-

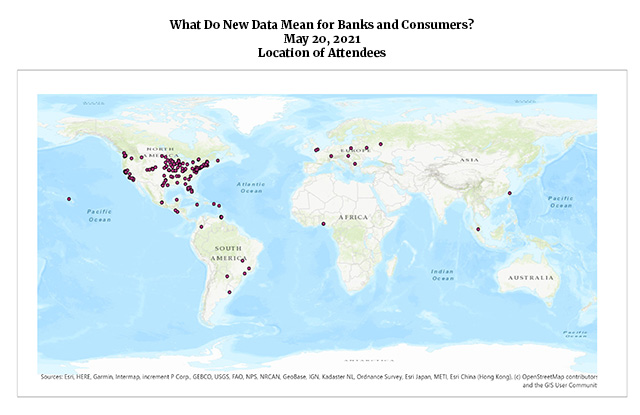

WEBINAR 2: What Do New Data Mean for Banks and Consumers?

May 20, 2021

Provide policy and consumer impact perspectives on the use of big data and alternative data by financial institutions to provide services and products.

| Featured Speakers |

|---|

|

Mr. Meghji is a nonresident scholar in the Cyber Policy Initiative at the Carnegie Endowment for International Peace. His research focuses on the architecture of the global financial system, cyber and critical infrastructure security, and the impact of artificial intelligence and quantum computing. He is also an adjunct professor at Washington University’s Olin Business School, and a distinguished member of the Bretton Woods Committee and the Missouri Advisory Committee for the U.S. Global Leadership Coalition. Mr. Meghji has served as an advisor to the U.S. Treasury, the Group of Seven (G7), the Office of the Comptroller of the Currency (OCC), and the Federal Bureau of Investigation (FBI) in the areas of cybersecurity, quantum computing, and artificial intelligence. |

|

|

|

Before joining the firm in 2019, Wendy was CMO at Franklin Templeton where she led a team of over 650 people across 10 countries, supporting the institutional and retail business globally. She served in CMO and COO roles at start-up firms such as Figure Technologies, Inc. and Internet Capital Group. She also worked extensively in financial services as an Associate Principal at McKinsey & Company. Wendy’s consultative, Fintech and asset management proficiencies coupled with her entrepreneurial expertise building start-ups has influenced her critical strategic thinking, digital prowess, and operational know-how. She is an Associate Editor for the Journal of Investment Management and an advisor to multiple startups. Wendy earned a B.S. degree in Business Administration with a concentration in Management Information Systems from the University of Illinois at Urbana-Champaign and a MBA from the Stanford Graduate School of Business. |

|

Prior to establishing FinRegLab, Melissa served as the U.S. Treasury Department's Deputy Assistant Secretary for Consumer Policy. In that role, Melissa helped to build the first government offered preretirement savings product, the myRA. She also established the $5 million Innovation Fund to support research and strategies to improve consumers’ financial health and their access to safe and affordable financial products and services. Melissa has testified before the Senate Banking and House Financial Services Committees, and she has spoken extensively to policy, industry, and consumer advocacy audiences. FinRegLab Studies: |

Questions

If you have questions about the webinar series, please email your inquiry to SHR_BnkonDataCf-2021@FDIC.gov.

Stay up to date with the Banking on Data: Great Possibilities, Great Responsibilities Webinar Series by following #FDICResearch.

PDF Help - Information on downloading and using the PDF reader.