DIF Balance Sheet - Fourth Quarter 2022

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Dec-22 | Sep-22 | Quarterly Change | Dec-21 | Year-Over-Year Change | |

| Cash and cash equivalents | $2,599 | $5,767 | ($3,168) | $5,563 | ($2,964) |

| Investment in U.S. Treasury securities | 122,442 | 116,572 | 5,870 | 114,551 | 7,891 |

| Assessments receivable | 2,159 | 2,101 | 58 | 1,711 | 448 |

| Interest receivable on investments and other assets, net | 688 |

745 |

(57) |

718 |

(30) |

| Receivables from resolutions, net | 521 |

590 |

(69) |

885 |

(364) |

| Property and equipment | 360 |

355 |

5 |

327 |

33 |

| Operating lease right-of-use assets | 93 |

98 |

(5) |

85 |

8 |

| Total Assets | $128,862 |

$126,228 |

$2,634 |

$123,840 |

$5,022 |

| Accounts payable and other liabilities | 269 |

259 |

10 |

255 |

14 |

| Operating lease liabilities | 111 |

114 |

(3) |

91 |

20 |

| Postretirement benefit liability | 232 |

332 |

(100) |

332 |

(100) |

| Contingent liability for anticipated failures | 31 |

65 |

(34) |

21 |

10 |

| Contingent liability for litigation losses | 1 |

1 |

0 |

0 |

1 |

| Total Liabilities | $644 |

$771 |

($127) |

$699 |

($55) |

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (2,985) |

(3,459) |

474 |

(149) |

(2,836) |

| FYI: Unrealized postretirement benefit (loss) gain | 27 |

(83) |

110 |

(83) |

110 |

| Fund Balance | $128,218 |

$125,457 |

$2,761 |

$123,141 |

$5,077 |

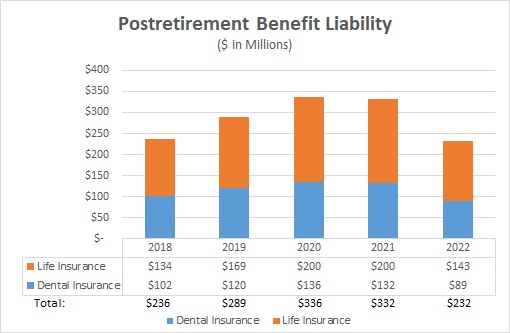

| 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|

| Life Insurance | $134 | $169 |

$200 | $200 | $143 |

| Dental Insurance | $102 | $120 | $136 | $132 | $89 |

| Total | $236 | $289 | $336 | $332 | $232 |

The FDIC provides certain life and dental insurance coverage for its eligible retirees, the retirees' beneficiaries, and covered dependents. During 2022, the postretirement benefit liability decreased by $100 million primarily due to an increase in the discount rate that is used to present value expected benefit payments. The discount rate increased form 2.82 percent to 5.27 percent at year-end 2022.