The lending landscape for banks continues to evolve. What hasn’t changed is that the quality of a bank’s loan portfolio continues to be of paramount importance to its long-term financial health. Thus, the assessment of lending and its related risks continues to be a key focus of the FDIC. This article describes the assessments of lending conditions and risks by FDIC risk-management examiners, based on Credit and Consumer Products/Services Surveys (Credit Surveys) submitted for examinations completed through the first half of 2015.

Lending Conditions

As measured by bank loan growth, recovery from the financial crisis and “great recession” continues to gather momentum. Total loans and leases held by FDIC-insured institutions rose to $8.5 trillion as of June 30, 2015, up 5.4 percent compared to one year prior.1 This post-crisis rebound in lending volume is likely attributable, in part, to the low interest rate environment and a fair economic outlook encouraging individuals and businesses to tap into available credit. Not only is loan volume growing, but the proportion of institutions that are growing their loan portfolios is increasing. During the second quarter of 2015, 78 percent of banks grew their lending portfolios. This is up from about 74 percent the year prior.

Further, the rise in loan volume is broad-based. Acquisition, development, and construction (ADC) loans stood at $256 billion at mid-year 2015, an increase of nearly 15 percent from a year earlier. Commercial and industrial (C&I) loans were $1.8 trillion, an 8 percent increase from a year earlier. Consumer lending increased 4 percent to $1.4 trillion. Nonfarm, nonresidential commercial real estate loans increased 4 percent to about $1.2 trillion. In addition, 1-4 family residential mortgage loans held on balance sheet grew about 2 percent to a little less than $1.9 trillion. Unused loan commitments are nearly $6.7 trillion and are up 6 percent from a year earlier, indicating continued loan growth.

Loan performance continues to improve, reflecting the ongoing recovery in the nation’s economy and bankers working through and/or selling off many of the problem legacy credits. The past due and nonaccrual (PDNA) ratio as of June 30, 2015, is 2.38 percent, a 67 basis point improvement from the year prior. During the 12-month period, the PDNA ratio improved for nearly all loan categories except the “All other loans and leases (including farm)” category, which only increased six basis points to 0.45 percent.

Given that borrowers generally do not immediately default after they have received a loan, metrics such as the PDNA ratio tend to be a lagging indicator of loan quality, especially in periods of rapid loan growth, and may not effectively provide banks and their regulators the lead time necessary to properly identify and address emerging credit risk. Accordingly, to facilitate earlier identification and stronger tracking of lending conditions and risks, the FDIC reviews and analyzes examiners’ responses to the Credit Surveys.2

Credit Survey Results

The observations reported by examiners in the Credit Survey reflect continuing improvement in the financial condition and overall risk profile of the banking industry. At the same time, Credit Survey results suggest that just as loan growth is returning, so to some extent are riskier lending practices. This development is not unusual in a banking cycle’s upswing phase. Moreover, while selected indicators suggest the direction of risk is increasing, examiners are still typically reporting these indicators in the context of low to moderate levels of overall risk.

Overall Loan Portfolio Risk

Credit Survey respondents continue to label the degree of risk in most lending portfolios as “low” to “moderate.”3 Reports of “high” risk portfolios declined substantially, from 23 percent of responses for the first half of 2013 to 14 percent of responses for the first half of 2015. For the first half of 2015, roughly 67 percent of Credit Surveys reported “moderate” risk in the loan portfolio, and 18 percent considered the risk level “low.” Comparatively, for the first half of 2013, responses were 62 percent for “moderate” risk and 15 percent for “low” risk, respectively. The migration from the “high” risk level in the past few years may be due to the working through or selling-off of many problem credits and improvements in the economy, but perhaps also to tightening of underwriting standards in the aftermath of the recent financial crisis that was noted in prior Credit Survey results.4

When assessing the level of risk on a portfolio-type basis, an overall improving trend is noted for nearly all portfolios. Regardless, some portfolios are reporting a slight uptick in the proportion of “high” risk designations in the first half of 2015 (although the frequency of such designations remains well below those experienced with the recent crisis), suggesting that lending risk may be in the very early stages of increasing.

