The housing boom of the early 2000s affected many areas of the United States, as consumers and investors took advantage of low interest rates to purchase, upgrade, and invest in houses and condominiums. The entry, and general acceptance, of numerous nontraditional mortgage loan products into the financial landscape also bolstered many people’s goal of achieving home ownership. The nontraditional products facilitated an increase in the dollar amount of mortgages individuals financed, which helped spur housing demand. As this demand increased, so did price appreciation, and the purchase of a house became more than just a home for many individuals: residential real estate became the new “golden egg.”

Historically, a mortgage transaction involved two parties: the lender and borrower. Borrowers conducted their business across a desk at a local bank, and the only other people involved in the process were bank employees (or individuals closely associated with the bank). Today, a single mortgage transaction can involve a wide number of independent parties who may never meet the borrower or the lender. In addition, the pressure to close a loan quickly is paramount, as fast-paced consumers look for more convenience and less hassle. Unscrupulous individuals are increasingly manipulating these types of circumstances to their advantage, resulting in a significant and growing mortgage fraud problem throughout the country.

The following example demonstrates the egregious nature of mortgage fraud. Picture 1 was included in a fraudulent appraisal used to secure a $250,000 mortgage loan on this home in Atlanta, Georgia. However, the appraiser failed to include the second picture, which shows the rear view of the property! The loan was granted, and the lender incurred a material loss upon subsequent foreclosure and disposition of the property.1

Picture 1

Picture 2

This article explores common types of mortgage fraud, focusing on examples from a recent poll of FDIC examiners. The authors also offer suggestions and links to additional information for further support in mitigating the risks of mortgage fraud.

Mortgage Fraud Reaches New Heights

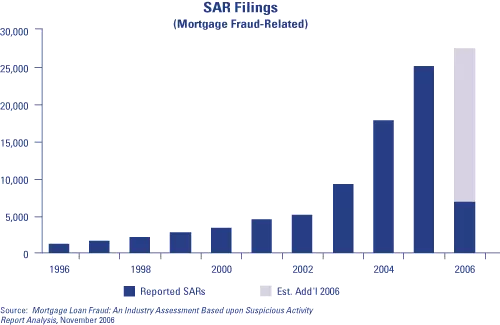

Mortgage fraud activity has increased markedly in recent years. In 2005, reported losses associated with mortgage fraud passed the $1 billion mark nationwide for the first time.2 As shown in the chart titled SAR Filings, suspicious activity reports (SARs)3 involving mortgage fraud doubled from 2003 to 2004 and continue to increase. According to the National Association of Mortgage Brokers, as many as two-thirds of all mortgages are originated by mortgage brokers. When one considers that mortgage brokers are not required to file SARs, the actual volume of mortgage fraud activity could be much higher.

Chart 1. SAR Filings

As of early March 2007, the Federal Bureau of Investigation (FBI) had 1,036 pending mortgage fraud investigations,4 compared with 818 and 721, respectively, in the two previous years. The FBI estimates, however, that the actual number of mortgage fraud cases was closer to 36,000 for the fiscal year ended September 30, 2006, compared with 22,000 the previous year.5 More than half of the current investigations involve expected losses greater than $1 million, and financial institutions represent 57 percent of the victims.

Categorizing Mortgage Fraud

The bulk of mortgage fraud falls into two broad categories based on the motivation behind the fraud.

- Fraud for property typically involves a borrower who will overstate income or asset values on his or her financial statement to qualify for a loan to purchase a home. In many of these cases, expectations are that if the income does not rise to meet the payment, the home will be sold at a profit from appreciation.

- Fraud for profit involves more complicated schemes and presents a higher exposure to the market. Fraudulent methods are used to acquire and dispose of property with the inflated profits going to the perpetrators of the fraudulent transaction. Participants in these fraudulent transactions involve a variety of insiders and third parties: straw borrowers, sellers, loan originators, brokers, agents, appraisers, builders, and developers. Opportunities for fraud for profit involving insiders are limited only by the perpetrator’s imagination.6

Case Studies: Reports from Examiners

Bearing headlines such as “Eight Indicted in Loan Scam” (Dallas Morning News, March 9, 2007) and “Mortgage Fraud Alleged in 149 Transactions” (Journal Gazette, Fort Wayne, Indiana, April 1, 2007), the media are filled with stories demonstrating the pervasiveness of mortgage fraud. Rarely, however, do these stories offer insights into what might have been done to detect or prevent the fraud or the effect of the fraud on the insured institutions involved.

