2015 Annual Report

I. Management’s Discussion and Analysis

The Year in Review

SUPERVISION

Supervision and consumer protection are cornerstones of the FDIC’s efforts to ensure the stability of, and public confidence in, the nation’s financial system. The FDIC’s supervision program promotes the safety and soundness of FDIC-supervised IDIs, protects consumers’ rights, and promotes community investment initiatives.

Examination Program

The FDIC’s strong bank examination program is the core of its supervisory program. As of December 31, 2015, the FDIC was the primary federal regulator (PFR) for 4,008 FDIC-insured, state-chartered institutions that were not members of the Federal Reserve System [generally referred to as “state nonmember” (SNM) institutions]. Through risk management (safety and soundness), consumer compliance and the Community Reinvestment Act (CRA), and other specialty examinations, the FDIC assesses an institution’s operating condition, management practices and policies, and compliance with applicable laws and regulations.

As of December 31, 2015, the FDIC conducted 1,871 statutorily required risk management examinations, including a review of Bank Secrecy Act (BSA) compliance, and all required follow-up examinations for FDIC-supervised problem institutions, within prescribed time frames. The FDIC also conducted 1,347 statutorily required CRA/compliance examinations (859 joint CRA/compliance examinations, 478 compliance-only examinations, and 10 CRA-only examinations). In addition, the FDIC performed 4,157 specialty examinations.

The table below compares the number of examinations, by type, conducted from 2013

through 2015.

| 2015 | 2014 | 2013 | |

|---|---|---|---|

| Risk Management (Safety and Soundness): | |||

| State Nonmemember Banks | 1,665 | 1,881 | 2,077 |

| Savings Banks | 206 | 206 | 203 |

| Savings Associations | 0 | 0 | 0 |

| National Banks | 0 | 0 | 0 |

| State Member Banks | 0 | 0 | 4 |

| Subtotal - Risk Management Examinations | 1,871 | 2,087 | 2,284 |

| CRA/Compliance Examinations: | |||

| Compliance/Community Reinvestment Act | 859 | 1,019 | 1,201 |

| Compliance only | 478 | 376 | 371 |

| CRA - only | 10 | 11 | 4 |

| Subtotal - CRA/Compliance Examinations | 1,347 | 1,406 | 1,576 |

| Specialty Examinations: | |||

| Trust Departments | 365 | 428 | 406 |

| Information Technology and Operations | 1,886 | 2,113 | 2,323 |

| Bank Secrecy Act | 1,906 | 2,126 | 2,328 |

| Subtotal - Specialty Examinations | 4,157 | 4,667 | 5,057 |

| Total | 7,375 | 8,160 | 8,917 |

Risk Management

All risk management examinations have been conducted in accordance with statutorily established timeframes. As of September 30, 2015, 203 insured institutions with total assets of $51.1 billion were designated as problem institutions for safety and soundness purposes (defined as those institutions having a composite CAMELS1 rating of 4 or 5), compared to the 329 problem institutions with total assets of $102.3 billion on September 30, 2014. This is a 38 percent decline in the number of problem institutions and a 50 percent decrease in problem institution assets. For the twelve months ending September 30, 2015, 142 institutions with aggregate assets of $51.8 billion were removed from the list of problem financial institutions, while 16 institutions with aggregate assets of $3.0 billion were added to the list. The FDIC is the PFR for 133 of the 203 problem institutions, with total assets of $24.5 billion.

In 2015, the FDIC’s Division of Risk Management Supervision initiated 233 formal enforcement actions and 165 informal enforcement actions. Enforcement actions against institutions included, but were not limited to, 28 actions under Section 8(b) of the FDI Act (27 consent orders and 1 notice of charges), 3 civil money penalty (CMP) actions, and 165 MOUs. Of these enforcement actions against institutions, 17 consent orders, 2 CMPs, and 22 MOUs were based, in whole or in part, on apparent violations of BSA and anti-money laundering (AML) laws and regulations. In addition, enforcement actions were also initiated against individuals. These actions included, but were not limited to, 88 removal and prohibition actions under Section 8(e) of the FDI Act (84 consent orders and 4 notices of intention to remove/prohibit), 4 actions under Section 8(b) of the FDI Act (2 restitution orders and 2 notices of charges), and 24 CMPs (15 orders to pay and 9 notices of assessment).

The FDIC has heightened its focus on forward-looking supervision aimed at ensuring that risks are mitigated before they lead to financial deterioration. In 2015, the FDIC concluded a two-year effort to train risk management supervision staff on forward-looking approaches to supervising institutions.

Compliance

As of December 31, 2015, 51 insured SNM institutions, about 1 percent of all supervised institutions, with total assets of $61 billion, were problem institutions for compliance, CRA, or both. All of the problem institutions for compliance were rated “4” for compliance purposes, with none rated “5.” For CRA purposes, the majority were rated “Needs to Improve,” and only five were rated “Substantial Noncompliance.” As of December 31, 2015, all follow-up examinations for problem institutions were performed on schedule.

During 2015, the FDIC conducted all required compliance and CRA examinations and, when violations were identified, completed follow-up visits and implemented appropriate enforcement actions in accordance with FDIC policy. In completing these activities, the FDIC substantially met its internally established time standards for the issuance of final examination reports and enforcement actions.

Overall, banks demonstrated strong consumer compliance programs. The most significant consumer protection issue that emerged from the 2015 compliance examinations involved banks’ failure to adequately monitor third-party vendors. For example, the FDIC found violations involving unfair or deceptive acts or practices, relating to issues such as failure to disclose material information about product features and limitations, deceptive marketing and sales practices, and misrepresentations about the costs of products. As a result, the FDIC issued orders requiring consumer restitution and the payment of civil money penalties (CMPs).

During 2015, the FDIC initiated 35 formal enforcement actions and 28 informal enforcement actions to address compliance concerns (see chart on page 138). This included 10 consent orders (including one that also addressed safety and soundness concerns), 7 restitution orders, 18 CMPs, and 28 MOUs. Restitution orders are formal actions that require institutions to pay restitution in the form of consumer refunds for different violations of law. In 2015, these restitution orders required institutions to refund approximately $99.6 million to consumers, primarily related to unfair and deceptive practices by the institutions. The CMPs totaled just over $12.8 million.

Large and Complex Financial Institutions

The FDIC established the Large Bank Supervision Branch within the Division of Risk Management Supervision in response to the growing complexity of large banking organizations. This branch is responsible for both supervisory oversight and ongoing monitoring, and it supports the insurance and resolutions business lines. For SNM banks over $10 billion, the FDIC generally applies a continuous examination program, whereby dedicated staff conduct ongoing onsite supervisory examinations and institution monitoring. At institutions where the FDIC is not the PFR, staff works closely with other financial institution regulatory authorities to identify emerging risks and assess the overall risk profile of large and complex institutions.

