DIF Balance Sheet - First Quarter 2020

| Balance Sheet | |||||

|---|---|---|---|---|---|

|

|

| Quarterly |

| Year-Over-Year |

| Cash and cash equivalents | $9,490 | $5,991 | $3,499 | $7,062 | $2,428 |

| Investment in US Treasury securities | 99,733 | 100,072 | (339) | 93,507 | 6,226 |

| Assessments receivable | 1,357 | 1,242 | 115 | 1,372 | (15) |

| Interest receivable on investments and other assets, net | 709 | 1,021 | (312) | 567 | 142 |

| Receivables from resolutions, net | 2,456 | 2,669 | (213) | 3,187 | (731) |

| Property and equipment, net | 326 | 330 | (4) | 324 | 2 |

| Operating lease right-of-use assets | 120 | 0 | 120 | 0 | 120 |

| Total Assets | $114,191 | $111,325 | $2,866 | $106,019 | $8,172 |

| Accounts payable and other liabilities | 215 | 215 | 0 | 211 | 4 |

| Operating lease liabilities | 127 | 0 | 127 | 0 | 127 |

| Liabilities due to resolutions | 213 | 346 | (133) | 554 | (341) |

| Postretirement benefit liability | 289 | 289 | 0 | 236 | 53 |

| Contingent liability for anticipated failures | 107 | 94 | 13 | 115 | (8) |

| Contingent liability for guarantee payments and litigation losses | 34 | 34 | 0 | 33 | 1 |

| Total Liabilities | $985 | $978 | $7 | $1,149 | $(164) |

| FYI: Unrealized gain (loss) on US Treasury securities, net | 2,037 | 587 | 1,450 | (194) | 2,231 |

| FYI: Unrealized postretirement benefit (loss) gain | (61) | (61) | 0 | (14) | (47) |

| Fund Balance | $113,206 | $110,347 | $2,859 | $104,870 | $8,336 |

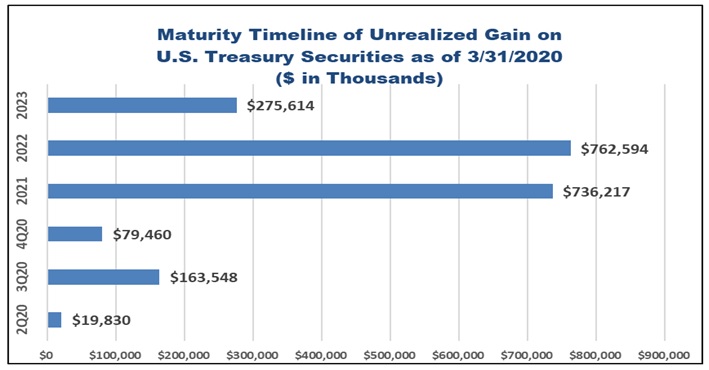

| Unrealized Gain on U.S. Treasury Securities |

|---|---|

| 2Q20 | $19,830 |

| 3Q20 | $163,548 |

| 4Q20 | $79,460 |

| 2021 | $736,217 |

| 2022 | $762,594 |

| 2023 | $275,614 |

As each US Treasury security nears its maturity, the market value will approach the par value, and the unrealized gain will reduce to zero. For those securities that mature by year end 2020, their unrealized gain as of March 31, 2020 of $263 million, or 13 percent of total unrealized gains, will be reduced to zero.