301 Moved Permanently

301 Moved Permanently

openresty

|

I.

Corporate Fund Financial Results - Third Quarter 2012

Deposit Insurance Fund (DIF)

- For the nine months ended September 30, 2012, the DIF’s comprehensive income totaled $13.4 billion compared to comprehensive income of $15.2 billion for the same period last year. This $1.8 billion year-over-year decrease was mostly due to a $5.1 billion year-to-year swing in loss provisions (a negative $879 million in 2012 vs. a negative $5.9 billion in 2011), offset by a $4.0 billion increase in recognition of Debt Guarantee Program (DGP) deferred revenue and an $829 million decrease in assessment revenue.

- The provision for insurance losses was negative $879 million for nine months of 2012. The negative provision primarily resulted from a $1.2 billion reduction in the contingent loss reserve due to the improvement in the financial condition of institutions that were previously identified to fail offset by a $299 million increase in the estimated losses for banks that had previously failed.

Assessments

- During the third quarter of 2012, the DIF recognized a total of $2.8 billion in assessment revenue. The estimate for third quarter 2012 insurance coverage totaled $3.0 billion—$2.4 billion was recognized for those institutions that prepaid assessments and $660 million was recorded as a receivable from those institutions that did not have prepaid assessments available for offset. Additionally, a net adjustment of $182 million was recognized that reduced assessment revenue. This adjustment consisted of $20 million in prior period amendments and a $202 million decrease to the estimate for second quarter 2012 insurance coverage that was recorded at June 30, 2012. The latter adjustment was due to lower than estimated growth in the assessment base and lower average assessment rates.

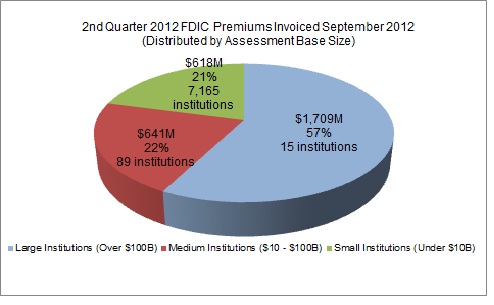

- On September 28, 2012, the FDIC collected $374 million in DIF assessments for second quarter 2012 insurance coverage. Unearned revenue (prepaid assessments) totaled $9.2 billion on September 30, 2012.

2nd Quarter 2012 FDIC Premiums Invoiced September 2012 (Distributed by Assessment Base Size) |

| |

Dollars in millions |

Percentage

|

Number of Institutions |

| Large Institutions (over $100B) |

$1,709 |

57% |

15 |

| Medium Institutions ($10 - $100B) |

$641 |

22% |

89 |

| Small Institutions (Under $10B) |

$618 |

21% |

7,165 |

FSLIC Resolution Fund (FRF)

- On October 19, 2012, the FRF paid $181 million as a result of a settlement in one goodwill case, leaving two active goodwill cases.

|