To get a picture of how mortgage fraud might be affecting insured financial institutions, and to provide some practical advice, the authors asked examiners from across the country to provide examples of the more common types of fraud they were encountering. The types of fraud most prevalent in examiners’ responses were

- Broker-facilitated fraud;

- Loan documentation fraud;

- Appraisal fraud;

- Property flipping; and

- Misapplication of funds from construction or rehabilitation

projects.

As illustrated in the examples that follow, examiners are often not the ones to first discover a case of fraud. The vast majority of fraud instances are discovered and reported by the institutions themselves.

Broker-Facilitated Fraud

According to a study by BasePoint Analytics LLC, broker-facilitated fraud has surfaced as the most prevalent segment of mortgage fraud nationwide.7 Broker-facilitated mortgage fraud occurs when a broker materially misrepresents, misstates, or omits information that a loan officer relies on to make the decision to extend credit.8 Broker-facilitated fraud can be fraud for property, fraud for profit, or a combination of both. For example, the borrower may be committing the fraud with the primary interest of obtaining a home, while the broker facilitating the fraud is motivated by profit from closing the loan. The following represents a case of fraud for profit.

Example: A $165 million community bank decided to enter the mortgage banking business. The bank purchased a small mortgage company and hired an experienced mortgage banker to run the operation. Nearly five years into the relationship, an investor notified the bank that several loans—all originated through the same third-party broker—were being returned for repurchase. During the bank’s investigation of these loans, the FBI alerted the bank that they were investigating this same broker for possible fraud. The bank notified its primary federal regulator, which then contacted the FDIC because of the potential impact on the bank’s financial condition.

Further investigation revealed that the broker was working in collusion with a builder and an appraiser to flip properties over and over again for higher, illegitimate profits. In total, more than 100 loans were originated to one builder in the same subdivision. The bank incurred a loss of approximately $6 million and went to the third-party broker for reimbursement of the loss. The broker refused to make the payments, and the case went into litigation. The bank was eventually awarded $3.5 million.

Lessons Learned: In a subsequent discussion with FDIC examiners, the bank’s president indicated that he had always heard that the most difficult part of mortgage banking was making sure you implemented the right hedge to offset any interest rate risk the bank might incur while warehousing a significant volume of mortgage loans. He did not focus much attention on mortgage loan origination because the bank made sure the contracts with the brokers it used included language requiring the brokers to reimburse the bank for any nonconforming loans that were returned by the ultimate investor for repurchase. The bank had representation and warranty clauses in contracts with its brokers and thought it had recourse with respect to the loans being originated and sold through the pipeline.

During the litigation, the third-party broker argued that the bank should share some responsibility for this exposure because its internal control systems should have recognized a loan concentration to this one subdivision and instituted measures to deter this risk. The bank president acknowledged that the monitoring system used at that time did not adequately measure concentration risk with respect to loans being generated by the mortgage banking business. In addition to establishing an adequate system to monitor concentration risk, the bank president said that if he had it to do over again, he would institute regular surprise audits to sample loan origination documentation and make sure loans were being underwritten according to the bank’s standards.

Loan Documentation Fraud

While broker-facilitated fraud and loan documentation fraud are closely aligned, loan documentation fraud extends beyond mortgage brokers to all individuals involved in the process. Loan documentation fraud may involve a borrower, broker, or lender knowingly making written false statements or concealing material facts to influence the approval of the loan.

According to the BasePoint Analytics study, the most common types of fraud are employment, income, and occupancy misrepresentations—all of which relate to documentation.9 The Mortgage Asset Research Institute (MARI) reports that in a sample of loans by one of MARI’s clients, 90 percent of stated incomes were exaggerated by 5 percent or more, and 60 percent of stated incomes were inflated by more than 50 percent.10 The ultimate effect of loan documentation fraud on property values and the overall economy remains to be seen. Loan documentation fraud is most often fraud for property, although if the lender or broker is aware of the deception, as in the first example below, fraud for profit (income for the lender or broker) may also be involved.

Example: A $43 million community bank hired a mortgage loan officer for a new loan program designed to benefit minority individuals with poor or no credit histories. The loan officer began generating consistent business, and management did not closely monitor her activities. The loan officer provided credit to individuals who were using false or stolen Social Security numbers. She also accepted, and in some cases actually generated, false or questionable documents to support the loans, including false rental and utility payment histories. The bank became aware of the problem only when another institution, which had purchased some of these loans, conducted due diligence and discovered the falsified information. The bank had to repurchase these loans, but the bank’s total exposure has not yet been determined. The FDIC became aware of this fraud through a routine review of SARs filed by both institutions.

