Chief Financial Officer's (CFO) Report to the Board

DIF Balance Sheet - First Quarter 2016

| Fund Financial Results | ($ in millions) |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

DIF Fund Balance |

|

Dollars in millions |

|

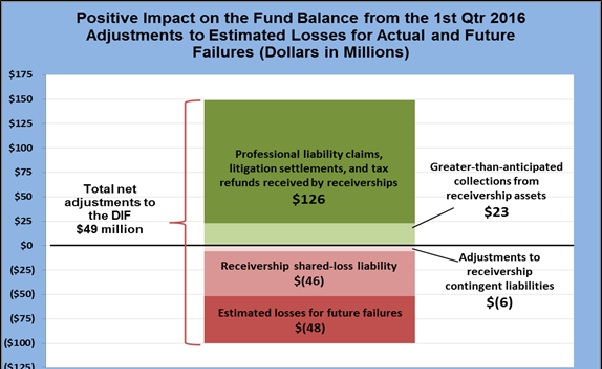

Professional liability claims, litigation settlements, and tax refunds received by receiverships |

$126 |

Greater-than-anticipated collections from receivership assets |

$23 |

Receivership share-loss liability |

($46) |

Estimated losses for future failures |

($48) |

Adjustments to receivership contingent liabilities |

($6) |

Total net adjustments to the DIF |

$49 |

The estimated recoveries from assets held by receiverships and estimated payments related to shared-loss covered assets and other liabilities are used to derive the loss allowance on the receivables from resolutions.

The $23 million adjustment resulted from greater-than-anticipated collections from a receivership’s investment in a structured transaction.

The $46 million net adjustment to the receiverships’ shared-loss liability primarily resulted from higher than estimated final payments on commercial shared-loss agreements (SLA) where loss coverage expired, net of savings on early SLA terminations.

The $6 million adjustment resulted from a $9 million increase in estimated rep & warranty liabilities, net of a $3 million decline in estimated litigation liabilities.