301 Moved Permanently

301 Moved Permanently

openresty

|

DIF

Balance Sheet -

Third Quarter 2015

| Fund Financial Results |

($

in millions) |

| Balance

Sheet |

| |

Unaudited

Sep-15 |

Unaudited

Jun-15 |

Quarterly

Change |

Unaudited

Sep-14 |

Year-Over-Year

Change |

| Cash and cash equivalents |

$2,450 |

$2,544 |

$(94) |

$2,115 |

$335 |

| Investment in U.S. Treasury obligations, net |

58,552 |

55,850 |

2,702 |

47,783 |

10,769 |

| Assessments receivable, net |

2,188 |

2,177 |

11 |

2,072 |

116 |

| Interest receivable on investments and other assets, net |

534 |

590 |

(56) |

382 |

152 |

| Receivables from resolutions, net |

13,877 |

14,862 |

(985) |

15,227 |

(1,350) |

| Property and equipment, net |

359 |

364 |

(5) |

357 |

2 |

| Total Assets |

$77,960 |

$76,387 |

$1,573 |

$67,936 |

$10,024 |

| Accounts payable and other liabilities |

351 |

278 |

73 |

255 |

96 |

| Liabilities due to resolutions |

6,727 |

7,593 |

(866) |

11,260 |

(4,533) |

| Postretirement benefit liability |

243 |

243 |

- |

194 |

49 |

| Contingent liability for anticipated failures |

524 |

684 |

(160) |

1,902 |

(1,378) |

| Contingent liability for litigation losses |

0 |

0 |

0 |

5 |

(5) |

| Total Liabilities |

$7,845 |

$8,798 |

$(953) |

$13,616 |

$(5,771) |

| FYI: Unrealized gain (loss) on U.S. Treasury investments, net |

312 |

248 |

64 |

27 |

285 |

| FYI: Unrealized postretirement benefit (loss) gain |

(58) |

(58) |

- |

(16) |

(42) |

| Fund Balance |

$70,115 |

$67,589 |

$2,526 |

$54,320 |

$15,795 |

|

|

|

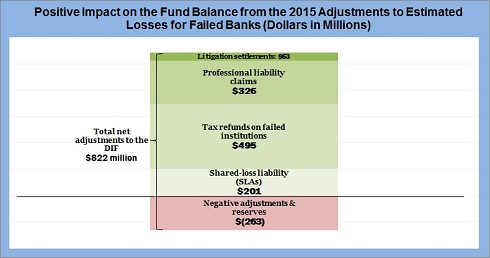

Positive Impact on the Fund Balance from the 2015 Adjustments to Estimated Losses for Failed Banks (Dollars in millions) |

| |

Adjustments to DIF |

| Litigation settlements |

$63 |

Professional liability claims |

$326 |

Tax refunds on failed institutions |

$495 |

Shared-loss liability (SLAs) |

$201 |

| Negative adjustments & reserves |

($263) |

Total net adjustments to the DIF |

$822 |

The estimated recoveries from assets held by receiverships and estimated payments related to share-loss covered assets are used to derive the loss allowance on the receivables from resolutions.

The YTD $201 million decrease in the receivership's shared-loss liability is attributable to lower-than-anticipated losses from terminated SLAs.

The YTD $884 million in unanticipated recoveries from failed financial institutions (litigation settlements, professional liability claims, and tax refunds) are not recognized until the cash is received since significant uncertainties surround their recovery.

The YTD negative $263 million adjustment resulted from an increase in legal and rep & warranty reserves and lower loan recovery rates. |