The Large Insured Depository Institution (LIDI) Program remains the primary instrument for off-site monitoring of IDIs with $10 billion or more in total assets. The LIDI Program provides a comprehensive process to standardize data capture and reporting through nationwide quantitative and qualitative risk analysis of large and complex institutions. In 2015, the LIDI Program covered 108 institutions with total assets of $12.8 trillion. The comprehensive LIDI Program is essential to effective large bank supervision because it captures information on the risks and uses that information to best deploy resources to high-risk areas, determine the need for supervisory action, and support insurance assessments and resolution planning.

The Shared National Credit (SNC) Program is an interagency initiative administered jointly by the FDIC, the FRB, and the OCC to ensure consistency in the regulatory review of large, syndicated credits, as well as identify risk in this market, which comprises a large volume of domestic commercial lending. In 2015, outstanding credit commitments identified in the SNC Program totaled $3.9 trillion. The FDIC, the FRB, and the OCC issued a joint press release detailing the results of the review in November 2015. The interagency SNC review indicated credit risk in the portfolio remains high, despite a relatively favorable economic environment. The agencies noted a significant increase in leveraged lending volumes and continued loose underwriting, as evidenced by weak capital structures and provisions that limit the lender’s ability to manage risk. While some improvement in underwriting practices was evident in the second half of the year, weakness in leveraged lending transactions drove an increase in classified commitments. Also, in 2015 the agencies agreed to change the program timing from an annual review to a semi-annual review. A pilot was conducted in September 2015, and the 2016 reviews will be completed in February and August.

In 2015, the FDIC continued with various initiatives to expand knowledge and expertise related to large bank supervisory matters. For example, a long-term program established in 2014 to expand on-the-job training and provide mentoring of select staff regarding examination processes and risk analysis at large banks continues as a mechanism to develop expertise. The FDIC is also focused on hiring and developing additional staff with quantitative skill sets to facilitate the evaluation of complex modeling used by the largest banks. In addition, several training initiatives were developed and implemented in 2015 that focused on large bank supervisory risks, structures, vulnerabilities, and processes.

Bank Secrecy Act/Anti-Money Laundering

The FDIC, with support from the FRB, OCC, and NCUA, facilitated the Spanish translation of the FFIEC BSA/AML Examination Manual (BSA/AML Manual). The Spanish version of the BSA/AML Manual was made public on the FFIEC InfoBase in October 2015. The BSA/AML Manual provides current guidance on risk-based policies, procedures, and processes for banking organizations to comply with the BSA and safeguard operations from money laundering and terrorist financing.

In July 2015, the FDIC hosted an Office of Foreign Assets Control (OFAC) representative who provided training to 30 examiners on recent changes to existing U.S. economic sanctions programs, as well as OFAC compliance expectations and enforcement case studies. The FDIC also participated in the Financial Action Task Force’s mutual evaluation of the United States’ system for preventing money laundering abuse of the financial system.

Information Technology, Cyber Fraud, and Financial Crimes

To highlight the importance and rapidly evolving nature of cybersecurity and information technology-related risks, a new Operational Risk Branch was created within the Division of Risk Management Supervision. The new branch has responsibility for information technology policy and examinations as well as cybersecurity and critical infrastructure protection initiatives.

To address the specialized nature of technology- and operations-related supervision, cyber risks, and controls in the banking industry, the FDIC routinely conducts information technology (IT) and operations examinations at FDIC-supervised institutions. The FDIC and other banking agencies also conduct IT and operations examinations of technology service providers (TSPs), which support financial institutions. The result of an IT and operations examination is a rating under the FFIEC Uniform Rating System for Information Technology, which is incorporated into the Management component of the Safety and Soundness rating and the Safety and Soundness Report of Examination.

In 2015, the FDIC conducted 1,886 IT and operations examinations at financial institutions and TSPs. Further, as part of its ongoing supervision process, the FDIC monitors significant events, such as data breaches and natural disasters that may affect financial institution operations or customers.

In addition to the FDIC’s operations and technology examination program, the FDIC regularly monitors cybersecurity issues in the banking industry through on-site examinations, regulatory reports, and intelligence reports. The FDIC works with the Financial and Banking Information Infrastructure Committee, the Financial Services Sector Coordinating Council for Critical Infrastructure Protection, Homeland Security, the Financial Services Information Sharing and Analysis Center (FS-ISAC), other regulatory agencies, law enforcement, and others to share information regarding emerging issues and coordinate responses. Further, the FDIC actively participates in the FFIEC’s Cybersecurity and Critical Infrastructure Working Group (CCIWG). The CCIWG serves as a forum to address policy related to cybersecurity and critical infrastructure, enables members to communicate and collaborate on activities to support and strengthen the resilience of the financial services sector, and provides input to FFIEC principal members regarding cybersecurity matters.

The FDIC’s major accomplishments during 2015 to promote IT security, assess risk management practices, and combat cyber fraud and other financial crimes included the following:

- Provided nationwide cybersecurity awareness training for financial institution management and all risk management examination staff at all six FDIC regional office locations and by teleconference. The training focused on the need for banks to establish a culture of managerial and directorate collaboration to address cybersecurity risks, particularly given the increasing volume and sophistication of cyber attacks.

- Produced a video on cybersecurity awareness as part of the FDIC’s Community Banking Initiative. The video provides useful information to bank directors, officers, and employees on cybersecurity.

- Hosted a nationwide teleconference to discuss the FDIC’s regulatory expectations regarding cybersecurity preparedness. During the teleconference, industry participants submitted and asked questions. The call was held in October 2015 in support of National Cybersecurity Awareness Month.

- Added three new scenarios to the FDIC’s Cyber Challenge simulation exercise. The exercise encourages community banks to discuss operational risk issues and the potential impact of information technology disruptions. The exercise now contains seven videos that depict various operational disruptions and materials to facilitate discussion about how the bank would respond to the disruptions. Lists of reference materials where banks can obtain additional information are also included.

- Published three FDIC Consumer News articles: “Computer Security Tips for Bank Customers: A Basic Checklist,” “Mobile Banking and Payments: New Uses for Phones...and Even Watches,” and “Beware of Thieves Who Target Loan and Credit Card Shoppers.”

- Conducted training for all FDIC IT Examiners that addressed technology and operational issues facing the federal financial regulatory agencies.

- Assisted financial institutions in identifying and shutting down “phishing” websites that attempt to fraudulently obtain and use an individual’s confidential personal or financial information.

- Hired 30 additional IT Examination Analysts to enhance the technical expertise of the IT supervisory workforce in areas of forensic analysis, network systems, payment systems, applications development, and business continuity planning/disaster recovery.

