301 Moved Permanently

301 Moved Permanently

openresty

|

DIF

Balance Sheet -

Third Quarter 2012

| Fund Financial Results |

($

in millions) |

Balance

Sheet |

|

Sep-12 |

Jun-12 |

Quarterly

Change |

Sep -11 |

Year-Over-Year

Change |

| Cash and cash equivalents |

$1,587 |

$4,137 |

($2,550) |

$9,929 |

($8,342) |

| Cash and investments - restricted - systemic risk |

1,115 |

945 |

170 |

7,393 |

(6,278) |

| Investment in U.S. Treasury obligations, net |

35,460 |

33,314 |

2,146 |

25,370 |

10,090 |

| Trust preferred securities |

2,255 |

2,314 |

(59) |

2,179 |

76 |

| Assessments receivable, net |

660 |

454 |

206 |

231 |

429 |

| Receivables and other assets - systemic risk |

1,568 |

1,723 |

(155) |

1,834 |

(266) |

| Interest receivable on investments and other assets, net |

462 |

449 |

13 |

320 |

142 |

| Receivables from resolutions, net |

18,948 |

21,855 |

(2,907) |

29,316 |

(10,368) |

| Property and equipment, net |

379 |

386 |

(7) |

401 |

(22) |

| Total Assets |

$62,434 |

$65,577 |

($3,143) |

$76,973 |

($14,539) |

| Accounts payable and other liabilities |

346 |

348 |

(2) |

369 |

(23) |

| Unearned revenue - prepaid assessments |

9,219 |

11,474 |

(2,255) |

20,360 |

(11,141) |

| Liabilities due to resolutions |

21,215 |

24,185 |

(2,970) |

31,492 |

(10,277) |

| Debt Guarantee Program liabilities - systemic risk |

- |

- |

- |

110 |

(110) |

| Deferred revenue - systemic risk |

2,682 |

2,668 |

14 |

9,101 |

(6,419) |

| Postretirement benefit liability |

188 |

188 |

- |

166 |

22 |

| Contingent liability for anticipated failures |

3,556 |

4,017 |

(461) |

7,247 |

(3,691) |

| Contingent liability for systemic risk |

- |

- |

- |

15 |

(15) |

| Contingent liability for litigation losses |

4 |

4 |

- |

300 |

(296) |

| Total Liabilities |

$37,210 |

$42,884 |

($5,674) |

$69,160 |

($31,950) |

| FYI: Unrealized gain (loss) on U.S. Treasury investments, net |

65 |

(1) |

66 |

41 |

24 |

| FYI: Unrealized gain (loss) on trust preferred securities |

293 |

352 |

(59) |

218 |

75 |

| FYI: Unrealized postretirement benefit (loss) gain |

(34) |

(34) |

- |

(19) |

(15) |

| Fund Balance |

$25,224 |

$22,693 |

$2,531 |

$7,813 |

$17,411 |

|

|

|

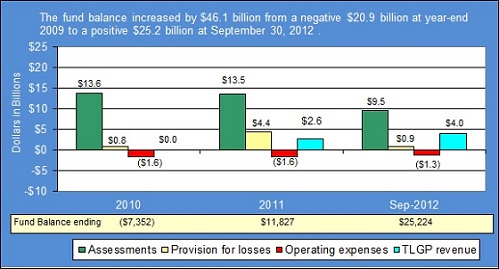

| Fund Balance ($ in billion) |

| |

Assessments |

Provision for Losses |

Operating Expenses |

TLGP Revenue |

Fund Balance |

2010 |

$13.6 |

$0.8 |

($1.6) |

$0.0 |

($7,352) |

| 2011 |

$13.5 |

$4.4 |

($1.6) |

$2.6 |

$11,827 |

| Sep-2012 |

$9.5 |

$0.9 |

($1.3) |

$4.0 |

$25,224 |

|

Of the total $46.1 billion increase in the fund balance, the primary contributors were $36.6 billion in assessments, $6.1 billion in negative provision for insurance losses, and $6.6 billion in TLGP revenue, offset by $4.5 billion in operating expenses. |