DIF Balance Sheet - First Quarter 2023

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Mar-23 | Dec-22 | Quarterly Change | Mar-22 | Year-Over-Year Change | |

| Cash and cash equivalents | $18,088 | $2,599 | ($15,489) | $5,802 | $12,286 |

| Investment in U.S. Treasury securities | 81,717 | 122,442 | (40,725) | 114,230 | (32,513) |

| Assessments receivable | 3,187 | 2,159 | 1,028 | 1,818 | 1,369 |

| Special Assessments receivable | 15,776 |

0 |

15,776 |

0 |

15,776 |

| Interest receivable on investments and other assets, net | 416 |

688 |

(272) |

776 |

(360) |

| Receivables from resolutions, net | 86,590 |

521 |

86,069 |

815 |

85,775 |

| Property and equipment | 361 |

360 |

1 |

326 |

35 |

| Operating lease right-of-use assets | 85 |

93 |

(8) |

80 |

5 |

| Total Assets | $206,220 |

$128,862 |

$77,358 |

$123,847 |

$82,373 |

| Accounts payable and other liabilities | 270 |

268 |

2 |

245 |

25 |

| Operating lease liabilities | 105 |

111 |

(6) |

85 |

20 |

| Liabilities due to resolutions | 75,828 |

1 |

75.827 |

1 |

75,827 |

| Postretirement benefit liability | 232 |

232 |

0 |

332 |

(100) |

| Contingent liability for anticipated failures | 13,713 |

31 |

13,682 |

145 |

13,568 |

| Contingent liability for litigation losses | 1 |

1 |

0 |

0 |

1 |

| Total Liabilities | $90,149 |

$664 |

$89,505 |

$808 |

$89,341 |

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (535) |

(2,985) |

2,450 |

(1,835) |

1,300 |

| FYI: Unrealized postretirement benefit (loss) gain | 27 |

27 |

0 |

(83) |

110 |

| Fund Balance | $116,071 |

$128,218 |

($12,147) |

$123,039 |

($6,968) |

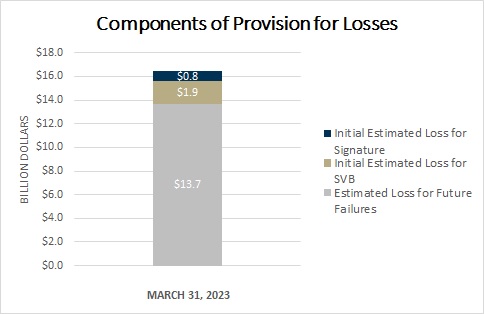

| March 31, 2023 | |

|---|---|

| Initial estimated loss for signature | $0.8 |

| Initial estimated loss for SVB | $1.9 |

| Initial estiamted loss for Signature | $13.7 |

The total initial estimated loss for SVB and Signature Bank failures are $14.3 billion and $2.4 billion, respectively, however, only 14% and 33% of the total loss covering insured deposits impacted the DIF balance. The remaining share for uninsured deposits will be recovered from the banking industry through a special assessment ($14.2 billion and $1.6 billion, respectively).