Introduction

The Federal Reserve Board, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (“the agencies”), jointly issued a final rule, effective October 10, 1997, that adopted uniform regulations1 implementing section 109 of the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 (IBBEA).

IBBEA allows banks to branch across state lines. Section 109, however, prohibits any bank from establishing or acquiring a branch or branches outside of its home State, pursuant to IBBEA, primarily for the purpose of deposit production. Congress enacted section 109 to ensure that interstate branches would not take deposits from a community without the bank reasonably helping to meet the credit needs of that community.

Subsequently, section 106 of the Gramm-Leach-Bliley Act of 1999 (GLBA) amended section 109 by changing the definition of an “interstate branch” to include any branch of a bank controlled by an out-of State bank holding company. Interagency regulations implementing this amendment became effective October 1, 2002.

The language of section 109 and its legislative history make clear that the agencies are to administer section 109 without imposing additional regulatory burden on banks. Consequently, the agencies’ regulations do not impose additional data reporting requirements nor do they require a bank to produce, or assist in producing, relevant data.

Coverage

Section 109 applies to any bank that has covered interstate branches. Examples of covered interstate branches can be found at the end of the Examination Procedures in this section.

Definitions

“Covered Interstate Branch”

Any branch of a national bank, a State member bank, or a State nonmember bank, and any Federal branch of a foreign bank, or any uninsured or insured branch of a foreign bank licensed by a State, that:

(i) is established or acquired outside the bank’s home State pursuant to the interstate branching authority granted by IBBEA or by any amendment made by IBBEA to any other provision of law; or

(ii) could not have been established or acquired outside of the bank’s home State but for the establishment or acquisition of a branch described in (i) and

- any bank or branch of a bank controlled by an out-of-State bank holding company.

“Home State”

- For State banks, home State means the State that chartered the bank.

- With respect to a national bank, home State means the State in which the main office of the bank is located.

With respect to a bank holding company, home State means the State in which the total deposits of all banking subsidiaries of such company are the largest on the later of:

(i) July 1, 1966; or

(ii) the date on which the company becomes a holding company under the Bank Holding Company Act.

With respect to a foreign bank, home State means:

(i) for purposes of determining whether a U.S. branch of a foreign bank is a covered interstate branch, the home State of the foreign bank as determined in accordance with 12 USC 3103(c) and Section 211.22 of the Federal Reserve Board’s Regulations (12 CFR §211.22), Section 28.11(o)) of the OCC’s regulations (12 CFR §28.11(o), and Section 347.202(j) of the FDIC’s regulations (12 CFR §347.202(j)); and

(ii) for purposes of determining whether a branch of a U.S. bank controlled by a foreign bank is a covered interstate branch, the State in which the total deposits of all banking subsidiaries of such foreign bank are the largest on the later of:

(a) July 1, 1966; or

(b) the date on which the foreign bank becomes a bank holding company under the Bank Holding Company Act.

“Host State” – means a State in which a covered interstate branch is established or acquired.

“Host State Loan-to-Deposit Ratio” – is the ratio of total loans in the host State to total deposits from the host State for all banks that have that State as their home State.

“Out-of-State Bank Holding Company” – means, with respect to any State, a bank holding company whose home State is another State.

“Statewide Loan-to-Deposit Ratio” – relates to an individual bank and is the ratio of the bank’s loans to its deposits in a particular State where it has one or more covered interstate branches.

The Two Step Test

Beginning no earlier than one year after a covered interstate branch is acquired or established, the agency will determine whether a bank is complying with the provisions of section 109. Section 109 provides a two-step test for determining compliance with the prohibition against interstate deposit production offices:

- Loan-to-deposit ratio. The first step involves a loan-to-deposit (LTD) ratio screen, which is designed to measure the lending and deposit activities of covered interstate branches. The LTD ratio screen compares the bank’s statewide LTD ratio to the host State LTD ratio. If the bank’s statewide LTD ratio is at least one-half of the relevant host State LTD ratio, the bank passes the section 109 evaluation and no further review is required. Host State ratios are prepared, and made public, by the agencies annually. For the most recent ratios, see OCC bulletins, FDIC Financial Institution Letters, or FRB Press Releases.

- Credit needs determination. The second step is a credit needs determination that is conducted if a bank fails the LTD ratio screen or if the LTD ratio cannot be calculated due to insufficient data or due to data that are not reasonably available. This step requires the examiner to review the activities of the bank, such as its lending activity and performance under the CRA, in order to determine whether the bank is reasonably helping to meet the credit needs of the communities served by the bank in the host State. Banks may provide the examiner with any relevant information including loan data, if a credit needs determination is performed.

