The steep drop in oil prices that started in mid-2014, following a five-year boom, tested the risk management practices of insured banks active in oil and gas (O&G) lending as well as other insured banks operating in areas that depend on the O&G industry. During the lead-up and ensuing period of volatility and elevated uncertainty in oil prices, the FDIC’s surveillance and supervision programs focused on monitoring O&G industry trends, quantifying the amount of risk that was building in insured banks with O&G exposure from stress in the sector, and assessing bank management’s actions to mitigate the risk.

It is not uncommon for booms in certain industries or market sectors to give rise to an environment of loosened underwriting, and the FDIC anticipated that growth in the exploration and production (E&P) and O&G supporting services sectors was leading to building risk in insured banks. O&G commitments in the Shared National Credit (SNC)1 portfolio were increasing. Moreover, substantial loan growth was noted at banks in energy-hub states; however, O&G loans were not readily quantifiable from regulatory data. Accordingly, the FDIC set out to quantify these loans and study insured banks’ exposure to oil price volatility. This article summarizes what the FDIC learned from these efforts, which included SNC Program reviews and on-site safety-and-soundness visitations and examinations of banks, primarily community banks, operating in geographic areas characterized by high levels of O&G activity.

O&G lending is a complex and highly specialized business due to the capital-intensive nature of O&G E&P activities, global supply and demand forces, and geopolitical uncertainty. O&G market fluctuations can adversely affect the financial condition of borrowers reliant on the O&G industry, directly or indirectly,2 and their ability to repay loans.

For example, for the period 1980-1994, 1,617 insured commercial and savings banks were closed or received FDIC financial assistance. Bank failures during this period were highly concentrated with nearly 60 percent in five states: California, Kansas, Louisiana, Oklahoma, and Texas. A variety of factors contributed to the bank failures; however, the incidence of failure was particularly high in states characterized by severe economic downturns, such as in Oklahoma and Texas related to the collapse in oil prices and real estate values. Further, bank failures were generally associated with regional recessions that had been preceded by rapid regional expansions.3

Banks now appear better positioned against the effects of lower and more volatile oil prices. Overall, relatively few FDIC-supervised banks have become severely stressed by the developments in the O&G sector during the past few years, in part due to healthier capital levels and stronger risk management practices going into the most recent oil price downturn.

That said, examination findings and financial data suggest that banks with significant direct lending exposure to the O&G sector have seen greater increases in problem assets than other banks. Banks also may have indirect exposure to stress in the O&G sector if they operate in geographic areas with relatively heavy concentrations of O&G activity. At banks where these issues appear to be relevant, FDIC safety-and-soundness visitations and examinations have included a focus on identifying the extent of direct and indirect O&G exposures and discussing management of the risks

of such exposures with bankers. The oil price slide initially exposed some underwriting weaknesses. However, the conclusion from these supervisory activities is that, for the most part, banks have taken steps to mitigate stress from oil price volatility. These topics are explored at greater length in the remainder of this article.

Growth Precedes Pressure on Oil Prices

Leading up to and into 2014, when Spot West Texas Intermediate (WTI) crude oil prices reached more than $100 per barrel, investments in O&G exploration increased and SNC O&G commitments were growing. The high, sustained oil prices drove SNC O&G commitments up more than 27 percent between the 2012 and 2014 SNC review periods.

Additionally, many geographic areas experienced economic expansion driven in part by technological advances in hydraulic fracturing (“fracking”)4 and oil production activity. Several of the O&G geographies that were booming going into 2014 were rural markets served by many community banks.