Major interagency accomplishments as a member of the FFIEC included the following:

- Published a Cybersecurity Assessment Tool to help financial institutions identify risks and determine their cybersecurity preparedness. The Assessment Tool provides a repeatable and measurable process for financial institutions to measure their cybersecurity preparedness over time.

- Collaborated with the FRB and OCC to develop a Cybersecurity Evaluation Tool to be used during TSP examinations.

- Published FFIEC statements on Cyber Attacks Compromising Credentials and Destructive Malware.

- Issued an appendix to the Business Continuity Planning (BCP) booklet of the FFIEC Information Technology Examination Handbook entitled “Strengthening the Resilience of Outsourced Technology Services.” The booklet is part of the IT Examination Handbook series. The appendix highlights and strengthens the BCP Booklet in four specific areas: Third-Party Management, Third-Party Capacity, Testing with Technology Service Providers, and Cyber Resilience.

- Revised the Management booklet of the FFIEC IT Examination Handbook to incorporate cybersecurity and cyber resiliency concepts as part of information security.

- Improved information sharing on identified technology risks among the IT examination workforces of the FFIEC member agencies through discussions at the March 2015 annual Supervisory Strategy meeting.

Minority Depository Institution Activities

The preservation of minority depository institutions (MDIs) remains a high priority for the FDIC.

In 2015, the FDIC continued to advocate for MDI and Community Development Financial Institution (CDFI) industry-led strategies for success. The institutions were encouraged to build on the results of the 2013 Interagency MDI and CDFI Bank Conference and the FDIC’s 2014 study on MDIs entitled Minority Depository Institutions: Structure, Performance and Social Impact. These strategies include industry-led solutions; MDI and CDFI bankers working together to tell their story; collaborative approaches to partnerships to share costs, raise capital, or pool loans; technical assistance; and innovative use of federal programs.

In June 2015, the FDIC sponsored a roundtable in Salt Lake City, Utah, with three trade groups representing nearly 100 MDIs and CDFIs and approximately 20 representatives of potential bank partners to discuss CRA partnerships. The FDIC provided an overview of five CRA community development activities related to minority and women-owned financial institutions. The trade groups outlined the community development needs of their members that might be opportunities for the banks to invest in or develop partnerships. The banks had the opportunity to engage in dialog with the MDI representatives. The trade groups and the banks will continue to build upon these initial discussions following the roundtable.

The FDIC co-sponsored with the OCC and the FRB the 2015 Interagency MDI and CDFI Bank Conference, held in July. Nearly 110 bankers from 72 banks attended the Celebrate 150 Years of Minority Depository Institutions: Changes, Challenges and Opportunities conference. The conference featured an interactive panel with FDIC Chairman Martin J. Gruenberg, Federal Reserve Board Governor Lael Brainard, and Comptroller of the Currency Thomas J. Curry. The conference encouraged interactive discussion among those who believe MDIs and CDFIs are uniquely positioned to create positive change in their communities. In addition, senior officials from federal agencies provided updates on programs and policies that can help MDIs and CDFIs achieve goals.

The FDIC also continues to pursue ways to improve communication and interaction with MDIs and to respond to the concerns of minority bankers. In addition to active outreach with MDI trade groups, the FDIC annually offers to arrange meetings between regional management and each MDI’s board of directors to discuss issues of interest. In addition, the FDIC routinely contacts MDIs to offer return visits and technical assistance following the conclusion of FDIC safety and soundness, compliance, CRA, and specialty examinations to assist bank management in understanding and implementing examination recommendations. These return visits, normally conducted 90 to 120 days after the examination, are to provide recommendations or feedback for improving operations, not to identify new issues. MDIs also may initiate contact with the FDIC to request technical assistance at any time. In 2015, the FDIC provided 101 individual technical assistance sessions on approximately 50 risk management and compliance topics, including the following:

- Accounting

- Bank Secrecy Act and Anti-Money Laundering

- Basel III Capital Rules

- Brokered Deposits/Waivers

- Capital Planning

- Commercial Real Estate Concentrations

- Community Reinvestment Act

- Funding and Liquidity

- Global Cash Flow

- High Volatility Commercial Real Estate

- Information Technology Risk Management and Security

- Interest Rate Risk

- Loan Underwriting and Administration

- Qualified Mortgage Rules

- Strategic Planning

- Third-Party Risk Management

The FDIC regional offices also held outreach, training, and educational programs for MDIs through conference calls and banker roundtables. In 2015, topics of discussion for these sessions included many of those listed above, as well as cybersecurity, vendor management, and the FDIC’s Community Banking Initiative, including the Technical Assistance Videos.

Economic Growth and Regulatory Paperwork Reduction Act

The FDIC, along with the other banking regulatory agencies, launched a cooperative, three-year effort to review all of their regulations. This review started in 2014 and continued throughout 2015. The purpose of the review, which is mandated by the Economic Growth and Regulatory Paperwork Reduction Act of 1996 (EGRPRA), is to identify and eliminate any regulatory requirements that are outdated or otherwise unnecessary.

To facilitate the review, the agencies categorized their regulations into 12 separate groups. Over the course of two years, the groups of regulations are being published for comment, providing industry participants, consumer and community groups, and other interested parties an opportunity to identify regulatory requirements they believe are no longer needed or should be modified. The agencies are analyzing the comments received and considering amendments to their regulations where appropriate.

On May 14, 2015, the public comment period closed for the regulations in the categories of Banking Operations, Capital, and the Community Reinvestment Act; approximately 23 comment letters were received.

On September 3, 2015, the comment period closed for rules relating to Consumer Protection; Directors, Officers and Employees; and Anti-Money Laundering. Approximately 16 comment letters were received.

On December 23, 2015, the agencies published the fourth Federal Register notice requesting comment on regulations regarding Securities, Safety and Soundness, and Rules of Procedure as well as all regulations the agencies have recently finalized, including those rules that the agencies have yet to fully implement. The comment period closes on March 22, 2016.

As a part of the regulatory burden reduction effort, the agencies hosted five nationwide outreach meetings during 2015 to facilitate awareness of the EGRPRA project and to listen to stakeholder comments and suggestions. Each meeting featured three banker panels covering the 12 categories of regulations and a consumer/community group panel. The outreach meetings were held at the Federal Reserve Banks in Dallas, Texas; Boston, Massachusetts; Kansas City, Missouri; and Chicago, Illinois; and at the FDIC in Arlington, Virginia. More than 1,030 individuals participated in the meetings in-person, by telephone, or via webcast. The Kansas City meeting focused on rural bank issues.

Several themes have emerged through the EGRPRA process that could affect community banks. One consistent item has been the discussion of whether laws and regulations based on long-standing thresholds should be changed.

