Deposit insurance is at the core of the FDIC's mission, and it is vital to ensuring the safety and soundness of our nation's financial system. To accomplish this, the FDIC maintains the Deposit Insurance Fund (DIF), which is primarily funded through quarterly assessments on insured institutions. The FDIC provides a number of resources to help bankers understand and calculate their deposit insurance assessments, and understand how the FDIC manages the DIF.

If you have questions, suggestions, or requests about deposit insurance assessments, please contact us.

| Bank Requests and Appeals January 1, 2018 - December 31, 2025 | Small Banks | Large Banks |

|---|---|---|

| Requests for Adjustment to Total Score (Large Bank Pricing Scorecard) | N/A | 13 |

| Requests for Review of Assessment Rate | 5 | 1 |

| Appeals of Decision | 3 | 1 |

| Generally, large banks are defined as institutions with total assets of $10 billion or more and small banks have total assets under $10 billion. | ||

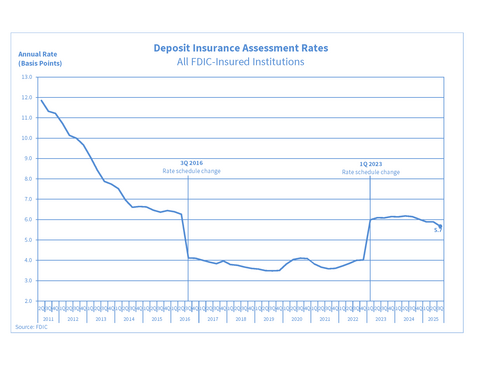

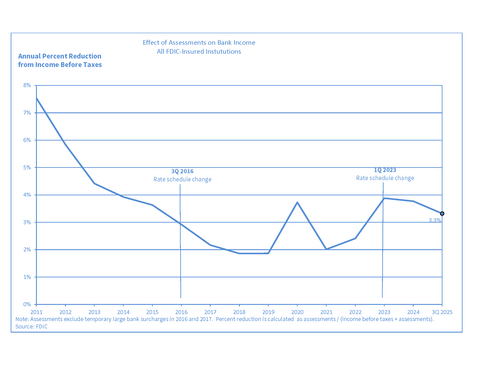

The time series for these charts begins with 2011 because the assessment base for FDIC-insured institutions changed that year due to provisions of the Dodd-Frank Act.

| Number of Large and Highly Complex Bank Total Score Adjustments in Effect Through September 30, 2025 | 5 Points | 10 Points | 15 Points |

|---|---|---|---|

| Upward Adjustments | 5 | 0 | 0 |

| Downward Adjustments | 4 | 0 | 0 |

| Adjustments in effect through December 31, 2025, will be determined using reported fourth quarter 2025 Call Report data and finalized on March 15, 2026 (assessments are calculated and invoiced quarterly in arrears). For historical data on adjustments in effect since implementation of scorecards (second quarter, 2011), including FDIC initiated and bank-requested, see: Large and Highly Complex Bank Requests for Adjustments to Total Score in Large Bank Pricing Scorecards. | |||

Assessments

The Assessments webpage provides an overview of the deposit insurance assessments. The webpage includes information on: risk-based pricing of FDIC assessments, assessment rate schedules.

Assessment Rate Calculators

The calculators illustrate deposit insurance assessment rates. (Last Updated May 28, 2025)

Financial Institution Employee's Guide to Deposit Insurance

This Guide is intended to assist depository institutions insured by the FDIC in providing accurate information about FDIC insurance coverage to their depositors.