2005 Annual Report

II. Financial Highlights

Deposit Insurance Fund Performance

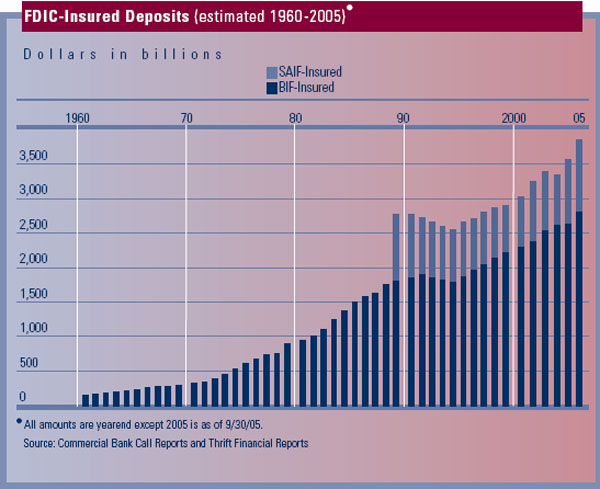

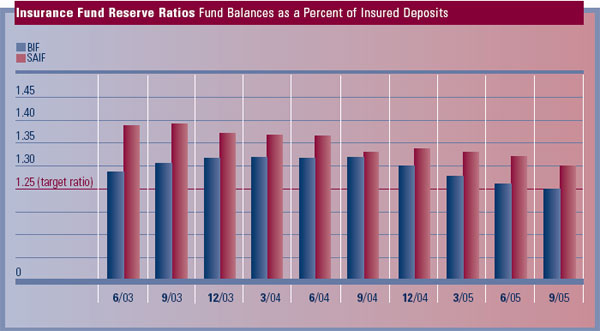

The FDIC administers two deposit insurance funds – the Bank Insurance

Fund (BIF) and the Savings Association Insurance Fund (SAIF) – and manages

the FSLIC Resolution Fund (FRF), which fulfills the obligations of the former

Federal Savings and Loan Insurance Corporation (FSLIC) and the former Resolution

Trust Corporation (RTC). The following summarizes the condition of the FDIC's

insurance funds. (See the accompanying tables on FDIC-Insured Deposits, Insurance

Fund Reserve Ratios and Risk-Related Premiums on the following pages.)

The BIF reported comprehensive

income (net income plus current period unrealized gains/losses on available-for-sale

(AFS) securities) of

$680 million in 2005

compared to $1.004 billion in 2004. This reduction of $324 million was primarily

due to an increase in unrealized losses on AFS securities of $279 million,

lower recoveries of prior years' provisions for insurance losses of $143

million, an increase in operating expenses of $25 million, and a decrease in

assessment revenues of $43 million, offset by an increase of $161 million in

interest revenue on U.S. Treasury obligations. As of December 31, 2005, the

fund balance was $35.5 billion, up from $34.8 billion at year-end 2004.

The SAIF reported comprehensive

income of $409 million in 2005, compared to $480 million in 2004. This reduction

of $71 million was primarily

due to an

increase in unrealized losses on AFS securities of $93 million and lower recoveries

of prior years' provisions for insurance losses of $50 million, offset

by a $73 million increase in interest revenue on U.S. Treasury obligations.

As of December 31, 2005, the fund balance was $13.1 billion, up from $12.7

billion at year-end 2004.

For both BIF and SAIF, higher interest revenue on U.S. Treasury obligations

stemmed from higher overnight and short-term Treasury yields as well as higher

inflation compensation on Treasury Inflation Protected Securities. However,

the higher interest revenue was more than offset by an increase in unrealized

losses that resulted from a rise in Treasury market yields on short- to intermediate-maturity

AFS securities during 2005.

d

d

d

d

Operating Expenses

Corporate Operating Budget expenses totaled $990 million in 2005, including

$979 million in ongoing operations and $11 million for receivership funding.

This represented approximately 95 percent of the approved budget for ongoing

operations and 15 percent of the approved budget for receivership funding.

In December 2005, the Board of Directors approved a 2006 Corporate Operating

Budget of approximately $1.05 billion, including $975 million for ongoing

operations. The level of approved Corporate Operating Budget for 2006 is

more than 5 percent lower than the Corporate Operating Budget for 2005 due

to savings achieved through continued staffing reductions and the realization

of other efficiencies. The Corporate Operating Budget includes funding for

a number of major new initiatives, including increased funding for consumer

protection activities; continued implementation of the Corporate Employee

Program; several new learning initiatives consistent with the Corporation's

commitment to an environment of continuous employee growth and development;

and several projects to explore increased automation of the bank examination

process.

Investment Spending

The

FDIC has a disciplined process for reviewing proposed new investment projects

and managing the implementation

of approved projects.

Most of the projects

in the current investment portfolio are major IT system initiatives. Proposed

IT projects are carefully reviewed to ensure that they are consistent with

the Corporation's enterprise architecture and include an appropriate

return on investment for the insurance funds. The process also enables the

FDIC to be aware of risks to the major capital investment projects and facilitates

appropriate, timely intervention to address these risks throughout the development

process. An investment portfolio performance review of the major capital investments

is provided to the FDIC's Board of Directors quarterly.

During 2005, the Corporation completed and implemented three projects in its

investment portfolio. Spending for investment projects in 2005 totaled approximately

$62 million, but is expected to drop significantly in 2006. The Board of Directors

did not approve any new investment projects in 2005.

Risk-Related Premiums

The following tables show the number and percentage of institutions insured

by the Bank Insurance Fund (BIF) and the Savings Association Insurance Fund

(SAIF), according to risk classifications effective for the first semiannual

assessment period of 2005. Each institution is categorized based on its capital

group (1, 2, or 3) and supervisory subgroup (A, B, or C), which is generally

determined by on-site examinations. Assessment rates are basis points, cents

per $100 of assessable deposits, per year.

| BIF Supervisory Subgroups1 |

| Capital Group |

A |

B |

C |

| 1. Well Capitalized: |

| Assessment Rate |

0 |

3 |

17 |

| Number of Institutions |

7,307 (94.2%) |

344 (4.4%) |

47 (0.6%) |

| 2. Adequately Capitalized: |

| Assessment Rate |

3 |

10 |

24 |

| Number of Institutions |

49 (0.6%) |

5 (0.1%) |

7 (0.1%) |

| 3. Undercapitalized: |

| Assessment Rate |

10 |

24 |

27 |

| Number of Institutions |

0 (0.0%) |

0 (0.0%) |

2 (0.0%) |

| SAIF Supervisory Subgroups2 |

| Capital Group |

A |

B |

C |

| 1. Well Capitalized: |

| Assessment Rate |

0 |

3 |

17 |

| Number of Institutions |

1,034 (93.5%) |

58 (5.2%) |

11 (1.0%) |

| 2. Adequately Capitalized: |

| Assessment Rate |

3 |

10 |

24 |

| Number of Institutions |

3 (0.3%) |

0 (0.0%) |

0 (0.0%) |

| 3. Undercapitalized: |

| Assessment Rate |

10 |

24 |

27 |

| Number of Institutions |

0 (0.0%) |

0 (0.0%) |

0 (0.0%) |

1 BIF data exclude SAIF-member "Oakar" institutions that hold BIF-insured deposits. The assessment rates reflect the rates for BIF-assessable deposits, which remained the same throughout 2005.

2 SAIF data exclude BIF-member "Oakar" institutions that hold SAIF-insured deposits. The assessment rates reflect the rates for SAIF-assessable deposits, which remained the same throughout 2005.