In addition, due in part to feedback received as part of the EGRPRA review, the FDIC and the other FFIEC member entities are undertaking a community bank Call Report burden-reduction initiative. The objective of this initiative, which comprises actions in five areas, is to streamline and simplify regulatory reporting requirements for community banks. As an initial step, the banking agencies, under the auspices of the FFIEC, published proposed Call Report revisions, including a first set of proposed burden-reducing changes, on September 18, 2015. The agencies are evaluating the comments on the proposal and would begin to implement the revisions in the third quarter of 2016. As a second action, the banking agencies have accelerated the start of a statutorily mandated review of the existing Call Report data items, which otherwise would have commenced in 2017. Third, the FFIEC member entities are considering the feasibility and merits of creating a less burdensome version of the Call Report for small institutions. A fourth action for the FFIEC member entities is to better understand, through industry, the aspects of community banks’ Call Report preparation processes that are significant sources of reporting burden. This outreach effort included on-site visits to nine community banks during third quarter 2015 to learn about their reporting processes. Finally, the FFIEC and the agencies will offer periodic banker training by teleconferences and webinars to explain upcoming reporting changes and provide guidance on Call Report requirements that bankers find challenging.

Under Section 316(b) of the Dodd-Frank Act, rules transferred from the Office of Thrift Supervision (OTS) to the FDIC and other successor agencies remain in effect ’’until modified, terminated, set aside, or superseded in accordance with applicable law’’ by the relevant successor agency, by a court of competent jurisdiction, or by operation of law. When the FDIC republished the transferred OTS regulations as new FDIC regulations applicable to state savings associations, the FDIC stated in the Federal Register notice that its staff would evaluate the transferred OTS rules and might later recommend incorporating the transferred OTS regulations into other FDIC rules, amending them, or rescinding them. This process began in 2013 and continues, involving publication in the Federal Register of a series of NPRs and rulemakings. In 2015, the FDIC removed ten transferred OTS rules while making technical amendments to related FDIC rules for applicability to state savings associations. In addition, the FDIC repealed two transferred OTS rules that did not have corresponding FDIC rules and were deemed unnecessary to retain. The rules repealed were Possession by Conservators and Receivers for Federal and State Savings Associations, and Electronic Operations.

Other Rulemaking and Guidance Issued

During 2015, the FDIC issued and participated in the issuance of other rulemaking and guidance in several areas as described below.

Brokered Deposit Guidance

In January 2015, the FDIC issued FIL-2-2015 titled Guidance on Identifying, Accepting, and Reporting Brokered Deposits due to numerous questions regarding brokered deposit determinations. This FIL provided a series of FAQs regarding identifying, accepting, and reporting brokered deposits. The FAQs are based on Section 29 of the FDI Act and Section 337.6 of the FDIC Rules and Regulations, as well as on advisory opinions and the Study on Core Deposits and Brokered Deposits, which the FDIC issued in July 2011. The FDIC issued the FAQs in a plain language summary of previously issued guidance that is conveniently located in one place. In response to follow-up inquiries, the FDIC hosted an industry call on April 22, 2015, to further discuss the FIL and FAQs. Further, on November 13, 2015, the FDIC issued an update to the FAQs document in response to additional inquiries and requested public comments on those FAQs. The comment period on the updated document closed on December 28, 2015.

Statement on Providing Banking Services

In January 2015, the FDIC issued the Statement on Providing Banking Services (FIL-5-2015) to encourage institutions to take a risk-based approach in assessing individual customer relationships rather than declining to provide banking services to entire categories of customers, without regard to the risks presented by an individual customer or the financial institution’s ability to manage the risk.

Guidance on Private Student Loans with Graduated Repayment Terms at Loan Origination

In February 2015, the FDIC, jointly with the FRB, CFPB, NCUA, and the OCC and in conjunction with the State Liaison Committee (SLC), issued student loan guidance, which provides principles that financial institutions should consider in their policies and procedures for originating private student loans with graduated repayment terms. The guidance recognizes that students leaving a higher education program may prefer more flexibility with their payments as they transition into the labor market. It also reminds financial institutions that originate private student loans with graduated repayment terms to prudently underwrite the loans and provide disclosures that clearly communicate the timing and the amount of payments to facilitate a borrower’s understanding of the loan’s terms and features.

Filing Requirements and Processing Procedures for Changes in Control

In October 2015, the FDIC approved a final rule that amends Part 303 of the FDIC Rules and Regulations for filing requirements and processing procedures for notices filed under the Change in Bank Control Act (Notices). The final rule consolidated into one subpart the requirements and procedures for Notices filed with respect to state nonmember banks and state savings associations and eliminated Part 391, subpart E. The final rule also adopted certain practices of related regulations of the OCC and the FRB. The final rule clarifies the FDIC’s requirements and procedures based on its experience interpreting and implementing the existing regulation and is part of the FDIC’s continuing review of its regulations under EGRPRA.

Rescission of the Temporary Liquidity Guarantee Program

In October 2015, the FDIC rescinded Part 370 of the FDIC Rules and Regulations, which implemented the Temporary Liquidity Guarantee Program (TLGP). The TLGP was composed of two distinct components, the Debt Guarantee Program (DGP) and the Transaction Account Guarantee Program (TAGP). The DGP provided a temporary FDIC guarantee for all newly issued senior unsecured debt issued by participating entities up to prescribed limits, and the TAGP provided for the extension of unlimited deposit insurance for noninterest-bearing transaction accounts. Both programs had previously expired.

Clarifying Approach to Banks Offering Products and Services, such as Deposit Accounts and Extensions of Credit, to Nonbank Payday Lenders

In November 2015, the FDIC issued FIL-52-2015 clarifying its approach to banks offering products and services to nonbank payday lenders. The FIL reissued and updated FIL-14-2005, Payday Lending Programs: Revised Examination Guidance, and its attachment, Revised Guidelines for Payday Lending. The guidance was revised to make clear that it applies only to banks making payday loans. It does not apply to banks offering products and services, such as deposit accounts and extensions of credit, to nonbank payday lenders.

In addition, the aforementioned FILs reiterate the FDIC’s longstanding policy that financial institutions that properly manage customer relationships and effectively mitigate risks are neither prohibited nor discouraged from providing services to any category of customer accounts or individual customer operating in compliance with applicable state and federal law.

