DIF Balance Sheet - Fourth Quarter 2021

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Dec-21 | Sep-21 | Quarterly Change | Dec-20 | Year-Over-Year Change | |

| Cash and cash equivalents | $5,563 | $3,944 | $1,619 | $3,311 | $2,252 |

| Investment in U.S. Treasury securities | 114,551 | 114,705 | (154) | 110,464 | 4,087 |

| Assessments receivable | 1,711 | 1,676 | 35 | 1,949 | (238) |

| Interest receivable on investments and other assets, net | 718 |

998 |

(280) |

1,159 |

(441) |

| Receivables from resolutions, net | 885 |

903 |

(18) |

1,367 |

(482) |

| Property and equipment | 327 |

323 |

4 |

321 |

6 |

| Operating lease right-of-use assets | 85 |

93 |

(8) |

112 |

(27) |

| Total Assets | $123,840 |

$122,642 |

$1,198 |

$118,683 |

$5,157 |

| Accounts payable and other liabilities | 255 |

259 |

(4) |

251 |

4 |

| Operating lease liabilities | 91 |

99 |

(8) |

119 |

(28) |

| Liabilities due to resolutions | 0 |

1 |

(1) |

1 |

(1) |

| Postretirement benefit liability | 332 |

336 |

(4) |

336 |

(4) |

| Contingent liability for anticipated failures | 21 |

12 |

9 |

79 |

(58) |

| Contingent liability for litigation losses | 0 |

0 |

0 |

0 |

0 |

| Total Liabilities | $699 |

$707 |

($8) |

$786 |

($87) |

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (149) |

387 |

(536) |

1,070 |

(1,219) |

| FYI: Unrealized postretirement benefit (loss) gain | (83) |

(98) |

15 |

(98) |

15 |

| Fund Balance | $123,141 |

$121,935 |

$1,206 |

$117,897 |

$5,244 |

| Assessments | Earnings on U.S. Treasury Securities | Operating Expenses | Negative Provision for Insurance Losses | Comprehensive Income | |

|---|---|---|---|---|---|

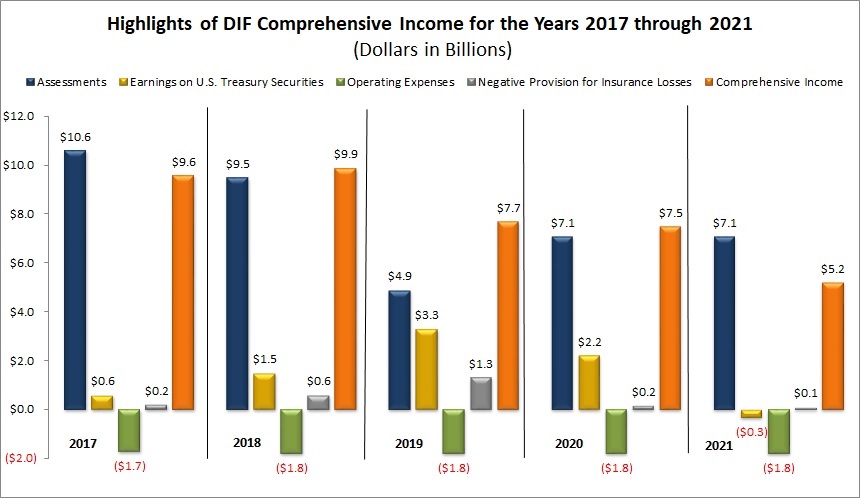

| 2017 | $10.6 | $0.6 | ($1.7) | $0.2 | $9.6 |

| 2018 | $9.5 | $1.5 | ($1.8) | $0.6 | $9.9 |

| 2019 | $4.9 | $3.3 | ($1.8) | $1.3 | $7.7 |

| 2020 | $7.1 | $2.2 | ($1.8) | $0.2 | $7.5 |

| 2021 | $7.1 | ($0.3) | ($1.8) | $0.1 | $5.2 |

The DIF’s comprehensive income totaled $5.2 billion for 2021 compared to comprehensive income of $7.5 billion during 2020. The year-over-year decrease in comprehensive income of $2.3 billion was primarily driven by a decrease in interest and market value adjustments on U.S.Treasury securities of $2.4 billion.