DIF Balance Sheet - Third Quarter 2022

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Sep-22 | Jun-21 | Quarterly Change | Sep-21 | Year-Over-Year Change | |

| Cash and cash equivalents | $5,767 | $6,694 | ($927) | $3,944 | $1,823 |

| Investment in U.S. Treasury securities | 116,572 | 114,574 | 1,998 | 114,705 | 1,867 |

| Assessments receivable | 2,101 | 1,968 | 133 | 1,676 | 425 |

| Interest receivable on investments and other assets, net | 745 |

792 |

(47) |

998 |

(253) |

| Receivables from resolutions, net | 590 |

733 |

(143) |

903 |

(313) |

| Property and equipment | 355 |

348 |

7 |

323 |

32 |

| Operating lease right-of-use assets | 98 |

73 |

25 |

93 |

5 |

| Total Assets | $126,228 |

$125,182 |

$1,046 |

$122,642 |

$3,586 |

| Accounts payable and other liabilities | 259 |

249 |

10 |

260 |

(1) |

| Operating lease liabilities | 114 |

77 |

37 |

99 |

15 |

| Postretirement benefit liability | 332 |

332 |

0 |

336 |

(4) |

| Contingent liability for anticipated failures | 65 |

66 |

(1) |

12 |

53 |

| Contingent liability for litigation losses | 1 |

0 |

1 |

0 |

1 |

| Total Liabilities | $771 |

$724 |

$47 |

$707 |

$64 |

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (3,459) |

(2,382) |

(1,077) |

387 |

(3,846) |

| FYI: Unrealized postretirement benefit (loss) gain | (83) |

(83) |

0 |

(98) |

15 |

| Fund Balance | $125,457 |

$124,458 |

$999 |

$121,935 |

$3,522 |

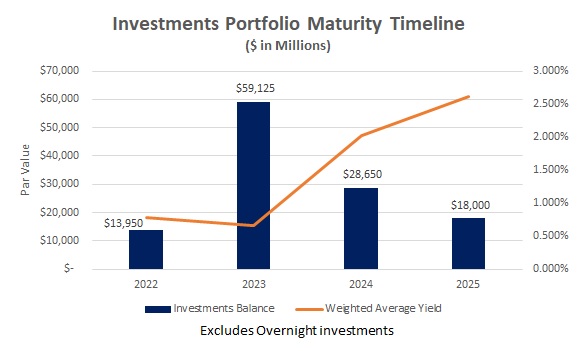

| 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|

| Investments Balance | $13,950 | $59,125 |

$28,650 | $18,000 |

| Weighted Average Yield | 0.776% | 0.667% | 2.019% | 2.617% |

The Federal Reserve’s rate hike cycle, beginning in March of 2022, resulted in yields rising quickly, elevating unrealized losses within the investment portfolio. With another rate hike expected in December, and perhaps more for 2023, market participants are expecting the yield curve to continue seeing upward pressure. Over 60% of the portfolio is expected to mature by the end of 2023, and these securities will pull to par as the maturity dates approach. With a weighted average yield of 0.776% for the remainder of the 2022 maturities and 0.667% for the 2023 maturities, the reinvestment into significantly higher yielding securities will rapidly push the weighted average yield of the entire portfolio higher.