Advisory on Effective Risk Management Practices for Purchased Loans and Purchased Loan Participations

In November 2015, the FDIC issued FIL-49-2015 to update and replace the FDIC Advisory on Effective Credit Risk Management Practices for Purchased Loan Participations (FIL-38-2012, issued in September 2012). The updated Advisory reminds FDIC-supervised institutions of the importance of underwriting and administering purchased loans and loan participations in the same diligent manner as if they were being directly originated by the purchasing institution. It also outlines areas that should be considered before purchasing a loan or participation or entering into a third-party arrangement to purchase or participate in loans. More specifically, FDIC-supervised institutions should: (1) ensure that loan policies address the purchases; (2) understand the terms and limitations of agreements; (3) perform appropriate due diligence; and (4) obtain necessary board or committee approvals. Finally, the Advisory reminds institutions that third-party arrangements to facilitate loan and loan participation purchases should be managed by an effective third-party risk management process. The Advisory is based on existing guidance, including Guidance for Managing Third-Party Risk and Interagency Guidelines Establishing Standards for Safety and Soundness (Appendix A to Part 364 of the FDIC Rules and Regulations).

Statement on Prudent Risk Management for Commercial Real Estate Lending

In December 2015, the FDIC, FRB, and OCC jointly issued a statement to remind financial institutions of existing regulatory guidance on prudent risk management practices for commercial real estate (CRE) lending activity through economic cycles.

The guidance reminds financial institutions that they should maintain underwriting discipline and exercise prudent risk management practices that identify, manage, monitor, and control the risks arising from their CRE lending activity.

Regulatory Relief

During 2015, the FDIC issued ten FILs that provide guidance to help financial institutions and to facilitate recovery in areas affected by tornadoes, flooding, wild fires, landslides, mudslides, and other severe events. In these FILs, the FDIC encouraged banks to work constructively with borrowers experiencing financial difficulties as a result of natural disasters. The FILs also clarified that prudent extensions or modifications of loan terms in such circumstances can contribute to the health of communities and serve the long-term interests of lending institutions.

Depositor and Consumer Protection Rulemaking and Guidance

Joint Final Rule on Loans in Areas Having Special Flood Hazards

In June 2015, the FDIC issued a final rule, jointly with the OCC, FRB, NCUA, and FCA, amending the FDIC’s flood insurance regulation and implementing certain provisions in the Biggert-Waters Flood Insurance Reform Act of 2012 and the Homeowner Flood Insurance Affordability Act of 2014. Specifically, the final rule addressed detached structures, force placement of flood insurance, escrowing flood insurance premiums and fees, and notice of special flood hazards.

Interagency Examination Procedures for

the Truth in Lending Act (Regulation Z) and Real Estate Settlement Procedures

Act (Regulation X) Mortgage Rules

In June 2015, the FDIC released revised interagency examination procedures for the new Truth in Lending Act (TILA) - Real Estate Settlement Procedures Act (RESPA) Integrated Disclosure Rule (TRID Rule), as well as amendments to other provisions of TILA Regulation Z and RESPA Regulation X. The procedures were developed in coordination with member agencies of the FFIEC. The examination procedures should help financial institutions better understand the areas on which the FDIC will focus as part of the examination process.

Financial Institution Letter Regarding Military Lending Act Final Rule

In September 2015, the FDIC issued FIL-37-2015 to notify FDIC-supervised institutions that the Department of Defense (DOD) promulgated a final rule amending the implementing regulations of the Military Lending Act of 2006 (MLA). The final rule expands specific protections provided to service members and their families under the MLA and addresses a wider range of credit products than the DOD’s previous regulation. FDIC-supervised institutions and other creditors must comply with the rule for new covered transactions beginning October 3, 2016. For credit extended in a new credit card account under an open-end consumer credit plan, compliance is required beginning October 3, 2017.

Guidance on Supervisory Expectations for Financial Institutions Implementing the Truth in Lending Act (Regulation Z) and Real Estate Settlement Procedures Act (Regulation X) Integrated Disclosure Rule

In October 2015, the FDIC issued FIL-43-2015 providing guidance on initial supervisory expectations in connection with examinations of financial institutions for compliance with the TRID Rule, which became effective on October 3, 2015. During initial examinations for compliance with the TRID Rule, FDIC examiners will evaluate an institution’s compliance management system and overall efforts to come into compliance, recognizing the scope and scale of changes necessary for each supervised institution to achieve effective compliance. The FDIC’s supervisory approach regarding the TRID Rule is similar to the approach the FDIC took in initial examinations for compliance with the Ability-to-Repay/Qualified Mortgage rules that became effective in January 2014.

Promoting Economic Inclusion

The FDIC is strongly committed to promoting consumer access to a broad array of banking products to meet consumer financial needs. To promote financial access to responsible and sustainable products offered by IDIs, the FDIC:

- Conducts research on the unbanked and underbanked.

- Engages in research and development on models of products meeting the needs of lower-income consumers.

- Supports partnerships to promote consumer access and use of banking services.

- Advances financial education and literacy.

- Facilitates partnerships to support community and small business development.

Advisory Committee on Economic Inclusion

The Advisory Committee on Economic Inclusion (ComE-IN) provides the FDIC with advice and recommendations on important initiatives focused on expanding access to mainstream banking services to underserved populations. This may include reviewing basic retail financial services such as low-cost, safe transaction accounts, affordable small-dollar loans, savings accounts, and other services that promote individual asset accumulation and financial stability. During 2015, the ComE-IN met in May and October to discuss approaches to expanding access to Safe accounts, the economic inclusion potential of mobile financial services, financial education opportunities for young people, qualitative research into economic inclusion strategies for individuals with disabilities, and Money Smart for Small Business.

FDIC National Survey of Unbanked and Underbanked Households and Related Research

As part of its ongoing commitment to expanding economic inclusion in the United States, the FDIC works to fill the research and data gap regarding household participation in mainstream banking and the use of nonbank financial services. In addition, Section 7 of the Federal Deposit Insurance Reform Conforming Amendments Act of 2005 (Reform Act) mandates that the FDIC regularly report on underserved populations and bank efforts to bring individuals and families into the conventional finance system. In response, the FDIC regularly conducts and reports on surveys of households and banks to inform the efforts of financial institutions, policymakers, regulators, researchers, academics, and others.

During 2015, the FDIC revised, tested, and administered the 2015 FDIC National Survey of Unbanked and Underbanked Households, in partnership with the U.S. Census Bureau. The survey focuses on basic checking and savings account ownership, but it also explores household use of alternative financial services to better understand the extent to which families are meeting their financial needs outside of mainstream financial institutions. In addition, the survey incorporated questions designed to assess the typical monthly financial services consumption patterns and to better understand household use of bank and nonbank consumer credit instruments. A full report is expected in 2016.

In 2015, the FDIC also launched two qualitative research projects to further develop insights in this area. In the first, the FDIC conducted consumer research to better understand the economic inclusion potential of mobile financial services. Initial findings confirmed and provided more detailed insights into the opportunity of mobile financial services to improve the sustainability of banking relationships. In the second, the FDIC initiated interviews with bankers and other stakeholders to better understand the programs, products, and strategies that banks are finding useful for attracting and retaining unbanked households as customers.

