DIF Balance Sheet - Third Quarter 2021

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Sep-21 | Jun-21 | Quarterly Change | Sep-20 | Year-Over-Year Change | |

| Cash and cash equivalents | $3,944 |

$5,361 |

($1,417) |

$6,801 |

($2,857) |

| Investment in U.S. Treasury securities | 114,705 |

111,991 |

2,714 |

105,830 |

8,875 |

| Assessments receivable | 1,676 |

1,755 |

(79) |

1,902 |

(226) |

| Interest receivable on investments and other assets net | 998 |

832 |

166 |

864 |

134 |

| Receivables from resolutions net | 903 |

908 |

(5) |

1,352 |

(449) |

| Property and equipment net | 323 |

320 |

3 |

314 |

9 |

| Operating lease right-of-use assets | 93 |

100 |

(7) |

115 |

(22) |

Total Assets |

$122,642 |

$121,267 |

$1,375 |

$117,178 |

$5,464 |

| Accounts payable and other liabilities | 259 |

235 |

24 |

234 |

25 |

| Operating lease liabilities | 99 |

107 |

(8) |

122 |

(23) |

| Liabilities due to resolutions | 1 |

7 |

(6) |

5 |

(4) |

| Postretirement benefit liability | 336 |

336 |

0 |

289 |

47 |

| Contingent liability for anticipated failures | 12 |

35 |

(23) |

62 |

(50) |

| Contingent liability for guarantee payments and litigation losses | 0 |

0 |

0 |

32 |

(32) |

Total Liabilities |

$707 |

$720 |

($13) |

$744 |

($37) |

| FYI: Unrealized gain (loss) on U.S. Treasury securities net | 387 |

552 |

(165) |

1,370 |

(983) |

| FYI: Unrealized postretirement benefit (loss) gain | (98) |

(98) |

0 |

(61) |

(37) |

Fund Balance |

$121,935 |

$120,547 |

$1,388 |

$116,434 |

$5,501 |

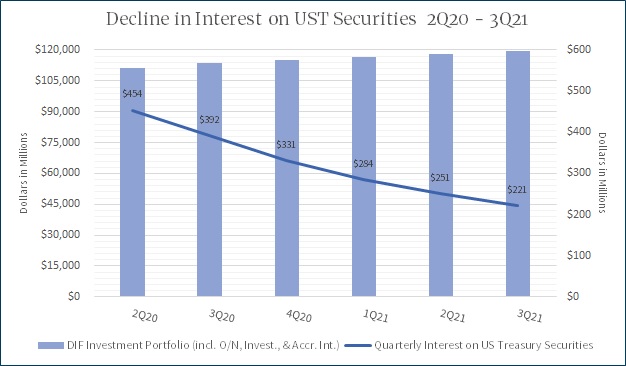

| DIF Investment Portfolio (incl. O/N, Invest., & Accr. Int.) | Quarterly Interest on US Treasury Securities | |

|---|---|---|

| 2Q20 | $111,474 | $454 |

| 3Q20 | $113,442 | $392 |

| 4Q20 | $114,910 | $331 |

| 1Q21 | $116,511 | $284 |

| 2Q21 | $118,155 | $251 |

| 3Q21 | $119,613 | $221 |

The DIF has experienced a 7% growth in the market value of its investment portfolio from second quarter of 2020 through the third quarter of 2021. The DIF's investment portfolio balance has seen modest growth quarter over quarter, mostly attributable to assessment income. Total interest income continues to decline, as securities with higher yields purchased pre-pandemic mature. Newly purchased securities have seen some yield pickup over historic lows; however, the overnight rate continues to hover near zero.