Marketplace lending is a small but growing alternative to traditional financial services for consumers and small businesses. Attracted by opportunities for earnings growth, some banks have entered the marketplace lending business either as investors or through third-party arrangements. As with any new and emerging line of business, marketplace lending can present risks. Financial institutions can manage these risks through proper risk identification, appropriate risk management practices, and effective oversight.

Conversely, failure to understand and manage these risks may expose a financial institution to financial loss, regulatory action, and litigation, and may even compromise an institution’s ability to service new or existing customer relationships. Before participating in marketplace lending, financial institution management should identify potential vulnerabilities and implement an effective risk management strategy that protects the bank from undue risk.

This article is intended to heighten bankers’ and examiners’ understanding of marketplace lending and potential associated risks, including those arising in third-party arrangements. The article also highlights the importance of a pragmatic business strategy that considers the degree of risk together with the potential revenue stream, and emphasizes the importance of banks exercising the same due diligence they practice whenever they extend credit to a borrower.

Marketplace Lending Defined

For purposes of this article, marketplace lending is broadly defined to include any practice of pairing borrowers and lenders through the use of an online platform without a traditional bank intermediary. Although the model, originally started as a “peer-to-peer” concept for individuals to lend to one another, the market has evolved as more institutional investors have become interested in funding the activity. As such, the term “peer-to-peer lending” has become less descriptive of the business model and current references to the activity generally use the term “marketplace lending.”

Marketplace lending typically involves a prospective borrower submitting a loan application online where it is assessed, graded, and assigned an interest rate using the marketplace lending company’s proprietary credit scoring tool. Credit grades are assigned based on the marketplace lending company’s unique scoring algorithm, which often gives consideration to a borrower’s credit score, debt-to-income ratio, income, and other factors set by the marketplace lender. Once the application process is complete, the loan request is advertised for retail investors to review and pledge funds based on their investment criteria. A loan will fund from the monies collected if investors pledge sufficient capital before the deadline stated in the loan request (e.g. 14 days after the request is posted). As an alternative to funding loans through such retail investments, institutional investors can provide funding through whole loan purchases or direct securitizations.

When a borrower’s requested loan amount is fully pledged, the marketplace lending company originates and funds the loan through one of two frameworks: 1) the company lends the funds directly (subsequently referred to as a “ direct marketplace lender”) or 2) the company partners with a traditional bank to facilitate the loan transaction (subsequently referred to as a “bank-affiliated marketplace company”).

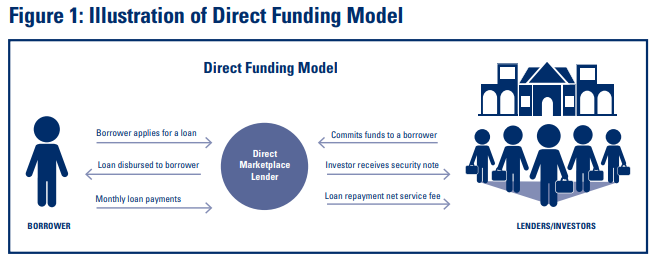

A direct marketplace lender typically is required to be registered and licensed to lend in the respective state(s) in which it conducts business. Direct marketplace lenders facilitate all elements of the transaction, including collecting borrower applications, assigning credit ratings, advertising the loan request, pairing borrowers with interested investors, originating the loan, and servicing any collected loan payments. As part of the transaction, direct marketplace lenders issue investors either registered or unregistered security notes (subsequently referred to as “security notes”) in exchange for the investments used to fund the loan. Consequently, the borrower’s repayment obligation remains with the direct marketplace lender, the security notes issued to investors become the obligation of the direct marketplace lender, and the investors are unsecured creditors of the direct marketplace lender. (See Figure 1 on the previous page for an illustration of this process.)