Partnerships for Access to Mainstream Banking

The FDIC supports broadening consumer access to mainstream banking through work with the Alliances for Economic Inclusion (AEI), Bank On initiatives, local and state government, and in collaboration with federal partners and many local and national organizations. The FDIC also collaborates with other financial regulatory agencies to provide information and technical assistance on community development.

Local collaborations are many and diverse. The FDIC sponsored or co-sponsored more than 98 events during 2015 that provided opportunities for partners to collaborate on increasing access to bank accounts and credit services, opportunities to build savings and improve credit histories, and initiatives to significantly strengthen financial capability of community service providers who directly serve low- and moderate-income consumers.

During 2015, the FDIC helped convene financial institutions, community organizations, local, state, and federal agencies, and other partners to support coalitions that bring unbanked and underbanked consumers and owners of small businesses into the financial mainstream through the FDIC’s 14 area AEIs. AEI committees and working groups addressed specific challenges and financial services needs in their communities including education on the specific needs of unbanked and underbanked consumers, credit building training and seminars for community service providers and asset building organizations, workshops for financial coaches and counselors, promotion of savings opportunities for low- and moderate-income people and communities, outreach to bring larger numbers of people to expanded tax preparation assistance sites, and education for business owners to help them become bankable.

The FDIC also provided information and technical assistance in the development of safe and affordable transaction and savings accounts. In over 30 markets, the FDIC provided technical assistance to local Bank On initiatives and asset building coalition activities designed to reduce barriers to banking and increase access to the financial mainstream. For example, the FDIC collaborated with the Cities for Financial Empowerment Fund to support its national efforts to work with local government and other partners to increase the access of low- or moderate-income (LMI) consumers to safe and affordable financial products and services. In October 2015, FDIC Chairman Martin J. Gruenberg addressed the national launch of Bank On’s national account standards in San Francisco to advance strategies to expand access to products that are consistent with the FDIC’s Safe Account model.

The FDIC also supported efforts to link consumers to financial education and savings through activities organized for designated Money Smart or “financial fitness” weeks or months, involving hundreds of consumer outreach events. Moreover, working with the national, local, state, and targeted (youth, military, and minority consumer-focused) America Saves campaigns, the FDIC continued to link banking companies to active efforts for engaging consumers with setting savings goals at tax time and year round.

Advancing Financial Education

Financial education helps consumers understand and use bank products effectively and sustain a banking relationship over time. The FDIC continued to be a leader in developing high-quality, free financial education resources and pursuing collaborations to use those tools to educate the public. The FDIC’s work during 2015 dealt primarily with young people, consistent with the Financial Literacy and Education Commission’s focus on Starting Early for Financial Success.

In April 2015, the FDIC and the CFPB launched new educational tools for parents, students, and teachers. The new Money Smart for Young People series consists of four new age-appropriate curricula that are aligned with key academic standards. Unlike previous Money Smart products, these new tools involve educators, parents/caregivers, and young people in the learning process.

Strategic collaborations continue to be a critical component of the FDIC’s financial education efforts. The FDIC emphasizes the importance of pairing education with access to appropriate banking products and services through outreach. Working through coalitions, the FDIC participated as a speaker or exhibitor at 28 conferences and events that reached an estimated 10,000 people. As part of a small pilot project, the FDIC also provided training to 60 teachers in three jurisdictions on Money Smart for Young People as part of an initiative to better understand how the curriculum can be used and supported.

During 2015, the FDIC launched the second phase of the Youth Savings Pilot Program, aimed at identifying and highlighting promising approaches to offering financial education tied to the opening of safe, low-cost savings accounts for school-aged children. In the second phase, the FDIC selected 12 banks to join with the 9 banks selected in 2014 for the first phase. The FDIC facilitated discussions and knowledge sharing among the Pilot participants to talk about program design and structure, such as approaches to program evaluation, offering incentives, and opening accounts. The FDIC also responded to a range of inquiries from banks on technical issues to support their youth savings initiatives. The Pilot will culminate with a report in the fall of 2016 that will communicate lessons learned and offer promising practices for banks to work with schools or other organizations to combine financial education with access to savings accounts.

To support these types of collaborations, the FDIC, the FRB, the NCUA, the OCC, and the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) issued Interagency Guidance to Encourage Financial Institution Youth Savings Programs and Address Related Frequently Asked Questions in February 2015. The guidance is intended to encourage financial institutions to develop and implement programs to expand the financial capability of youth and build opportunities for financial inclusion for more families. It also addresses frequently asked questions that may arise as financial institutions collaborate with schools, local and state governments, nonprofit organizations, or corporate entities to facilitate youth savings and financial education programs.

While youth materials were the strategic focus during 2015, the FDIC also enhanced Money Smart program products for other audiences. For example, the instructor-led Money Smart materials for adults were updated to reflect the new mortgage disclosure rules. In addition, three new modules were added to the Money Smart for Small Business curriculum, using feedback from the small business technical assistance organizations that are also Money Smart Alliance members. The three new modules, developed jointly with the Small Business Administration (SBA), were added to help aspiring entrepreneurs learn about business ownership, gain a realistic perspective on costs of starting a business, and understand the purpose of cash flow management. In addition, the entire small business curriculum was made available in Spanish during 2015.

The FDIC continues to strengthen collaboration with the SBA and other small business resources beyond training. In 2015, each of the six FDIC regional Community Affairs teams sponsored 25 regional events for banks and the SBA and its SBA Resource Partner Network (SCORE, Small Business Development Centers and Women’s Business Centers, and Veteran’s Business Outreach Centers) to convene and discuss collaborations or provide technical assistance to small business leaders.

Community Development

In 2015, the FDIC provided technical assistance to banks and community organizations through 111 outreach events designed to foster understanding and practical relationships between financial institutions and other community development resources and stakeholders and to improve knowledge about the CRA.

The FDIC’s work particularly emphasized sharing information to support bank efforts to provide prudent access to responsible mortgage credit in underserved markets and improve the banking connections of small businesses. In addition, the FDIC sponsored sessions with interagency partners covering basic and advanced CRA training for banks. The agencies also offered CRA basics for community-based organizations as well as seminars on establishing effective bank-community collaborations for community development.

During 2015, the FDIC, other federal regulators, and federal and state housing agencies hosted two housing roundtable discussions and two housing workshops to offer technical assistance to help expand access to mortgage credit for LMI households. During these events, banks and program managers shared experiences with federal mortgage guarantee and secondary market programs and state and local down payment assistance and counseling programs. They offered details of their work so that audiences could gain a better understanding of how to address challenges and identify opportunities for expanding participation in these programs.

