|

Home > About FDIC > Financial Reports > 2004 Annual Report |

|||

|

2004 Annual Report

VI. Appendix A – Key Statistics Corporate Planning and Budget

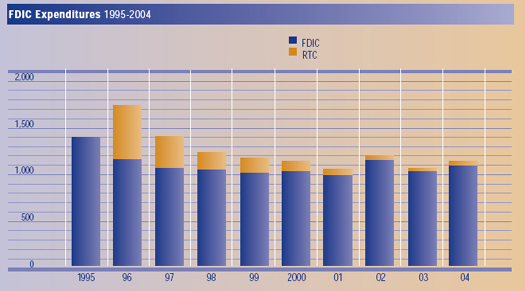

Note: Resolution Trust Corporation (RTC) expenditures became the responsibility of the FDIC on January 1, 1996.

The FDIC’s Strategic Plan and Annual Performance Plan provide the basis for annual planning and budgeting for needed resources. The 2004 aggregate budget (for corporate, receivership and investment spending) was $1.21 billion, while actual expenditures for the year were $1.11 billion, about $77 million more than 2003 expenditures. Over the past 10 years, the FDIC’s expenditures have varied in response to workload. During the past decade, expenditures generally declined due to decreasing resolution and receivership activity, although they temporarily increased in 1996 in conjunction with the absorption of the Resolution Trust Corporation (RTC) and its residual operations and workload. Total expenditures increased in 2002 due to an increase in receivership-related expenses. The largest component of FDIC spending is the costs associated with staffing. Staffing decreased by just over 4 percent in 2004, from 5,311 employees at the beginning of the year to 5,078 at the end of the year.

|

|||||||||||||||||||||||||||||||||||||||||||||||

| Last Updated 04/19/2005 | communications@fdic.gov | ||||||||||||||||||||||||||||||||||||||||||||||