FDIC-Insured Institutions Reported Net Income of $59.9 Billion In Fourth Quarter 2020

For Release

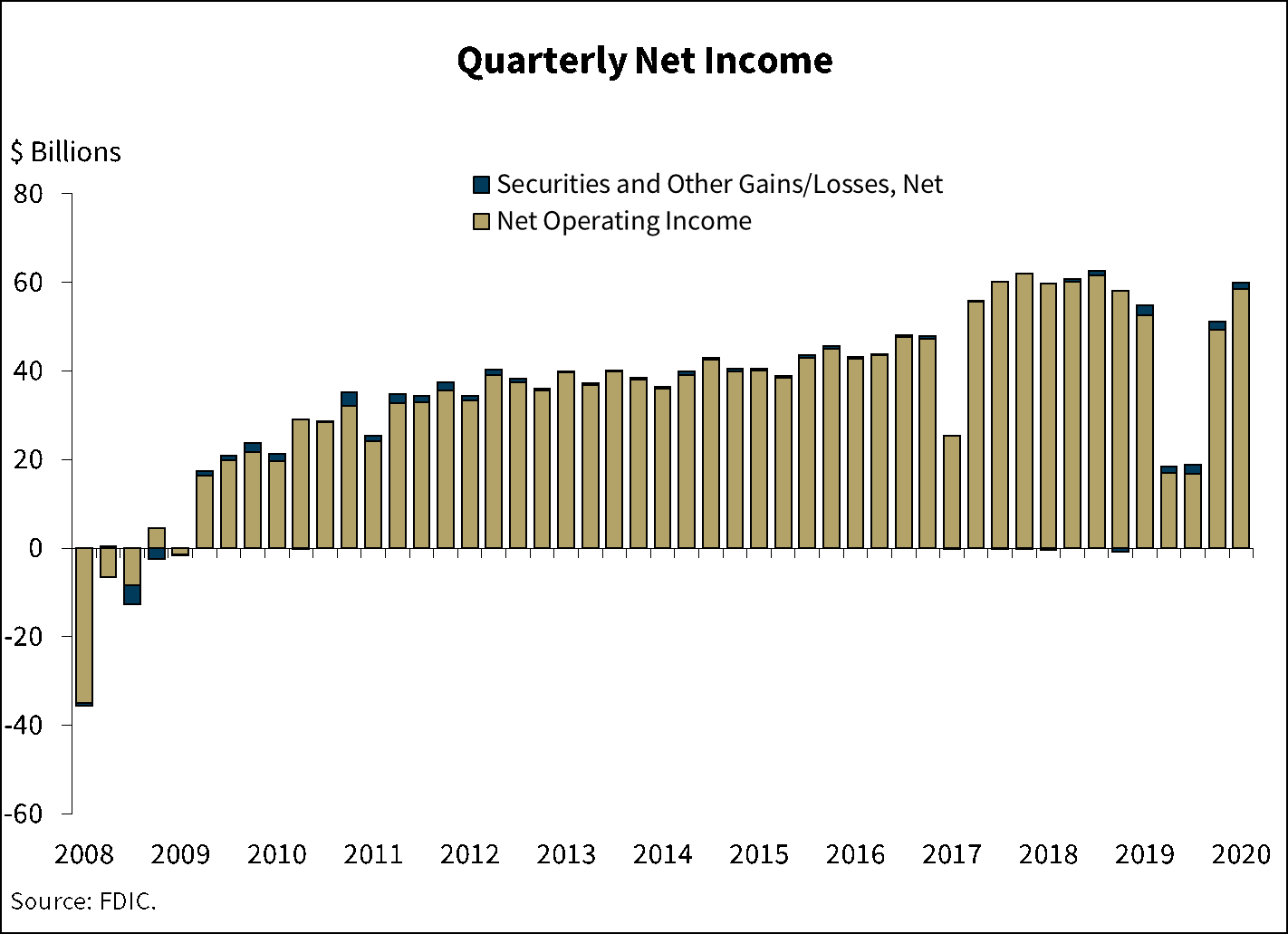

- Full-Year 2020 Net Income Declined 36.5 Percent to $147.9 Billion

- Quarterly Net Income Increased 9.1 Percent from a Year Ago

- Net Interest Margin Remained Unchanged from Third Quarter at a Record Low Level

- Loan Balances Declined from the Previous Quarter, Led by Lower Commercial and Industrial Lending Activity

- Asset Quality Metrics Remained Stable from the Previous Quarter and a Year Ago

- Community Banks Reported a 21.2 Percent Increase in Quarterly Net Income Year-Over-Year

“While banking industry income for the full year 2020 declined from full year 2019 levels, banks remained resilient in fourth quarter 2020, consistent with the improving economic outlook.”