Community Banking Initiatives

Community banks provide traditional, relationship-based banking services in their local communities. These banks accounted for 13 percent of banking industry assets; however, this measure vastly understates the importance of these institutions to the U.S. economy and local communities across the nation. For example, community banks hold 44 percent of the industry’s small loans to farms and businesses, making them the lifeline to entrepreneurs and small enterprises of all types. Community banks also hold the majority of bank deposits in U.S. rural counties and micropolitan counties with populations up to 50,000. In fact, as of June 2015, community banks held more than 75 percent of deposits in more than 1,200 U.S. counties. In over 600 of these counties, the only banking offices available to consumers were those operated by community banks.

The FDIC is the lead federal supervisor for the majority of community banks and the insurer of all IDIs. The FDIC has a particular responsibility for the safety and soundness of community banks and for understanding and communicating the role they play in the banking system. Accordingly, the FDIC in 2012 launched a Community Banking Initiative focused on publishing new research on issues of importance to community banks and providing resources that will be useful to their efforts to manage risks, enhance the expertise of their staff, and better understand changes in the regulatory environment.

The FDIC continues to pursue an ambitious research agenda on community banks. Since the 2012 publication of the FDIC Community Banking Study, FDIC researchers have published ten additional studies on topics ranging from small business financing to the factors that have driven industry consolidation over the past 30 years. During 2015, the FDIC published studies on recent trends in branch banking; the challenges and opportunities facing small, closely held community banks; and an updated model of economies of scale at community banks. The Community Bank Performance section of the FDIC Quarterly Banking Profile (QBP), first introduced in 2014, continues to provide a detailed statistical picture of the community banking sector that can be accessed by analysts, other regulators, and bankers themselves. The most recent report shows that net income at community banks continued to grow at double-digit annual rates in 2015, while total loans and leases at these institutions grew at a rate that was substantially faster than the industry as a whole.

Community Banking Research Highlights from 2015

In 2015, FDIC economists published important research analyzing branch banking and the management and closely held ownership among community banks.

Branch Banking

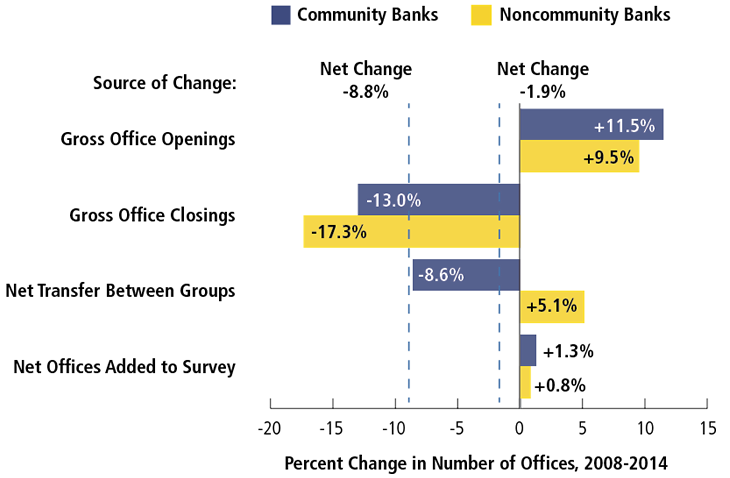

During the historic period of charter consolidation in U.S. banking since 1985, the number of banks and thrifts has declined by almost two-thirds. Yet, FDIC-insured institutions continue to operate about 93,000 banking offices—only 6 percent fewer than the all-time high reached in 2009. Even after the waves of new banking technologies introduced in recent decades, the density of U.S. banking offices per capita stands higher today than at any time before 1977. This relative stability in brick-and-mortar offices suggests that they remain useful in providing banking services even in the era of mobile banking. This is especially the case for community banks, which were shown to open new banking offices more frequently and to close existing banking offices less frequently than larger noncommunity banks (see chart on page 41). Even as technology marches forward, branch offices appear to remain an integral channel through which banks serve their customers and earn their trust.

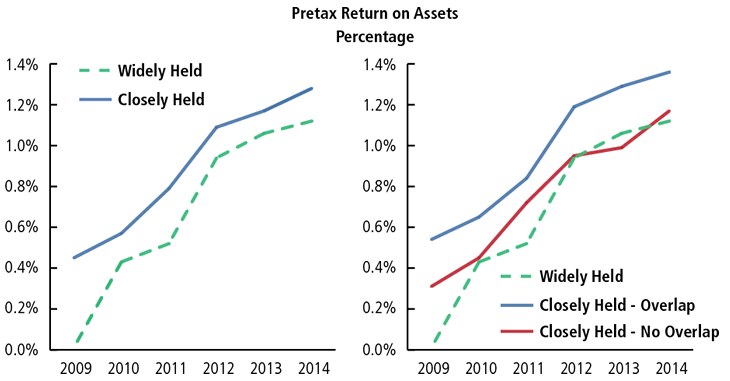

Closely Held Ownership

Small, closely held banks are often thought to experience certain disadvantages compared to their larger competitors. They seldom have ready access to the capital markets, and may find it hard to recruit management talent from outside the bank. Yet a new FDIC study shows that small, closely held community banks have consistently outperformed widely held institutions in recent years in terms of return on assets (see chart on page 42) and operational efficiency. What is the secret of their success? In a sample of nearly 1,400 community banks in three supervisory regions, nearly 75 percent were deemed by FDIC examiners to be “closely held” by an ownership group that was almost always based on family or community ties, or both. In almost 60 percent of these institutions, the key officer that managed the bank was either part of or affiliated with the ownership group. Moreover, this set of institutions—where ownership and management overlap—has reported the highest financial performance since 2009, suggesting that bank profitability may improve if ownership and management share the same goals. The real challenge for small, closely held banks may be to find equally qualified successors to manage the institution over the long run.

COMMUNITY BANKS HAVE TENDED TO OPEN MORE NEW OFFICES AND CLOSE FEWER EXISTING OFFICES THAN NONCOMMUNITY BANKS

Apart from research, the Community Bank Initiative includes a robust technical assistance program for bank directors, officers, and employees. The technical assistance program includes Directors’ College events held across the country, industry teleconferences, and a video program.

In 2015, the FDIC hosted 47 Directors’ College events. These events were typically conducted jointly with state trade associations and addressed issues such as corporate governance, regulatory capital, community banking, concentrations management, consumer protection, the Bank Secrecy Act, and interest rate risk, among others. In addition, the FDIC hosted five industry teleconferences on a range of topics of interest to community bankers, including brokered deposits, cybersecurity awareness, the implementation of CFPB’s mortgage rules, the interagency rule on loans in areas with special flood hazards, and youth savings programs. The FDIC also participated in two FFIEC industry teleconferences regarding regulatory capital reporting changes. In addition, the FDIC offered four deposit insurance coverage seminars for bank officers and employees in 2015. These free seminars, which were offered nationwide, particularly benefitted smaller institutions that have limited training resources. The FDIC also released three deposit insurance seminar training videos on the FDIC’s website and YouTube channel.

