301 Moved Permanently

301 Moved Permanently

openresty

|

Selected

Financial Data - Third Quarter

2012

| Fund Financial Results |

($

in millions) |

| FSLIC

Resolution Fund |

| |

Sep-12 |

Jun-12 |

Quarterly Change |

Sep-11 |

Year-Over-Year Change |

Cash and cash equivalents |

$3,594 |

$3,596 |

($2) |

$3,528 |

$66 |

| Accumulated deficit |

(124,460) |

(124,461) |

1 |

(124,275) |

(185) |

| Total resolution equity |

3,596 |

3,595 |

1 |

3,551 |

45 |

| Total revenue |

4 |

2 |

|

6 |

(2) |

| Operating expenses |

4 |

3 |

|

3 |

1 |

| Goodwill litigation expenses |

181 |

181 |

|

33 |

148 |

| Payment/Recovery of tax benefits |

- |

- |

|

26 |

(26) |

| Net Income (Loss) |

($180) |

($180) |

|

($51) |

($129) |

| Receivership

Selected Statistics September 2012 vs. September 2011 |

| $ in millions |

DIF |

FRF |

ALL FUNDS |

| |

Sep-12 |

Sep-11 |

Change |

Sep-12 |

Sep-11 |

Change |

Sep-12 |

Sep-11 |

Change |

Total Receiverships |

462 |

410 |

52 |

4 |

8 |

(4) |

466 |

418 |

48 |

| Assets in Liquidation |

$18,158 |

$22,379 |

($4,221) |

$7 |

$22 |

($15) |

$18,165 |

$22,401 |

($4,236) |

| YTD Collections |

$6,337 |

$9,885 |

($3,548) |

$18 |

$8 |

$10 |

$6,355 |

$9,893 |

($3,538) |

| YTD Dividend/ Other Pymts - Cash |

$3,917 |

$7,389 |

($3,472) |

$- |

$- |

$- |

$3,917 |

$7,389 |

($3,472) |

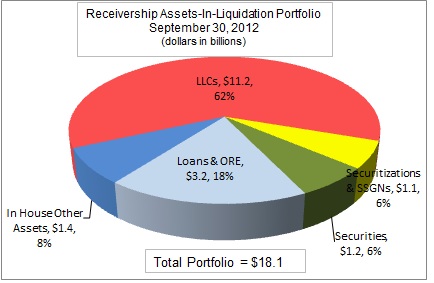

DIF Receivership Assets-In-Liquidation Portfolio September 30, 2012 (dollars in billions) |

| |

Amount |

Percentage |

LLCs |

$11.2 |

62% |

Securitizations & SSGNs |

$1.1 |

6% |

Loans & ORE |

$3.2 |

18% |

Securities |

$1.2 |

6% |

In House Other Assets |

$1.4 |

8% |

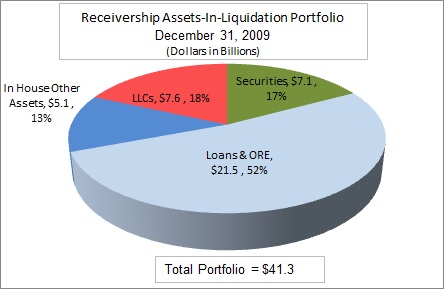

DIF Receivership Assets-In-Liquidation Portfolio December 31, 2009 (dollars in billions) |

| |

Amount |

Percentage |

LLCs |

$7.6 |

18% |

Securities |

$7.1 |

17% |

Loans & ORE |

$21.5 |

52% |

In House Other Assets |

$5.1 |

13% |

|