The Credit Survey results show the level of risk in the Agricultural loan portfolio has increased slightly during the past two years. Since the Credit Survey was implemented, the Agricultural loan portfolio generally had one of the highest percentages of “low” risk responses. During the past two years, there has been a slight but noticeable shift from “low” to “moderate” and “high” risk. Such a shift is to be expected as farm income has declined after several years of extraordinarily high levels. Although farm income has declined, farm debt levels remain manageable. That said, the level of risk within the Agricultural loan portfolio is dependent on how borrowers and bankers adjust to the lower levels of farm income. As a reminder, financial institutions are encouraged to work with borrowers experiencing financial difficulties. The FDIC will continue to closely monitor the agricultural economy and the quality and performance of the Agricultural loan portfolio.

Regulators are also keeping a close eye on other portfolios, including ADC and commercial real estate (CRE) in general, which experienced significant loan losses in the recent financial crisis. Out-of-area lending and concentrations also remain on the regulatory radar and are discussed later in this article.

Underwriting

Prudent loan risk selection remains vital to a bank’s financial health, and a bank’s first line of defense against booking excessive credit risk is the initial underwriting process. For the first half of 2015, about 9 percent of Credit Surveys reported “generally liberal” underwriting in one or more portfolios.5 This is a slight uptick from the 8 percent reported in the second half of 2014, but is still a lower incidence of “generally liberal” underwriting practices than reported in all other prior six-month periods. The portfolio most often cited as having “generally liberal” underwriting is the consumer portfolio (6 percent for the first half of 2015), with the C&I portfolio ranking second (6 percent), and the ADC portfolio ranking third (5 percent).

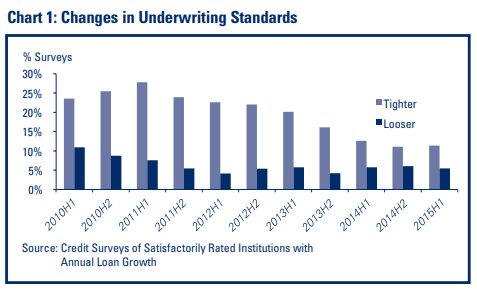

The Credit Surveys indicate that examiners are typically observing no material changes in underwriting. This has remained the case during the past five years (see Chart 1). When examiners have observed a material change in loan underwriting practices, they more often report tightening than easing, again a trend that has persisted during this period. Another consistent trend is that the proportion of banks where examiners have reported tighter standards has generally declined since 2011, leading to an increase in “no material change” observations. Whether tightening or relaxing, the preponderance of the material underwriting changes continues to be characterized by Credit Survey respondents as “moderate” versus “substantial.”

On an aggregate portfolio basis, changes in economic conditions and responses to regulatory observations and recommendations are generally the most common factors reported to be influencing changes in underwriting practices. Lesser, but still important, reported factors include competitive forces, changes in management, and growth goals.

The Credit Survey results described thus far have indicated that in broad terms, the banking industry continues to exhibit a lower risk profile than it did coming out of the financial crisis, and that examiners generally are describing the overall level of lending risks as moderate. However, as noted earlier, Credit Survey responses also indicate that risks related to selected portfolios or lending practices may be starting to increase. Some of these issues are described below.

About 10 percent of the applicable surveys for satisfactorily rated banks during the past 18 months reported those banks loosening at least one of the specified types of underwriting standards for C&I and permanent CRE loans. Reducing the spread between the loan rate and cost of funds is the most frequently reported area of loosening for this portfolio, followed by increasing the maximum maturity of loans.

As mentioned previously, ADC lending is on the rise, albeit from a lower base following a post-crisis retrenchment of this sector. Examiners noted higher-risk ADC lending activities in about 22 percent of applicable Credit Surveys for satisfactorily rated banks during the past 18 months. This remains elevated compared to other loan portfolio types. Speculative lending is the most frequently reported higher-risk activity. It is followed by repayment source themes: funding of ADC loans without consideration of repayment sources other than the sale of collateral and failing to verify the quality of alternative repayment sources.

The agricultural economy has been strong; however, real net farm income has been declining since the 2013 peak. The increases in the overall level of risk in agricultural loan portfolios noted earlier is probably more attributable to these economic developments rather than to weak lending practices, since for most banks the Credit Survey results do not show an increase in higher-risk agricultural lending practices. For some banks, however, riskier practices are being reported. One sign of a weaker agricultural economy is an increase in Credit Surveys reporting institutions that are extending or renewing unpaid production/operating loans structured to be paid in full at maturity and not secured by marketable collateral, e.g. carryover debt. Other agricultural lending practices reported to be on the rise at some banks, although less frequently reported than carryover debt, are making livestock loans without documenting livestock inspections and lending to borrowers who lack documented financial strength to support the loan.

