Selected Financial Data - First Quarter 2021

Fund Financial Results ($ in millions)

| FSLIC Resolution Fund |

| |

Mar-21 |

Dec-20 |

Quarterly Change |

Mar-20 |

Year-Over-Year Change |

| Cash and cash equivalents |

$907 |

$907 |

$0 |

$926 |

($19) |

| Accumulated deficit |

(124,562) |

(124,562) |

0 |

(124,563) |

1 |

| Total resolution equity |

907 |

907 |

0 |

926 |

(19) |

| Total revenue |

0 |

4 |

|

3 |

(3) |

| Operating expenses |

0 |

0 |

|

0 |

0 |

| Recovery of tax benefits |

0 |

0 |

|

0 |

0 |

| Losses related to thrift resolutions |

0 |

0 |

|

0 |

0 |

| Net Income (Loss) |

$0 |

$4 |

|

$3 |

($3) |

Receivership Selected Statistics March 2021 vs. March 2020

| $ in millions |

DIF |

FRF |

ALL FUNDS |

| |

Mar 21 |

Mar 20 |

Change |

Mar 21 |

Mar 20 |

Change |

Mar 21 |

Mar 20 |

Change |

| Total Receiverships |

229 |

245 |

(16) |

0 |

0 |

0 |

229 |

245 |

(16) |

| Assets in Liquidation |

$273 |

$546 |

($273) |

$0 |

$1 |

($1) |

$273 |

$547 |

($274) |

| YTD Collections |

$62 |

$87 |

($25) |

$1 |

$0 |

$1 |

$63 |

$87 |

($24) |

| YTD Dividend/Other Pmts - Cash |

$192 |

$189 |

3 |

$0 |

$0 |

$0 |

$192 |

$189 |

$3 |

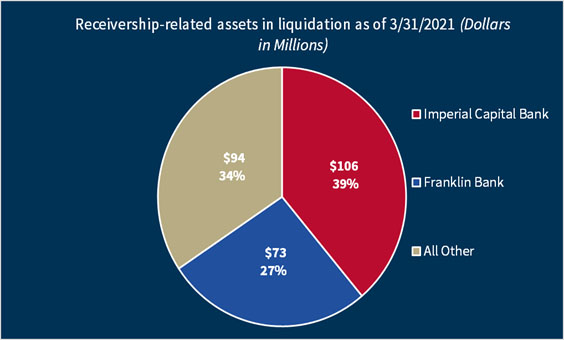

Receivership-related assets in liquidation as of 3/31/21 (dollars in millions)

| |

Imperial Capital Bank |

Franklin Bank |

All Other |

| Dollars |

$106 |

$94 |

$73 |

| Percentage |

39% |

34% |

27% |

Of the receivership-related assets in liquidation of $273 million as of March 31, 2021, 66 percent are concentrated in two receiverships. For these two receiverships, the assets primarily consist of interests in receivership-originated structured transactions which are expected to liquidate by 2022.