FDIC-Insured Institutions Reported Improved Profitability in Third Quarter 2020

For Release

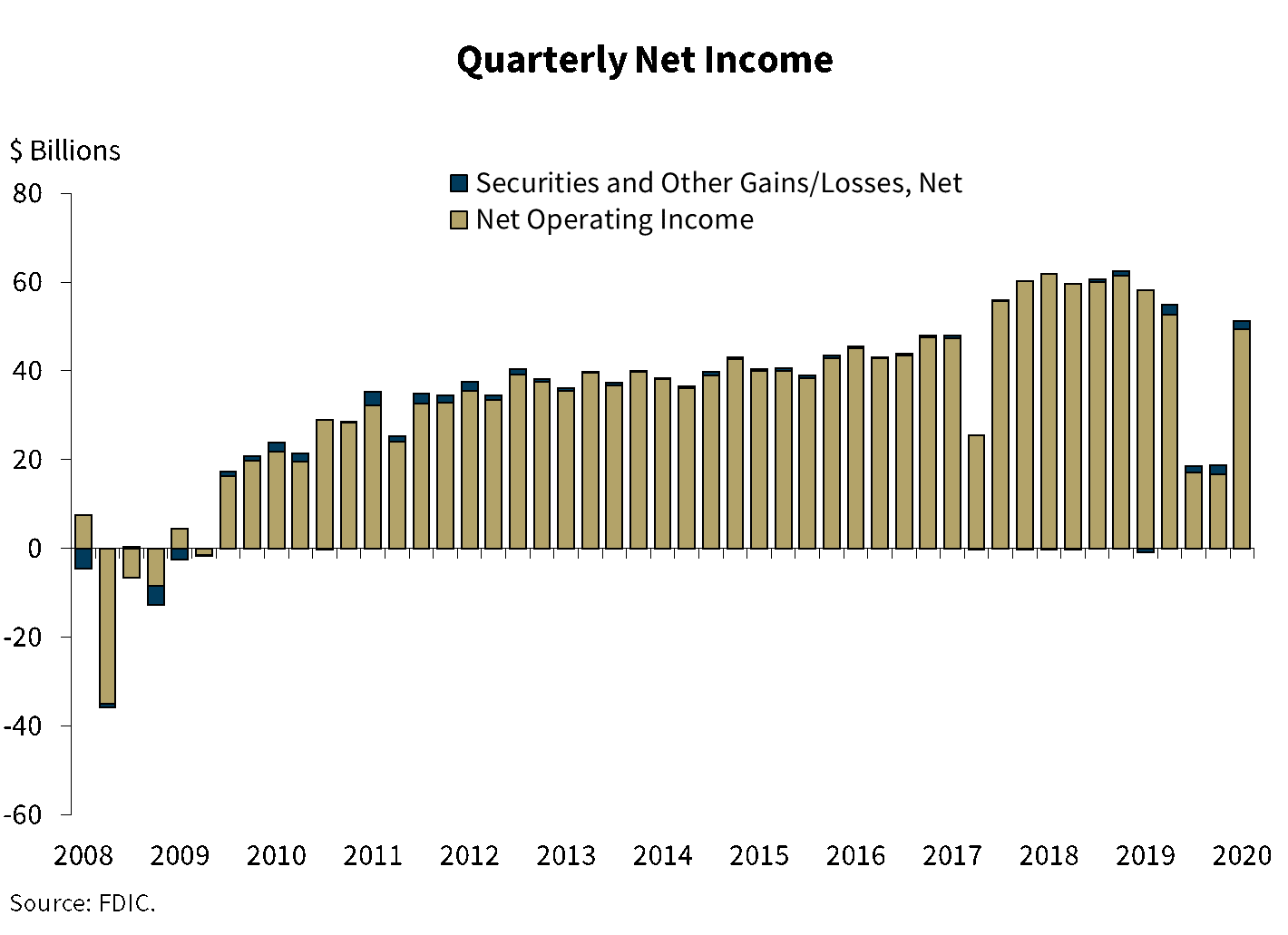

- Quarterly Net Income Improved, Primarily Because of Lower Provision Expense

- Net Interest Margin Fell to a Record Low

- Loan and Lease Balances Declined, Driven by Reduced Commercial and Industrial Lending Activity

- Noncurrent Loan Balances Increased Modestly

- Community Banks Reported a 10 Percent Increase in Net Income Year Over Year

“The banking industry exhibited operational resiliency in the third quarter, with improvements in profitability despite continued headwinds and economic uncertainties resulting from the effects of the COVID-19 pandemic.”

