FDIC-Insured Institutions Reported Net Income of $64.4 Billion in Second Quarter 2022

For Release

- Net Income Declined Year Over Year

- Net Interest Margin Widened

- Loan Growth Was Broad-Based

- Credit Quality Remained Favorable Despite Growth in Early Delinquencies

- Total Deposits Declined Moderately for the First Time Since Second Quarter 2018

- Community Banks Reported a Moderate Decline in Net Income

“The banking industry reported generally positive results in the second quarter as loan balances strengthened, net interest income grew, and credit quality remained favorable, although net income declined as a result of increased provision expenses. Looking forward, downside risks from inflation, rising interest rates, slowing economic growth, and continuing pandemic and geopolitical uncertainties will continue to challenge bank profitability, credit quality, and loan growth.”

— FDIC Acting Chairman Martin J. Gruenberg

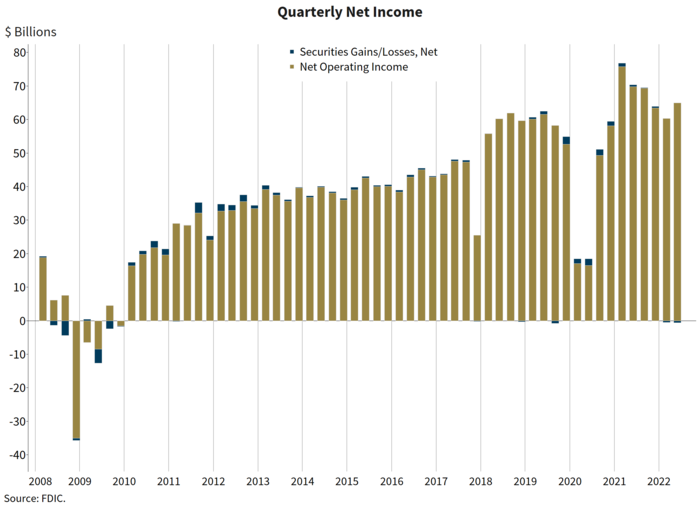

WASHINGTON— Reports from 4,771 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $64.4 billion in second quarter 2022, a decline of $6.0 billion (8.5 percent) from a year ago. An increase in provision expense drove the annual reduction in net income. These and other financial results for second quarter 2022 are included in the FDIC’s latest Quarterly Banking Profile released today.

Highlights from the Second Quarter 2022 Quarterly Banking Profile

Net Income Declined Year Over Year: Quarterly net income totaled $64.4 billion, a decline of $6.0 billion (8.5 percent) from the same quarter a year ago, primarily due to an increase in provision expense. Provision expense increased $21.9 billion from the year-ago quarter, from negative $10.8 billion in second quarter 2021 to positive $11.1 billion this quarter. More than half of all banks (51.5 percent) reported an annual decline in quarterly net income. However, net income rose $4.6 billion (7.8 percent) from first quarter 2022 as growth in net interest income exceeded growth in provision expense.

The banking industry reported an aggregate return on average assets (ROAA) ratio of 1.08 percent, down 16 basis points from the ROAA ratio reported in second quarter 2021 but up 7 basis points from the ROAA ratio reported in first quarter 2022.

Net Interest Margin Widened: The net interest margin (NIM) increased 26 basis points from the prior quarter to 2.80 percent, the highest quarterly growth in NIM since first quarter 2010. Most banks (70.5 percent) reported higher net interest income compared with a year ago.

The yield on earning assets increased to 3.05 percent (up 35 basis points from the previous quarter and 37 basis points from a year ago) reflecting loan growth during the recent rising interest rate environment. Average funding costs increased 10 basis points from first quarter 2022 and 8 basis points from the year-ago quarter.

Community Banks Reported a Decline in Net Income From the Year-Ago Quarter: Community banks reported a decline in net income of $523.0 million (6.5 percent) from the year-ago quarter, resulting from higher noninterest expense, lower noninterest income, losses on the sale of securities, and higher provisions for credit losses. Most of the 4,333 FDIC-insured community banks (52.0 percent) reported lower quarterly net income compared with the year-ago quarter. Net income, however, increased $583.6 million (8.4 percent) from first quarter 2022.

Net interest income for community banks rose $1.9 billion (9.6 percent) to $21.4 billion from the year-ago quarter due primarily to an increase in “other real estate loan income” (up $929.4 million, or 10.5 percent) and income from investment securities (up $937.5 million, or 45.4 percent).1 Interest expense declined $181.8 million (or 9.3 percent). Net interest income also increased from first quarter 2022 (up $1.9 billion, or 9.6 percent). Provisions for credit losses rose $533.4 million (739.7 percent) from the year-ago quarter and $318.7 million (110.4 percent) from the previous quarter to $607.4 million.2

The net interest margin for community banks widened 8 basis points from the year-ago quarter to 3.33 percent. This was the largest quarterly increase since second quarter 1985.

Loan Balances Increased from the Previous Quarter and a Year Ago: Total loan and lease balances increased $414.9 billion (3.7 percent) from the previous quarter. The banking industry reported growth in several loan portfolios, including 1-4 family residential loans (up $94.7 billion, or 4.2 percent), commercial and industrial loans (up $92.3 billion, or 3.9 percent), and consumer loans (up $79.3 billion, or 4.2 percent).

Annually, total loan and lease balances increased $913.6 billion (8.4 percent), driven by growth in consumer loans (up $204.3 billion, or 11.6 percent), 1-4 family residential mortgage loans (up $187.1 billion, or 8.6 percent), and “all other loans” (up $162.7 billion, or 13.7 percent).3

Community banks reported a 4.9 percent increase in loan balances from the previous quarter, and a 7.7 percent increase from the prior year. Growth in 1-4 family residential mortgage loans drove the quarterly increase in loan balances for community banks, while growth in commercial real estate loans drove the annual increase.

Credit Quality Was Favorable Overall Despite Growth in Early Delinquencies: Loans that were 90 days or more past due or in nonaccrual status (i.e., noncurrent loans) continued to decline (down $7.2 billion or 7.6 percent) from first quarter 2022. The noncurrent rate for total loans declined 9 basis points from the previous quarter to 0.75 percent, the lowest level since third quarter 2006. Total net charge-offs also continued to decline (down $600.7 million, or 8.2 percent) from a year ago. The total net charge-off rate declined 4 basis points to 0.23 percent—just above the record low of 0.19 percent set in third quarter 2021. However, early delinquencies (i.e., loans past due 30-89 days) increased $11.4 billion (25.0 percent) from the year-ago quarter and $2.8 billion (5.2 percent) from first quarter 2022. Both the quarterly and annual increases were driven by an increase in past due consumer loans.

The Reserve Ratio for the Deposit Insurance Fund Rose to 1.26 Percent: The Deposit Insurance Fund (DIF) balance was $124.5 billion on June 30, up $1.4 billion from the end of the first quarter. The reserve ratio rose three basis points to 1.26 percent, as insured deposits fell 0.7 percent.

Merger Activity Continued in the Second Quarter: Twenty-eight institutions merged and no banks failed in second quarter 2022.

| 1 | “Other real estate loan income” includes commercial real estate and farmland loan income. |

| 2 | Provisions for credit losses include both losses for loans and securities for Current Expected Credit Losses (CECL) adopters and only loan losses for non-adopters. |

| 3 | “All other consumer loans” includes single payment and installment loans other than automobile loans and all student loans. |