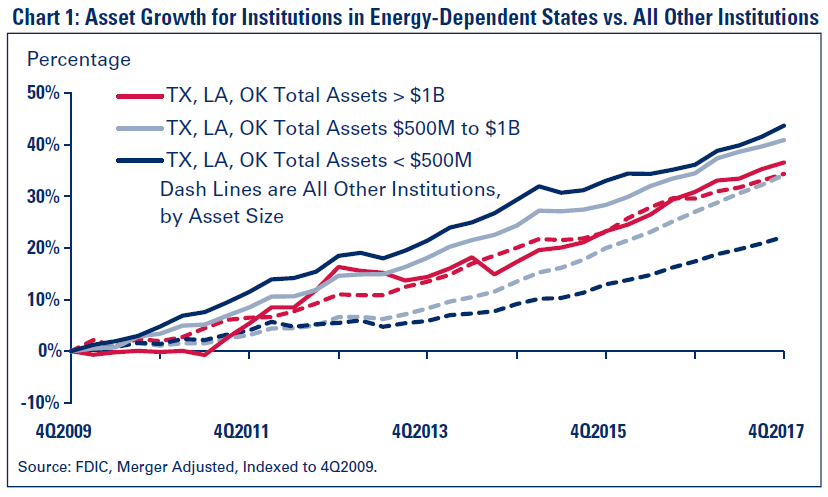

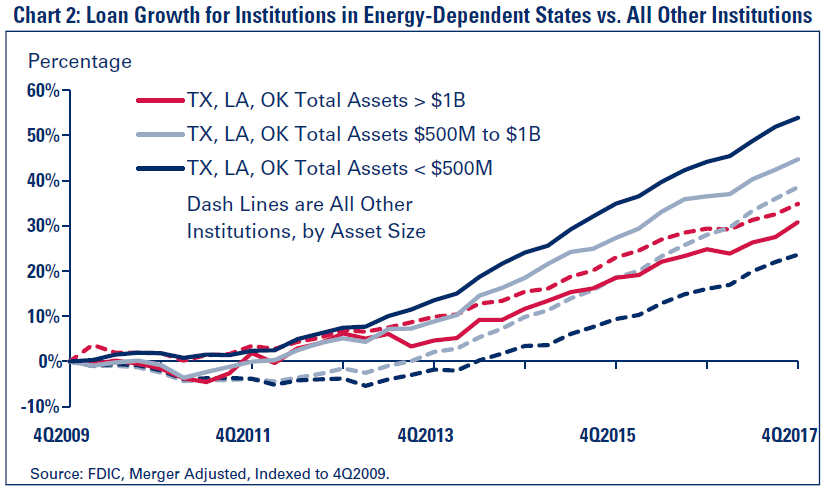

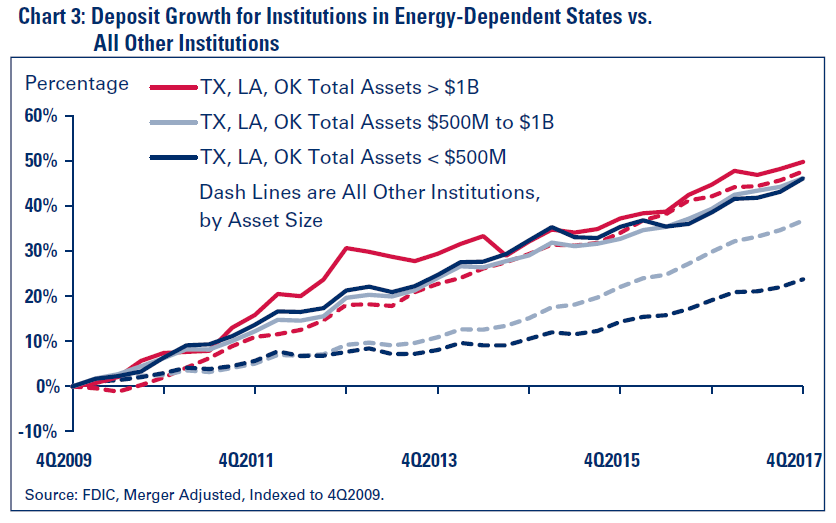

Banks in O&G geographies often had above average growth during the boom period, as shown in Charts 1, 2, and 3. The charts measure asset, loan, and deposit growth rates from the fourth quarter of 2009 for banks headquartered in Texas, Oklahoma, and Louisiana5 against the growth rates for all other banks in the nation.

The FDIC has included the energy sector as part of its regional economic analyses and risk discussions for many years, as fracking flourished and oil-related rig counts, production, and employment rose. The energy sector was frequently on the FDIC’s agenda at banker outreach meetings in energy- concentrated areas. Conversations with bankers during the most recent boom period suggested that bank personnel remembered the economic stress and resultant strain on banks that accompanied the oil bust in the early 1980s.