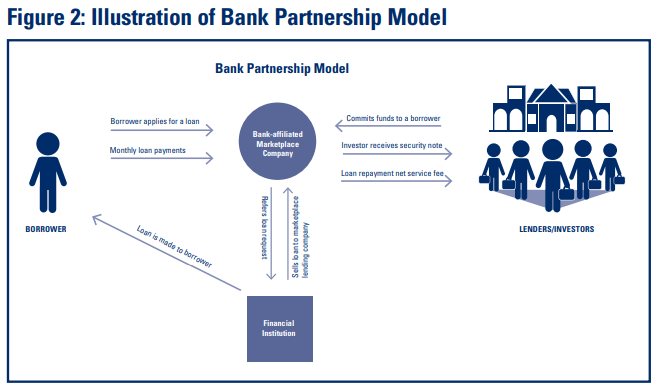

Some marketplace lending companies operate under the second framework by working through a cooperative arrangement with a partner bank. In these cases, the bank-affiliated marketplace company collects borrower applications, assigns the credit grade, and solicits investor interest. However, from that point the bank-affiliated marketplace company refers the completed loan application packages to the partner bank that makes the loan to the borrower. The partner bank typically holds the loan on its books for 2-3 days before selling it to the bank-affiliated marketplace company. Once the bank-affiliated marketplace company purchases the loan from the partner bank, it issues security notes up to the purchase amount to its retail investors who pledged to fund the loan. By the end of the sequence of transactions, the borrower’s repayment obligation transfers to the bank-affiliated marketplace company, and the security noteholder maintains an unsecured creditor status to the bank-affiliated marketplace company, which mirrors the outcomes described under the direct funding framework (see Figure 2 on the previous page). In certain circumstances, some institutional investors may invest in whole loan transactions, which are often arranged directly between the interested parties and outside any cooperative arrangement with a partner bank.

Once the process is complete, borrowers begin making fixed monthly payments to the bank-affiliated marketplace company which issues a pro rata payment to the investor, less loan servicing fees.

Common barriers to entry for banks and other traditional financial services entities include state licensure laws, capital requirements, access to financing, regulatory compliance, and security concerns. Some of these barriers may not exist for marketplace lending companies. New start-up marketplace lenders may be established quickly and often with a unique niche to capture a particular share of the market. In 2009, industry analysts with IBISWorld identified at least three marketplace lending companies; by 2014, the number had grown to 63 marketplace lending companies.1 As of September 2015, the number of established marketplace lending companies totaled 163 with new entrants continuing to join the competitive market.2

Concomitant with the increasing number of market participants, new or expanded product lines are introduced as companies attempt to establish a niche position in the market. Some examples of marketplace loan products include unsecured consumer loans, debt consolidation loans, auto loans, purchase financing, education financing, real estate lending, merchant cash advance, medical patient financing, and small business loans.

The Importance of Effective Risk Identification

The marketplace lending business model depends largely on the willingness of investors to take on the credit risk of an unsecured consumer, small business owner, or other borrower. Given the market’s infancy and that it has primarily existed in an environment of low and steady interest rates, current credit loss reports or loss-adjusted rates of return may not provide an accurate picture of the risks associated with each marketplace lending product.

Further, each marketplace lending company’s risk level and composition varies depending on the business model or credit offering, with potentially significant variations across credit products. Given the credit model variations that exist, using a nonspecific approach to risk identification could lead to an incomplete risk analysis in the bank’s marketplace investments or critical gaps in bank management’s planning and oversight of third-party arrangements. As such, banks should perform a thorough pre-analysis and risk assessment on each marketplace lending company with which it transacts business, whether acting as an institutional investor or as a strategic partner.3

A comprehensive list of risks associated with marketplace lending is not possible without an understanding of the arranged lending activity and the products offered. Although not a complete list, some risks include third-party, credit, compliance, liquidity, transaction, servicing, and bankruptcy risks. Before engaging in marketplace activity, banks should complete appropriate due diligence and ensure effective risk identification practices are in place as part of the risk assessment process.

