Effective collateral valuation policies and practices are critical to the success of any real estate lending program. A prudent valuation process can help an institution fully understand its real estate collateral position and minimize losses when the collateral becomes the primary repayment source. To clarify supervisory expectations for prudent real estate appraisals and evaluations, the federal financial institution regulatory agencies1 issued the Interagency Appraisal and Evaluation Guidelines (Guidelines)2 on December 2, 2010. Banks have implemented the various provisions of the Guidelines to strengthen their overall real estate valuation program, but continue to seek feedback from their regulators about several issues discussed in this article.

The purpose of this article is to highlight certain aspects of the Guidelines and discuss sound practices for banks’ real estate valuation processes. The tenets described herein are based on existing regulatory guidance and the authors’ collective observations from field examinations and dialogue with financial institutions. The article describes appraisal-related regulatory expectations dealing specifically with valuation review, reviewer independence, content standards, preparer selection, and monitoring. The use of evaluations and third party arrangements are also discussed, as well as recent independence and fee standards resulting from the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).3

Reviewing Appraisals/Evaluations

A review of valuation information is an essential component of sound credit administration and is mandated by the Dodd-Frank Act.4 Reviewing appraisals and evaluations before engaging in a loan transaction ensures the value conclusion is reliable and enables financial institutions to make informed credit decisions, manage credit risk, and meet supervisory requirements.

The following practices can help banks employ a more effective valuation review process:

- Valuation reviewer experience. Establishing reviewer qualification criteria helps ensure internal and external (if outsourced) reviewers have the requisite education, experience, and competence to perform the level of review appropriate for the type, risk, and complexity of the transaction. It also ensures that the appraisal/evaluation contains sufficient information and analysis to support the decision to engage in the transaction. In addition, having a qualified reviewer conduct a risk-based, secondary review of a sample of each reviewer’s work products can help achieve consistency in the review process, monitor the effectiveness of the reviewers, and address any weaknesses in a timely manner.

Reviewer independence. To ensure independence in the valuation review process, banks should assess whether the reviewer is independent of loan production staff by:

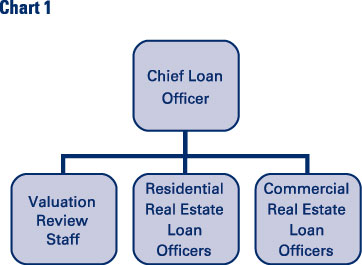

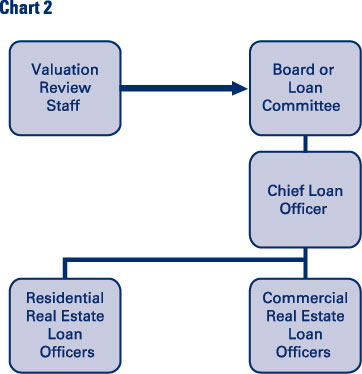

- Analyzing the institution’s organization reporting lines. Chart 1 depicts a credit organization that is not sufficiently independent, as the valuation review staff reports directly to an individual who approves real estate loans. Chart 2 shows how reviewer independence could be optimized at the organization.

- Observing the reporting lines, document flows, and decision points between the valuation reviewer and his or her supervisor.

- Examining the institution’s loan approval or voting process.

- Discussing the issue of independence internally with executive management and the credit review staff, and possibly with regulators that are familiar with the institution’s real estate lending program.

- Ensuring the valuation reviewer is independent when the institution outsources the review function. In such situations, the selected reviewer should not be in the competitive pool of appraisers who bid for the valuation assignment under review.

- Depth of review. The scope of a review is usually a function of the property’s complexity and the institution’s perceived risk threshold.5 Therefore, the review’s depth should be sufficient to ensure that methods, assumptions, data sources, and conclusions are reasonable and appropriate. A risk-focused review approach can assist in:

- Identifying valuations that are not adequately supported. Institutions should establish policies and procedures for resolving any appraisal or evaluation weaknesses identified through the review process before engaging in a credit transaction, as outlined in the Guidelines.6

- Ensuring the review provides meaningful results. A review’s depth and technical nature should be commensurate with the size, type, risk, and complexity of the underlying credit transaction. Factual or checklist-type reviews may be sufficient for low-risk transactions to verify report content, policy compliance, and conformance with the USPAP. However, reviews of complex or higher-risk properties may need to be supplemented with an explanatory narrative or other data to ensure critical assumptions and conclusions are supported. Generally, complex or higher-risk transactions should receive a more comprehensive review that assesses the technical quality of the appraiser’s analysis.

