On July 9, 2013, the FDIC Board of Directors approved the Basel III interim final rule (new capital rule or rule). The new capital rule, which takes effect for community banks in January 2015, is intended to strengthen the quality and increase the required level of regulatory capital in order to promote a more stable and resilient banking system.1 This article is part of the FDIC’s effort to provide technical assistance to community banks on the new capital rule. It focuses on a specific aspect of the rule that changes the treatment for certain capital investments that community banks may hold: the deductions from regulatory capital for investments in the capital instruments of unconsolidated financial institutions.

Background on Basel III

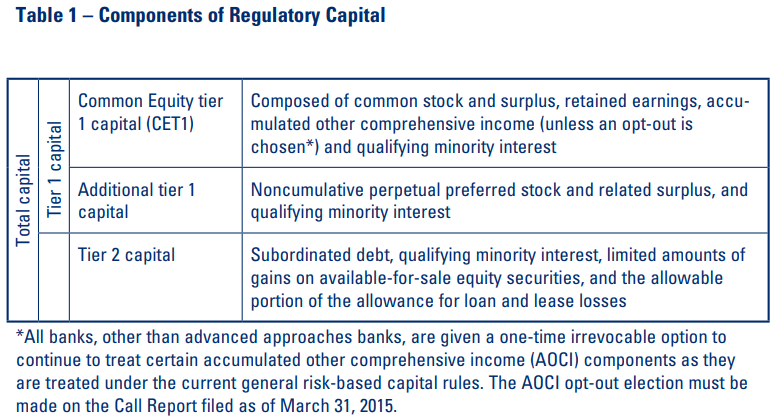

An important goal of the new capital rule is to strengthen the definition of regulatory capital to ensure it consists of elements that can absorb loss. Beginning with the Call Report dated March 31, 2015, community banks will report a new regulatory capital measure, common equity tier 1 (CET1), which is limited to capital elements of the highest quality. Some banks may have other capital elements such as noncumulative perpetual preferred stock; these, if any, may be recognized as “additional tier 1 capital,” which when added to CET1 equals tier 1 capital. Finally, a bank’s total regulatory capital may also include certain tier 2 elements (see Table 1).

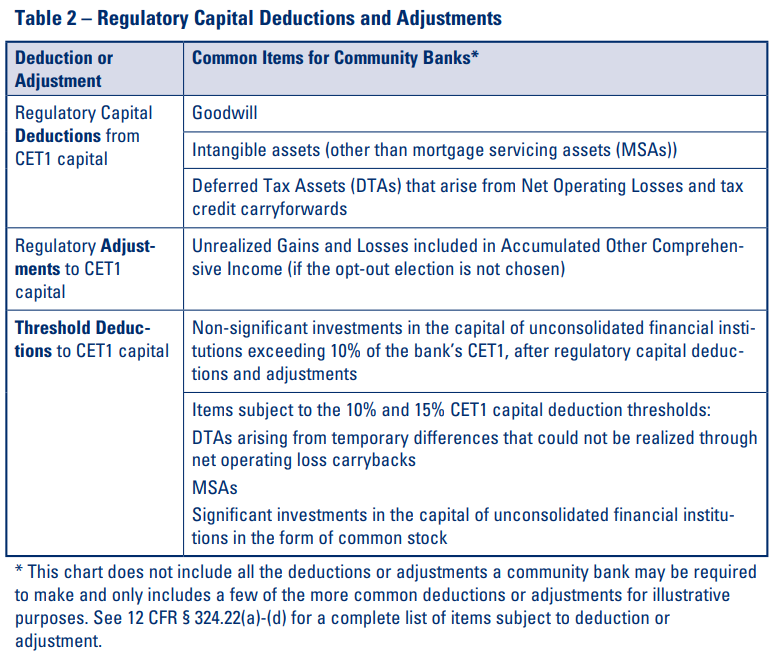

The new rule includes a series of adjustments and deductions to arrive at the final value of reported CET1 used to meet the regulatory capital requirements (see Table 2). Some adjustments and deductions are straightforward and longstanding, such as the deduction of goodwill. Others are conceptually straightforward but new. For example, certain types of deferred tax assets are automatically deducted, and all intangible assets are deducted except a limited amount of mortgage servicing assets. In addition, there are threshold deductions, which are new and not quite as straightforward. The remainder of this article will describe the threshold deductions and work through an extended example to demonstrate the deduction calculations.