Lessons Learned: A thorough background check on the loan officer would have disclosed that she used a false Social Security number to obtain her position with the bank and falsified other information on her employment application. A call to her former employer would have revealed that she had been terminated from that financial institution for orchestrating the very same type of fraud. In addition, instituting periodic quality control measures, such as sampling loan files, could have identified these practices early and limited the bank’s exposure.

Example: A $1 billion urban financial institution became heavily involved in wholesale mortgage lending and began pressuring employees to increase loan production. A disgruntled employee notified FDIC examiners about widespread documentation fraud in the bank’s residential mortgage banking business. Reportedly, intense pressure from senior management to increase loan production resulted in a practice of altering documents by cutting and pasting customer signatures on different forms to manufacture false loans. These loans were being packaged and sold to third-party investors, leaving the bank vulnerable to potential buyback claims. The disgruntled employee surrendered documents to the FDIC that bank management allegedly told him to destroy in an effort to hide the files from regulators. The FDIC continues to investigate this case, including possible false statements by one senior manager that may result in a prohibition action, criminal violations, and prosecution.

Lessons Learned: The board of directors and the audit committee did not establish comprehensive reporting and monitoring procedures, largely delegating this responsibility to operating management. Information provided to the board was usually informal and lacked adequate, useful detail. Examiners recommended that the board establish clear expectations for the timing and reporting of periodic quality control initiatives (e.g., loan documentation sampling). Examiners also recommended that management perform a risk assessment to determine areas of increased exposure and provide fraud identification training to staff, including originators, processors, underwriters, and internal audit personnel. Properly trained staff can help identify red flags such as white outs, squeezed-in names or numbers, and illegible signatures with no supporting identification or verification information.

Appraisal Fraud

Appraisal fraud is usually outright fraud or negligence on the part of the appraiser, often in collusion with other parties. Some institutions have internal appraisers, but most use outside companies. Manipulating or inflating the comparable locations, market values, and property characteristics are all tactics of appraisal fraud. Questionable practices include “windshield appraisals,” where appraisers merely drive by a property and use inappropriate comparables that will get the value where they want it to be. In some cases, appraisers may fraudulently overstate the benefits of a particular property to back into the value needed for the loan. Appraisal fraud can be used to qualify an undervalued home for a higher mortgage amount (usually fraud for property) or to inflate the value of real estate so that the property can be resold or flipped quickly to a straw or duped buyer and the profit retained by perpetrators (fraud for profit). Under the first scenario, appraisers may be pressured by mortgage brokers or loan officers to falsify an appraisal so that a loan transaction can be approved. Under the second scenario, the appraiser actually works in collusion with other conspirators to perpetrate the fraud.

Example: A small community bank (total assets less than $250 million) became involved in an inflated appraisal fraud scheme. The bank discovered inflated appraisals on residential properties securing loans to two borrowers when those borrowers defaulted on the debts. The bank later determined that one of the borrowers owned the appraisal firm that prepared the original appraisals for these properties. The borrowers allegedly worked in collusion with bank loan officers to finance these properties at inflated values. In total, the bank financed dozens of residential properties, with a combined original (fraudulent) appraised value totaling approximately $2 million. After the defaults, these properties were reappraised at less than one-third of their original appraised value. The bank suffered a significant loss, which has been difficult for it to absorb. The FDIC is seeking a removal/prohibition action against the loan officers involved, who have resigned from the bank. The FDIC became aware of this fraud by reviewing SARs submitted by the institution.

Lessons Learned: Once these activities were uncovered, the bank worked aggressively to identify all relevant exposure by getting new appraisals and providing adequate loan loss reserves. However, some improvements to the bank’s loan review and monitoring procedures could have helped the bank identify negative trends prior to the borrowers defaulting on the debts. First, the bank’s monitoring procedures were not sophisticated enough to establish a connection between either the borrowers or the appraisals supporting these loans. As a result, this increasing level of exposure remained largely undetected. Second, while each loan was relatively small, the combined total of these loans was significant. However, because of the small size of each loan, the bank’s internal loan review did not pick up any of the loans. The bank would have benefited by changing the scope of its loan review to include a sampling of loans from all loan officers, regardless of the loan size. Finally, the bank was not completely familiar with the appraisal firm used to value the collateral supporting these loans. If the ownership structure of the appraisal firm had been investigated initially, the bank would have discovered this apparent conflict of interest, which would have triggered additional investigation.

