DIF Balance Sheet - First Quarter 2024

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Mar-24 | Dec-23 | Quarterly Change | Mar-23 | Year-Over-Year Change | |

| Cash and cash equivalents | $61,042 | $4,873 | $56,169 | $18,088 | $42,954 |

| Investment in U.S. Treasury securities | 9,953 | 18,929 | (8,976) | 81,717 | (71,764) |

| Assessments receivable | 3,293 | 3,236 | 57 | 3,187 | 106 |

| Special Assessments receivable | 19,179 |

20,423 |

(1,244) |

15,776 |

3,403 |

| Interest receivable on investments and other assets, net | 109 |

146 |

(37) |

416 |

(307) |

| Receivables from resolutions, net | 55,521 |

97,778 |

(42,257) |

86,590 |

(31,069) |

| Property and equipment | 315 |

319 |

(4) |

361 |

(46) |

| Operating lease right-of-use assets | 79 |

81 |

(2) |

85 |

(6) |

| Total Assets | $149,491 |

$145,785 |

$3,706 |

$206,220 |

($56,729) |

| Accounts payable and other liabilities | 536 |

410 |

126 |

270 |

266 |

| Operating lease liabilities | 99 |

102 |

3 |

105 |

(6) |

| Liabilities due to resolutions | 22,503 |

22,513 |

(10) |

75,828 |

(55,325) |

| Postretirement benefit liability | 256 |

256 |

0 |

232 |

24 |

| Contingent liability for anticipated failures | 797 |

726 |

71 |

13,713 |

(12,916) |

| Contingent liability for litigation losses | 0 |

0 |

0 |

1 |

(1) |

| Total Liabilities | $24,191 |

$24,007 |

$184 |

$90,149 |

($65,958) |

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (10) |

(30) |

20 |

(535) |

525 |

| FYI: Unrealized postretirement benefit (loss) gain | 10 |

10 |

0 |

27 |

(17) |

| Fund Balance | $125,300 |

$121,778 |

$3,522 |

$116,071 |

$9,229 |

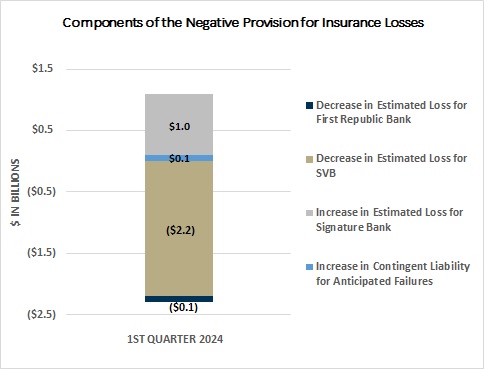

During the first quarter 2024, the total estimated losses for the three large regional bank failures in 2023 decreased by $1.3 billion to $39.1 billion as of March 31, 2024.

| Mar -2024 | |

|---|---|

| Increase in Contingent liability for anticipated failures | $0.1 |

| Increase in Estimated Loss for Signature Bank | $1.0 |

| Decrease in Estimated Loss for SVB | ($2.2) |

| Decrease in Estimated Loss for First Republic Bank | ($0.1) |