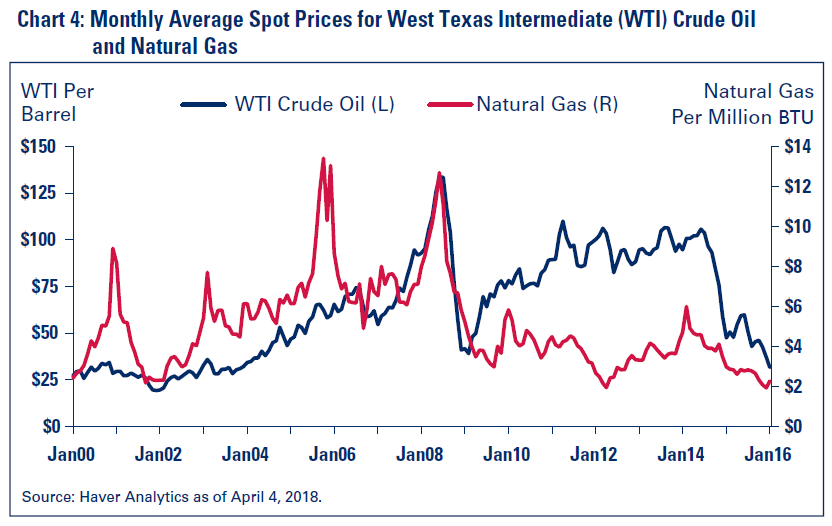

Recent history also provided a reminder of how volatile oil prices can be. The daily spot price of WTI crude oil reached its historic high of $145 per barrel in July 2008. Within seven months, as the financial crisis played out, the daily spot price of WTI crude oil had dropped nearly 77 percent, reaching $34 per barrel in February 2009. The low prices, however, were not prolonged as daily spot WTI crude oil prices then staged a dramatic five-year recovery and reached $107 per barrel in June 2014.6 However, in mid-June 2014 prices fell sharply downward, this time largely because of the growing supply glut, which added to the uncertainties about supply and demand fundamentals and how long a low price environment would persist.

Supervision Planning and Activities

The most recent oil price decline began to take shape around the time the 2014 SNC review was concluding. Planning for and executing the 2015 SNC review, therefore, included a focus on O&G lending. The FDIC also readily recognized that the oil price decline could pose a notable risk to many banks, particularly if the drop became severe or lasted for an extended period. The agency anticipated the repercussions would not only affect syndicated O&G credits, but could pose credit quality risk at smaller banks operating in or near economies supported by O&G businesses.

Communication was critical to staying ahead of the risk. FDIC staff collaborated with other banking regulators to identify institutions most exposed to oil price volatility, either directly or indirectly. FDIC divisions responsible for safety-and-soundness supervision and deposit insurance and research collaborated, including on monitoring information from Consolidated Reports of Condition and Income (Call Reports), the U.S. Energy Information Administration, the Bureau of Economic Analysis, the Bureau of Labor Statistics, other publishers of analyses and statistics, and media coverage. Metrics, topics, and forecasts assessed included production area geographies and characteristics, rig counts, oil supply and demand figures, and O&G-related employment levels and trends.

With consideration of this information and of lending activity and trends during the expansion years, staff prioritized and, beginning in late 2014, conducted off-site reviews and on-site visitations and examinations of numerous banks operating in geographic areas characterized by high levels of O&G activity. The FDIC ultimately evaluated hundreds of potentially affected banks, primarily from Texas to North Dakota, throughout and surrounding the oil-rich Bakken, Eagle Ford, and Permian Basin areas.

Generally, the subject banks, which were predominantly community banks, were in sound financial condition, with healthy capital levels and fairly low levels of problem assets, when the oil price decline began.

However, a bank’s current financial performance and condition (for example, low levels of nonperforming loans and charge-offs) is not necessarily indicative of the level of risk present or of the quality of risk management. As such, supervisory staff employed a heightened focus on assessing bank management’s identification and risk management of O&G exposures, because a bank’s ability to navigate stress in the O&G sector depends greatly on the quality and administration of its O&G credit policies and approach to risk management.

From a forward-looking perspective, it was important for the FDIC to evaluate the overall quality of loan underwriting for O&G-related credits. Amongst considerations was the extent to which loan underwriting practices considered the potential for oil prices declining markedly and staying “low for long.” It was also important for the FDIC to gauge the potential indirect effects as a result of stress on O&G support businesses and their local economies.

Accordingly, FDIC examiners documented assessments of bank management’s policies and procedures regarding direct loans to oil production, servicing, and other oil-related companies. They also determined the segments of the loan portfolio that could be indirectly exposed to O&G sector stress, for example, those loan segments supporting oil-related workers and their households and localities. Further, examiners assessed bank management’s O&G lending strategies under a scenario of continued low energy prices or further reductions in energy prices, which could affect loan quality, the adequacy of capital, and reserves for loan and lease losses.

As mentioned, O&G lending is complex and highly specialized. Going into 2014, the FDIC’s subject matter experts in the affected regions had a deep knowledge of the O&G sector and related lending, in part via participation in the SNC review processes. To reinforce the quality of on-site and off-site assessments of risk management practices of FDIC-supervised banks that were, potentially, the most vulnerable to the oil price downturn, subject matter experts shared their knowledge with other FDIC examiners. In addition, in 2016, banker roundtables in states such as Texas, Oklahoma, and Louisiana included discussions about oil lending issues.