Although Section 109 specifically requires the examiner to consider a bank’s CRA rating when making a credit needs determination, a bank’s CRA rating should not be the only factor considered. However, since most of the other factors (see procedure for Credit Needs Determination) are taken into account as part of a bank’s performance context under CRA, it is expected that banks with a satisfactory or better CRA rating will receive a favorable credit needs determination. Banks with a less than satisfactory CRA rating may receive an adverse credit needs determination unless mitigated by the other factors enumerated in section 109. To ensure consistency, compliance with Section 109 generally should be reviewed in conjunction with the evaluation of a bank’s CRA performance.

With respect to institutions designated as wholesale or limited purpose banks, a credit needs determination should consider a bank’s performance using the appropriate CRA performance test provided in the CRA regulations. For banks not subject to CRA, including certain special purpose banks and uninsured branches of foreign banks,2 the examiner should use the CRA regulations only as a guideline when making a credit needs determination for such institutions. Section 109 does not obligate the institution to have a record of performance under the CRA nor does it require the institution to pass any CRA performance tests.

Enforcement and Sanctions

Before a bank can be sanctioned under section 109, the appropriate agency is required to demonstrate that the bank failed to comply with the LTD ratio screen and failed to reasonably help meet the credit needs of the communities served by the bank in the host State. Since the bank must fail both the LTD ratio screen and the credit needs determination in order to be in noncompliance with Section 109, the agencies have an obligation to apply the LTD ratio screen before seeking sanctions, regardless of the regulatory burden imposed. Thus, if a bank receives an adverse credit needs determination, the LTD ratio screen must be applied even if the data necessary to calculate the appropriate ratio are not readily available. Consequently, the agencies are required to obtain the necessary data to calculate the bank’s statewide LTD ratio before sanctions are imposed.

If a bank fails both steps of the section 109 evaluation, the statute outlines sanctions that the appropriate agency can impose. The sanctions are:

(i) ordering the closing of the interstate branch in the host State; and

(ii) prohibiting the bank from opening a new branch in the host State.

Sanctions, however, may not be warranted if a bank provides reasonable assurances to the satisfaction of the appropriate agency that it has an acceptable plan that will reasonably help to meet the credit needs of the communities served, or to be served. An examiner should consult with the RO before discussing possible sanctions with any bank. Also, before sanctions are imposed, the agencies stated in the preamble to the final 1997 regulation that they intend to consult with State banking authorities.

Examination Objective

To ensure that a bank is not operating a covered interstate branch(es), as defined, primarily for the purpose of deposit production, by determining if the bank meets (i) the loan-to-deposit (LTD) ratio screen, or (ii) the credit needs determination requirements of section 109 of IBBEA.

Examination Procedures3

Examples of covered interstate branches can be found at the end of this section.

Identification of Covered Interstate Branches

- Banks controlled by an out-of-State bank holding company.

- Determine if the bank is controlled by an out-of-State bank holding company by identifying the home State of the bank and the home State of the bank holding company. To determine the home State of a bank, refer to the definition. To determine the home State of a bank holding company, refer to home State data available from your agency and confirm the home State with bank management.

- If the bank is not controlled by a bank holding company, or the home State of the bank holding company is the same state as the home State of the bank, the bank does not have any covered interstate branches under procedures #1. Go to procedure #2.

- If the home State of the bank holding company is not the same as the home State of the bank, then the bank meets the definition of a covered interstate branch and is subject to section 109. Go to procedures #2 and #3.

- Banks with interstate branches. Determine if the bank has any branches that were established or acquired pursuant to IBBEA in states other than the bank’s home State. If so, the bank has a covered interstate branch. Go to procedure #3. If the bank has no covered interstate branches under procedures #1 and #2, the bank is not subject to section 109 and no further review is necessary.

- One-year rule. For the covered interstate branches identified in procedure #1 and/or #2, determine if any have been covered interstate branches for one year or more. Note that, if any of a bank’s covered interstate branches within a particular state have been covered interstate branches for one year or more, then all of the bank’s covered interstate branches within that State are subject to review. If any branch has been a covered interstate branch for one year or more, go to procedure #4. If not, no further review is necessary at this time.

Assessing Compliance with the LTD Ratio Screen

- For a covered interstate branch subject to section 109, determine if the bank has sufficient data to calculate a statewide LTD ratio for each respective host State. (The bank is not required to provide this information or assist in providing this information.) For States where the bank has sufficient data, go to procedure #5. For States where the bank does not have sufficient data, go to procedure #6.

- For each host State where the bank can provide loan and deposit data, calculate and compare the bank’s statewide LTD ratio to the applicable host State LTD ratio provided by the agencies. If the bank’s statewide LTD ratio equals or exceeds one-half of the relevant host State LTD ratio, the bank passes the LTD ratio screen and the section 109 evaluation in that state and no further review is necessary. If the bank’s statewide LTD ratio is less than one-half of the host State LTD ratio in that state, the bank fails the LTD ratio screen. Go to procedure #6.