Among other FDIC technical assistance initiatives is the Directors’ Resource Center, a special section of the FDIC’s website that provides useful information to bank directors, officers, and employees on areas of supervisory focus and regulatory changes. One key element of this resource center is a Technical Assistance Video Program that offers in-depth, technical training for bankers to view at their convenience. During 2015, the FDIC released three technical assistance videos on cybersecurity awareness, the Loan Originator Compensation Rule, and the Servicing Rule. In addition, the FDIC expanded an existing resource—the FDIC’s Cyber Challenge: A Community Bank Cyber Exercise—to include three additional exercises. In 2015, the FDIC surveyed almost 800 financial institutions to obtain feedback on the Technical Assistance Video Program. The survey requested comments on the program as a whole and on individual videos within the program and asked for suggestions for the program, including topics for new videos. The FDIC is evaluating the feedback received.

CLOSELY HELD COMMUNITY BANKS WHERE OWNERSHIP AND MANAGERIAL CONTROL OVERLAP

HAVE CONSISTENTLY

REPORTED HIGHER PROFITABILITY

The FDIC continues to promote open communication with industry members during these meetings, including feedback on the pre-examination planning process. The FDIC’s electronic pre-examination planning package, launched in 2013, has enabled examiners to tailor examination information requests to the particular characteristics and risk profile of the institution, thereby reducing the amount of the information requested. The FDIC continues to monitor industry feedback on this process from outreach events and through the Post Examination Survey, and communicate best practices to examination staff regarding information requests and use of the information received.

Consumer Complaints and Inquiries

The FDIC helps consumers by receiving, investigating, and responding to consumer complaints about FDIC-supervised institutions and answering inquiries about banking laws and regulations, FDIC operations, and other related topics. In addition, the FDIC provides analytical reports and information on complaint data for internal and external use, and conducts outreach activities to educate consumers.

The FDIC recognizes that consumer complaints and inquiries play an important role in the development of strong public and supervisory policy. Assessing and resolving these matters helps the agency identify trends or problems affecting consumer rights, understand the public perception of consumer protection issues, formulate policy that aids consumers, and foster confidence in the banking system by educating consumers about the protection they receive under certain consumer protection laws and regulations.

Consumer Complaints by Product and Issue

The FDIC receives complaints and inquiries by telephone, fax, U.S. mail, email, and online through the FDIC’s website. In 2015, the FDIC handled 18,118 written and telephone complaints and inquiries. Of this total, 9,042 related to FDIC-supervised institutions. The FDIC responded to nearly 98 percent of these complaints within time frames established by corporate policy, and acknowledged 100 percent of all consumer complaints and inquiries within 14 days. As part of the complaint and inquiry handling process, the FDIC works with the other federal financial regulatory agencies to ensure that complaints and inquiries are forwarded to the appropriate agencies for response.

The FDIC carefully analyzes the products and issues involved in complaints about FDIC-supervised institutions. The number of complaints received about a specific bank product and issue can serve as a red flag to prompt further review of practices that may raise consumer protection or supervisory concerns.

In 2015, the five most frequently identified consumer product complaints and inquiries about FDIC-supervised institutions concerned credit cards (22 percent), consumer loans (15 percent), checking accounts (13 percent), residential real estate loans (11 percent), and prepaid cards (6 percent). Credit card complaints and inquiries most frequently described issues with billing disputes and error resolution, while the issues most commonly cited in correspondence about consumer loans were concerns with the reporting of erroneous information. Complaints and inquiries on checking accounts related to discrepancies or transaction errors on the account. The largest share of correspondence about residential real estate loans cited loan modifications and foreclosures as the main concern. Lastly, consumers most often identified issues with the release of funds in relation to prepaid cards.

The FDIC also investigated 89 complaints alleging discrimination during 2015. The number of discrimination complaints investigated has fluctuated over the past several years but averaged approximately 117 complaints per year between 2008 and 2015. Over this period, nearly 37 percent of the complaints investigated alleged discrimination based on the race, color, national origin, or ethnicity of the applicant or borrower; 22 percent related to discrimination allegations based on age; 8 percent involved the sex of the borrower or applicant; and roughly 5 percent concerned marital status.

Consumer refunds generally involve the financial institution offering a voluntary credit to the consumer’s account, often as a direct result of complaint investigations and identification of a banking error or violation of law. In 2015, consumers received more than $636,792 in refunds from financial institutions as a result of the assistance provided by the FDIC’s Consumer Affairs Program.

Public Awareness of Deposit Insurance Coverage

An important part of the FDIC’s deposit insurance mission is to ensure that bankers and consumers have access to accurate information about the FDIC’s rules for deposit insurance coverage. The FDIC has an extensive deposit insurance education program consisting of seminars for bankers, electronic tools for estimating deposit insurance coverage, and written and electronic information targeted to both bankers and consumers.

The FDIC continued its efforts to educate bankers and consumers about the rules and requirements for FDIC insurance coverage during 2015. For example, the FDIC conducted four telephone seminars for bankers on deposit insurance coverage, reaching an estimated 4,449 bankers participating at approximately 1,271 bank sites throughout the country. The FDIC also created deposit insurance training videos that are available on the FDIC’s website and YouTube channel.

During 2015, the FDIC received and answered approximately 90,429 telephone deposit insurance-related inquiries from consumers and bankers. The FDIC Call Center addressed 38,662 of these inquiries, and deposit insurance coverage subject-matter experts handled the other 51,767. In addition to telephone inquiries about deposit insurance coverage, the FDIC received 1,859 written inquiries from consumers and bankers. Of these inquiries, 99 percent received responses within two weeks, as required by corporate policy.

Center for Financial Research

The FDIC’s Center for Financial Research (CFR) encourages and supports innovative research on topics that are important to the FDIC’s roles as deposit insurer and bank supervisor. Research from CFR staff was accepted during the year for publication in leading banking, finance, and economics journals, and was presented at banking and finance seminars at major conferences, regulatory institutions, and universities. CFR researchers also produced a number of new working papers in 2015.

In addition, the CFR organized and sponsored the 15th Annual Bank Research Conference jointly with the Journal for Financial Services Research. More than 120 participants attended the conference, which was held in September 2015 and included more than 15 presentations on topics related to bank capital, liquidity, lending, dividend policy, systemic risk, and macroprudential regulation.

1 The CAMELS composite rating represents the adequacy of Capital, the quality of Assets, the capability of Management, the quality and level of Earnings, the adequacy of Liquidity, and the Sensitivity to market risk, and ranges from “1” (strongest) to “5” (weakest).