Introduction

This article provides an update on the extent of commercial real estate (CRE) lending exposure in the banking industry as a whole. The article also provides CRE loan risk management and governance trends observed at FDIC-supervised insured depository institutions (IDIs) with concentrations in CRE. These institutions represent over three-quarters of all IDIs with concentrations in CRE and 61 percent of all assets of IDIs with concentrations in CRE. The article discusses broad supervisory findings and does not establish new requirements or new supervisory guidance. Rather, it provides insights into current industry risk management practices and governance, based on examiners’ views.

CRE Exposure in the Banking Industry

During the 2008 crisis, many IDIs failed or experienced problems because of large levels of poorly underwritten and administered CRE loans and, in particular, acquisition, development, and construction (ADC) loans, relative to their capital.1 These IDIs also often experienced rapid asset growth, relatively greater use of wholesale funding sources, and lower capital levels as compared with other IDIs.

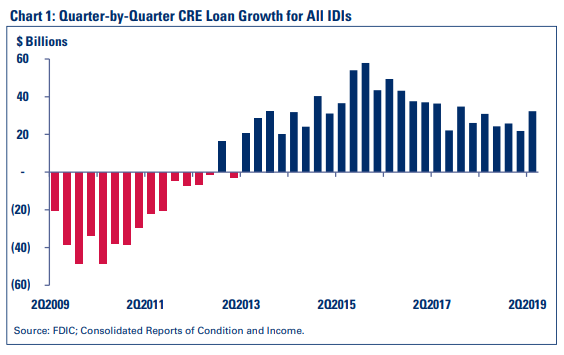

After shrinking following the 2008 financial crisis, the dollar volume of CRE lending at all IDIs began to grow again in 2013. Since 2015, CRE loan growth at IDIs has been slowing (see Chart 1). Average quarterly CRE loan growth figures for 2015, 2016, 2017, and 2018 are $44.9 billion, $43.4 billion, $32.6 billion, and $26.8 billion, respectively.

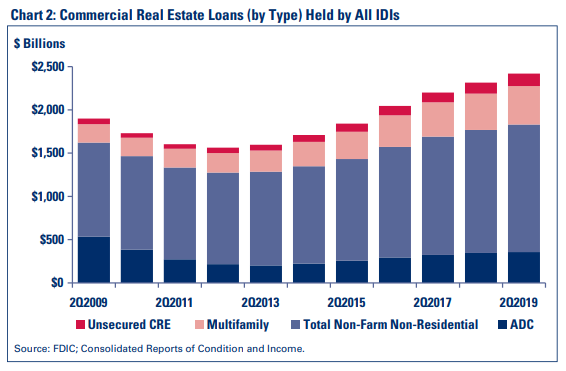

However, with the addition of $32.4 billion in second quarter 2019, the total volume of CRE loans held by all IDIs reached a new high of more than $2.4 trillion as of June 30, 2019 (see Chart 2). Non-farm, non-residential loans continue to represent the largest CRE subcategory at nearly $1.5 trillion. Multi-family loans have grown to $444.9 billion, and ADC loans total about $357.1 billion.

CRE is a widely held asset class. As of June 30, 2019, more than 98 percent of all IDIs hold CRE loans. Although not all of these IDIs specialize in CRE lending, a large number do, and holding a significant level of these credits could heighten an IDI’s vulnerability to a CRE market downturn.

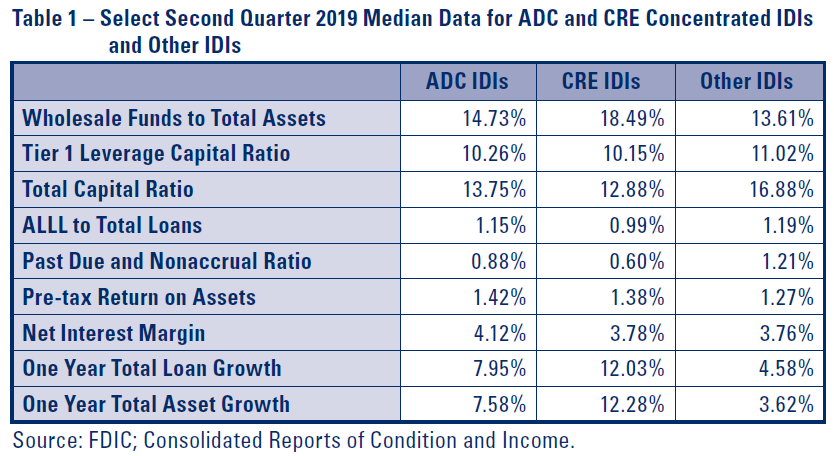

Table 1 reflects a point-in-time snapshot of the performance of all concentrated IDIs2 compared to all other IDIs as of June 30, 2019. As displayed in the table, concentrated CRE and ADC lenders use wholesale funding sources more than other IDIs. Additionally, the capital cushion of concentrated IDIs is lower than that of other IDIs (as measured by the tier 1 leverage capital and the total capital ratios), although earnings, as measured by pre-tax return on assets, are somewhat higher at the concentrated IDIs as compared to the other IDIs.