Extent of O&G Related Lending and Quality of Risk Management Frameworks

Determining the extent of O&G-related lending and the quality of bank underwriting were key to effective assessments. Analysts typically categorize oil industry activities into four sectors: 1) the E&P sector, which is also known as the upstream sector; 2) the mid-stream sector, which is transportation; 3) the downstream sector, which is refineries and retail operations; and 4) the support and service (S&S) sector, which is also known as the oilfield services sector.

O&G SNC commitments continued to grow following the onset of the oil price slide. By the 2015 SNC review, O&G commitments had grown to approximately $480 billion, with the E&P sector continuing to represent the largest share. While the dollar volume of SNC commitments to the mid-stream sector was higher than the dollar volume to the S&S sector, the S&S sector was anticipated to encounter issues sooner. The 2015 SNC review focused on the E&P and S&S sectors.7 By the first quarter 2016 SNC review, O&G commitments had reached roughly $502 billion.8 Increases in outstanding loan volumes reflected borrowers’ drawdowns on remaining senior commitments as industry revenues decreased and liquidity pressure intensified. By the 2017 SNC review, the effects of bankruptcy-driven restructures and periodic collateral revaluations to control reserve-based borrowing lines were reflected in reduced commitments for the E&P sector and service subsectors.9 Nonetheless, the preceding growth in the E&P and S&S sector lending had resulted in an increase in SNC O&G loans distributed to banks.

Meanwhile, findings from bank safety-and-soundness visitations and examinations that had a heightened focus on O&G risk management (again, primarily covering community banks) revealed that lending to the S&S sector comprised the largest share of their O&G direct lending (and was more prevalent in the smaller banks). The upstream (E&P) sector represented the second largest share of O&G lending for these banks. Downstream refining and retailing loans and midstream transportation loans accounted for the smallest shares of direct O&G lending.

By dollar volume, most of the direct O&G lending reviewed was in larger banks. Overall for institutions examined with a heightened focus on O&G risk management, as a proportion of aggregate assets, direct O&G loans were generally 5 percent or less, and concentrations in direct O&G lending appeared moderate. Examination findings suggest that only a handful of FDIC-supervised banks, concentrated in the FDIC’s Dallas Region,10 had more than 25 percent of loan volume held in direct O&G lending.

With regard to risk management, it was critical that bank management consider how a continuation of current low energy prices, or further reductions in energy prices, could affect loan quality and the adequacy of loan loss reserves and capital going forward. If the effects were expected to be material, bank management needed to consider whether new or enhanced risk-mitigating steps were necessary to position the bank to navigate continued stressful conditions in the energy sector. When such issues appeared inadequately considered or addressed by bank management, examiners made recommendations for corrective action.

At some banks, weaknesses in risk management frameworks were evident. Some common areas of weakness overall included, but were not limited to:

- Limited coverage of O&G lending exposures in loan policies;

- Significant indirect exposures not tracked or monitored; and

- Qualitative allocations for O&G exposures not considered in the allowance for loan and lease losses (ALLL) analysis.

Moreover, some banks with little or no prior experience in O&G lending entered the market during the boom, which fostered competition and loosening of credit terms. And, some institutions evidenced poor risk selection. From an underwriting perspective, concerns identified included, amongst others:

- Loan policy exceptions;

- Weak financial covenants that did not instill sufficient financial discipline;

- Borrowers with high leverage and low levels of liquidity or that were not sufficiently experienced;

- Insufficient review and/or verifica- tion of engineering reports;

- Overly optimistic oil price esti- mates that led to swollen borrowing bases,11 resulting in over-lending not supported by cash flows; and

- Insufficient price hedging strategies that exacerbated the problem.

In some cases underwriting and credit administration weaknesses in non-energy lending were also exposed by the general economic downturn that accompanied the oil price slide. While the direct and indirect impact of the oil price decline was fairly contained, the robust economic conditions leading into the downturn in some areas led some banks to be lax in underwriting. While not widespread, the issue contributed to increased loan classifications in some banks.

Some Stress on Banks’ Performance Metrics Set in Motion by Oil Price Slide

Daily spot WTI crude oil prices ultimately dipped into the low $40s per barrel in March 2015 and bottomed out in the mid $20s in first quarter 2016.12 Chart 4 depicts the monthly average spot prices for WTI crude oil and the price slide into 2016.

During the downturn, it was unclear how low oil prices might drop and how long the downward pressure on oil prices would last. Near- and long-term forecasts varied widely. Although lower oil prices may translate into economic growth as consumers and businesses take advantage of lower fuel prices, drops in oil prices can prompt oil companies and service firms to enact cost-saving measures, including cutting jobs and capital spending.