Lending Products and Strategies

As the banking industry continues its rebound from the crisis and banks look to combat compressed net interest margins, banks are growing loans, sometimes by way of offering new products or expanding existing lending strategies. Credit Surveys reporting new or evolving products, activities, or strategies that could pose risks to the institution increased from about 10 percent between 2010 and 2011 to roughly 13 percent in 2014 and 2015. Examples of the most frequently cited new and emphasized lending products in the Credit Surveys include purchasing loans (including out-of-area, participations, and Shared National Credits); ADC and CRE lending; C&I lending; and Small Business Administration lending.

Along with the uptick in new and emphasized lending products, Credit Survey results show that examiners view the risks associated with loan growth as somewhat greater than in past Credit Surveys. Specifically, for the first half of 2015, 47 percent of Credit Surveys reported the risk associated with loan growth and/or changes in lending activities as “moderate” or “high.” This is up from 43 percent two years prior and from 45 percent one year ago.

A variety of reasons for “high” risk designations was observed. For satisfactorily rated institutions, many comments focused on the rate of growth, with CRE/ADC and residential real estate being the most frequently cited. Credit administration, merger/acquisition activity, and participation or brokered loans were also repeatedly cited as risk factors.

Out-of-Area Lending

Many banks, such as some in markets with sluggish loan demand, consider out-of-area lending as a way to grow loans. Over time, advances in technology and partnerships with third parties have made out-of-area loans more readily available to banks. As discussed in the Winter 2013 SIJ article, out-of-area lending grew dramatically in the years before the crisis, and those loans often were purchased whole or in participations underwritten by other financial institutions. Many failed banks had relatively large portfolios of out-of-area loans that deteriorated quickly, and the deterioration was exacerbated by weak due diligence at origination, lack of knowledge about the area where the loan was made, and reliance on a third party that poorly managed the credit. The Winter 2013 SIJ article also suggested that institutions were implementing lessons learned from the crisis as fewer banks were making out-of-area loans at that time.

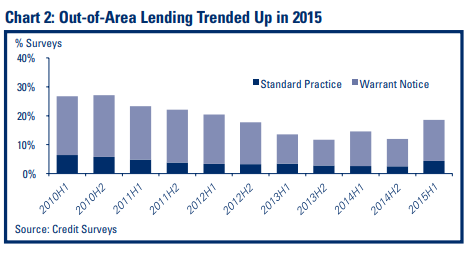

More recently, Credit Survey results show that trend may be reversing. Reports of out-of-area lending increased in the first half of 2015 (see Chart 2). About 19 percent of Credit Surveys for this period6 report out-of-area lending as a standard practice or a practice engaged in frequently enough to warrant notice. This is up from 15 percent for the first half of 2014 and from 14 percent for the first half of 2013. Although out-of-area lending is trending up, it has not reached the levels reported for 2009 to 2012.

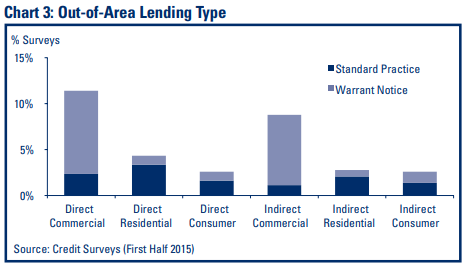

In January 2015, the Credit Survey question for out-of-area lending was revised, in part, to separate the lending categories into direct and indirect lending.7 Commercial lending (including CRE/ADC) is the loan portfolio most often associated with out-of-area lending, on both direct and indirect bases. In 13 percent of Credit Surveys for the first half of 2015, institutions were identified as being engaged in direct or indirect out-of-area lending for their commercial portfolios as a standard practice or frequently enough to warrant notice. The percentages reported for residential and consumer portfolios were much lower (see Chart 3). Depending on the portfolio type, approximately 26 to 29 percent of the institutions identified as engaged in out-of-area lending are reported to be engaged in both direct and indirect out-of-area lending.

In early November 2015, the FDIC issued FIL-49-2015 to update information contained in the FDIC Advisory on Effective Credit Risk Management Practices for Purchased Loan Participations (FIL-38-2012). The updated advisory addresses purchased loans and loan participations and reminds FDIC-supervised institutions of the importance of underwriting and administering purchased credits as if the loans were originated by the purchasing institution. The updated advisory also reminds institutions that third-party arrangements to facilitate loan and loan participation purchases should be managed by an effective third-party risk management process.

