Introduction

The purpose of the Federal Trade Commission’s (FTC) 1976 rule concerning the Preservation of Consumers’ Claims and Defenses (16 C.F.R. Part 433), sometimes called the Holder-in-Due-Course Rule (Rule), is to ensure that consumer credit contracts used in financing the retail purchase of consumer goods or services specifically preserve the consumer’s rights against the seller. The FTC determined that it constitutes an unfair and deceptive practice for a seller, in the course of financing a consumer purchase of goods or services, to employ procedures which make the consumer’s duty to pay independent of the seller’s duty to fulfill its obligations.

Regulation Overview

The Holder-in-Due-Course Rule prohibits a seller from taking or receiving a consumer credit contract that does not contain a prescribed notice which preserves the consumer’s claims and defenses in the event that the contract is negotiated or assigned to a third party creditor. In addition, the Rule provides that the seller may not accept the proceeds of a purchase money loan unless the evidence of the loan contains the prescribed notice preserving as against the lender whatever claims and defenses the consumer may have against the seller. Omission of the required notice by the seller, or acceptance by the seller of the proceeds of the purchase money loan where the evidence of the loan does not contain the notice, constitutes an unfair or deceptive practice within the meaning of Section 5 of the Federal Trade Commission Act.

The Rule does not apply to all credit instruments. The Notice must appear in written obligations defined as “Consumer Credit Contracts” in the Rule. The definition includes any written instrument which, under the Truth in Lending Act and Regulation Z constitutes a consumer credit contract and which is used to “Finance a Sale” or in connection with a “Purchase Money Loan,” as those terms are defined in the Rule. Credit card instruments are specifically exempted from the Rule.

Under the Rule, banks which purchase consumer paper containing the notice required of sellers cannot avail themselves of the holder-in-due-course doctrine. Also, banks which make purchase money loans containing the notice will be subject to all claims and defenses which the consumer could assert against the seller.

If banks accept consumer paper which fails to contain the notice required of sellers, they may be considered to be a participant in the seller’s violation of the Rule. Banks making purchase money loans must include the prescribed notice in their contracts.

The required notice, which follows, must be in at least ten point, bold face, type:

NOTICE

Any holder of this consumer credit contract is subject to all claims and defenses which the debtor could assert against the seller of goods or services obtained pursuant hereto or with the proceeds hereof. Recovery hereunder by the debtor shall not exceed amounts paid by the debtor hereunder.