In terms of asset quality, the median past due and nonaccrual ratio for all other IDIs is higher than the corresponding median ratios for concentrated IDIs; however, these concentrated IDIs are growing faster than the other IDIs, and growth in loan portfolios can mask building risk as unseasoned loans may drive down delinquency ratios. Furthermore, protection provided by the Allowance for Loan and Lease Losses (ALLL) is lower for the concentrated IDIs compared to other IDIs.

Regulatory Requirements Regarding Risk Management and Governance

Assessing the effectiveness of an FDIC-supervised IDI’s risk management practices continues to be a critical part of the FDIC’s forward- looking, risk-focused supervision. For concentrated FDIC-supervised IDIs, examiners assess the IDI’s risk management and governance framework in accordance with Part 365 of the FDIC Rules and Regulations, Real Estate Lending Standards, and Part 364 of the FDIC Rules and Regulations, Standards for Safety and Soundness.3

More specifically, Section 365.2 of the FDIC Rules and Regulations requires FDIC-supervised IDIs to adopt and maintain written policies that establish appropriate limits and standards for extensions of credit secured by real estate. Among other things, these policies must establish portfolio diversification standards; prudent underwriting standards; loan administration procedures; and documentation, approval, and reporting requirements to monitor compliance with the IDI’s policies.

Additionally, Section 365.2 requires FDIC-supervised IDIs to monitor conditions in the real estate market in their lending areas to make sure that their policies continue to be appropriate for current market conditions and also to ensure that policies consider the Interagency Guidelines for Real Estate Lending Policies, which are included as Appendix A to Subpart A of the regulation.

Section 39 of the Federal Deposit Insurance Act requires each Federal banking agency to establish safety and soundness standards by regulation or guideline. The FDIC establishes these standards by guidelines which appear in Appendix A to Part 364. Among other things, the standards described in Appendix A, titled Interagency Guidelines Establishing Standards for Safety and Soundness (Interagency Safety and Soundness Standards), provide that IDIs:

- have internal controls and information systems that are appropriate to the size of the institution and the nature, scope, and risk of its activities;

- consider the source, volatility, and use of funds that support asset growth;

- conduct periodic asset quality reviews to identify problem assets;

- establish allowances for loan and lease losses sufficient to absorb estimated losses; and

- maintain prudent credit underwriting practices that take adequate account of concentration of credit risk and establish a system of independent, ongoing credit review and appropriate communication to management and to the board of directors.

When FDIC examiners identify concerns with risk management practices at an FDIC-supervised IDI, they communicate such information to an IDI’s management in the form of “supervisory recommendations.” Supervisory recommendations are intended to help the IDI improve its practices, operations, or financial condition. Conditions leading to supervisory recommendations generally are correctable by the IDI in the normal course of business. However, Matters Requiring Board Attention (MRBA), a subset of supervisory recommendations, identify issues or risks of significant importance that require the attention of the IDI’s board of directors and senior management.4 MRBA are an FDIC communication intended to inform the IDI of the FDIC’s views about changes needed in its practices, operations, or financial condition to help directors prioritize their efforts to address examiner concerns, identify emerging problems, and correct deficiencies before the IDI’s condition deteriorates (or to keep the IDI viable if conditions have already deteriorated).

To inform its view of current trends, the FDIC considered high-level findings in the form of supervisory recommendations and MRBA from more than 470 supervisory activities completed at concentrated FDIC- supervised IDIs over a two-year period ending March 2019.5 These IDIs held composite ratings of “1,” “2,” or “3” at the time the supervisory activities began.6

The preponderance of the IDIs remain satisfactorily rated. However, examiners identified one or more CRE-related MRBA in about 24 percent of the supervisory activities. CRE-related supervisory recommendations and MRBA most often addressed board/management governance and oversight, portfolio sensitivity analyses, portfolio management, and funding strategies. Although instances of MRBA for CRE loan underwriting were infrequent, general supervisory recommendations for CRE loan underwriting were more widespread. These areas are explored below.

Board/Management Oversight

A sound CRE lending program begins with the direction and oversight of the IDI’s board of directors and senior management. Over 56 percent of the reviews yielded supervisory recommendations regarding board/management oversight, and roughly 27 percent of that pool with supervisory recommendations included MRBA. Supervisory recommendations and MRBA regarding oversight most commonly addressed inadequate establishment and monitoring of concentration limits and sub-limits, improvements needed in loan policy exception tracking and reporting, and concerns about strategic planning.

