Introduction

The FDIC may initiate informal or formal action when an insured depository institution is found to be in an unsatisfactory condition. Informal actions represent the final supervisory step before formal enforcement proceedings are initiated. The FDIC has broad enforcement powers under the Federal Deposit Insurance (FDI) Act to issue formal enforcement actions.

This section provides a brief summary of the types of informal and formal actions that the FDIC has the authority to issue. When considering an enforcement action, the consultation policy should be followed.

Types of Enforcement Actions

Informal actions are voluntary commitments made by the Board of Directors/trustees of a financial institution. They are designed to correct identified deficiencies and ensure compliance with federal and state banking laws and regulations. Informal actions are neither publicly disclosed nor legally enforceable.

The most common informal enforcement actions used by the FDIC are the following:

- Board Resolution: Informal commitments developed and adopted by a financial institution’s Board of Directors/trustees, often at the request of an FDIC Regional Director, directing the institution’s personnel to take corrective action regarding specific noted deficiencies. The FDIC is not a party to the resolution, but approves and accepts the resolution as a means to initiate corrective action.

- Memorandum of Understanding: Informal agreement between an institution and the FDIC that is drafted by the Regional Office staff to address and correct identified weaknesses in an institution’s compliance or CRA posture. A Memorandum of Understanding is generally used in place of a Board Resolution when the FDIC has reason to believe that a Board Resolution would not adequately address the deficiencies noted during the examination.

Formal enforcement actions are those taken pursuant to the powers granted to the FDIC’s Board of Directors under Section 8 of the FDI Act. Each situation and circumstance determines the most appropriate action(s) to be taken. It is of note that formal enforcement actions are publicly available records.

Formal actions used in connection with compliance matters may include the following:

- Termination of Insurance: Section 8(a).

- Cease-and-Desist Order: Section 8(b): Issued to halt violations of laws or regulations as well as to require affirmative action to correct any condition resulting from such violations. By ordering an institution or an institution affiliated party (IAP), including an individual officer or director of an institution, to cease and desist from practices and/or take affirmative actions, the FDIC may prevent the problems facing the institution from reaching such serious proportions as to require more severe enforcement actions. If an institution voluntarily agrees to the entry of a Cease -and- Desist Order, it is entitled a “Consent Order.”

- Order for Restitution: Section 8(b)(6): Issued to require an institution or IAP to disgorge any unjust enrichment to consumers and/or take other affirmative action to redress consumer harm.

- Temporary Cease-and-Desist Order: Section 8(c): Issued in the most severe situations to halt particularly egregious practices pending a formal hearing on permanent Cease-and-Desist Orders issued pursuant to Section 8(b).

- Removal and Prohibition Order: Section 8(e)(1): The FDIC has the authority to order the removal of an IAP, i.e., director, officer, employee, controlling stockholder other than a bank holding company, or agent for an insured depository institution. The prohibition may be for specific activities or may be industry-wide.

- Temporary Suspension Order: Section 8(e)(3): The FDIC may order the temporary suspension of an IAP pending a hearing on an Order of Removal if the individual’s continued participation poses an immediate threat to the institution or to the interests of the institution’s depositors.

- Suspension Order: Section 8(g): Issued to IAPs who are charged with felonies involving dishonesty or a breach of trust pending the disposition of the criminal charges.

