Printable Version

Printable Version en Español

Put yourself in the driver’s seat with these great tips

Many experts consider January and February a good time to make a vehicle purchase because consumers have access to the newest models and prices tend to be lower than later in the year. There are other ways to save on this important purchase, such as improving your credit score for better interest rates, saving for a larger down payment, buying a less expensive car than planned, and getting fewer add-ons, features, or options on a vehicle. If you’re thinking about buying a new car, before you head out to a dealership, review these tips and resources to determine if this is the right time for you.

How much should I spend?

Creating a budget is one of the best ways to show what funds are available and what is needed to make a car purchase. The cost of the vehicle is just one part; there are additional upfront costs to consider like taxes, title fees, and dealer fees. Then there are costs to protect your new purchase and keep it in working order, such as insurance, gas, tires, annual registration fees, maintenance, and even parking. It is a lot to consider, and seeing all of the costs together will give you a better picture of what is required.

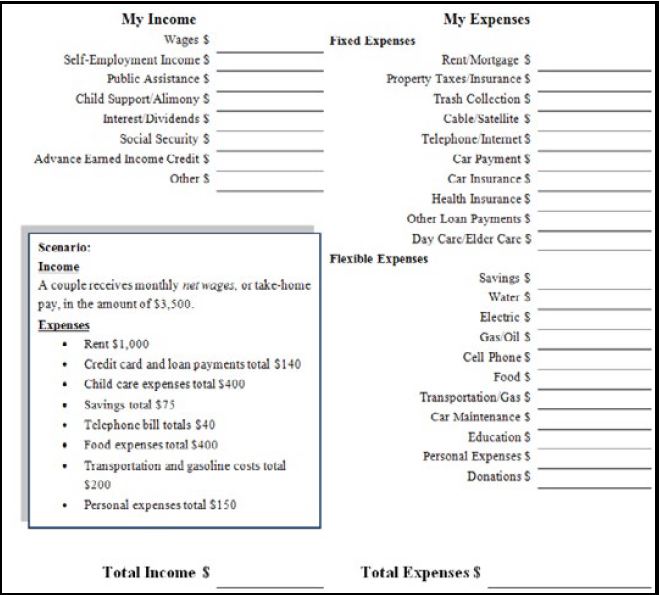

A personal budget is a great tool to capture expenses and help determine how much to spend. Budget templates are available in a variety of formats for smartphones, tablets, and computers, and often look something like this:

For more information on budgeting, visit https://www.consumer.gov/content/make-budget-worksheet (www.consumer.gov).

Make a Budget - PDF (www.consumer.gov).

Credit scores and loan costs

It’s a good idea to shop for loans to get the best interest rate and terms. Your credit score also helps determine what kind of auto loans and interest rates are available to you. A higher credit score typically gives you a better interest rate on your loan. To learn more about improving your credit score, go to: FDIC Consumer News - Summer 2015: Establishing or Rebuilding Credit Scores: Options for Moving Forward.

Be sure to review your credit report and dispute any errors that you may find to ensure your credit score is accurate.

For more information about obtaining a free copy of your credit report, visit: Consumer Protection Topics - Credit Reports: Credit Report Basics.

Loan Preapproval

Getting preapproved for a loan by multiple lenders allows them to compete for your business. This puts you in a stronger negotiating position with your lenders and can help lower your total loan cost. Be sure to compare the financing offered through the dealership with the rate and terms of any preapproval you received from other lenders, and then choose the option that best fits your budget. Regulation Z, which implements the Truth in Lending Act, requires banks to provide consumers with certain information about a loan before you decide to move forward with it. Banks should provide an itemization of the costs to be financed, annual percentage rate (APR), payment schedule, total number of payments, late payment information and fees, and security interest information.

Co-signers

Consider whether or not you need a co-signer for your auto loan. A co-signer is a person, such as a parent, family member, or friend who is contractually obligated to pay back the loan if you can’t. If your credit history is limited, needs improvement, or you have a low credit score (or no credit score), a co-signer with good or excellent credit could significantly lower your interest rate. The lender relies on the co-signer’s credit history and score when deciding whether or not to make the loan. You and the potential co-signer should think carefully about this option. If you do not repay your loan, you and your co-signer will be responsible for repayment. The co-signer will be responsible for the loan even though he or she has no right to possession of the vehicle. In addition, any late payments made on the loan would affect both your credit history and scores and your co-signer’s credit history and scores.

Add-ons

Some common add-ons are service contracts or warranties, Guaranteed Auto Protection (GAP) Insurance, and Credit Insurance. Often there are optional physical features for the vehicle, such as alarm systems, window tinting, tire and wheel protection, and other products offered by the auto dealer. It’s a good idea to think about optional add-ons ahead of time, so that you are prepared and know what you want on the day you finance your vehicle. If you buy them, it will increase the total cost of your loan. Shopping around for any add-ons that you decide you want can also save you money.

Buying a new car can be exciting, just make sure you are well informed on the costs and financing and have a plan in place before you start shopping.

For more help or information, go to FDIC.gov or call the FDIC toll-free at 1-877-ASK-FDIC (1-877-275-3342). Please send your story ideas or comments to ConsumerNews@fdic.gov