Selected Financial Data - Fourth Quarter 2021

| FSLIC Resolution Fund | |||||

|---|---|---|---|---|---|

| Dec-21 | Sep-21 | Quarterly Change | Dec-20 | Year-Over-Year Change | |

| Cash and cash equivalents | $908 | $908 | $0 | $907 | $1 |

| Accumulated deficit | (124,562) |

(124,562) |

0 |

(124,562) |

0 |

| Total resolution equity | 908 |

908 |

0 |

907 |

1 |

| Total revenue | 0 |

0 |

0 |

4 |

(4) |

| Operating expenses | 0 |

0 |

0 |

0 |

0 |

| Recovery of tax benefits | 0 |

0 |

0 |

0 |

0 |

| Losses related to thrift resolutions | 0 |

0 |

0 |

0 |

0 |

| Net Income (Loss) | $0 |

$0 |

$0 |

$4 |

($4) |

| $ in millions | DIF | FRF | ALL FUNDS | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Dec 21 | Dec 20 | Change | Dec 21 | Dec 20 | Change | Dec 21 | Dec 20 | Change | |

| Total Receiverships | 191 | 234 | (43) | 0 | 0 | 0 | 191 | 234 | (43) |

| Assets in Liquidation | $92 |

$282 |

($190) |

$ 0 |

$ 1 |

($1) |

$92 |

$283 |

($191) |

| YTD Collections | $514 |

$512 |

$2 |

$1 |

$1 |

$ 0 |

$515 |

$513 |

$2 |

| YTD Dividend/Other Pmts - Cash | $586 |

$1,433 |

($847) |

$ 0 |

$ 0 |

$ 0 |

$586 |

$1,433 |

($847) |

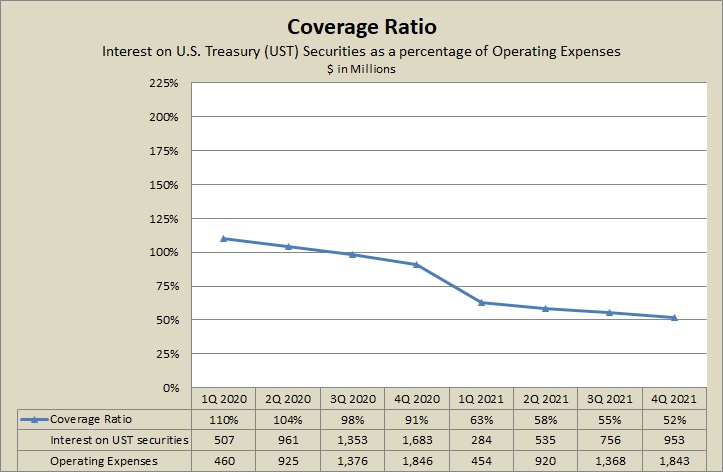

| 1Q2020 | 2Q2020 | 3Q202 | 4Q2020 | 1Q2021 | 2Q2021 | 3Q2021 | 4Q2021 | |

|---|---|---|---|---|---|---|---|---|

| Coverage Ratio | 110% | 104% | 98% | 91% | 63% | 58% | 55% | 52% |

| Interest on UST securities | 507 | 961 | 1,353 | 1,683 | 284 | 535 | 756 | 953 |

| Operating Expenses | 460 | 925 | 1,376 | 1,846 | 454 | 920 | 1,368 | 1,843 |