Credit Needs Determination

- For each host State identified in procedure #4 and/or #5, determine whether the bank is reasonably helping to meet the credit needs of communities served by the bank in the host State. When making this determination, consider the following items:

- whether the covered interstate branches were formerly part of a failed or failing depository institution;

- whether the covered interstate branches were acquired under circumstances where there was a low LTD ratio because of the nature of the acquired institution’s business or loan portfolio;

- whether the covered interstate branches have a higher concentration of commercial or credit card lending, trust services, or other specialized activities, including the extent to which the covered interstate branches accept deposits in the host State;

- the most recent ratings (overall rating, multistate MSA rating, and State ratings) received by the bank under the Community Reinvestment Act (CRA);

- economic conditions, including the level of loan demand, within the communities served by the covered interstate branches;

- the safe and sound operation and condition of the bank; and

- the CRA regulation, examination procedures, and interpretations of the regulation.

If the bank passes the credit needs determination test, the bank complies with section 109 and no further review is necessary. If the bank fails the credit needs determination test but a LTD ratio screen has not been conducted, go to procedure #7. If the bank fails the credit needs determination test and has failed the LTD ratio screen, the bank is in noncompliance with section 109. Go to procedure #8.

Determining Whether Sanctions are Warranted

- Calculate the bank’s statewide LTD ratio for each host State in which the bank failed the credit needs determination test. The data used to calculate these ratios may be obtained from any reliable source. The bank may, but is not required to, provide the examiner with additional data at any time during the examination. If the bank’s statewide LTD ratio(s) is equal to or greater than one-half of the host State LTD ratio, the bank complies with section 109 requirements and no further review is necessary. If a bank’s statewide LTD ratio is less than one-half of the respective host State LTD ratio, the bank is in noncompliance with section 109. Go to procedure #8.

- Consult the RO to determine whether sanctions are warranted.

Examination Checklist | ||

|---|---|---|

| Identify covered interstate branches subject to Section 109 | Yes | No |

| Evaluation | ||

1. Does the bank have any covered interstate branches? Determine: (a) if the bank has established or acquired any branches outside the bank’s home State pursuant to the interstate branching authority granted by the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, or (b) whether the bank, including a bank consisting of only a main office, is controlled by an out-of-State bank holding company as defined in section 2(o)(7) of the Bank Holding Company Act of 1956. | ||

| If the answer to both (a) and (b) is No, no further review is necessary. | ||

| 2. Have any covered interstate branches been covered interstate branches for one year or more? If any of a bank’s covered interstate branches within a particular state have been covered interstate branches for one year or more, then all of the bank’s covered interstate branches within that state are subject to review. | ||

| If the answer is No, no further review is necessary. | ||

| Assess Compliance with the Loan-to-Deposit (LTD) Ratio Screen | ||

| 3. Does the bank have sufficient data to calculate a statewide LTD ratio(s) in each respective host State for covered interstate branches subject to section 109? | ||

| For each host State where the answer is No, proceed to #5. | ||

| 4. For each host State where a covered interstate branch exists, calculate the bank’s statewide LTD ratio. Is the statewide LTD ratio equal to or greater than one-half of the host state LTD ratio? | ||

| For each host State where the answer is Yes, the bank complies with section 109 and no further review is necessary. For each host State where the answer is No, proceed to #5. | ||

| Perform Credit Needs Determination | ||

| 5. For each host State identified in #3 or #4, is the bank reasonably helping to meet the credit needs of the communities served by the bank in the host State? When making this determination, consider the following items: | ||

| • Whether the covered interstate branches were formerly part of a failed or failing depository institution; | ||

| • Whether the covered interstate branches were acquired under circumstances where there was a low LTD ratio because of the nature of the acquired institution’s business or loan portfolio; | ||

| • Whether the covered interstate branches have a higher concentration of commercial or credit card lending, trust services, or other specialized activities, including the extent to which the covered interstate branches accept deposits in the host State; | ||

| • The most recent ratings (overall rating, multistate MSA rating, and State ratings) received by the bank under the Community Reinvestment Act (CRA); | ||

| • Economic conditions, including the level of loan demand, within the communities served by the covered interstate branches; | ||

| • The safe and sound operation and condition of the bank; and | ||

| • The CRA regulation, examination procedures, and interpretations of this regulation. | ||

| If the bank passes the credit needs determination test, the bank complies with section 109 and no further review is necessary. If the bank fails the credit needs determination test but the LTD ratio screen has not yet been conducted, go to #6. If the bank fails the credit needs determination test and has failed the LTD ratio screen, go to #7. | ||

