How Money Smart Are You? Evaluation Findings

A new FDIC study shows that the interactive games in How Money Smart Are You? do more than entertain—they empower. Designed to boost consumer confidence and encourage positive financial behaviors, the free online platform proves that it delivers positive and measurable results for people. Further, How Money Smart Are You? aligns with the Money Smart for Adults curriculum, offering a digital starting point that complements deeper, in-person or virtual learning.

What the Data Shows

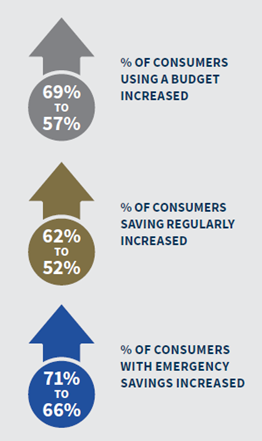

People who used How Money Smart Are You? showed clear improvements in key financial habits:

- Budget use jumped from 57 percent to 69 percent.

- Regular saving rose from 52 percent to 62 percent.

- Access to emergency savings increased from 66 percent to 71 percent.

Users reported a high level of satisfaction with the games. They overwhelmingly said they trusted the information (95%), enjoyed the games (78%), and would recommend them to others (89%).

Voices from the Evaluation

Participants shared how the games helped them take control of their finances and helped them make more confident financial decisions.

Organizations also reported positive impacts on the people they serve, noting that players gained skills and confidence.

Please consider sending us your Money Smart success story to ConsumerEducation@fdic.gov. We look forward to highlighting your programs in a future edition of this newsletter.

Protecting Military Communities Through Financial Education

Service members, veterans, and their families often face unique financial challenges—from frequent relocations to navigating benefits and transitioning to civilian life. This Military Consumer Month, the FDIC highlights the Money Smart for Adults and How Money Smart Are You? programs, which cover key topics such as credit, budgeting, and fraud prevention, while Money Smart for Older Adults focuses on scams and identity theft—particularly relevant for veterans and caregivers.

Financial institutions, nonprofits, government entities and other organizations can use these free resources to provide trusted financial education and strengthen the financial readiness of military communities.

Upcoming Money Smart Events

- On July 23, 2025, from 1 - 2pm EDT, the FDIC will host FDIC Money Smart Strengthens Financial Skills and Behaviors: Key Insights from a Recent Evaluation. Click REGISTER and fill out the needed information.

- On August 20, 2025, 1 - 2pm EDT, the FDIC will host Money Smart Back-to-School Town Hall: Featuring Educators Using FDIC Reality Fair Resources for School-Aged Youth. Click REGISTER and fill out the needed information.

For more consumer resources, visit FDIC.gov, or go to the FDIC Knowledge Center. You can also call the FDIC toll-free at 1-877-ASK-FDIC (1-877-275-3342). Please send your story ideas or comments to ConsumerEducation@fdic.gov. You can subscribe to this and other free FDIC publications to keep informed!