Call Reports Reveal Ramp Up of Reserves, Delinquencies, and Losses in O&G-Dependent Areas

Call Report data are lagging and do not contain line items specific to O&G lending. Nonetheless, Call Report indicators for banks headquartered in O&G geographies continued to be closely monitored for signs of emerging risk. For example, increases to loan- loss reserve allocations related to O&G were initial signs of the adverse effects of O&G price declines that banks experienced. Several banks announced such reserve increases in their public quarterly performance releases.

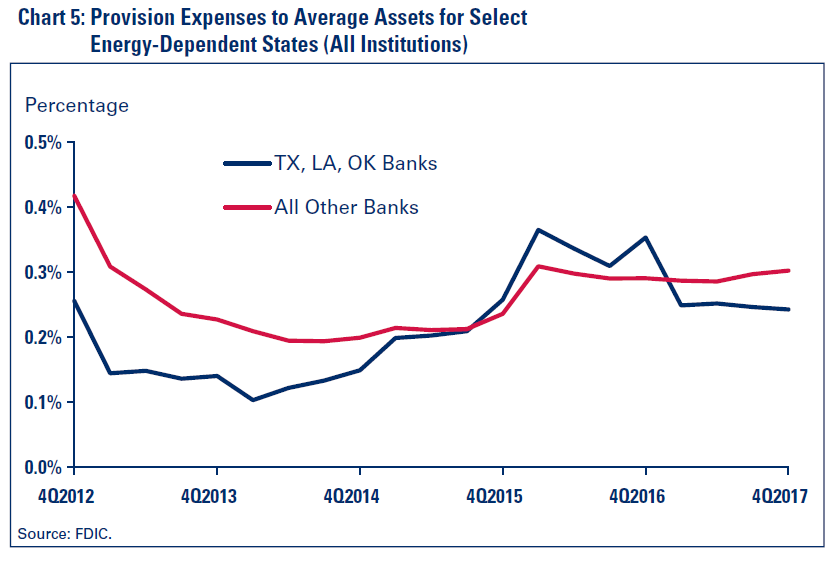

Chart 5 depicts the ratio of provision expenses for loan and lease losses13 to average assets. In the three select energy-dependent states, banks began increasing provision expenses earlier in 2014 as compared to banks in other states. The ratio of provision expenses to average assets peaked in 2016 and began declining in 2017 as the energy sector adapted to the lower prices. Although many other industries are important to these three states, it is reasonable to assume that deterioration in the O&G sector was a factor in increased provision expenses.

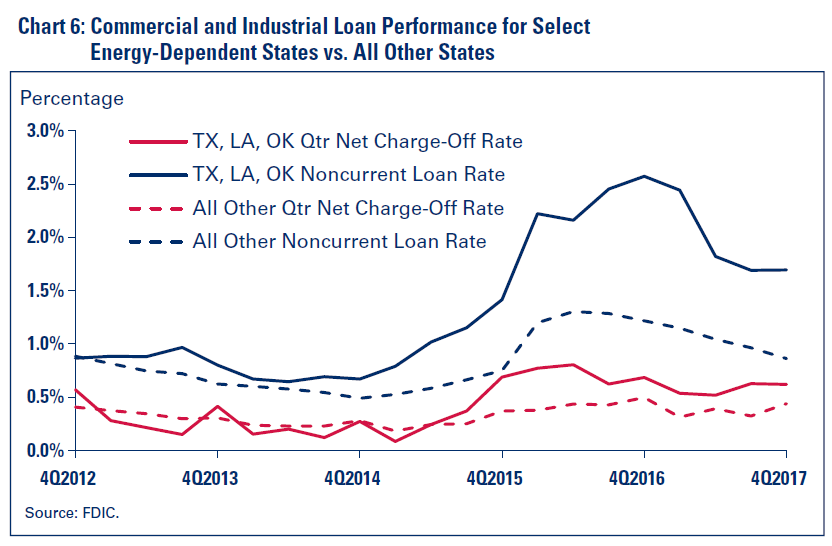

As discussed in the FDIC’s second quarter 2016 Quarterly Banking Profile, stress in energy sector loans was a leading cause of an increase in the total volume of noncurrent commercial and industrial (C&I) loans for the banking industry as a whole.14 Similar to trends for provision expenses, the increase in noncurrent loans and charge-offs was more pronounced for banks headquartered in areas with meaningful reliance on the energy sector.

For example, Chart 6 depicts C&I loan performance trends for banks headquartered in Texas, Oklahoma, and Louisiana, and shows that, in aggregate, noncurrent C&I loan rates and net C&I loan charge-off rates increased more for banks in those states than for banks in the other states. While performance trends appear manageable, it is reasonable to assume that stress in the O&G sector was a factor in the deteriorated loan performance. Consistent with the outlook for the improving O&G sector, noncurrent and charge-off rates have also more recently improved, but remain higher than rates for all other banks.