The Call Report instructions will also be available to walk banks step by step through these calculations. It is expected that the once a bank has identified its investments that are subject to the threshold deductions (if any), the calculation of those deductions and applicable transitions will be performed within Call Report software. It should also be noted that the examples in this article involve relatively large capital deductions and a relatively large proportion of additional tier 1 capital within the example bank’s tier 1 capital. The amounts in the examples are to help explain the calculations and are not viewed as representative of typical banks.

Reasons for these Threshold Deductions

First and foremost, the purpose of the threshold deductions for investments in financial institutions is to limit the double counting of capital in the financial system. When banks invest in capital instruments of other financial institutions, problems at one institution can directly affect the financial health of other banks investing in its capital instruments. A good example is the losses some banks experienced on their investments in collateralized debt obligations (CDOs) of trust preferred securities of other banking organizations. This type of interdependence among banks can exacerbate a financial crisis.

A. What is the starting point for the threshold deductions?

If a bank has investments in the capital instruments of a financial institution, then these investments may be subject to the threshold deductions. The threshold deductions are made to CET1 after regulatory capital deductions and regulatory adjustments (see the first two panels of Table 2).

B. What is the definition of a financial institution?

If certain investments in financial institutions are to be deducted, the first question must be, for what types of financial institutions? The answer is in the definition of financial institution in the Basel III regulation, which determines whether any of a bank’s capital investments may be subject to the threshold deductions. In brief, “financial institutions” include banks (including bankers’ banks), bank holding companies, savings and loan holding companies, and other institutions cited in the definition. For purposes of the threshold deductions, financial institutions do not include government-sponsored enterprises (for example, Federal Home Loan Banks), small business investment companies, community development financial institutions, mutual funds, and employee benefit plans.

The definition also includes a predominantly engaged test as a catch-all for types of financial institutions not expressly listed. Investments in the capital instruments of such companies would also be subject to the threshold deduction. If a community bank owns more than 10 percent of a potential unconsolidated financial institution’s common stock, the bank would have to apply this test.

C. What is the amount of my investment?

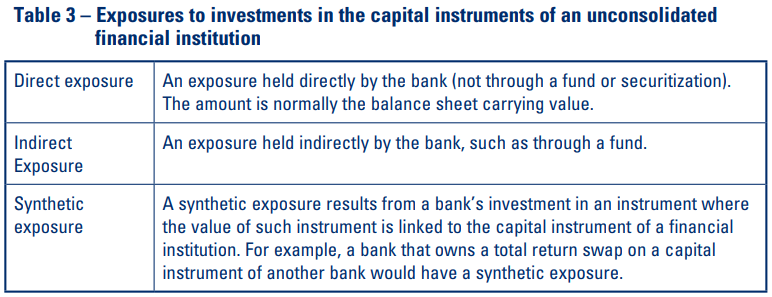

Once a bank determines it has an investment in the capital instrument of an unconsolidated financial institution, it must determine the amount of the investment. A bank may have such an investment through either a direct, indirect, or synthetic exposure (see Table 3).

D. Is my investment significant or non-significant?

The bank needs to determine whether its investment is significant or non-significant as this directly affects the calculation of the deduction:

- A significant investment in the capital of an unconsolidated financial institution refers to all investments in the capital instruments of an unconsolidated financial institution where the bank owns more than 10 percent of the common stock of the unconsolidated financial institution. Note that when a bank determines it has a significant investment in the capital instruments of an unconsolidated financial institution, the bank’s other investments in the capital instruments of that financial institution are also considered significant. For example, any qualifying subordinated debt or noncumulative perpetual preferred stock owned by the bank also would be considered a significant investment.

- A non-significant investment in the capital of an unconsolidated financial institution refers to all investments in the capital instruments of an unconsolidated financial institution where the bank owns 10 percent or less of the common stock of the unconsolidated financial institution (including situations in which the bank owns no common stock). For example, if a bank only owns noncumulative perpetual preferred stock in an unconsolidated financial institution, its investment is non-significant regardless of the amount of preferred stock owned.