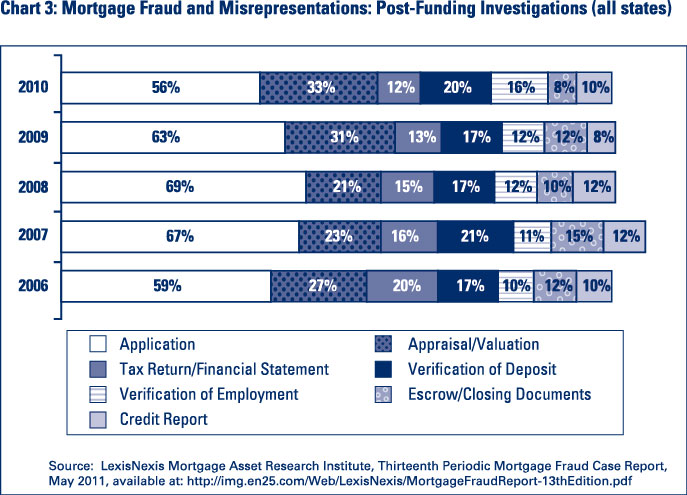

- Detecting potential fraud and following-up as appropriate. As Chart 3 illustrates, a recent study found that approximately one-third of all mortgage fraud cases in 2010 involved appraisal/valuation fraud. According to the Guidelines, institutions should file a Suspicious Activity Report (SAR) with the Financial Crimes Enforcement Network when fraud is suspected or other transactions are identified as meeting the SAR filing criteria.7 Moreover, a proactive review program should include procedures for submitting referrals or complaints to the appropriate state authorities when warranted. The Guidelines state an institution should consider filing a complaint with the appropriate state appraisal regulatory body when the institution suspects that a state-certified or state-licensed appraiser failed to comply with the USPAP, state laws, or engaged in unethical or unprofessional conduct.8

Valuation Standards

The USPAP requires appraisers to use appropriate valuation methods and techniques in the development and reporting of appraisals.9 Accordingly, appraisals should include information required by USPAP relative to the research, methodology, and analysis in the valuation. Banks should ensure that appraisal reports meet USPAP requirements and include an analysis of the project’s market, marketability and its highest and best use.10 Lenders’ valuation policies and engagement letters should instruct appraisers to conduct appropriate research and analysis on market supply and demand characteristics. Fees for such services should provide for an appraisal’s development commensurate with the risk associated with the type of real estate and the loan transaction.

A property with a highest and best use conclusion such as “hold for future development” or “hold as investment” may indicate potentially higher risk for a development project, as these are prospective investment strategies versus a highest and best use analysis based on actual current market conditions as of the effective date of the appraisal. In cases of a prospective highest and best use analysis, lenders should require appraisers to perform an appropriate depth of analysis, including a discussion of their conclusions about a potential purchaser’s profile (e.g., investor, merchant builder, or end user) and a reasonable, market-supported absorption period.

Selection and Monitoring of Appraisers

Selecting competent appraisers is critical to obtaining reliable collateral valuation information. Best practices for selecting and monitoring appraisers include:

- Verifying an appraiser’s credentials and standing through the National Registry at https://www.asc.gov/appraiser. The Appraisal Subcommittee (ASC) of the Federal Financial Institutions Examination Council maintains the National Registry of state-licensed and -certified appraisers. The National Registry lists the state(s) in which an appraiser is licensed, the license number and type (e.g., Certified Residential or Certified General), whether the license status is active or inactive, whether the license holder meets the qualification criteria (education, experience, and examination) of the Appraiser Qualifications Board, and whether the licensee is subject to active disciplinary actions. The ASC Web site includes a link to all state appraisal regulatory agencies, which can provide more information regarding appraiser disciplinary actions and other matters.11

- Using the findings from the appraisal review process to evaluate an appraiser’s performance. The appraisal review process can assist in the evaluation of individual appraisers’ performance and report accuracy. Some banks have found that tracking deficiencies in each reviewer’s valuation reports can be a useful way to strengthen the performance of the bank’s real estate valuation function.