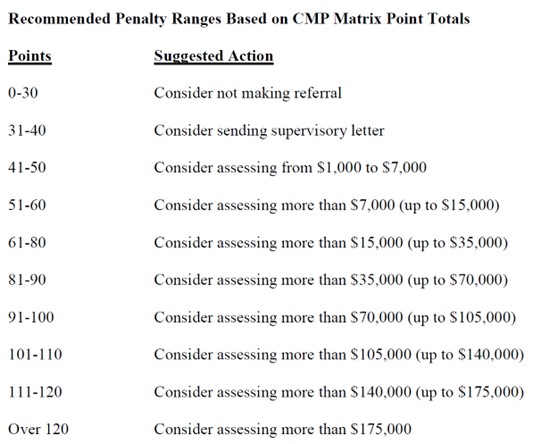

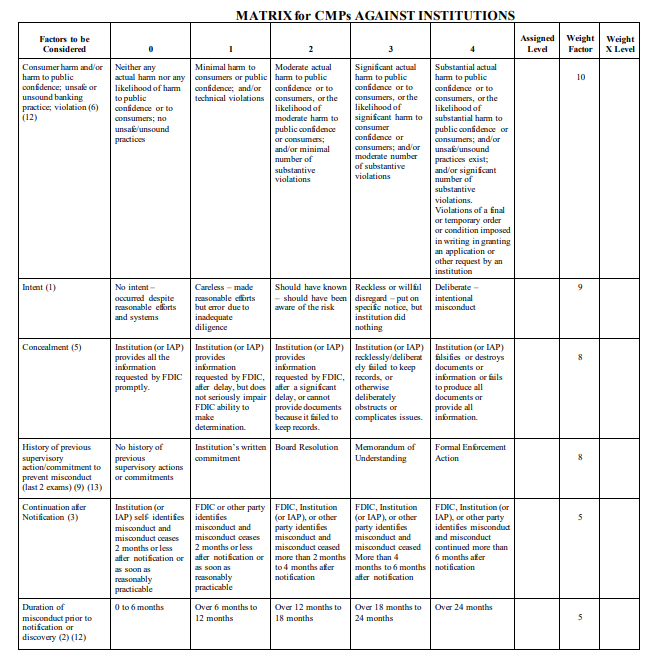

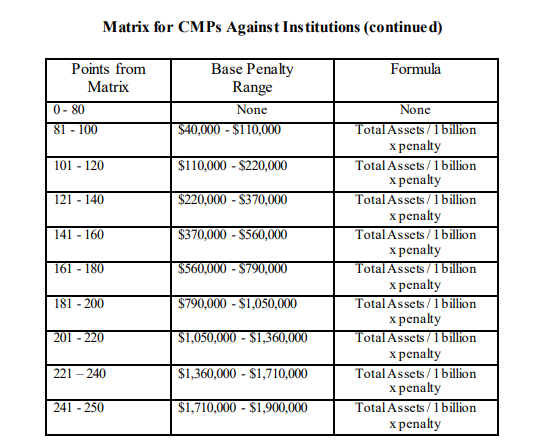

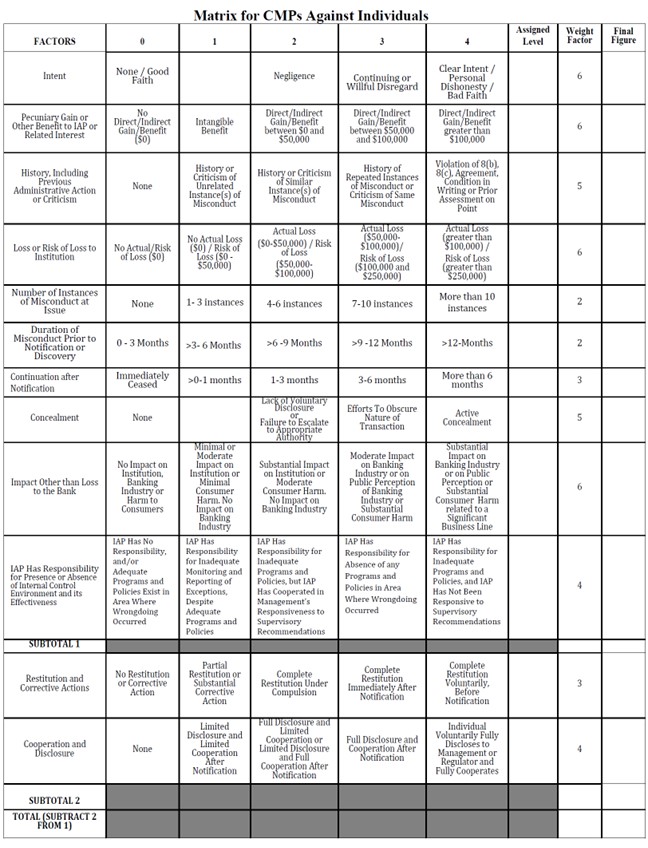

- Civil Money Penalties: Section 8(i)(2): CMPs are assessed to sanction an institution, IAP, or an individual for a violation, breach of a fiduciary duty, and/or practice. They are also assessed to deter future occurrences. In the case of a CMP assessed to an institution or IAP, twelve factors that measure the breadth and severity of the problem are considered, including consumer harm, cooperation, and supervisory history. Additionally, the asset size of the institution is taken into account. In the case of a CMP assessed to an individual, a similar analysis is performed. The FDIC utilizes separate matrices for institutions and individuals. In both cases, the CMP matrices are guidance intended to promote consistency in the assessment of CMPs. The matrices aid the examiner in determining the appropriateness and/or level of CMPs. Each CMP matrix is included at the end of this section.

Annual publication of adjustments to civil money penalties will occur by January 15 of each calendar year. The FDIC will publish notice in the Federal Register of the maximum penalties that may be assessed after January 15 of that year. When recommending or assessing a CMP, the CMP amount recommended or assessed will reflect the most recent inflation-adjusted CMP amounts.

References

Federal Deposit Insurance Act, Section 8

12 CFR §308 (Rules of Procedure; multiple subparts)

Interagency Policy Regarding the Assessment of Civil Money Penalties by the Federal Financial Institutions Regulatory Agencies

Interagency Notification and Coordination of Enforcement Actions by the Federal Banking Regulatory Agencies

Joint statement of Policy: Administrative Enforcement of the Truth in Lending Act – Restitution

MATRIX for CMPs AGAINST INSTITUTIONS

Matrix for CMPs Against Institutions (continued)

NOTE: The Matrix for CMPs Against Institutions is offered only as guidance; it should not be a substitute for experience and sound supervisory judgment. The matrix in no way limits the discretion of the FDIC to factor in the precise facts and circumstances of each case, or other factors as justice requires, into the CMP determination. Also, to determine a CMP against an individual, refer to the Instructions and Matrix for Civil Money Penalties Against Individuals. The CMP amount may not exceed the statutory maximum set forth in section 8(i)(2) of the FDI Act, as adjusted by 12 C.F.R. § 308.132.

Matrix for CMPs Against Individuals

Matrix for CMPs Against Individuals (continued)