Banks must evaluate investments in the capital instruments of each unconsolidated financial institution to which they are exposed to determine whether the exposure is significant or non-significant. Once this analysis is completed, the resulting significant and non-significant investments are aggregated into two separate buckets for purposes of the threshold deductions (i.e., the separate threshold deductions for significant and non-significant investments are computed based upon the aggregate exposure, not an individual exposure). The calculation of the threshold deductions differs for significant and non-significant investments and is described in greater detail in the next two sections of the article.

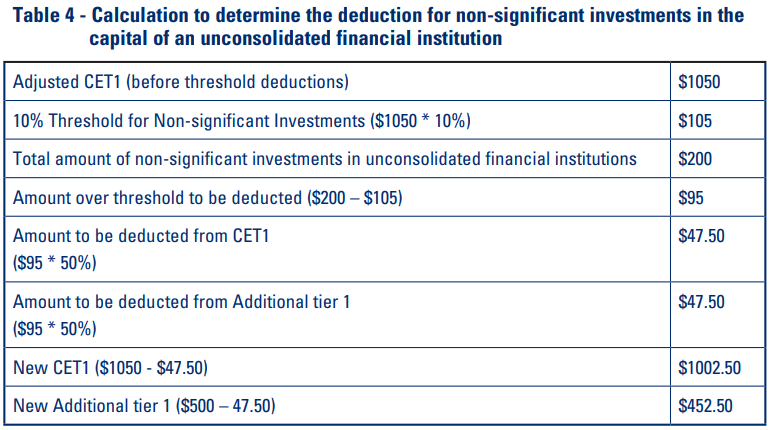

E. The threshold deduction requirements for non-significant investments in unconsolidated financial institutions

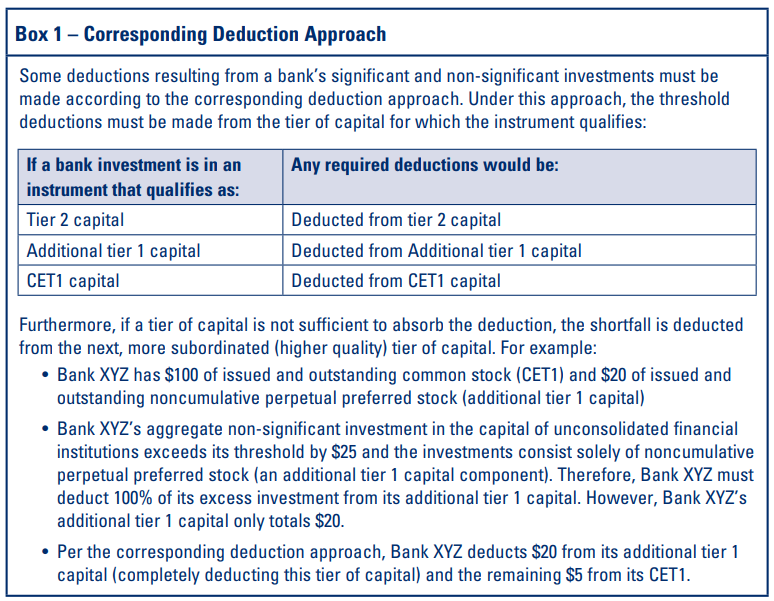

The threshold deduction requirements for non-significant investments in unconsolidated financial institutions are described in § 324.22(c)(4) of the new capital rule. First, the bank aggregates all of its non-significant investments in the capital of unconsolidated financial institutions. Second, the bank must determine its 10 percent threshold amount. The threshold is 10 percent of the bank’s adjusted CETI capital (conceptually, the adjusted CET1 is computed by completing Table 1 and adjusting according to the first two panels of Table 2). Any aggregate amount of non-significant investments above this threshold is deducted according to the corresponding deduction approach (see Box 1).

Amounts below the threshold are not deducted and are risk weighted in accordance with the new standardized approach (see Part 324 Subpart D of the new capital rule). For example:

- Bank A has adjusted CET1 of $1,050 and a total of $500 in noncumulative perpetual stock issued and outstanding.

- Bank A’s threshold for non-significant investments in the capital of unconsolidated financial institutions is 10% of its adjusted CET1, or $105.

- Bank A has a total of $200 in nonsignificant investments in the capital of unconsolidated financial institutions consisting of $100 in common stock and $100 in noncumulative perpetual preferred stocks.

- Therefore, Bank A must deduct $95 of its aggregate non-significant investment in the capital of unconsolidated financial institutions. This is reflected in line 4 of Table 4.

