Practical Experience Supports Financial Education for Students

Hands-on learning, such as programs that involve banking-at-school or entrepreneurship training, allows students the chance to apply their financial education to practical situations that they can expect to face in life. This is one reason the FDIC’s Youth Savings Pilot is underway to identify how banks work with schools and/or nonprofit organizations to help students open savings accounts in conjunction with financial education programs. (For a list of participating banks and to learn more, visit https://www.fdic.gov/youthsavingspilot.) In this Success Story, we discuss the Money Smart-related work of the First Bank of Highland Park (FBHP) in Highland Park, Illinois, one of the nine banks participating in the first phase of the pilot program.

In 2011, the bank piloted the “Junior Banking Ambassador” program at St. James School, a private school in Highwood, Illinois, about 30 miles north of Chicago, with a diverse student body in Pre-Kindergarten through Grade 8. Five of the 32 students at the junior-high level in the program were selected as Student Council Officers and designated as Junior Banking Ambassadors who would be educated on financial responsibility and help teach their peers. “In an effort to make the program more engaging and interactive for the students, the class was designed to promote peer-to-peer teaching of the lessons with guidance from the First Bank of Highland Park staff,” explained Denise Bryant, the director of marketing at the bank.

Bankers from FBHP scheduled a monthly meeting with the five Junior Banking Ambassadors to review the lessons that were scheduled to be presented to students. Each Banking Ambassador took part in practicing how to deliver the information, administer the pre-test found in the Money Smart for Young Adults (MSYA) curriculum, play roles from comic strips in Money Smart, operate the computer (such as to advance PowerPoint presentations or use the interactive computer-based scenarios from Money Smart), and coordinate other activities. The following week, the FBHP employees returned to the school and the Banking Ambassadors assisted in conducting the actual lesson. “I think that the First Bank of Highland Park banking program is a great way to teach kids and teenagers my age about using money wisely for the future,” said a student named Nya. “I value this program very much and am fortunate to have it.”

At the conclusion of the first program in April 2012, the students in the class were asked to create a financial storyboard — a mix of words, drawings and pictures — depicting how they would live and manage their money using an assigned career, income, debt level, and daily expenses, and the lessons they learned during the program. Another student, Bailey, said, “I love how the banking classes give us an opportunity to learn about skills I’ll need for the future. Most kids walk into adulthood and have no idea what they're doing.”

The students were then invited to an FBHP branch to present their storyboards, which were displayed in the bank for a month. They toured the bank and got to see the bankers working and conducting real transactions. “It is a full-circle moment when you see the financial storyboards and listen to the students talk about being financially responsible,” Bryant said. “It was priceless to see their faces light up at the bank when they recognized the banker who came to their classroom or they assisted a teller in the drive-up. We know that we have designed a program that will leave a lasting impression on these students and they will share their knowledge with family and friends.”

At the completion of the program, each student received a Junior Banking Ambassador certificate. They also were invited, along with friends and family, to open a savings account called “My First Account,” for which FBHP matched the $25 minimum initial deposit. In one day, 15 new accounts were opened and are still active.

Since the inception of the Junior Banking Ambassador program, FBHP has expanded it to include local public schools (including a high school business class using Money Smart), the Highland Park High School Rotary Club, Girl Scout and Boy Scout troops, as well as social service agencies serving the Latino community. Currently, about 100 children benefit from the financial education provided by the bank’s staff each year.

The program continues to be a success at St. James School. In the 2014-2015 school year, FBHP is conducting the program for a class of 25 students (including the five Junior Ambassador/Student Council members trained to help deliver the Money Smart for Young Adults curriculum) and a teacher. At the students’ request, the president of the bank is scheduled to attend one of the sessions.

St. James School Principal Mary Vitulli applauded how the bankers and students worked together to build financial awareness. “My students were excited to see the bankers each month and to put their knowledge to good use when they were invited to the bank for a behind-the-scenes tour,” she said.