Property Flipping

Property flipping is the practice of purchasing properties and reselling them at artificially inflated prices to straw or duped buyers11 and is strictly fraud for profit. Flipping schemes typically involve fraudulent appraisals, doctored loan documentation, or inflated buyer income. Financial incentives to buyers, investors, brokers, appraisers, and title company employees are also common and indicate the degree of collusion necessary to flip a property. Based on existing investigations and mortgage fraud reports, the FBI estimates that 80 percent of all reported fraud losses involve collaboration or collusion by industry insiders.12 A particularly troublesome aspect of property flipping is that it taints property sale databases and presents the illusion of rising property values in neighborhoods where the flipping takes place.

Example: During a routine examination of a $1 billion financial institution, examiners became suspicious when they noticed that one loan officer worked apart from other loan originators and had processing personnel dedicated to his loan originations. Bank management indicated the loan officer was the bank’s highest producer and that “even a bad month was a good month” for that loan officer. The loan officer maintained a high number of loan originations, even though he took no referrals from the phone queue. On further investigation, the FDIC discovered that the loan officer had an undisclosed relationship with a local mortgage broker. Examiners’ review of the officer’s lending activity revealed several loans that had been originated, sold, and then quickly fell into foreclosure. Properties were also refinanced rapidly, with an affiliate of the broker placing second mortgages on the property that would immediately be paid from the next refinance. A sample of the officer’s loan documentation discovered altered or falsified account statements, purchase and sale agreements, income figures, credit reports, and verification of deposit forms. The loan officer has since resigned from the institution and is the subject of an ongoing criminal investigation. Total loss exposure to the bank is still being determined; however, the bank has already had to repurchase several loans as a result of this officer’s actions.

Lessons Learned: Bank management focused on income generated by this loan officer and overlooked or ignored several key matters that would normally trigger further investigation. First, the isolation of this loan officer from others, including separate processing support, allowed him to dominate transactions from start to finish. The lack of dual control over these transactions greatly enhanced the loan officer’s ability to perpetrate the fraud. Second, the lack of proper review and oversight allowed the relationship with the mortgage broker to remain undisclosed to management. Implementing periodic quality control audits to verify the accuracy and completeness of documentation would have brought these activities to light, including the rapid refinancing of properties and falsified loan support documentation.

Misapplication of Funds from Construction or Rehabilitation Projects

Construction or rehabilitation project loans are normally established as operating lines of credit. Borrowers make draws upon these lines of credit and use these funds to complete various phases of a proposed construction or rehabilitation project. Draws are usually matched to the percentage of the project that is complete, with a final percentage held back as an abundance of caution. For example, a builder may ask for a draw that represents 20 percent of the loan/line total, with verified completion actually totaling around 23–25 percent. The draw is used to pay subcontractors for work performed, as well as to provide working capital for the builder, whose fees are built into the line.

Under fraudulent circumstances, builders may use funds or draws on one project to pay for improvements related to another project, or may simply divert funds or draws for their own enrichment—fraud for profit. When this happens, subcontractors do not get paid, and, in some cases, no improvements are made to the property. In the end, the builder exhausts the line of credit, and the bank is left to dispose of a property with very little supporting value.

Example: A $365 million community bank authorized 13 construction lines of credit to a local builder for the construction of speculative houses—those built without a buyer or signed purchase agreement. As soon as the lines were approved, the builder began requesting draws. The builder used falsified sales contracts to mislead the loan officer into believing many of the homes were presold. The loan officer routinely advanced funds to the builder and signed off on construction inspection documentation without ever actually inspecting the construction sites. After some time had elapsed with no corresponding sales activity, the loan officer began pressing the builder about the status of construction and requests for new money. The builder confessed that no houses had been constructed on 11 of the bank’s 13 construction lines. The bank ultimately recorded a loss of $2 million on the $2.6 million construction line. The builder was convicted of fraud and sent to federal prison. The FDIC banned the loan officer from banking. The loss had a significant impact on the bank’s earnings, and the institution’s reputation was tarnished as a result of local media coverage. The FDIC became aware of this fraud by reviewing SARs submitted by the institution.

Lessons Learned: The monetary reward and success of attracting and signing a loan client is much more attractive than the subsequent job of properly administering the credit; however, both are equally important to a financial institution. In this instance, the loan officer became busy with other responsibilities and did not devote the time necessary to properly monitoring construction draws and documenting the proper allocation of funds to each project. The institution had no established procedures or forms for conducting and documenting on-site inspections, except to check the “inspection” box on the disbursement form. Consequently, to authorize a construction draw and deter loan review attention, the loan officer would falsely indicate on loan disbursement forms that construction inspections had been completed. Loan oversight was limited to verifying that the “inspection” box was checked, with no subsequent confirmation or review of supporting documentation. In addition, the bank did not review or monitor the builder’s deposit account activity, which would have revealed construction draws being used for a multitude of purposes unrelated to the project. Verifying the legitimacy of the sales contracts with the proposed purchasers also would have immediately alerted the bank of a possible problem.