Third-party risk can vary greatly depending on each third-party arrangement, elevating the importance for banks to conduct effective due diligence. Banks are encouraged to review the FDIC’s Financial Institution Letter 44-2008 titled Guidance for Managing Third-Party Risk,4 which discusses the critical elements to an effective third-party risk management process: (1) risk assessment, (2) due diligence in selecting a third party, (3) contract structuring and review, and (4) oversight.

Before engaging in any third-party arrangement, a financial institution should consider whether the proposed activities are consistent with the institution’s overall business strategy and risk tolerances. Bank management is encouraged to develop a strong understanding of the marketplace lending company’s business model, establish contractual agreements that protect the bank from risk, regularly monitor the marketplace service provider, and require the marketplace lending company to take corrective action when gaps or deficiencies occur. This due diligence may result in banks requiring policies and procedures from the marketplace lending company with respect to legal and regulatory compliance prior to the bank’s investment or before any services are offered.

Some considerations include, but are not limited to, compliance with applicable federal laws such as lending laws, consumer protection requirements, anti-money laundering rules, and fair credit responsibilities along with adherence to any applicable state laws, licensing, or required registrations. As with any third-party arrangement, banks should monitor marketplace activities and expect marketplace servicers to undergo independent audits and take corrective action on audit exceptions as warranted. Failure to do so could expose a bank to substantial financial loss and an unacceptable level of risk.

For banks contemplating a funding relationship with a marketplace lending company, management should consider several issues that could affect the bank’s risk profile. (See Due Diligence sidebar.) Banks also should consider validating the marketplace lending company’s compliance with any applicable state or federal laws. Negotiated contracts should consider provisions allowing the financial institution the ability to control and monitor third-party activities (e.g., underwriting guidelines, outside audits) and discontinue relationships if contractual obligations are not met.

Compliance risk is inherent in any marketplace lending activity. Banks are accountable for complying with all relevant consumer protection and fair lending laws and regulatory requirements and cannot assign this responsibility to a marketplace lending company. Although marketplace lending companies are required to comply with many of these requirements, well-run bank programs should include appropriate due diligence and ongoing monitoring to validate that the marketplace lending company demonstrates adherence to these requirements. Relevant laws may include the Truth in Lending Act5 (TILA) that, among other things, requires the disclosure of standardized loan terms and conditions at point of sale and in advertisements, and Section 5 of the Federal Trade Commission Act,6 which prohibits unfair and deceptive acts or practices.

Consistent with the third-party risk guidance,7 banks also should evaluate whether a bank-affiliated marketplace lending company complies with fair lending and other related laws including the Equal Credit Opportunity Act8 (ECOA), which prohibits lenders from taking action related to any aspect of a credit transaction on the basis of race, color, religion, and other prohibited factors. Banks that partner with marketplace lending companies should exercise due diligence to ensure the marketplace loan underwriting and pricing policies and procedures are consistent with fair lending requirements.

Transaction risk is present given the potential for customer service problems or a marketplace lending company’s failure to fulfill its duties as expected by the financial institution or its customers. Marketplace loans may be subject to high levels of transaction risk given the large volume of loans, handling of documents, and movement of loan funds between institutions or third-party originators. Banks should anticipate risks that could arise from problems with customer service, product delivery, technology failures, inadequate business continuity, and data security breaches.

Servicing risk exists given the pass-through nature of marketplace notes. The investor becomes a creditor to the marketplace lending company and has no access to the borrower. Therefore, if a marketplace lending company that services the loans becomes insolvent, investors may become exposed not only to bankruptcy risk but also servicing risk if the loan servicing process is disrupted. In bankruptcy, a marketplace lending company may be unable to fulfill its note servicing obligations to investors even if the borrowers continue to make timely payments.

Notwithstanding the fact that the loans in which they invested are fully performing, investors also may be exposed to losses if other creditors seek rights to these borrower payments in the bankruptcy proceeding. In the event a marketplace lending company becomes insolvent, investors line up in bankruptcy court to collect on monies owed on a pro rata basis, with no investor having any superior claim to a stream of payment than any other, and often times with interest halted once the bankruptcy proceedings commence.