Supervisory Findings

SNC Review Findings

As it would take time and resources to assess the large swath of banks potentially affected by the O&G price downturn, the 2015 SNC review process served as an initial indicator of whether and to what degree deterioration was emanating from the O&G sectors.

The 2015 SNC review15 found that O&G-related credits were in the early stages of a downturn. The report noted that the significant decline in oil prices was adversely affecting many O&G E&P companies, increasing adversely classified commitments in that subsector. The report further noted that from 2010 to 2014, aggressive acquisition and exploration strategies funded by term debt raised leverage levels, elevating those borrowers’ susceptibility to a protracted decline in oil prices. The report also found that a general lack of protective covenants in reserve- based loans further exacerbated the situation. The report also disclosed that banks were showing flexibility in working with borrowers experiencing problems.

Results of the next SNC review, published in July 2016, reported ongoing growth of credit risk in the O&G portfolio. Classified O&G borrowers totaled $77.0 billion, or 27.0 percent of total classified commitments, compared to $38.2 billion, or 16.7 percent of total classified commitments, in 2015. Stress was apparent particularly for non-investment grade and unrated E&P and energy service companies.16 The ensuing SNC reviews (third quarter 2016 and first quarter 2017)17 found again that a high level of credit risk in the portfolio stemmed, in large part, from distressed borrowers in the O&G sector.

SNC O&G loan losses for insured banks accumulated to approximately $7 billion from mid-2012 to early 2018. Senior secured lending positions and a more recent rebound in oil prices that has boosted recovery rates have served to temper losses in the E&P sector.

Results for Examinations with a Heightened Focus on O&G Risk Management

Of banks that were reviewed with a heightened focus on O&G risk management, which were primarily community banks, few developed financial problems of supervisory concern as a result of the extended oil price downturn. In addition, the banks identified with O&G-related lending ultimately comprised a much smaller group than initially anticipated, due, in part, to a lesser than expected impact from select levels of O&G-related employment and counties surrounding shale areas in the examination prioritization scheme. It is noted, however, that for the subject banks that had more than one examination with a heightened focus on O&G risk management since June 30, 2015, classified direct O&G loans increased between examinations, reflecting the lag in loan performance. Aggregate dollars of direct O&G loans, on the other hand, decreased.

The vast majority of the banks remain satisfactorily rated. As illustrated previously, Call Report indicators for banks headquartered in O&G geographies showed increases in loan-loss reserve allocations beginning in 2014 in light of their exposure. In some cases, bankers boosted reserves in response to supervisory recommendations. Ratings that were less than satisfactory or worse in 2016 or 2017 were infrequent and occurred at only a slightly higher rate than for the general population of insured banks.

Banks with more than 10 percent of the loan portfolio dedicated to direct O&G lending, concentrated in the FDIC’s Dallas Region, experienced more financial stress and supervisory downgrades than banks reviewed with less O&G exposure. Meanwhile, banks with less than 10 percent of lending in direct O&G loans, but with indirect O&G lending of more than 10 percent of loans, also experienced modestly higher supervisory downgrades as compared to banks with lower O&G exposure levels. This statement is also true of asset quality assessments. Trends such as these (higher rates of supervisory downgrades and increased levels of adversely classified assets) are typical for banks working out of credits to distressed sectors. Indirect O&G lending did not appear to cause significant financial stress on the affected banks.

Among the banks that were satisfactorily rated, more than a third had one or more Matters Requiring Board Attention (MRBA) listed in the report of examination;18 this is slightly higher than the rate experienced at other examinations in the aggregate. Those MRBA most commonly related to lending and credit administration, board and management oversight, apparent violations, and liquidity. These categories generally align with the categories most commonly noted at other satisfactorily rated banks in the aggregate.

Supervisory Issuances Related to O&G Lending

Lending associated with O&G activities is a potentially complex activity that requires prudent underwriting, appropriate structuring, experienced and knowledgeable lending staff, and sound loan administration practices. Further, for banks doing business in areas where the economy is dependent on O&G activity, knowledge and prudent management of geographic, industry, and borrower concentrations is critical. Guidelines, examination manuals, and other documents produced by the federal banking agencies, including the FDIC, are intended to be a useful resource for bankers in this respect.