Concentrations

Loan growth has the potential to create or exacerbate concentrations of credit and/or funding. The FDIC recognizes that concentration risk is a reality for many institutions, and is often a reflection of local economies, borrowing needs, and market conditions. Concentrations are not inherently problematic, but the associated risks need to be well-managed. As discussed in the Winter 2013 SIJ article, ineffective risk management of growing concentrated portfolios has been a key contributor to asset problems in many banking crises. As such, the FDIC continues to closely track trends in concentrations.

About 55 percent of Credit Surveys for the first half of 2015 reported at least one credit and/or funding concentration. Moreover, many institutions that have concentrated loan portfolios are growing those portfolios. Based on June 30, 2015, Call Report data, about 49 percent of institutions with one or more loan portfolios that exceed 300 percent of total capital8 grew such a portfolio over 10 percent.9

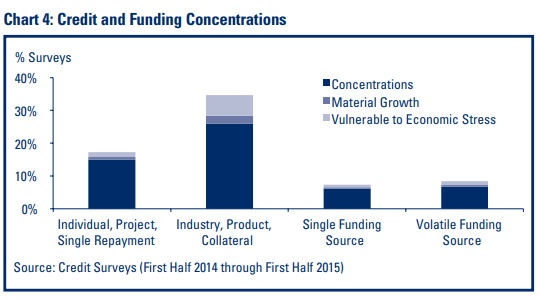

In the fourth quarter of 2013, the Credit Survey question for credit and funding concentrations was revised to provide more granular data on concentrations including, among other items, type. Chart 4 summarizes concentration types on a broad category basis as reported through the Credit Survey. More specifically, the most frequently cited credit concentrations in the Credit Survey results are CRE/ADC, individual borrower, agriculture, residential/multi-family real estate, hospitality, and out-of-area/participations. On the funding side, the most frequently cited concentrations are brokered deposits, borrowings/wholesale funds, large deposits, public funds, and internet/listing service deposits. As indicated in the Chart, survey responses characterized a subset of these concentrations as displaying material growth or vulnerability to economic stress.

Outlook and Viewpoint

The lending environment will continue to change. Banks are growing loan portfolios, and there may be early signs of emerging risk. In the current environment, banks are facing strong competition, earnings pressure, and increasing deposits. How well banks manage loan growth, concentrations, funding, and new products or services will be critical to their successful operation going forward. As banks revisit risk tolerances and market strategies to remain competitive, management should remember that prudent risk selection and careful monitoring of the lending portfolio are integral components of a well-managed institution. When assessing proposed and new products and activities, considerations should include matters such as whether the bank understands the risks associated with the market or product, whether pricing is appropriate for any increased risk, and whether the proper resources, including technology and staffing, are available.

The data obtained from the Credit Surveys are valuable to the supervisory process. The FDIC will continue to evaluate the Credit Survey data along with other sources of information to proactively identify and address the continued evolution of lending practices and risks at the banks we supervise.

Lisa A. Garcia

Senior Examination Specialist

Division of Risk Management Supervision

ligarcia@fdic.gov

Kenneth A. Weber

Senior Quantitative Risk Analyst

Division of Risk Management Supervision

kweber@fdic.gov

1 Financial data and banking statistics for this article obtained from Quarterly Banking Profile for second quarters 2015, 2014, and 2013.

2 Past SIJ articles summarizing Credit Survey results include: Jeffrey A. Forbes, Margaret M. Hanrahan, and Larry R. VonArb, “Lending Trends: Results from the FDIC’s Credit and Consumer Products/Services Survey,” Winter 2013; Jeffrey A. Forbes, Margaret M. Hanrahan, Andrea N. Plante, and Paul S. Vigil, “Results from the FDIC’s Credit and Consumer Products/Services Survey: Focus on Lending Trends,” Summer 2012; and Jeffrey A. Forbes, David P. Lafleur, Paul S. Vigil, and Kenneth A. Weber, “Insights from the FDIC’s Credit and Consumer Products/Services Survey,” Winter 2010.

3 These descriptors apply only to banks with lending portfolios representing more than two percent of total assets (“de minimis portfolio rule”).

4 See articles in the Summer 2012 and Winter 2013 issues referenced in footnote 2.

5 De minimis portfolio rule (see footnote 3).

6 Ibid.

7 Indirect lending includes purchased out-of-area participations and whole loans and all loans purchased from non-FDIC-insured entities regardless of the location.

8 For ADC lending, 100 percent of total capital is used.

9 For institutions with more than one portfolio exceeding the threshold, the highest growth rate is used.