- Now the bank must follow the corresponding deduction approach to determine how to deduct its excess non-significant investment in unconsolidated financial institutions. Since Bank A’s investments included $100 in common stock (a CET1 capital component) and $100 in noncumulative perpetual preferred stock (an additional tier 1 capital component), 50% of the excess nonsignificant investment in the capital of unconsolidated financial institutions is deducted from CET1 and 50% is deducted from additional tier 1 capital. This is reflected in lines 5 and 6 of Table 4.

- If Bank A did not have any qualifying additional tier 1 capital instruments on its books, it would have deducted the entire excess nonsignificant investment in the capital of unconsolidated financial institutions from its CET1 (refer to Box 1).

F. The threshold deduction requirements for significant investments in the form of common stock

The deduction for significant investments in common stock of an unconsolidated financial institution is governed by the 10 percent and 15 percent CET1 threshold deductions. These threshold deductions are applied individually and collectively to the following three categories:

- Significant investments in common stock of unconsolidated financial institutions;

- Mortgage servicing assets; and

- Deferred tax assets that arise from temporary timing differences not subject to carryback.

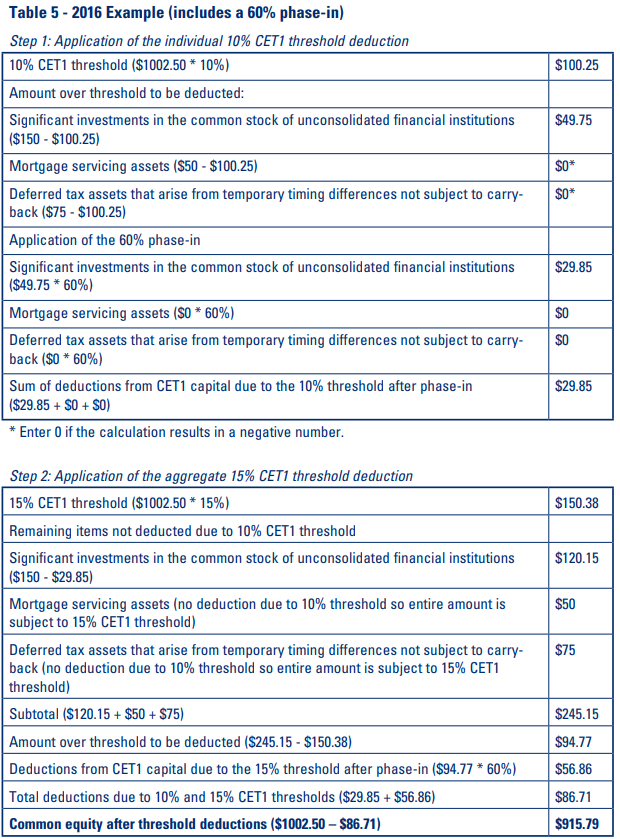

The 10% and 15% thresholds are applied to CET1 capital after making deductions for non-significant investments in the capital of an unconsolidated institution. These threshold deductions are calculated in two phases. First, the 10 percent threshold deduction is applied on an individual category basis – any amount of the three categories greater than the 10 percent threshold is deducted from CET1 capital. Second, the remaining amount attributed to the three categories is limited, in aggregate, to 15 percent of CET1 capital. Any amount above this threshold is also deducted from CET1 capital. The amounts not deducted in these three categories are risk weighted at 250 percent. Note that due to the transition periods, the calculation of the deduction changes slightly before and after 2018. See Table 5 (page 34) for an example:

- Continuing from the previous example, Bank A has CET1 capital of $1002.50 after adjustments,

- deductions and the threshold deduction for non-significant investments in the capital of an unconsolidated financial institution.

- Bank A has the following amounts in items subject to the 10 percent and 15 percent CET1 threshold deductions:

- $150 in significant investments in the common stock of unconsolidated financial institutions

- $50 in mortgage servicing assets

- $75 in deferred tax assets that arise from temporary timing differences not subject to carry-back

As noted previously, the 10 percent and 15 percent CET1 threshold deductions occur in two parts. The individual 10 percent threshold is applied first and the aggregate 15 percent threshold is applied second. The new capital rule includes a transition period for the threshold deductions to allow banks time to manage the impact to their regulatory capital position. To make the example more useful and demonstrate the impact of the transition periods, the threshold deductions are calculated below assuming two different time periods.