— FDIC Chairman Jelena McWilliams

WASHINGTON—The Federal Deposit Insurance Corporation (FDIC) today reported results from commercial banks and savings institutions that reflect improved profitability from the first and second quarters of this year, increased liquidity, and strengthened capital levels. As a result, the banking industry remains well positioned to accommodate loan demand and support the economy.

For the 5,033 FDIC-insured commercial banks and savings institutions that filed Call Reports, aggregate net income totaled $51.2 billion in third quarter 2020. Although this level is down $6.2 billion (10.7 percent) from a year ago, it marks an improvement from the first half of the year and reflects moderate increases in business activity and consumer spending during the third quarter. Economic uncertainties and the effects of the COVID-19 pandemic drove an annual increase in provision expenses, but quarterly provision expenses fell significantly from second quarter 2020. Financial results for third quarter 2020 are included in the FDIC’s latest Quarterly Banking Profile released today.

“Modest improvements in the economy and higher consumer spending supported stronger earnings results for the banking industry in the third quarter. However, economic uncertainties and pressure on revenue from unprecedented net interest margin compression continued to weigh on the banking industry. Nonetheless, the industry remains well positioned to accommodate loan demand and support the economy,” McWilliams said.

Highlights from the Third Quarter 2020 Quarterly Banking Profile

Quarterly Net Income Improved Relative to the First Half of 2020: Net income was $51.2 billion, up $32.4 billion (173 percent) from the second quarter 2020, but down $6.2 billion (10.7 percent) year-over-year. The annual reduction in net income was much less severe than that reported during the previous quarter and was boosted by a decline in provision expenses of $47.5 billion (76.8 percent) between second and third quarter 2020.

More than half of all banks (52.7 percent) reported improvements in quarterly net income from the second quarter; however, the share of unprofitable institutions increased from a year ago to 4.7 percent. The annual decline in earnings pulled the average return on assets ratio down from 1.25 percent in third quarter 2019 to 0.97 percent.

Net Interest Margin Fell to an Unprecedented Level: The average net interest margin fell by 68 basis points from a year ago to 2.68 percent, the lowest level reported in the history of the Quarterly Banking Profile . Net interest income declined for a fourth consecutive quarter, falling by $10 billion (7.2 percent) from third quarter 2019—the largest year-over-year decline on record. The annual reduction in yields on earning assets (down 139 basis points) outpaced the decline in average funding costs (down 72 basis points). Nearly half of all banks (49.9 percent) reported lower net interest income year-over-year.

Community Banks Reported a 10 Percent Increase in Net Income Year-Over-Year: Reports from 4,590 FDIC-insured community banks reflect annual net income growth of $659.7 million despite a 116.6 percent increase in provision expense and continued net interest margin compression. Nearly half of community banks (48 percent) reported higher quarterly net income. Higher revenue from the sale of loans (up $1.9 billion or 154.2 percent) drove the improvement in quarterly net income year-over-year. The net interest margin for community banks compressed 41 basis points year over year to 3.27 percent, as the decline in average earning asset yields continued to outpace the decline in average funding costs.

Loan and Lease Volume Fell Slightly in the Quarter: Total loans and leases declined by $84.5 billion (0.8 percent) from the previous quarter. A reduction in commercial and industrial (C&I) lending drove the decline of $150.3 billion (5.6 percent) from second quarter 2020. Compared with third quarter 2019, total loan and lease balances grew by 4.9 percent. This rate is below the annual growth rate of 6.8 percent reported last quarter, and driven by stronger loan growth in the first half of the year.

Community banks reported positive loan growth between second and third quarter 2020 of 1 percent. Annual loan growth was relatively strong for community banks at 13.4 percent, but was driven primarily by lending activity in the first half of 2020.

Asset Quality Weakened Marginally: Noncurrent loans (i.e., loans that were 90 days or more past due or in nonaccrual status) increased by $9.3 billion (7.9 percent) in third quarter 2020. The noncurrent rate for total loans increased by 9 basis points from the previous quarter to 1.17 percent. This movement was less severe than the 14 basis point increase reported in the previous quarter.

Net charge-offs declined by $418 million (3.2 percent) from a year ago, contributing to a 4 basis point reduction in the total net charge-off rate to 0.46 percent. Noncurrent and net charge-off rates remain well below historical highs.

The Deposit Insurance Fund’s Reserve Ratio Remained Unchanged from the Previous Quarter at 1.30 Percent as Deposit Growth Stabilized: The Deposit Insurance Fund totaled $116.4 billion in the third quarter, up $1.8 billion from the second quarter. Deposit growth stabilized during the third quarter after record increases in the first of 2020 and is now near the average rate of growth between year-end 2014 and year-end 2019.

Mergers and New Bank Openings Continued in the Third Quarter: During the third quarter, one new bank opened, 33 institutions were absorbed through mergers, and no banks failed.