DIF Balance Sheet - Third Quarter 2020

|

| Quarterly |

| Year-Over-Year | |

|---|---|---|---|---|---|

| Balance Sheet | |||||

| Cash and cash equivalents | $6,801 | $5,144 | $1,657 | $4,268 | $2,533 |

| Investment in US Treasury securities | 105,830 | 105,024 | 806 | 100,873 | 4,957 |

| Assessments receivable | 1,902 | 1,632 | 270 | 1,115 | 787 |

| Interest receivable on investments and other assets, net | 864 | 1,369 | (505) | 582 | 282 |

| Receivables from resolutions, net | 1,352 | 1,860 | (508) | 2,801 | (1,449) |

| Property and equipment, net | 314 | 320 | (6) | 317 | (3) |

| Operating lease right-of-use assets | 115 | 118 | (3) | 0 | 115 |

| Total Assets | $117,178 | $115,467 | $1,711 | $109,956 | $7,222 |

| Accounts payable and other liabilities | 234 | 221 | 13 | 212 | 22 |

| Operating lease liabilities | 122 | 127 | (5) | 0 | 122 |

| Liabilities due to resolutions | 5 | 73 | (68) | 427 | (422) |

| Postretirement benefit liability | 289 | 289 | 0 | 236 | 53 |

| Contingent liability for anticipated failures | 62 | 74 | (12) | 108 | (46) |

| Contingent liability for guarantee payments and litigation losses | 32 | 32 | 0 | 33 | (1) |

| Total Liabilities | $744 | $816 | ($72) | $1,016 | ($272) |

| FYI: Unrealized gain (loss) on US Treasury securities, net | 1,370 | 1,654 | (284) | 586 | 784 |

| FYI: Unrealized postretirement benefit (loss) gain | (61) | (61) | 0 | (14) | (47) |

| Fund Balance | $116,434 | $114,651 | $1,783 | $108,940 | $7,494 |

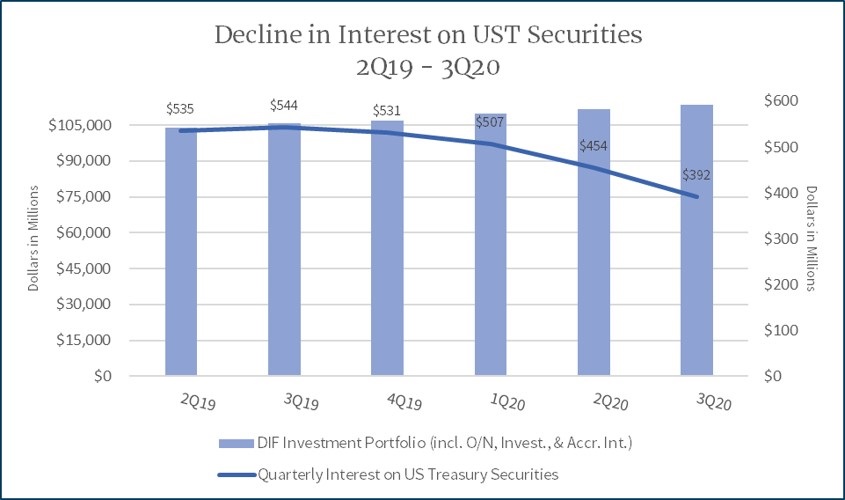

DIF Investment Portfolio (including O/N, Invest. & Accr. Int) | DIF Quarterly Interest on US Treasury Securities | |

|---|---|---|

| 2Q19 | $535 | $103,961 |

| 3Q19 | $544 | $105,676 |

| 4Q19 | $531 | $107,024 |

| 1Q20 | $507 | $109,871 |

| 2Q20 | $454 | $111,474 |

| 3Q20 | $392 | $113,442 |

The DIF has experienced a 9% growth in the market value of its investment portfolio from second quarter of 2019 through the third quarter of 2020. However that growth has failed to translate into higher interest earned, as yields plummeted to record lows in the second quarter of 2020 and will remain there for what is anticipated to be the next 2 to 3 years. Overnight interest, beginning in April of this year and through the third quarter and likely beyond, is a fraction of what was earned prior to March.