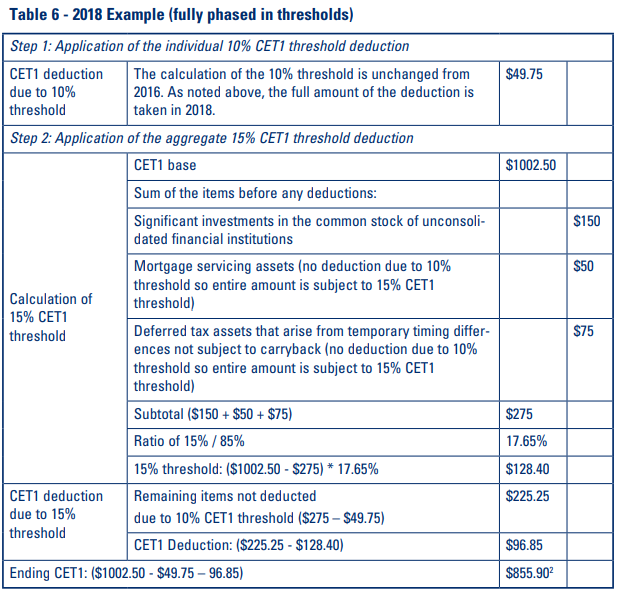

As demonstrated in the prior example, the transition period provided in the new capital rule mitigates the impact of the threshold deductions. See below for the impact to the threshold deductions once fully phased in (as of 2018):

Application of the 10 percent threshold: The calculation of the 10 percent threshold is consistent during and after the transition period. Once the threshold deductions are fully phased in, the amount to be deducted is no longer adjusted; therefore, in this example, the amount to be deducted due to the 10 percent threshold is $49.75.

Application of the 15 percent threshold: The calculation of the 15 percent threshold changes slightly once the deductions are fully phased in. The new capital rule requires that the aggregate sum of these items that are not deducted cannot exceed 15 percent of the CET1 capital of a bank. To effect this requirement, the 15 percent threshold is calculated as CET1 minus the sum of the three items before any deductions, with the result multiplied by 17.65 percent. Multiplying by 17.65 percent ensures that the ending amount of the items subject to deduction do not exceed 15 percent of ending CET1. See Table 6 below for an example:2

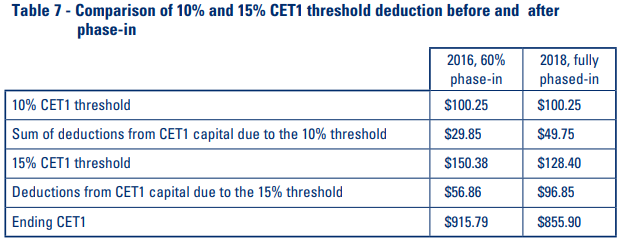

See Table 7 for a comparison of the deductions under these two time periods:

G. Significant investments in the capital of unconsolidated financial institutions that are not in the form of common stock

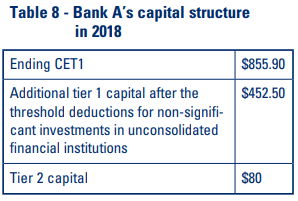

As discussed previously, if a bank determines it has a significant investment in the capital instruments of an unconsolidated financial institution (i.e., the bank owns 10 percent or more of the financial institution’s common stock), all other investments in the capital instruments of that unconsolidated financial institution are considered significant. These investments are fully deducted using the corresponding deduction approach; see Table 8, continuing from our previous example:

Suppose that in addition to the $150 in significant investments in the common stock of unconsolidated financial institutions, Bank A also has exposure of $100 in qualifying subordinated debt (tier 2 capital) to these same unconsolidated financial institutions. The $100 in subordinated debt would also be considered a significant investment as these are the capital instruments of unconsolidated financial institutions in which Bank A owns 10 percent or more of the financial institution’s common stock. Bank A would therefore deduct its entire exposure to the subordinated debt per the corresponding deduction approach:

- Bank A’s tier 2 capital, after deduction: $0, calculated as $80 $100

- Bank A’s additional tier 1 capital, after deduction: $432.50, calculated as $452.50 $20 (as Bank A’s tier 2 capital has been completely deducted, the remaining $20 is deducted from additional tier 1 capital)

