Selected Financial Data - Third Quarter 2020

| Sep-20 | Jun -19 | Quarterly Change | Sep -19 | Year-Over-Year Change |

|---|---|---|---|---|---|

| FSLIC Resolution Fund | |||||

| Cash and cash equivalents | $907 | $926 | ($19) | $918 | ($11) |

| Accumulated deficit | (124,562) | (124,563) | 1 | (124,570) | 8 |

| Total resolution equity | 907 | 907 | 0 | 919 | (12) |

| Total revenue | 4 | 3 | 1 | 17 | (13) |

| Operating expenses | 0 | 0 | 0 | 0 | 0 |

| Recovery of tax benefits | 0 | 0 | 0 | 0 | 0 |

| Losses related to thrift resolutions | 0 | 0 | 0 | 0 | 0 |

| Net Income (Loss) | $4 | $3 | $1 | $17 | ($13) |

| $ in millions | DIF | FRF | ALL FUNDS | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Sep-20 | Sep-19 | Change | Sep-20 | Sep-19 | Change | Sep-20 | Sep-19 | Change |

| Total Receiverships | 238 | 252 | (14) | 0 | 0 | 0 | 238 | 252 | (14) |

| Assets in Liquidation | $370 | $575 | ($205) | $0 | $2 | ($2) | $370 | $577 | ($207) |

| YTD Collections | $338 | $1,113 | ($775) | $1 | $2 | ($1) | $339 | $1,115 | ($776) |

| YTD Dividend/Other Pmts - Cash | $1,301 | $1,374 | ($73) | $0 | $0 | $0 | $1,301 | $1,374 | ($73) |

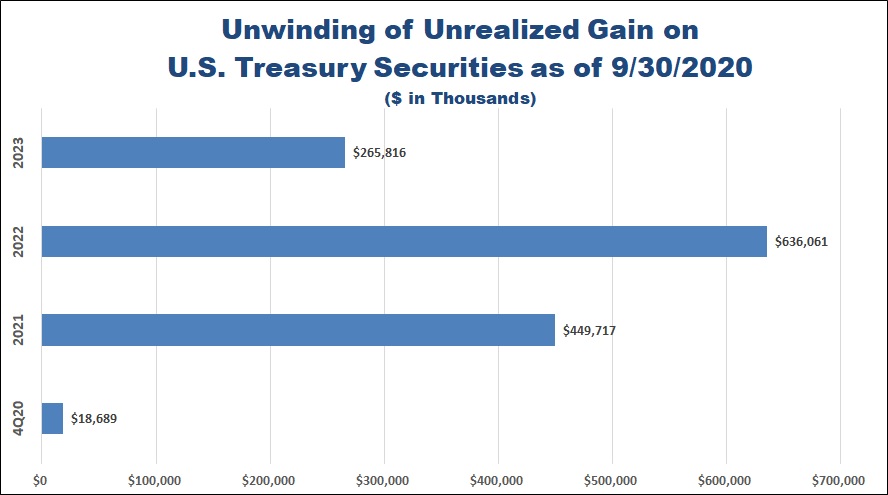

| Unrealized Gain on U.S. Treasury Securities | |

|---|---|

| 4Q20 | $18,689 |

| 2021 | $449,717 |

| 2022 | $636,061 |

| 2023 | $265,816 |

The total unrealized gains have decreased since the end of the first quarter of 2020, as the second and third quarters saw an aggregate of approximately $31.9BN in par value mature. Proceeds were subsequently reinvested at much lower yields. With $20.0BN of par value expected to mature in the first quarter of 2021, those unrealized gains have seen significant reduction as they approach maturity.