Deposit Payoff |

Centennial Bank

Ogden, UT

|

NM

|

3,809

|

$212,839

|

$205,076 |

$222,567

|

$78,843

|

03/05/10

|

Federal Deposit Insurance

Corporation

|

Advanta Bank Corp.

Draper, UT

|

NM

|

1,920

|

$1,525,931

|

$1,519,471

|

$1,335,574

|

$606,732 |

03/19/10

|

Federal Deposit Insurance

Corporation

|

Lakeside Community Bank

Sterling Heights, MI

|

NM

|

1,920

|

$49,173

|

$52,290

|

$58,990

|

$21,471

|

04/16/10 |

Federal Deposit Insurance

Corporation

|

Arcola Homestead Savings

Bank

Arcola, IL

|

SI

|

613

|

$17,028

|

$18,092

|

$17,115 |

$10,829

|

06/04/10

|

Federal Deposit Insurance

Corporation |

Ideal Federal Savings Bank

Baltimore, MD

|

SB

|

807

|

$6,177 |

$5,803

|

$5,378

|

$5,370

|

07/09/10

|

Federal Deposit Insurance

Corporation

|

| First Arizona Savings, FSB

Scottsdale, AZ |

SA |

11,574 |

$255,920 |

$190,615 |

$265,711 |

$32,316 |

10/22/10 |

Federal Deposit Insurance

Corporation |

Insured

Deposit

Transfer/Purchase

&

Assumption |

| Waterfield Bank

Germantown, MD |

SB |

5,987 |

$155,566 |

$156,188 |

$562,273 |

$41,733 |

03/05/10 |

Federal Deposit Insurance

Corporation |

Codes for Bank Class:

NM = State-chartered bank

that is not a member of the Federal Reserve

System

N = National Bank

SB = Savings Bank

SI = Stock and Mutual Savings

Bank

SM = State-chartered bank that is a member of the Federal Reserve

System

SA = Savings Association

- Total Assets and Total Deposits data is based

upon the last Call Report

filed by the institution prior to failure. Estimated losses are as of

12/31/10. back

- Estimated losses are routinely

adjusted with updated information from new appraisals and asset sales,

which

ultimately affect the asset values and projected recoveries. Represents

the estimated loss to the DIF from deposit insurance obligations. This

amount does not include the estimated loss allocable to the Transaction

Account Guarantee claim. back

Recoveries and Losses by the Deposit Insurance Fund on

Disbursements for the Protection of Depositors, 1934 – 2010

Dollars in Thousands

Bank and Thrift Failures 1

|

| Year 2 |

Number

of

Banks/

Thrifts |

Total

Assets

3 |

Total

Deposits

3 |

Insured

Deposit

Funding

and Other

Disbursements |

Recoveries |

Estimated

Additional

Recoveries |

Estimated

Losses |

|

2,417 |

$879,080,555

|

$653,997,204

|

$529,207,216

|

$381,767,253

|

$31,024,200

|

$116,415,763

|

20104

20094

20084

20074

20064

20054 |

157

140

25

3

0

0 |

92,084,987 169,709,160

371,945,480 2,614,928

0

0 |

79,548,141 137,067,132

234,321,715 2,424,187

0

0 |

82,015,397

135,769,886

205,407,426

1,914,177

0

0 |

45,848,906 82,055,693

181,587,856 1,364,131

0

0 |

11,342,867 14,902,675

4,199,157 365,827

0

0 |

24,823,624

38,811,518

19,620,413

184,219

0

0 |

2004

2003

2002

2001

2000 |

4

3

11

4

7 |

170,099

947,317

2,872,720

1,821,760

410,160 |

156,733

901,978

2,512,834

1,661,214

342,584 |

138,895

883,772

2,126,922

1,605,147

297,313 |

134,978

812,933

1,689,034

1,128,577

265,175 |

0

8,192

14,415

166,110

0 |

3,917

62,647

423,473

310,460

32,138 |

1999

1998

1997

1996

1995 |

8

3

1

6

6 |

1,592,189

290,238

27,923

232,634

802,124 |

1,320,573

260,675

27,511

230,390

776,387 |

1,307,045

292,678

25,546

201,533

609,043 |

685,154

58,248

20,520

140,918

524,571 |

7,557

11,600

0

0

0 |

614,334

222,830

5,026

60,615

84,472 |

1994

1993

1992

1991

1990 |

13

41

120

124

168 |

1,463,874

3,828,939

45,357,237

64,556,512 16,923,462 |

1,397,018

3,509,341

39,921,310

52,972,034

15,124,454 |

1,224,769

3,841,658

14,540,771

21,499,236

10,812,484 |

1,045,718

3,209,012

10,866,745

15,500,130

8,040,995 |

0

0

14

5,786

0 |

179,051

632,646

3,674,012

5,993,320

2,771,489 |

1989

1988

1987

1986

1985 |

206

200

184

138

116 |

28,930,572

38,402,475

6,928,889

7,356,544

3,090,897 |

24,152,468

26,524,014

6,599,180

6,638,903

2,889,801 |

11,443,281

10,432,655

4,876,994

4,632,121

2,154,955 |

5,247,995

5,055,158

3,014,502

2,949,583

1,506,776 |

0

0

0

0

0 |

6,195,286

5,377,497

1,862,492

1,682,538

648,179 |

1984

1983

1982

1981

1980 |

78

44

32

7

10 |

2,962,179

3,580,132

1,213,316

108,749

239,316 |

2,665,797

2,832,184

1,056,483

100,154

219,890 |

2,165,036

3,042,392

545,612

114,944

152,355 |

1,641,157

1,973,037

419,825

105,956

121,675 |

0

0

0

0

0 |

523,879

1,069,355

125,787

8,988

30,680 |

| 1934-1979

|

558 |

8,615,743 |

5,842,119 |

5,133,173 |