Selected Financial Data - Second Quarter 2022

| FSLIC Resolution Fund | |||||

|---|---|---|---|---|---|

| Jun-22 | Mar-22 | Quarterly Change | Jun-21 | Year-Over-Year Change | |

| Cash and cash equivalents | $909 | $908 | $1 | $907 | $2 |

| Accumulated deficit | (124,560) |

(124,562) |

2 |

(124,562) |

2 |

| Total resolution equity | 909 |

908 |

1 |

907 |

2 |

| Total revenue | 2 |

0 |

2 |

0 |

2 |

| Operating expenses | 0 |

0 |

0 |

0 |

0 |

| Recovery of tax benefits | 0 |

0 |

0 |

0 |

0 |

| Losses related to thrift resolutions | 0 |

0 |

0 |

0 |

0 |

| Net Income (Loss) | $2 |

$0 |

$2 |

$0 |

$2 |

| $ in millions | DIF | FRF | ALL FUNDS | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Jun 22 | Jun 21 | Change | Jun 22 | Jun 21 | Change | Jun 22 | Jun 21 | Change | |

| Total Receiverships | 175 | 220 | (45) | 0 | 0 | 0 | 175 | 220 | (45) |

| Assets in Liquidation | $57 |

$206 |

($149) |

$ 0 |

$0 |

$0 |

$57 |

$206 |

($149) |

| YTD Collections | $94 |

$176 |

($82) |

$0 |

$1 |

($1) |

$94 |

$177 |

($83) |

| YTD Dividend/Other Pmts - Cash | $193 |

$525 |

($332) |

$ 0 |

$ 0 |

$ 0 |

$193 |

$525 |

($332) |

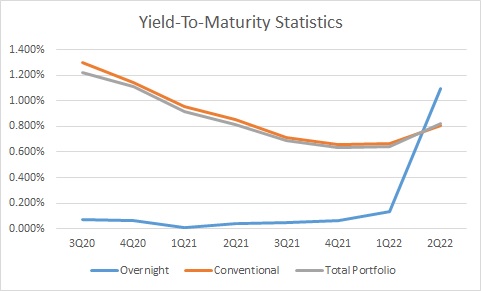

| 3Q2020 | 4Q2020 | 1Q2021 | 2Q2021 | 3Q2021 | 4Q2021 | 1Q2022 | 2Q2022 | |

|---|---|---|---|---|---|---|---|---|

| Overnight | 0.071% | 0.061% | 0.010% | 0.041% | 0.051% | 0.061% | 0.132% | 1.095% |

| Conventional | 1.297% | 1.144% | 0.953% | 0.853% | 0.709% | 0.661% | 0.667% | 0.805% |

| Total Portfolio | 1.223% | 1.113% | 0.913% | 0.816% | 0.687% | 0.633% | 0.641% | 0.821% |

The DIF portfolio's yield has seen dramatic change over the pandemic. The overnight rate closely tracks that of the Federal Funds rate and with the Federal Open Market Committee's recent decisions to raise rates, the overnight rate has seen a rapid recovery. The yield curve has also seen significant upward pressure in the first half of the year, and with that, the investment portfolio's yield has stopped declining. With nearly 30% of the portfolio scheduled to mature in the second half of the year, and continued expected rate hikes by the FOMC, the portfolio's yield will likely continue its upwards trajectory.