- Conducting random quality reviews of appraisals obtained through appraisal management companies. Such reviews can help ensure third-party valuation services meet regulatory requirements and the institution’s internal standards. Banks should also establish a process for addressing deficiencies found in third-party appraisals.

Ongoing Collateral and Other Real Estate Portfolio Monitoring

A sound valuation function should include procedures for monitoring collateral on a portfolio and individual asset basis over the life of the asset.

- Loans. Monitoring collateral values for a real estate loan portfolio and individual loans enables institutions to better identify changing market conditions which affect credit risk exposure. Establishing criteria for obtaining collateral valuations over the life of a performing credit supports the effective management of credit risk, particularly in declining markets. Valuation policies should establish parameters for the frequency and type of collateral valuation information to be obtained to ensure banks have useful market data to monitor changes in the risk profile of individual loans or portfolio segments.

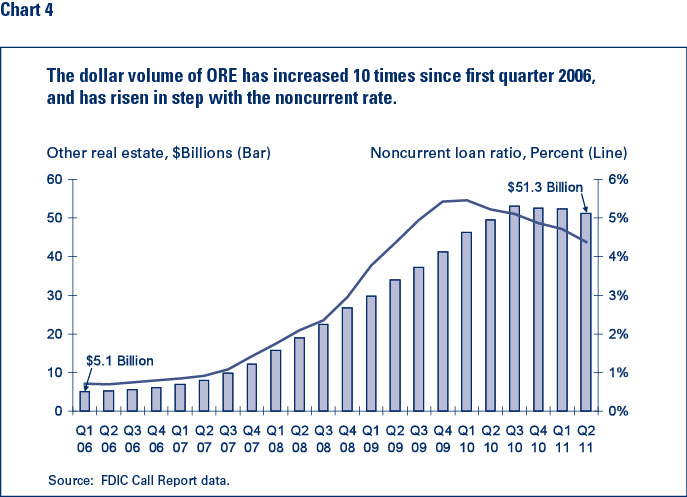

- Other Real Estate (ORE). The recent financial crisis resulted in a significant increase in non-performing loans and a surge in the volume of distressed sales and foreclosures (see Chart 4). When valuing a foreclosed property to determine its initial carrying value as ORE, institutions should consider selecting appraisers/evaluators not involved in the previous valuation(s) of that property. Institutions also should consider establishing policies and procedures for obtaining ORE valuation information to monitor its carrying value on an ongoing basis.

Evaluations

Part 323 of the FDIC’s Rules and Regulations requires institutions to obtain an evaluation when an appraisal is not required.12 The Guidelines establish supervisory expectations for real estate evaluations.13 The Guidelines also identify real estate-related transactions that allow evaluations, outline standards for developing an evaluation, and detail the minimum content of evaluations.14 Further, Appendix B of the Guidelines discusses the use of analytical methods or technological tools (such as automated valuation models) as a basis for evaluations.15

Institutions are encouraged to consider the following points as they enhance their real estate evaluation processes:

- Evaluation content. Developing minimum evaluation content standards helps ensure that evaluations contain sufficient information to support the market value conclusion. Specifying criteria for determining the level and extent of research or inspection necessary to ascertain the property’s physical condition also helps support the value conclusion and minimize the potential for fraud.

- Valuation techniques and tools. The tools and techniques used for the evaluation should support the property’s market value. Broker price opinions or automated valuation models should not be solely relied upon to develop an evaluation of value.

