Selected Financial Data - First Quarter 2023

| FSLIC Resolution Fund | |||||

|---|---|---|---|---|---|

| Mar-22 | Dec-22 | Quarterly Change | Mar-22 | Year-Over-Year Change | |

| Cash and cash equivalents | $932 | $922 | $10 | $908 | $24 |

| Accumulated deficit | (124,537) |

(124,547) |

10 |

(124,562) |

25 |

| Total resolution equity | 933 |

922 |

11 |

908 |

25 |

| Total revenue | 10 |

15 |

0 |

10 |

|

| Operating expenses | 0 |

0 |

0 |

0 |

|

| Losses related to thrift resolutions | 0 |

0 |

0 |

0 |

|

| Net Income (Loss) | $10 |

$15 |

$0 |

$10 |

|

| $ in millions | DIF | FRF | ALL FUNDS | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mar 23 | Mar 22 | Change | Mar 23 | Mar 22 | Change | Mar 23 | Mar 22 | Change | |

| Total Receiverships | 127 | 188 | (61) | 0 | 0 | 0 | 127 | 188 | (61) |

| Assets in Liquidation | $27,7411 |

$86 |

$27,655 |

$0 |

$0 |

$0 |

$27,741 |

$86 |

$27,655 |

| YTD Collections | $14 |

$34 |

($20) |

$0 |

$0 |

($1) |

$14 |

$34 |

($20) |

| YTD Dividend/Other Pmts - Cash | $40,039 |

$103 |

$39,936 |

$0 |

$0 |

$0 |

$40,039 |

$103 |

$39,936 |

1Does not incluede all of the assets retained by the SVB and Signature Bank receiverships until further analysis can be completed on various asset types.

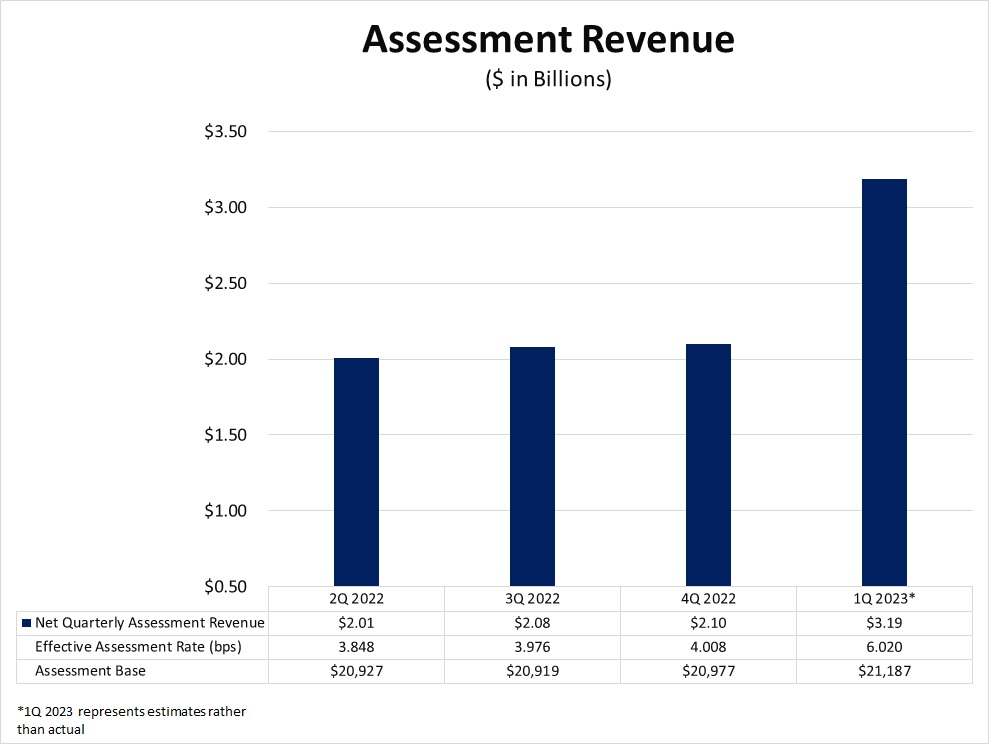

| 2Q2022 | 3Q2022 | 4Q2022 | 1Q2023 | |||||

|---|---|---|---|---|---|---|---|---|

| Net Quarterly Assessment Revenue | $2.01 | $2.08 | $2.10 | $3.19 | ||||

| Effective Assessment Rate (bps) | 3.848 | 3.976 | 4.008 | 6.020 | ||||

| Assessment Base | $20,927 | $20,919 | $20,977 | $21,187 | ||||

| 1 4Q2022 represents estimates rather than actual | ||||||||

1Q23 assessment revenue rose by $1.1b due to a 2 basis point increase in assessmet rates as mandated by the amended restoration plan.