In some instances, concentration limits or sub-limits were absent from written policies, and in other cases, IDI management merely had increased the policy’s concentration limit(s) to avoid exceptions. In certain instances, concentration limits appeared inappropriate when considering factors such as an IDI’s existing concentration level(s), strategic goals, or management’s experience level.

Supervisory recommendations regarding inadequate tracking and reporting of policy exceptions indicate opportunities for improvement in management’s policy enforcement. Policies, even when appropriate, generally will not be effective if management is not properly enforcing them. Untracked or poorly-tracked policy exceptions may lead to a credit culture and risk profile exceeding the risk tolerance established by the IDI’s board of directors.

With regard to strategic planning, in some instances, management did not incorporate CRE lending considerations at all. In other cases, considerations in the strategic plan did not reflect actual practices or were based on unrealistic or not well- developed assumptions.

Portfolio-level Sensitivity Analyses

As described in the “asset quality” provision of the Interagency Safety and Soundness Standards, an IDI should “consider the size and potential risks of material asset concentrations” and “provide periodic asset reports with adequate information for management and the board of directors to assess the level of asset risk.”7 Portfolio-level sensitivity analyses can help IDIs assess the extent of potential exposure to a downturn in CRE markets. Such analyses can inform management of an IDI’s specific vulnerabilities, allowing them to focus on effective risk-mitigation actions. Sensitivity analyses also may help determine the appropriateness of existing policies, strategies, targeted markets, and products. The sophistication of portfolio sensitivity analyses will vary by IDI based on the size, complexity, and risk characteristics of the IDI’s CRE portfolio.

Significant progress has been made by many FDIC-supervised IDIs with regard to portfolio-level sensitivity analyses. However, in some cases, portfolio-level analyses remain less evolved than necessary based on the IDI’s CRE portfolio. Across the reviews of IDIs with higher levels of CRE, approximately 41 percent reported supervisory recommendations related to portfolio- level sensitivity analyses, with 22 percent of that pool including MRBA.

Many concerns center on the overall implementation or quality of the sensitivity analyses. Others relate to failure to fully consider the results for budgeting, capital planning, and strategic planning purposes. More specifically, some supervisory recommendations noted that management performed calculations, but did not integrate results into the IDI’s oversight and planning processes or did not document the integration. In some cases, assumptions did not appear realistic or comprehensive or were based on industry data rather than the IDI’s own data.

Portfolio Management

CRE loan concentrations can expose an IDI to unacceptable risk if not properly managed and monitored, even when CRE loans are prudently underwritten as part of the initial transactions. Supervisory recommendations regarding portfolio management were evident in 37 percent of the reviews; over 28 percent of that pool involved MRBA. Portfolio monitoring emerged as a more common supervisory recommendation, with the MRBA primarily centered on establishing and monitoring limits for concentrations and pertinent sub-segments.

On a related note, management information systems (MIS) are an important tool to enable management and the board of directors to oversee 7 Refer to footnote 3. the CRE portfolio. According to the “internal controls and information systems” provision of the Interagency Safety and Soundness Standards, an IDI should have information systems that are appropriate to its size and the nature, scope, and risk of its activities. Such systems should not only provide for an organizational structure that establishes clear lines of authority and responsibility for monitoring adherence to established policies, but also provide for:

- effective risk assessment;

- timely and accurate financial, operational, and regulatory reports; and

- compliance with applicable laws and regulations.

In 19 percent of the reviews, supervisory recommendations specific to MIS were reported, with 20 percent of that subset incorporating MRBA. The concerns often related to the quality and lack of granularity of portfolio stratifications produced by the FDIC-supervised IDI’s MIS.

Contingency planning was another common theme among portfolio management supervisory recommendations. Contingency plans address possible actions for reducing or mitigating CRE concentration risk while ensuring the ongoing adequacy of capital protection. Contingency planning was absent in some cases. In other cases, contingency planning was too rudimentary for the complexity of the portfolio and warranted further development.

Funding Strategies

Over 11 percent of the reviews of CRE concentrated FDIC-supervised IDIs yielded a liquidity component rating of “3” or worse. Further, over 28 percent of the reviews reported supervisory recommendations regarding portfolio funding strategies, with over 45 percent of that subset containing MRBA.

The more common supervisory recommendation themes centered on improvements needed in the monitoring of funding sources supporting the CRE loan portfolio and its growth. Other common themes were weaknesses in liquidity sensitivity analyses and contingency funding planning. These included the need for supportable and robust assumptions and expanded stress scenarios during sensitivity analysis. This is particularly important for concentrated IDIs, because as noted, they are growing their assets faster than other IDIs.