In July 2016, the FDIC issued an advisory, Prudent Risk Management of Oil and Gas Exposures,19 reminding bank management to maintain prudent risk management practices around O&G lending. In addition to reminders about risk management practices and the importance of maintaining adequate capital, the advisory provides suggestions to senior management and boards of banks operating in markets dependent on O&G industries for quantifying and monitoring indirect exposures, not just direct exposures. The publication also reminds FDIC- supervised banks that they are encouraged to work with borrowers who are adversely affected by a severe or protracted downturn in commodity prices, provided the efforts are part of a well-conceived workout plan, coupled with effective internal controls to manage those loans. Previously issued Financial Institution Letters on this topic contain further information.20

In July 2016, the FDIC also issued an update to Section 3.2 of its Risk Management Manual of Examination Policies (Manual) which contained an expanded discussion of O&G lending to assist FDIC examination and supervision staff in their review and analysis of O&G lending practices. The revisions, found in the “Oil and Gas Lending” portion of Section 3.2, update and explain current guidance on risk management considerations for FDIC-supervised banks with O&G credit exposures. The revised section focuses primarily on reserve-based lending to borrowers engaged in E&P activities and covers important topics such as reserve engineering reports, discount rates, price decks, loan structure and covenants, borrowing base determinations, borrower and financial analysis, loan policies, and classification guidelines. The Manual is publicly available on the FDIC’s website.21

The FDIC published an article entitled “Credit Risk Trends and Supervisory Expectation Highlights” in the Winter 2016 edition of Supervisory Insights.22 The article identifies trends in credit risk in three areas, one of which is O&G lending. The article emphasizes to bankers and examiners the importance of long-standing principles of sound risk management practices, including the close monitoring of all credit concentrations.

Conclusion

The inherent volatility of commodities prices makes doing business in the O&G sector challenging, and energy-related analyses continue at the FDIC. During the past few years, banks have exhibited flexibility in working with borrowers exposed to the O&G sector. Overall, only a small number of FDIC-supervised banks exhibited supervisory concerns as a result of impacts from the oil price slide. Banks that experienced the most financial stress were more likely to be engaged in higher volumes of direct O&G lending, and the number of banks materially impacted by indirect O&G lending was less than initially anticipated. Oil prices rebounded somewhat in 2017 and, during the first quarter of 2018, had generally settled in a range in the low-to-mid $60s per barrel. This is well below prices experienced during the boom years. However, production advancements allow companies to operate profitably within price ranges much lower than those experienced during the most recent boom years. In addition, the industry has reduced operating costs and increased merger and acquisition activities as companies continue to move toward optimizing their operations.

Nevertheless, the ongoing recovery and uncertainty in O&G prices may continue to challenge banks with direct or indirect exposure to this sector. For banks doing business in O&G dependent areas or that have out-of-territory lending related to O&G, prudent management of geographic, industry, and borrower concentrations continues to be warranted. That, combined with a strong financial condition going into a downturn, will provide banks with a buffer against adverse impacts from any future oil price volatility.

Lisa A. Garcia

Senior Examination Specialist

Division of Risk Management Supervision

ligarcia@fdic.gov

Kenneth A. Weber

Senior Quantitative Risk Analys

Division of Risk Management Supervision

kweber@fdic.gov

1 The SNC Program is governed by an interagency agreement among the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency and is designed to review and assess risk in the largest and most complex credits shared by multiple financial institutions. Results of the SNC Program are released annually on a joint agency basis. A SNC is generally any loan or formal commitment, and any asset such as real estate, stocks, notes, bonds, and debentures taken as debts previously contracted, extended to borrowers by a federally supervised institution, its subsidiaries, and affiliates, that aggregates to $100 million or more (new global commitment threshold effective January 2018; was formerly $20 million or more) and which is shared by three or more unaffiliated federally supervised institutions.

2 Banks’ indirect exposures may occur through relationships with customers such as motels, restaurants, and other local businesses that provide services to O&G workers.

3 See FDIC, History of the Eighties - Lessons for the Future, volume 1, pages 13, 15, 16, 19, and 306-308, 1997, https://www.fdic.gov/bank/historical/history/.

4 A process whereby rock is fractured by a pressurized liquid to stimulate a natural gas, oil, or geothermal well to maximize extraction.

5 A subset of states exposed to O&G that reflected a high concentration in bank failures related to the 1980s oil busts. Although North Dakota is another O&G exposed state (it has had three oil booms, with the most recent one being its largest, by far), the charts in this article focus on the subset of three states (Texas, Louisiana, and Oklahoma) where O&G-related banking problems were generally historically concentrated.