- Determining when an evaluation is appropriate. The Guidelines identify the types of real estate-related transactions for which an evaluation is permissible.16 The Guidelines also recommend that institutions establish policies and procedures for determining when to obtain an appraisal even though an evaluation may be permissible.17 Most institutions understand these provisions; however, there has been some confusion regarding what type of valuation is needed for new and existing real estate-related transactions. Some of the regulatory requirements for obtaining an evaluation or appraisal are detailed below.

Overseeing Third-Party Arrangements

A financial institution may engage a third party, such as an appraisal management company (AMC), to perform certain collateral valuation functions on its behalf. Outsourcing this function may be motivated by concerns about appraiser independence or the lack of internal technical expertise or resources to properly review appraisals of complex or non-local properties. Importantly, the Guidelines state that the lender is responsible for ensuring that third-party servicers comply with applicable laws and regulations and their work products are consistent with supervisory guidance.18 To facilitate effective oversight of third-party arrangements, financial institutions should:

- Perform appropriate due diligence when selecting and overseeing an AMC. Performing due diligence before engaging a third party, as well as ongoing oversight of the arrangement, increases the likelihood the third-party provider will perform the services consistent with the financial institution’s standards and regulatory requirements.

- Conduct a review of the AMC’s selection process for appraisers/reviewers. To ensure the institution’s qualification requirements are met (e.g., education, experience, type and status of state license, and technical competency for particular property types and markets), it is critical the AMC be provided the institution’s criteria for reviewing and selecting appraisers and appraisal report reviewers.

Dodd-Frank Act Appraisal Independence Requirements

The Dodd-Frank Act required the FRB to prescribe interim final regulations defining specific acts or practices that violate appraisal independence in the context of the Truth in Lending Act.19 The FRB issued such interim final rules, effective April 1, 2011, by adding Section 226.42 to Regulation Z. While the new rules address several issues, three key appraisal-related matters for real estate credit transactions include:

- Appraiser independence. Section 226.42(c) encourages appraiser independence by prohibiting certain acts that directly or indirectly cause the value assigned to a consumer’s principal dwelling to be based on any factor other than the independent judgment of the person who prepares the valuation. Examples of such prohibited acts include, but are not limited to, seeking to influence the appraiser/evaluator to report a minimum or maximum value, withholding timely payment to the preparer because the property is not valued at or above a certain amount, and conditioning the preparer’s compensation on consummation of the covered transaction. These and other acts that would compromise the collateral valuation function also are noted in the Guidelines.20

- Conflicts of interest. Section 226.42(d) seeks to limit potential conflicts of interest by prohibiting persons preparing a valuation or performing valuation management functions from having a direct or indirect interest in the property or transaction for which the valuation is being performed. Notably, a person employed by or affiliated with the creditor does not have a conflict of interest based solely on that employment or affiliate relationship so long as certain conditions establishing a safe harbor are met.

The safe harbor for financial institutions with more than $250 million in assets as of year-end for the past two calendar years essentially requires total independence between the valuation function and the loan production process. This degree of separation may be problematic for many community banks with assets over $250 million, especially those with limited staff or a relatively low volume of residential mortgage loan originations. Institutions should document the prudent safeguards that have been implemented to isolate the valuation function from influence by the loan production process. Such safeguards could include having trained administrative staff control the appraisal ordering process based on a list of approved appraisers and requiring qualified officers and directors not involved in the origination of the pending real estate-related transaction to review the appraisal. Institutions may contact their local FDIC office to discuss possible safeguards. Examiners should continue to exercise judgment in determining whether a bank’s valuation function complies with these requirements. - Customary and reasonable fees. Section 226.42(f) requires the creditor and its agents to compensate a fee appraiser for performing appraisal services at a rate customary and reasonable for comparable appraisal services performed in the geographic market of the property being appraised. Two safe harbors are provided. The first is based on the creditor or its agents reviewing certain factors and not engaging in anticompetitive acts. The second is based on the creditor or its agents relying on certain external information for determining the amount of compensation. Some financial institutions may have difficulty obtaining sufficient and appropriate data to comply with these requirements. An institution may demonstrate compliance by documenting the information it considered and used in determining what is a customary and reasonable fee for a given appraisal service.