References

Job Aids

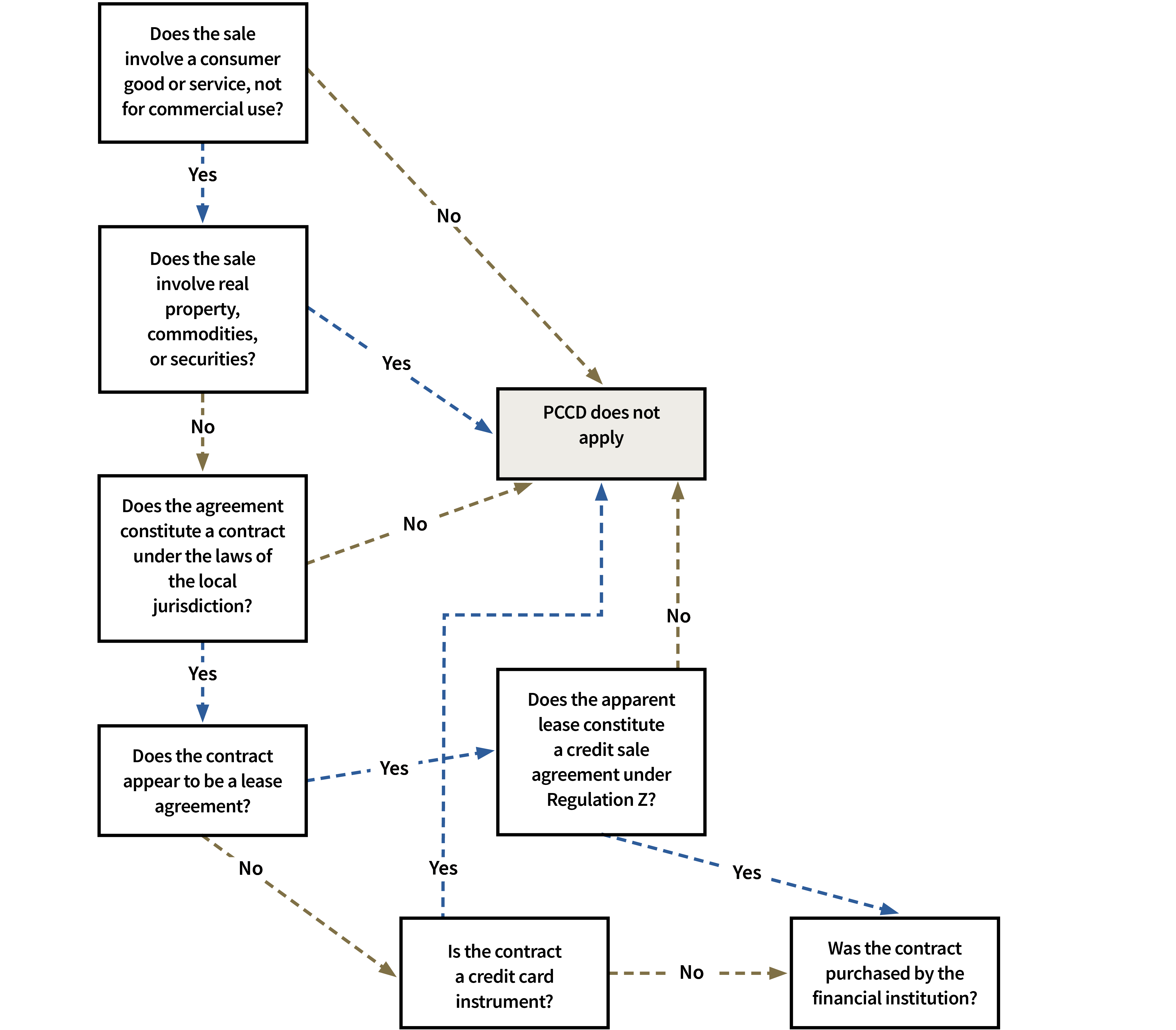

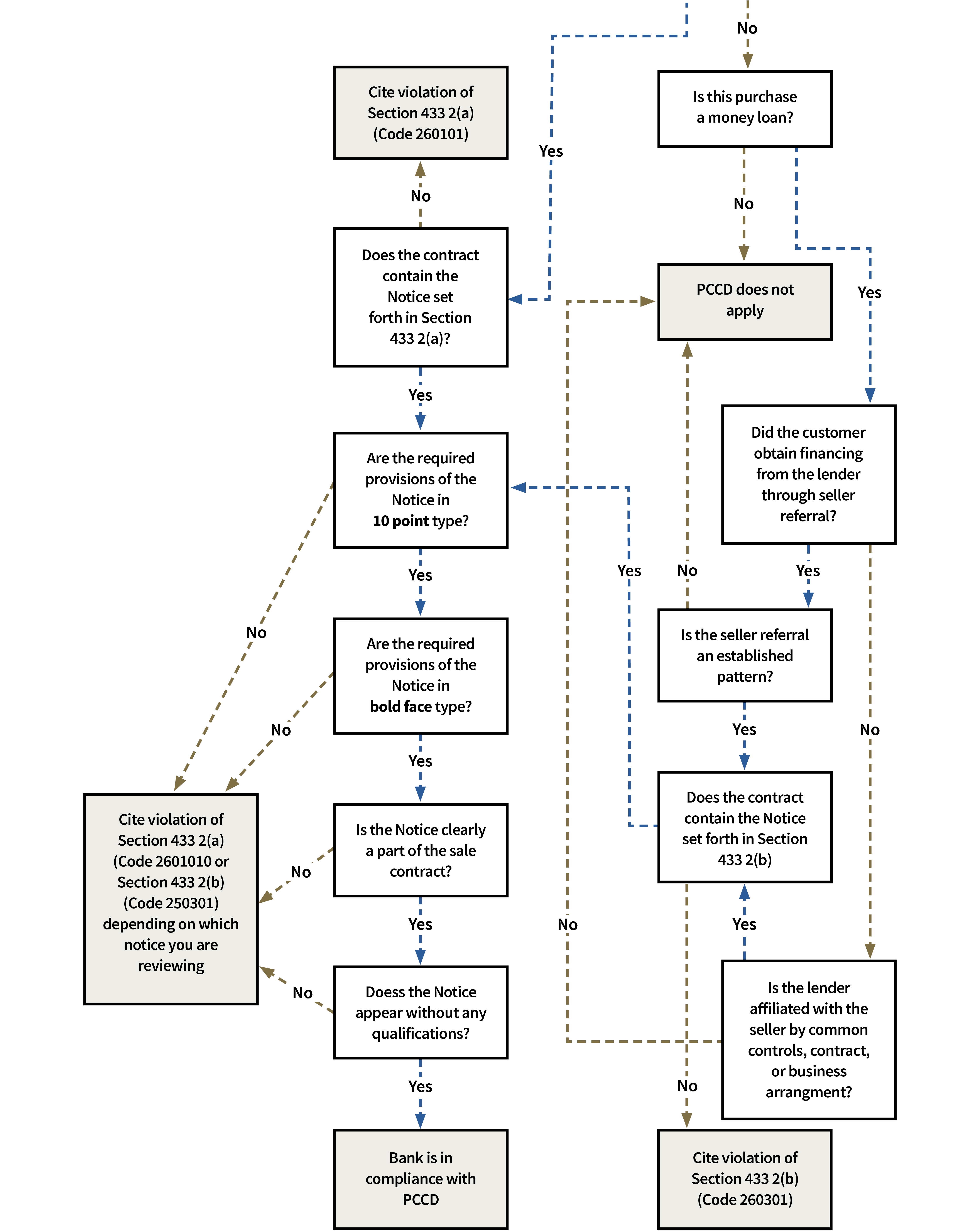

See Preservation of Consumers’ Claims and Defenses (PCCD) chart