At a minimum, banks that invest in marketplace loans should determine whether back-up servicing agreements are in place with an unaffiliated company before investment. Banks, as investors, committing significant capital to marketplace loans should assess the marketplace lending company’s creditworthiness with consideration given to the business’s solvency prior to investing the capital. Although this condition may not afford complete protection, it may mitigate some risk of loss.

Liquidity risk is present given the limited secondary market opportunities available for marketplace loans. Although there are a few known aftermarket providers, the secondary market for marketplace loans generally is limited with resale opportunities available only to a select few marketplace lending companies. Partner banks with loans in their marketplace pipeline may also experience liquidity risk for those pipeline loans that require funding.

Other considerations include compliance with other state and federal requirements, including anti-money laundering laws. The partner bank should evaluate the bank-affiliated marketplace company as it would any other customer or activity, and financial institutions investing in marketplace loans should exercise due diligence in evaluating appropriate compliance for any loan purchase.

A Supervisory Perspective

Before engaging in any marketplace lending third-party arrangement or balance sheet investment, a financial institution should ensure the proposed activities are consistent with the institution’s overall business strategy and risk tolerances. FDIC examiners assess how financial institutions manage third-party relationships and other investments with marketplace lenders through review of bank management’s record of and process for assessing, measuring, monitoring, and controlling the associated relationship and credit risks. The depth of the examination review depends on the scope of the activity and the degree of risk associated with the activity and the relationship. The FDIC considers the results of the review in its overall evaluation of management, including management’s ability to effectively control risk.

FDIC examiners address findings and recommendations relating to an institution’s third-party marketplace lender relationships and marketplace loan investments in the Report of Examination and within the ongoing supervisory process. Appropriate corrective actions, including formal or informal enforcement actions, may be pursued for deficiencies identified that pose significant safety and soundness concerns or result in violations of applicable federal or state laws or regulations.

Conclusion

Some banks are finding participation in the small but growing arena of marketplace lending to be an attractive source of revenue. With the market’s infancy and its lack of performance history through a complete economic cycle, bank management should look beyond the revenue stream and determine whether the related risks align with the institution’s business strategy. As noted earlier, financial institutions can manage the risks through proper risk identification, appropriate risk management practices, and effective oversight. With the rapidly evolving landscape in marketplace lending, institutions should ascertain the degree of risk involved, remembering they cannot abrogate responsibility for complying with applicable rules and regulations.

Angela M. Herrboldt

Senior Examination Specialist

Division of Risk Management Supervision

aherrboldt@fdic.gov

1 Omar Khedr, “Front money: Revenue will rise, but regulations threaten industry profitability,” IBISWorld Industry Report OD4736 Peer-to-Peer Lending Platforms in the US, December 2014. (A subscription to IBISWorld is needed to view this report.) http://clients1.ibisworld.com/reports/us/specializedreportsarchive/default.aspx?entid=4736.

2 Omar Khedr, “Street credit: New industry’s explosive growth may meet regulatory hurdles,” IBISWorld Industry Report OD4736 Peer-to-Peer Lending Platforms in the US, September 2015. (A subscription to IBISWorld is needed to view this report.) http://clients1.ibisworld.com/reports/us/industry/default.aspx?entid=4736.

3 See FIL-49-2015 “Advisory on Effective Risk Management Practices for Purchased Loans and Purchased Loan Participations”, November 6, 2015 at https://www.fdic.gov/news/news/financial/2015/fil15049.html.

4 See FIL-44-2008“Guidance for Managing Third-Party Risk,” June 6, 2008 at https://www.fdic.gov/news/news/financial/2008/fil08044.html.

5 See the Truth in Lending Act at https://www.fdic.gov/regulations/laws/rules/6500-3200.html#fdic65001026.1.

6 See Section 5 of the Federal Trade Commission Act at https://www.fdic.gov/regulations/laws/rules/8000-3000.html.

7 Ibid.

8 See the Equal Credit Opportunity Act at https://www.fdic.gov/regulations/laws/rules/6500-200.html.