Message from the Chairman

|

Our Priorities

- Stability

- Sound Policy

- Stewardship

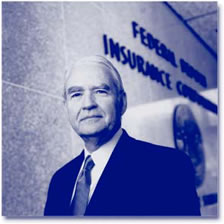

On behalf of the Federal Deposit Insurance Corporation (FDIC), I am pleased to present the 2003 Annual Report. During 2003, our focus was to promote the stability of the financial services industry, develop and effectively articulate sound policy, and research and administer corporate operations in a manner consistent with good stewardship of the deposit insurance funds. It gives me great pleasure to highlight just a few of our

major achievements in 2003: |

FDIC Chairman

Donald E. Powell

|

- We established an inter-divisional Risk Analysis Center (RAC) to identify, quantify, and respond more quickly and effectively to existing and emerging risks to the deposit insurance funds. The RAC allows us to better coordinate risk-monitoring efforts and action plans among the various business units of the FDIC. It brings together economists, bank examiners, financial analysts and others involved in assessing risk to the banking industry and the deposit insurance funds.

- We continued to expand the Money Smart program to promote financial literacy among low and moderate-income Americans outside of the financial mainstream. The Money Smart curriculum is now available in English, Spanish, Chinese and Korean. Since the rollout of Money Smart a little over two years ago, we have trained over 5,000 volunteer instructors and taught over 100,000 people. The FDIC has taken the lead in establishing partnerships with community groups and bankers to link services such as applying for Earned Income Tax Credit (EITC) funds, offering free tax preparation services and other incentives to promote and provide financial education. As a result of these partnerships, we have seen nearly 14,000 previously unbanked consumers establish new bank accounts. In 2003, we were honored to receive the Partnership for Public Service's prestigious Service to America Business and Commerce medal for our efforts in this area.

- We established the Center for Financial Research (CFR) to encourage and support innovative research on topics that are important to the FDIC's role as deposit insurer and bank supervisor. The CFR is a partnership between the FDIC and the academic community, with prominent scholars integrally involved in managing and directing its research program. The research sponsored by the CFR will explore key developments affecting the banking industry, risk measurement and management methods, regulatory policy and other topics of interest to the FDIC and the larger financial community. The CFR provides financial support for researchers outside of the FDIC to undertake relevant projects in selected program areas, and provides a forum for exchanging ideas among regulators, academicians and financial industry representatives. The CFR will be organizing research roundtables, workshops and discussion groups on issues critical to the business of the FDIC.

- We joined with other regulators in a multi-year interagency effort under the leadership of FDIC Vice Chairman John Reich to eliminate outdated or unnecessary regulations that impose costly, time-consuming burdens on the banking industry, in accordance with the Economic Growth and Regulatory Paperwork Reduction Act (EGRPRA). During the past year the federal banking agencies issued an EGRPRA Federal Register notice seeking industry and public comment on the regulatory review program and the first set of regulations subject to this review.

- We reached an agreement with our Federal Financial Institutions Examination Council (FFIEC) partners to build and implement a new internet-based Central Data Repository (CDR) for Call Reporting and other regulatory reports. The CDR will employ cutting edge technology based on the XBRL (Extensible Business Reporting Language) data standard. This system will reduce the reporting burden on the industry while simultaneously providing high quality, more timely data to regulators, financial institutions and the public.

- Again this year, we made progress toward the enactment of comprehensive deposit insurance reform legislation that would combine the deposit insurance funds, give FDIC greater managerial control over the combined funds and protect the level of deposit insurance coverage by indexing it to inflation. I testified before the House Financial Services Committee and the Senate Banking Committee in support of the FDIC's deposit insurance reform proposals. The House passed reform legislation in April by a vote of 411 to 11. The FDIC will continue to focus attention on this important issue during the second session of the 108th Congress.

- We completed implementation of an internet portal, FDICconnect, to facilitate the electronic exchange of information between the FDIC and its insured institutions and began to make initial use of it for the electronic filing of branch applications by insured institutions and Beneficial Ownership Reports by directors, officers, and principal shareholders of insured financial institutions. In addition, quarterly assessment invoices were made available to insured institutions for the first time through FDICconnect.

- We completed a comprehensive Information Technology (IT) Program Assessment and named a Chief Information Officer (CIO) who will provide leadership in improving our IT program. The new CIO will ensure that our corporate-wide information technology needs are met in a cost-effective manner, and that our information systems meet the highest security standards.

- We appointed the FDIC's first Chief Learning Officer and five Deans to provide leadership for our new Corporate University (CU). The CU was established to help our employees keep pace with changes in the banking industry, broaden their perspectives, sharpen their job skills, and enhance their leadership expertise.

As Chairman, I will continue to work diligently with the dedicated men and women of the FDIC to support the stability of the banking industry, promote sound banking policy, and be an effective steward of the insurance funds. The FDIC has helped to provide financial stability in the U.S. banking industry for 70 years, and in that time, not one penny of federally-insured depositors' money has ever been lost. We are proud of that accomplishment and committed to continuing that record in 2004.

Sincerely,

Donald E. Powell

|