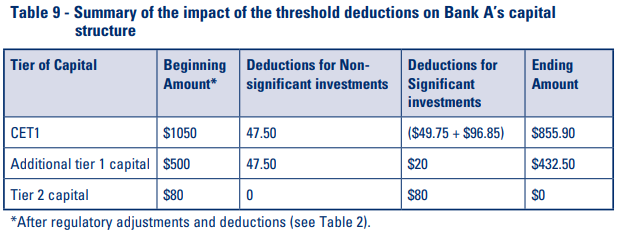

H. Summary of the impact of the threshold deductions on Bank A’s capital structure

Table 9 shows the impact on Bank A’s capital structure due to the threshold deductions (assuming the threshold deductions are made in the year 2018).

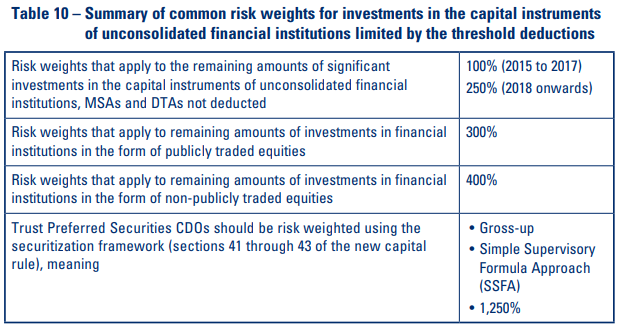

I. A bank will need to risk weight remaining amounts of capital instruments that are not deducted

The remaining amount of an item after making all required deductions is then risk weighted. Below is a summary of the risk weights to be applied to the items limited by the deductions described in this article (see Table 10):

Capital relief for a limited amount of non-significant equity exposures

The new capital rule applies significantly higher risk weights to equity exposures in general. To provide some relief from these higher risk weights, the new capital rule includes a 10 percent non-significant equity exposure threshold, which is separate and distinct from the previously described thresholds. This 10 percent threshold is calculated as 10 percent of the institution’s total capital. Certain equities that fall within this threshold can be risk weighted at 100 percent; however, this 10 percent bucket must be filled in the following order:

- Equity exposures to unconsolidated small business investment companies described in Section 302 of the Small Business Investment Act

- Publicly traded equity exposures (including those held indirectly through investment funds)

- Non-publicly traded equity exposures (including those held indirectly through investment funds)

Once this 10 percent bucket is filled, the other risk weights shown above would apply.

J. Transition Rules

Although the new capital rule takes effect January 1, 2015, for community banks, various aspects of the rule, such as the deductions for capital instruments in unconsolidated financial institutions, have a phase-in period, as illustrated above. Banks should consult the Transitions section of the new capital rule (§ 324.300) for full details.

K. Resources available to help guide the bank through these deduction requirements

Resources are available to guide banks through the deduction requirements, including the deductions related to investments in the capital instruments of unconsolidated financial institutions. For example, the preamble of the new capital rule includes a flow chart and the proposed call report instructions available on the Federal Financial Institutions Examination Council’s (FFIEC) Web site helps banks navigate the deduction requirements and the calculation of each tier of capital, including the transition arrangements. The FDIC Regulatory Capital website (http://www.fdic.gov/regulations/capital/index.html) includes presentations describing key aspects of the new capital rule, the Interagency Community Bank Guide, the Expanded Community Bank Guide for FDIC-supervised banks and a listing of contacts who can help to answer questions. Through these resources and outreach efforts such as this article, the goal is that banks will be able to understand this admittedly complex aspect of the new capital rule.

Benedetto Bosco

Capital Markets Policy Analyst

Division of Risk Management Supervision

bbosco@fdic.gov

The author acknowledges the valuable contributions made by several reviewers of this article with special thanks to David W. Riley, Senior Policy Analyst; and James S. Haas, Financial Analyst.

1 The rule, which is substantively identical to the rule issued by the Federal Reserve and the Office of the Comptroller of the Currency, is described in FIL-31-2013. Additional resources are available at http://www.fdic.gov/regulations/capital/index.html.

2 In this example, the amount of the items not deducted as a result of the 10% and 15% thresholds is $128.40, calculated as ($150 + $50 + 75) – ($49.75 + $96.85). Using 17.65% to calculate the 15% threshold, ensures that the amounts not deducted do not comprise more than 15% of ending CET1. ($128.40 / $855.90 = 15%).