What is FDIC Community Affairs?

FDIC Community Affairs promotes economic inclusion and community development through collaborations with stakeholders committed to strategic initiatives that impact low- and moderate-income individuals and communities. Our work broadens access to safe and affordable credit and deposit services from insured depository institutions, particularly for low- and moderate-income consumers and small businesses.

How do we work?

FDIC Community Affairs staff:

- Provide information and technical assistance to banks to assist them in responding to the credit and banking needs of the communities they serve;

- Convene banks, state and local governments, and community-based organizations to explore resources and promising practices on a variety of topics;

- Promote the use of financial education tools, and

- Support initiatives and alliances to expand economic inclusion and financial well-being.

How can I learn about upcoming Community Affairs convenings?

You can view and register for upcoming convenings on the Community Affairs events page.

Why is this important?

For low- and moderate-income consumers and small business owners, access to the insured banking system provides a pathway to economic opportunity. Over time, establishing a successful relationship with a financial institution can help people build wealth and achieve future goals.

Broad participation in the mainstream financial system is an essential element in promoting stability and confidence in that system. Banks build trust and confidence through their ongoing work to serve their communities and by offering fair, safe, and affordable services, including for low- and moderate-income people.

How can we help?

The FDIC’s Community Affairs staff is available to assist financial institutions in developing strategies responsive to community credit, service, and investment needs. For example, Community Affairs leads the Alliance for Economic Inclusion initiative in 12 communities across the country to foster greater financial inclusion and well-being. We also provide a resource guide to help banks develop or expand partnerships with Community Development Financial Institutions and a guide to support partnerships to benefit mission-driven banks.

Who can I contact to learn more?

10 Tenth Street NW, Suite 800

Atlanta, GA 30309-3906

Phone: (678) 916-2200 (main switchboard)

Phone: (800) 765-3342 (toll-free)

Manager: Lekeshia Frasure, Regional Manager, Community Affairs

Email: atlcommunityaffairs@fdic.gov

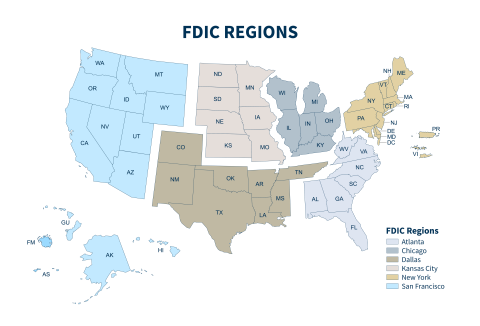

States Served: Alabama, Florida, Georgia, North Carolina, South Carolina, Virginia, West Virginia

300 South Riverside Plaza, Suite 1700

Chicago, IL 60606-3447

Phone: (312) 382-6000 (main switchboard)

Phone: (800) 944-5343 (toll-free)

Manager: D. Simone Stovall, Regional Manager, Community Affairs

Email: chicommunityaffairs@fdic.gov

States Served: Illinois, Indiana, Kentucky, Michigan, Ohio, Wisconsin

600 North Pearl Street, Suite 700

Dallas, TX 75201-4586

Phone: (214) 754-0098 (main switchboard)

Phone: (800) 568-9161 (toll-free)

Manager: Lekeshia Frasure, Regional Manager, Community Affairs

Email: dalcommunityaffairs@fdic.gov

States Served: Colorado, New Mexico, Oklahoma, Texas, Arkansas, Louisiana, Mississippi, Tennessee

Elizabeth Ortiz, Deputy Director

550 17th Street NW, F-6012

Consumer and Community Affairs Branch

Montrice Yakimov, Associate Director

550 17th Street NW, F-6006

(703) 516-5234

Community Affairs Branch

6060 Primacy Parkway, Suite 300

1100 Walnut St, Suite 2100

Kansas City, MO 64106

Phone: (816) 234-8000 (main switchboard)

Phone: (800) 209-7459 (toll-free)

Manager: Luke W. Reynolds, Regional Manager, Community Affairs

Email: kscommunityaffairs@fdic.gov

States Served: Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota

350 Fifth Avenue, Suite 1200

New York, NY 10118

Phone: (917) 320-2500 (main switchboard)

Phone: (800) 334-9593 (toll-free)

Manager: D. Simone Stovall, Regional Manager, Community Affairs

Email: nycommunityaffairs@fdic.gov

States and Territories Served: Delaware, District of Columbia, Maryland, New Jersey, New York, Pennsylvania, Puerto Rico, Virgin Islands, Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, Vermont

25 Jessie Street at Ecker Square, Suite 1800

San Francisco, CA 94105-2780

Phone: (415) 546-0160 (main switchboard)

Phone: (800) 756-3558 (toll-free)

Manager: Luke W. Reynolds, Regional Manager, Community Affairs

Email: sfcommunityaffairs@fdic.gov

States and Territories Served: Alaska, Arizona, California, Guam, Hawaii, Idaho, Montana, Nevada, Oregon, Utah, Washington, Wyoming