Michael, an 8th Grader, agreed. “I really appreciate that Mrs. Bryant comes in and teaches us,” he said. “Knowing finances will be very beneficial in the future.”

And 7th Grader Nicole reported that the program “is very good — it successfully taught me how to manage my money.”

Meanwhile, the students also have developed their own game, “Stump the Banker,” in which they ask FBHP employees financial-related questions on topics not in the curriculum. Michael stumped the bankers by asking, “Which U.S. President established the FDIC?” (Correct answer: Franklin D. Roosevelt.)

In support of financial education for adults, First Bank of Highland Park is piloting a financial education class for low- to moderate-income homeowners using the FDIC’s Money Smart for Adults curriculum.

How One Bank Uses Money Smart to Make a Lasting Impression on Students

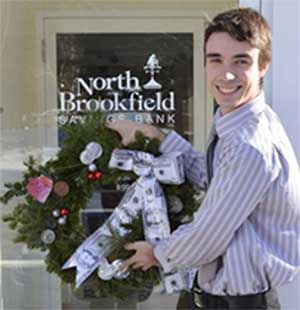

Andrew Leighton, Branch Manager, North Brookfield Savings Bank, with a wreath from students showing their appreciation for all he teaches them using the FDIC’s Money Smart for Young Adults

As educators begin to use the new Money Smart for Young People series (see www.fdic.gov/teachers), unveiled in April 2015, they can learn from the creative use of previous parts of the FDIC curriculum. Here’s how one bank in Massachusetts has obtained positive results using our Money Smart for Young Adults (MSYA) curriculum (part of the Money Smart for Young People series) to provide financial education to middle and high school students —lessons and strategies from which educators can benefit when using any part of the series.

Andrew Leighton is branch manager at North Brookfield Savings Bank (NBSB) in West Brookfield. He combines MSYA with his knowledge and experience from more than seven years in the banking industry to teach financial education classes at Quaboag Regional Middle High School in Warren and North Brookfield Jr./Sr. High School in North Brookfield.

Leighton conducts weekly classes at Quaboag for students ages 14-18 in a program the school calls the “Journey Program.” The class has about 10 students and the lessons help them build life skills to succeed after high school. “The activities and stories presented in the Money Smart lessons are perfect for my classes,” he said. “The materials present the information in a way that is easy for anyone to understand.” The class covers fundamentals such as opening and balancing a checking account.

Leighton added that many of the concepts in Money Smart have resonated with these students, particularly with the juniors and seniors on setting financial goals and budgeting. “It is encouraging to see them remembering and repeating the information,” said Leighton.

Some of the students Leighton worked with during the 2013–2014 school year opened a “High Five” savings account, which offers a premium rate and is available to children and young adults under 19 years of age. When the students feel ready to maintain a checking account along with a parent or guardian, they can join the “Cash for Good Grades” program. Through this incentive, any student who brings a report card with a GPA of at least 3.0 or the equivalent to one of the bank’s offices will get up to $20 per school year deposited into his or her account.

For the 2015 school year, Leighton will continue the Journey Program at Quaboag and at North Brookfield Jr./Sr. High, adding a segment on establishing and managing credit.

“The message for educators contained in the Money Smart literature is a strong one: There are many ways to stay organized financially, so explore what works best for you and stick with it,” Leighton said. “The lessons encourage students to take control of their own financial future and stress preparation over procrastination. This kind of positive thinking extends beyond the financial world and helps students to prepare themselves for their next stages of life. I feel that all students, regardless of age, can reap the benefits of this message.

“At NBSB, we are always looking for ways to support the surrounding communities that we serve. I feel strongly that a program like this can have a huge impact on our communities of the future,” Leighton added. “Money Smart also has been essential to my preparations as an instructor. As someone with a background in public speaking and banking but with no formal teaching experience, Money Smart has really helped me put it all together. The strong, positive messages in the material have helped build my confidence as an instructor and have even helped reinforce my own financial goals and savings habits.”

See more success stories from Money Smart News.

For help or information on how to use the Money Smart curriculum, contact communityaffairs@fdic.gov.