| Determine if Sanctions are Warranted | ||

| 6. Calculate the statewide LTD ratio for each host State where the bank failed the credit needs determination test. Is this ratio equal to or greater than one-half of the host State LTD ratio? | ||

| If the answer is Yes, the bank complies with section 109 and no further review is necessary. If the answer is No, the bank is in noncompliance with section 109 (go to #7). | ||

| 7. After consultation with RO, are sanctions warranted? | ||

Examples of Covered Interstate Branches

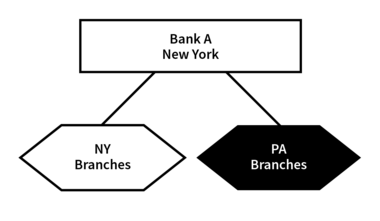

Bank with branches outside of its home State.

Bank A is an interstate bank with branches in PA that were established or acquired under IBBEA. Bank A’s home State is NY and its host State is PA. The PA branches are covered interstate branches subject to the section 109 review. Bank A’s statewide loan-to-deposit (LTD) ratio in PA is compared to the host State LTD ratio for PA.

The section 109 screen is conducted at the same time as a bank’s CRA examination.

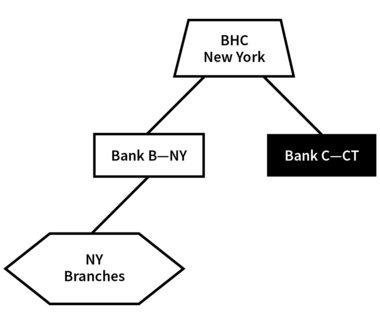

Bank, consisting only of a main office, controlled by an out-of-State bank holding company.

Banks B and Bank C are both controlled by a BHC whose home State is NY. Bank B is an intrastate bank and is not subject to the section 109 review.

Bank C’s home State is Connecticut and it is subject to the section 109 review because it is controlled by an out-of-State BHC whose home State is NY. Bank C’s statewide LTD ratio in CT will be compared to the host State LTD ratio for CT.

The section 109 screen is conducted at the same time as a bank’s CRA examination. The section 109 screen is conducted at the same time as a bank’s CRA examination.

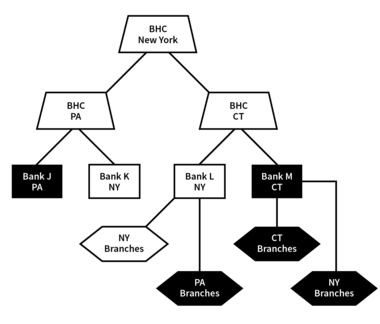

Covered interstate branches under a multi-tiered bank holding company structure.

This example illustrates the requirement to look to the top tier BHC when determining whether to conduct the section 109 review. Banks J, K, L, and M are all controlled by a top-tier BHC whose home State is NY.

Out-of-State BHC: Banks J and M are subject to section 109 reviews because an out-of-State top tier BHC controls both of them. Bank J’s home State is PA; its statewide LTD ratio in PA will be compared to the host State LTD ratio for PA. Bank M’s home State is CT; its statewide LTD ratio in CT will be compared to the host State LTD ratio for CT.

Out-of-State branches: Bank M’s branches in NY also are subject to the section 109 review because Bank M is an interstate bank. Bank M’s home State is CT; its statewide LTD ratio in NY is compared to the host State LTD ratio for NY. Bank L’s branches in PA also are subject to the section 109 review because Bank L is an interstate bank. Bank L’s home State is NY; its statewide LTD ratio in PA will be compared to the host State LTD ratio for PA.

Not subject to 109 review: Bank K is not subject to review for section 109 compliance because an out-of-State BHC does not control it and it does not have interstate branches.

The section 109 screen is conducted at the same time as a bank’s CRA examination.

References

Regulation - Part 369: Prohibition Against Use of Interstate Branches Primarily for Deposit Production

Job Aids

Host State Loan-to-Deposit Ratios

(Federal banking agencies jointly update the host state loan-to-deposit ratios annually in June for use during the following 12 months. The updated ratios, including additional information on how they are used to evaluate compliance with the requirements, are available on the federal banking agencies’ websites.)

| 1 | See 12 CFR 25, 12 CFR 208, and 12 CFR 369. |

| 2 | A special purpose bank that does not perform commercial or retail banking services by granting credit to the public in the ordinary course of business is not evaluated for CRA performance by the agencies. In addition, branches of a foreign bank, unless the branches are insured or resulted from an acquisition as described in the International Banking Act, 12 USC 3101 et seq., are not evaluated for CRA performance by the agencies. |

| 3 | This reflects the interagency examination procedures in their entirety. |