6 Daily spot WTI oil prices per the U.S. Energy Information Administration, https://www.eia.gov/dnav/pet/hist/RWTCD.htm.

7Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, “Shared National Credits Review Notes High Credit Risk and Weaknesses Related to Leveraged Lending and Oil and Gas,” November 5, 2015; https://www.fdic.gov/news/news/press/2015/pr15089.html

8Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, “Joint Release/Shared National Credit Review Finds Risk Remains High, but Underwriting and Risk Management Improve,” July 29, 2016; https://www.fdic.gov/news/news/press/2016/pr16059.html.

9 Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, “Joint Release/Reviews of Shared National Credit Portfolio Find Risk Remains High,” August 2, 2017; https://www.fdic.gov/news/news/press/2017/pr17058.html.

10 The FDIC’s Dallas Regional Office is responsible for supervisory activities associated with banks headquartered in Arkansas, Colorado, Louisiana, Mississippi, New Mexico, Oklahoma, Tennessee and Texas. The majority of Dallas Region banks with O&G activities are in Texas and Louisiana..

11 In E&P lending, the primary source of repayment is the cash flows from the extraction of O&G reserves. An independent, third party reserve engineering report serves as the primary tool to estimate the future cash stream and establish a “borrowing base,” which is a collateral base agreed to by the borrower and lender that is used to limit the amount of funds the lender advances to the borrower.

12 Daily spot WTI oil prices per the U.S. Energy Information Administration, https://www.eia.gov/dnav/pet/hist/RWTCD.htm

13 To properly apply U.S. generally accepted accounting principles, each bank must maintain an allowance for loan and lease losses (ALLL) to cover estimated credit losses associated with its loan and lease portfolio. At least quarterly, bank management must evaluate the collectability of the portfolio and make entries to maintain the balance of the ALLL on the balance sheet at an appropriate level. Additions to, or reductions of, the ALLL resulting from such evaluations are made through charges or credits to the provision for loan and lease losses account of the income statement.

14 Opening Statement Second Quarter 2016, FDIC Quarterly Banking Profile, August 30, 2016; https://www.fdic.gov/news/news/speeches/spaug3016.html.

15 Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, “Shared National Credits Review Notes High Credit Risk and Weaknesses Related to Leveraged Lending and Oil and Gas,” November 5, 2015; https://www.fdic.gov/news/news/press/2015/pr15089.html.

16 Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, “Shared National Credit Review Finds Risk Remains High, but Underwriting and Risk Management Improve,” July 29, 2016; https://www.fdic.gov/news/news/press/2016/pr16059.html.

17 Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation, Office of the Comptroller of the Currency, “Joint Release/Reviews of Shared National Credit Portfolio Find Risk Remains High,” August 2, 2017; https://www.fdic.gov/news/news/press/2017/pr17058.html.

18 MRBA are a subset of supervisory recommendations, which are an FDIC communication intended to inform the institution of the FDIC’s views about changes needed in its practices, operations, or financial condition to help directors prioritize their efforts to address examiner concerns, identify emerging problems, and correct deficiencies before the bank’s condition deteriorates (or to keep the bank viable if conditions already deteriorated). A principal purpose of supervisory recommendations is to communicate supervisory concerns to a bank so that it can make appropriate changes in its practices, operations, or financial condition and thereby avoid more formal remedies in the future, such as enforcement actions. See “Statement of FDIC Board of Directors on the Development and Communication of Supervisory Recommendations," https://www.fdic.gov/about/governance/recommendations.html and “FDIC Risk Management Manual of Examination Policies,” Section 16.1, https://www.fdic.gov/regulations/safety/manual/section16-1.pdf.

19 FDIC, Prudent Risk Management of Oil and Gas Exposures, (FIL-49-2016), July 27, 2016; https://www.fdic.gov/news/news/financial/2016/fil16049.html.

20 "Interagency Statement on Meeting the Credit Needs of Creditworthy Small Business Borrowers,” (FIL-5-2010) February 12, 2010 (https://www.fdic.gov/news/news/financial/2010/fil10005.html), “Interagency Policy Statement on Prudent Commercial Real Estate Loan Workouts,” (FIL-61-2009) October 30, 2009 (https://www.fdic.gov/news/news/financial/2009/fil09061.html), and “Interagency Statement on Meeting the Needs of Creditworthy Borrowers,” (FIL-128-2008) November 12, 2008 (https://www.fdic.gov/news/news/financial/2008/fil08128.html).

21 Risk Management Manual of Examination Policies; https://www.fdic.gov/regulations/safety/manual/.

22 Leeza Fridman, Lisa A. Garcia, Rae-Ann Miller, Camille C. Schmidt, and Kenneth A. Weber, “Credit Risk Trendsand Supervisory Expectation Highlights,” Supervisory Insights, Winter 2016; https://www.fdic.gov/regulations/examinations/supervisory/insights/siwin16/siwinter16-article1.pdf.