Selected Financial Data - Second Quarter 2021

| FSLIC Resolution Fund | |||||

|---|---|---|---|---|---|

| Jun-21 | Mar-21 | Quarterly Change | Jun-20 | Year-Over-Year Change | |

| Cash and cash equivalents | $907 | $907 | $0 | $926 | ($19) |

| Accumulated deficit | (124,562) | (124,562) | 0 | (124,563) | 1 |

| Total resolution equity | 907 | 907 | 0 | 907 | 0 |

| Total revenue | 0 | 0 | 0 | 3 | (3) |

| Operating expenses | 0 | 0 | 0 | 0 | 0 |

| Recovery of tax benefits | 0 | 0 | 0 | 0 | 0 |

| Losses related to thrift resolutions | 0 | 0 | 0 | 0 | 0 |

| Net Income (Loss) | $0 | $0 | 0 | $3 | ($3) |

| $ in millions | DIF | FRF | ALL FUNDS | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Jun 21 | Jun 20 | Change | Jun 21 | Jun 20 | Change | Jun 21 | Jun 20 | Change | |

| Total Receiverships | 220 | 244 | (24) | 0 | 0 | 0 | 220 | 244 | (24) |

| Assets in Liquidation | $206 | $380 | ($174) | $0 | $1 | ($1) | $206 | $381 | ($175) |

| YTD Collections | $176 | $285 | ($109) | $1 | $1 | $0 | $177 | $286 | ($109) |

| YTD Dividend/Other Pmts - Cash | $525 | $797 | ($272) | $0 | $0 | $0 | $525 | $797 | ($272) |

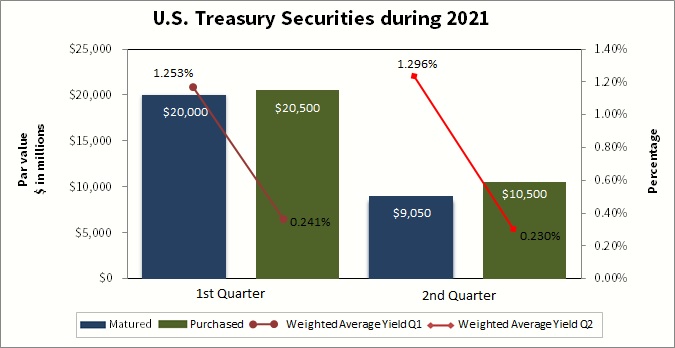

| 1st Quarter | 2nd Quarter | |||

| Matured | Purchased | Matured | Purchased | |

|---|---|---|---|---|

| UST Securities | $20,000 | $20,500 | $9,050 | $10,500 |

| Weighted Average Yield | 1,253% | 0.241% | 1.296% | 0.230% |