Establishing Controls: A Commonsense Approach

Fraud is often compared to a triangle, with the three points of the fraud triangle being motive, rationalization, and opportunity. The element of opportunity is particularly heightened at financial institutions because of the cash and financial transaction nature of the business. As can be seen from the examples and mitigating steps in this article, developing and implementing a sound internal control environment—including sound lending fundamentals, quality control procedures, and audit programs—is a key factor in reducing the opportunity for all types of mortgage loan fraud. While most institutions are aware of these safeguards, the cost/benefit of internal controls sometimes precludes management from making internal controls a top priority.

In addition to the mitigating steps already identified, some banks are exploring automated fraud detection products introduced over the past several years. These software applications search bank loan databases and compare borrowers, loan participants, common names, addresses, employers, appraisers, and the like, to detect potential red flags or signs of mortgage fraud. These products produce summary ratings or reports that serve to identify loans or groups of loans that may represent an increased risk of mortgage fraud and require further investigation. The ultimate decision as to whether these products represent a cost-effective solution remains an independent choice for each institution. However, it is important that all institutions consider the potential impact of fraud and establish adequate provisions for this risk as part of their normal profitability and budgeting process.

Conclusion

Mortgage loan fraud is a large and growing problem. It can occur in any neighborhood and requires that all parties concerned maintain a high level of vigilance. Bank management should keep alert to fraud triggers, ask questions, review mortgage documentation, perform verifications, and report suspicious activity to the appropriate regulatory and law enforcement authorities in a timely manner. While even the best internal control environment will not prevent mortgage fraud in all instances, strong internal controls, coupled with an alert and knowledgeable staff, are a financial institution’s best line of defense.

Ken A. Edwards

Supervisory Examiner,

Albany, GA

Jeffry A. Petruy

Examiner,

Gainesville, FL

Corbin Harrison

Examiner,

Atlanta, GA

Rebecca A. Berryman

Senior Capital Markets and Securities Specialist,

Atlanta, GA

Timothy J. Hubby

Assistant Regional Director,

Atlanta, GA

Acknowledgments: The authors would like to acknowledge the assistance provided by Stephen Corona, Office of Federal Housing Enterprise Oversight; Barbara Nelan, Assistant United States Attorney, Northern District of Georgia; Sandra Sheley, Director of Mortgage Supervision, Georgia Department of Banking and Finance; Ed Slagle, Special Agent, and Gary L. Sherrill, Senior Special Agent, Office of Inspector General, FDIC.

1 Ann D. Fulmer, Vice President of Industry Relations, Interthinx™; HUD STOP Conference, June 22, 2006, Savannah, Georgia.

2 Mortgage Bankers Association, “Mortgage Fraud Perpetrated Against Residential Lenders,” July 2006, from their website.

3 A suspicious activity report is a standard form used by all federally insured financial institutions to report activities of suspected criminal violations of federal law or suspicious transactions potentially related to money laundering.

4 FBI, Mortgage Fraud: New Partnership to Combat Problem, March 9, 2007. See https://archives.fbi.gov/archives/news/stories/2007/march/mortgage_030907.

5 Bob Tedeschi, “Mortgages: Fraud Cases Are Rising, FBI Says,” New York Times, January 14, 2007, http://www.nytimes.com/2007/01/14/realestate/14mort.html?ex=1181880000&en=c8c4e0174bb5ee1c&ei=5070.

6 The Detection, Investigation and Deterrence of Mortgage Loan Fraud Involving Third Parties: A White Paper, Federal Financial Institutions Examination Council (FFIEC) Fraud Investigations Symposium, February 2005, www.ffiec.gov/exam/3P_Mtg_Fraud_wp_oct04.pdf.

7 BasePoint Analytics LLC, Broker-Facilitated Fraud—The Impact on Lenders: A White Paper (2006), www.basepointanalytics.com/mortgagewhitepapers.html.

8 Broker-Facilitated Fraud.

9 Broker-Facilitated Fraud.

10 Merle Sharick, Erin E. Omba, Nick Larson, and D. James Croft, “Eighth Periodic Mortgage Fraud Case Report to Mortgage Bankers Association,” Mortgage Asset Research Institute, Inc. (April 2006).

11 Vernon Martin, “Detection of Mortgage Fraud,” RMA Journal, September 2004.

12 FBI, “Financial Crimes Report to the Public, Fiscal Year 2006.” See https://www.fbi.gov/file-repository/stats-services-publications-fcs_report2006-financial-crimes-report-to-the-public-2006-pdf/view.