— FDIC Chairman Jelena McWilliams

WASHINGTON— For the commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC), aggregate net income totaled $59.9 billion in fourth quarter 2020, an increase of $5 billion (9.1 percent) from a year ago. The improvement in quarterly net income was led by a reduction in provision expenses. Financial results for fourth quarter 2020 are included in the FDIC’s latest Quarterly Banking Profile released today.

Modest improvements in the economy and higher consumer spending supported stronger earnings results for the banking industry in the third quarter. However, economic uncertainties and pressure on revenue from unprecedented net interest margin compression continued to weigh on the banking industry. Nonetheless, the industry remains well positioned to accommodate loan demand and support the economy.

Highlights from the Fourth Quarter 2020 Quarterly Banking Profile

Full-Year 2020 Net Income Declined 36.5 Percent to $147.9 Billion: The banking industry reported full-year 2020 net income of $147.9 billion, down $84.9 billion (36.5 percent) from 2019. The decline was primarily attributable to higher provision expenses in the first half of 2020, related to the decline in economic conditions. The average return-on-assets (ROA) ratio declined from 1.29 percent in 2019 to 0.72 percent in 2020.

Quarterly Net Income Increased 9.1 Percent from a Year Ago: Net income totaled $59.9 billion, an increase of $5 billion (9.1 percent) from fourth quarter 2019. The reduction in provision expenses drove the improvement in quarterly net income. More than half of all banks (57.4 percent) reported annual improvements in quarterly net income. The share of unprofitable institutions remained relatively stable from a year ago at 7.3 percent. The ROA was 1.11 percent during the fourth quarter, up from 0.97 percent in the third quarter, but down from a recent high of 1.41 percent in third quarter 2018.

Net Interest Margin Remained Unchanged from Third Quarter at a Record Low Level: The average net interest margin fell by 60 basis points from a year ago to 2.68 percent, matching third quarter’s level. Net interest income declined for a fifth consecutive quarter, dropping by $5.4 billion (3.9 percent) from a year ago. The year-over-year reduction in yields on earning assets outpaced the decline in average funding costs, which are at record lows. Less than half of all banks (42.9 percent) reported lower net interest income compared to a year ago.

Community Banks Reported a 21.2 Percent Increase in Quarterly Net Income Year-Over-Year: Community banks reported annual net income growth of $1.3 billion, a 38.1 percent increase in provision expense, and a narrower net interest margin from a year ago. Increased income from loan sales (up $1.8 billion or 159.1 percent) drove the improvement in quarterly net income and offset the increase in provision expense year-over-year. More than half of the 4,559 FDIC–insured community banks (56.7 percent) reported higher quarterly net income.

Loan Balances Declined from the Previous Quarter, Led by Lower Commercial and Industrial Lending Activity: Total loan and lease balances fell slightly by $47.7 billion (0.4 percent) from the previous quarter. The decline was driven by a reduction in commercial and industrial (C&I) lending, which was down $103.8 billion (4.1 percent) from the third quarter 2020. Over the past year, total loan and lease balances increased by $345 billion (3.3 percent – the lowest annual rate since fourth quarter 2013.

Community bank loan and lease volume contracted modestly (1.6 percent) between third quarter and fourth quarter 2020. Annual loan growth was relatively strong for community banks at 10.3 percent, but was driven primarily by lending activity in the first half of 2020.

Asset Quality Metrics Remained Stable from the Previous Quarter and a Year Ago: Noncurrent loans (i.e., loans that were 90 days or more past due or in nonaccrual status) increased by $944.9 million (0.7 percent) in fourth quarter 2020. The noncurrent rate for total loans rose by 1 basis point from the previous quarter to 1.18 percent. Net charge-offs declined by $2.8 billion (19.7 percent) from a year ago, corresponding to a 13 basis point reduction in the total net charge-off rate to 0.41 percent.

The Deposit Insurance Fund’s Reserve Ratio Declined from the Previous Quarter to 1.29 Percent: The Deposit Insurance Fund totaled $117.9 billion in the fourth quarter, up $1.5 billion from the third quarter. The quarterly increase was led by assessment revenue and interest earned on investment securities held by the fund. The reserve ratio declined by 1 basis point from the previous quarter to 1.29 percent solely as a result of strong estimated insured deposit growth.

Mergers and New Bank Openings Continued in the Fourth Quarter: During the fourth quarter, three new banks opened, 31 institutions were absorbed through mergers, and two banks failed. 5,001 commercial banks and savings institutions filed fourth quarter Call Reports and are insured by the Federal Deposit Insurance Corporation (FDIC) as of December 31, 2020.