The intricacy of contingency funding plans, inclusive of execution timeframes, will vary by IDI based on the complexity and risk characteristics of the IDI’s funding strategies.

Underwriting

The Interagency Safety and Soundness Standards require an IDI to establish and maintain prudent credit underwriting practices that, among other things: “Provide for consideration, prior to credit commitment, of the borrower’s overall financial condition and resources; the financial responsibility of any guarantor; the nature and value of any underlying collateral; and the borrower’s character and willingness to repay as agreed.”8

The large majority of the FDIC- supervised IDIs reviewed have overall sound underwriting practices. Even so, CRE underwriting-related supervisory recommendations were observed for more than 27 percent of the reviews, with about 14 percent of that subset involving MRBA. The nature of supervisory recommendations varied widely, but more commonly related to inadequate analyses of repayment capacity, including inadequate global debt service coverage analyses. Such supervisory recommendations addressed situations in which there was not a clear demonstration of the borrower’s capacity to meet a realistic and reasonable payment plan. For instance, some IDIs were having problems calculating global cash flows, and, in other cases, not completing or considering global cash flow analyses at all, when it was applicable.

Loan pricing, another key consideration during the underwriting process, is affected by competition. Credit surveys and banker and examiner feedback characterize the lending landscape as increasingly competitive among IDIs as well as nonbanks. As shown in Table 1, the median pre-tax returns on average assets and the net interest margins at concentrated IDIs remain higher than those for all other IDIs; however, returns on specific portfolios are not reported in the IDIs’ Consolidated Reports of Condition and Income. Some instances of fairly generous interest-only terms or other relaxed structures (such as extended amortizations) were noted in supervisory recommendations and could be the result of competitive pressure.

Another more common category of underwriting-related supervisory recommendations is exceptions to underwriting policies, which emphasizes the importance of management implementing appropriate tracking and reporting mechanisms.

Conclusion

Supervisory activities at FDIC- supervised IDIs show that concentrated IDIs are generally managing risk adequately. Nevertheless, as discussed in this article, examiners have noted areas where CRE risk management frameworks can be improved. The FDIC encourages IDIs that engage in significant levels of CRE lending - or any other type of lending - to carefully consider the quality and comprehensiveness of concentration risk management practices and take appropriate action when shortfalls are apparent.

Lisa A. Garcia

Senior Examination Specialist

Division of Risk Management Supervision

LiGarcia@fdic.gov

Yelizaveta (Leeza) Shapiro

Senior Quantitative Risk Analyst

Division of Risk Management Supervision

YShapiro@fdic.gov

| 1 | See for example, FDIC, Crisis and Response: An FDIC History, 2008–2013. Washington, DC, 2017; https://www. fdic.gov/bank/historical/crisis/; FDIC Office of the Inspector General, Comprehensive Study on the Impact of the Failure of Insured Depository Institutions, EVAL-13-002, January 3, 2013, https://www.fdicoig.gov/sites/default/files/reports/2022-08/13-002EV.pdf; and FDIC, Office of Inspector General, Acquisition, Development, and Construction Loan Concentration Study, EVAL-13-001, October 2012, https://www.fdicoig.gov/sites/default/files/reports/2022-08/13-001EV.pdf. |

| 2 | For purposes of this article, a “concentrated IDI” is defined as an IDI with total ADC loans greater than 100 percent of the IDI’s total capital (ADC IDIs), or total CRE loans greater than 300 percent of the IDI’s total capital, and the CRE loan portfolio has increased by 50 percent or more during the prior 36 months (CRE IDIs). Total CRE does not include loans for owner-occupied properties. Approximately 596 IDIs active as of August 19, 2019, exceeded these criteria in at least one quarter during the four quarter period ending June 30, 2019. These concentration categories are for analytical purposes and do not in any way represent a ceiling or limit for IDIs. |

| 3 | See Part 365 of the FDIC Rules and Regulations at https://www.fdic.gov/regulations/laws/rules/2000-50.html and Part 364 of the FDIC Rules and Regulations at https://www.fdic.gov/regulations/laws/rules/2000-50.html. |

| 4 | See page 16.1-2 of the Report of Examination instructions at https://www.fdic.gov/resources/supervision-and-examinations/examination-policies-manual/section16-1.pdf. |

| 5 | Data as of May 21, 2019. Some data, while audited internally for quality, was manually tabulated and interpreted. A large majority of the supervisory activities were examinations by the FDIC, some of which were joint or concurrent examinations with the applicable state authorities. Some IDIs had more than one supervisory activity occur during this timeframe. |

| 6 | IDIs with composite ratings of “4” and “5” are excluded as the financial conditions of these IDIs are already being impacted, and such IDIs are typically already subject to formal enforcement actions. |

| 7 | Refer to footnote 3. |

| 8 | Refer to footnote 3. |