Conclusion

A borrower’s ability to repay a real estate loan according to reasonable terms remains the primary consideration in the lending decision and in examiner review of the loan portfolio. However, when collateral becomes the primary repayment source for a loan, the valuation and assessment of that collateral will help determine whether a loss could be sustained. Institutions should review valuation policies and procedures to ensure the valuation function is appropriate for the size, nature, and complexity of an institution’s real estate lending program. Efforts to provide accurate valuations can enable the institution to make more prudent and informed credit decisions.

Dennis C. Ankenbrand

Senior Examination Specialist

San Francisco Regional Office

DAnkenbrand@fdic.gov

Beverlea Suzy Gardner

Senior Examination Specialist

Washington Office

Bgardner@fdic.gov

Diane P. McKee

SRPA, SRA, Appraisal Review Specialist

San Francisco Field Office

DiMckee@fdic.gov

Donald T. Mulherin

Examiner

Cedar Rapids Field Office

DMulherin@fdic.gov

Richard G. Rawson

MAI, Appraisal Review Specialist

Phoenix Field Office

RRawson@fdic.gov

The authors would like to acknowledge the valuable contributions of Timothy P. McMahon, Examiner, to the research and writing of this article.

1 The Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the Office of Thrift Supervision (OTS), and the National Credit Union Administration (NCUA). Note that OTS functions transferred to other federal financial institution regulatory agencies on July 21, 2011, and the agency was abolished 90 days later.

2 See FIL-82-2010, Interagency Appraisal and Evaluation Guidelines, December 2, 2010, at https://www.fdic.gov/news/news/financial/2010/fil10082a.pdf.

3 See Section 1472 of the Dodd-Frank Act, Pub. L. No. 111-203 (July 21, 2010) available at http://www.gpo.gov/fdsys/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf.

4 The Uniform Standards of Professional Appraisal Practice (USPAP) 2010-2011 edition defines an appraisal review as the act or process of developing and communicating an opinion about the quality of another appraiser’s work that was performed as part of an appraisal, appraisal review, or appraisal consulting assignment. In addition, Section 1473(e) of the Dodd-Frank Act amended Section 1110 of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 to require the federal financial regulatory agencies, Federal Housing Finance Agency (FHFA), and Consumer Financial Protection Bureau (CFPB) to issue appraisal review standards.

5The Appraisal of Real Estate, Thirteenth Edition, 2008. Chicago, IL: The Appraisal Institute, page 593.

6 Guidelines, page 18 (XV. Reviewing Appraisals and Evaluations – Resolution of Deficiencies).

7 Guidelines, page 23 (XVIII. Referrals).

8 Ibid

9 USPAP Standards Rule 1-1.

10 USPAP Standards Rule 1-3.

11 https://www.asc.gov/appraiser.

12 See Part 323 at http://www.fdic.gov/regulations/laws/rules/2000-4300.html.

13 Guidelines, pages 5-6 (VI. Selection of Appraisers or Persons Who Perform Evaluations).

14 Guidelines, pages 12-14 (XII. Evaluation Development and XIII. Evaluation Content).

15 Guidelines, pages 31-35, (Appendix B – Evaluations Based on Analytical Methods or Technological Tools).

16 Guidelines, pages 11-12 (XI. Transactions That Require Evaluations).

17 Ibid., page 12. Depending on the extent of collateral exposure and overall credit risk involved, the institution may obtain an appraisal in lieu of an evaluation out of prudential concerns. Such appraisals must comply with USPAP.

18 Guidelines, pages 18-20 (XVI. Third Party Arrangements).

19 See Section 1472 of the Dodd-Frank Act, Pub. L. No. 111-203 (July 21, 2010) available at http://www.gpo.gov/fdsys/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf. Section 1472 also provides that the FRB, OCC, FDIC, NCUA, FHFA and CFPB may jointly issue rules, interpretive guidelines, and general statements of policy with respect to acts or practices that violate appraisal independence in the provision of mortgage lending services for a consumer credit transaction secured by the principal dwelling of the consumer and mortgage brokerage services for such a transaction.

20 Guidelines, pages 3-5 (V. Independence of the Appraisal and Evaluation Program).