This regular feature focuses on developments that affect the bank examination function. We welcome ideas for future columns. Readers are encouraged to e-mail suggestions to SupervisoryJournal@fdic.gov.

Managing Agricultural Credit Concentrations

The more than 1,500 farm banks remain a viable and important part of the U.S. banking industry, representing 1 of every 5 insured institutions.1 These institutions are heavily concentrated in the nation's heartland, including the Corn Belt and Great Plains.2 This is not unexpected given the importance of the agricultural economy in these geographic areas. The vast majority of farm banks are small institutions with limited geographic footprints in areas that are heavily dependent on agriculture; therefore, extensive diversification within the loan portfolio may not be realistic or feasible. Instead, these institutions must engage in sound oversight of their agricultural credit concentrations.

Although the agricultural sector is healthy, and the outlook remains favorable, the industry is cyclical and subject to substantial inherent volatility. Moreover, agricultural land values currently are experiencing a boom of historic proportions based in part on strong agricultural conditions. Similar episodes in the past ended with a sharp contraction of agricultural land values. Importantly, the credit structure underlying U.S. farmland does not appear to involve excessive leverage on the part of farmers, which was present in past episodes.

Vigilance and adherence to safe-and-sound banking practices now will help ensure farm banks are well positioned to weather any challenges on the horizon. This article highlights best practices relating to agricultural lending and effective management of agricultural credit concentrations that can help agricultural banks manage the uncertainties inherent in this industry.

State of the U.S. Agricultural Industry

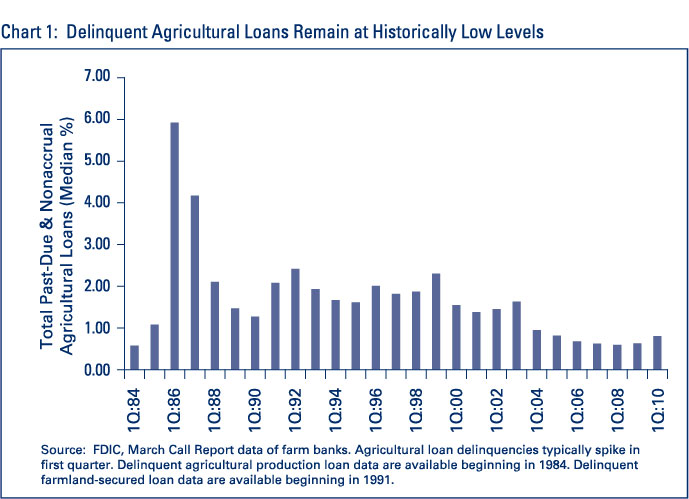

The agricultural sector has performed well during much of the past decade and has been one of the few bright spots amid the economic downturn and nascent recovery. On balance, the agricultural industry has benefited from solid production, strong demand and prices, and favorable financing costs. As a result, annual net farm income has been strong, with 6 of the past 8 years ranking among the top 10 since 1980. This solid performance is reflected in strong agricultural credit quality reported by the nation's farm banks. Median agricultural loan delinquencies and charge-offs remain near the lowest levels since data collection began in 1984 (see Chart 1).

Of some concern is that the current prosperity in the agricultural sector has not been shared across the sector's industries. Crop producers have done well while cattle, hog, and dairy producers struggled greatly during 2008 and 2009. As a result, net farm incomes among livestock producers did not keep pace with that of crop producers. Although all major livestock segments – beef, pork, dairy, and poultry – have struggled to varying degrees, conditions appear to have improved across the board during 2010, and the forecast is for continued strengthening into 2011.

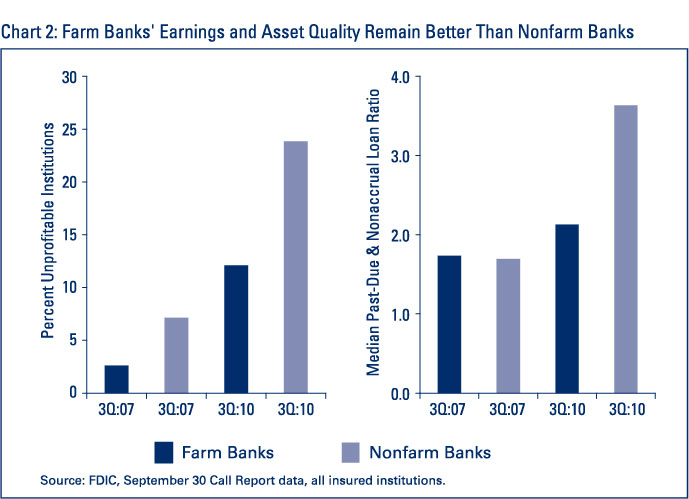

Moreover, even though agricultural loan quality remains favorable, the credit quality of farm bank nonagricultural loan portfolios has slipped. Earnings have declined as these institutions increased loan loss provisions in response to rising delinquencies and charge-offs. However, farm bank earnings and capital have held up much better than those at metro-based nonfarm banks during the past few years (see Chart 2).

Five Perennial "Health Hazards" for the Agricultural Economy

The agricultural sector appears poised to continue its years of prosperity in the near term. Crop prices remain high, and 2010 production of wheat, corn, and soybeans is projected to be strong. Moreover, hog prices have rebounded sharply from 2009 lows; cattle prices are moving up on tight inventories; and dairy prices have recovered moderately from 2009 lows. Meanwhile, an improving global economy is expected to bolster export demand.

However, the agricultural industry is inherently susceptible to shocks from a variety of sources, such as environmental pressures, market volatility, changes in interest rates, geopolitical issues, and the potential for declining farmland values.

Environmental Risk

The massive fires that raged across much of the former Soviet Union during the summer of 2010 and the resulting ban on Russian wheat exports (because of the significant failure of its wheat crop) are stark reminders of the potential impact of adverse weather conditions. This development echoes the 1970s when the Soviet Union imported U.S. wheat because of severe drought.

Weather is the major uncontrollable risk in agriculture, with drought topping the list of widespread, yield-limiting factors. The United States currently is 22 years removed from its last major drought in 1988, and many experts believe another major drought event is overdue. For example, climatologists note that serious droughts tend to follow a 19-year cycle.3

Market Volatility

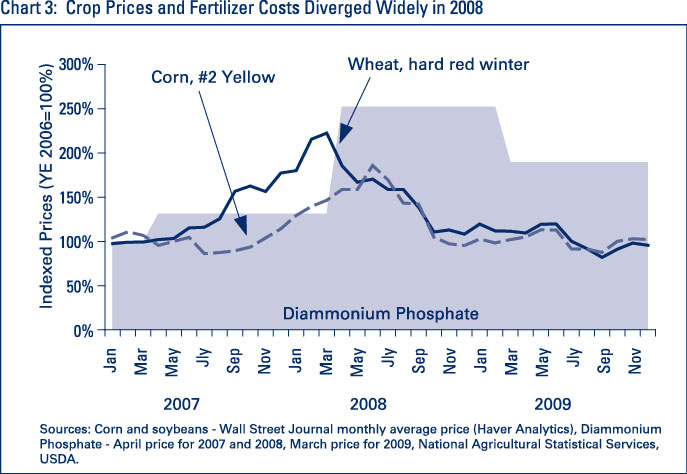

Market volatility for commodity prices and input costs can be extreme. For example, the price of fertilizer, the largest input cost, increased more than 250 percent between Spring 2007 and Spring 2008. Similarly, corn and wheat prices roughly doubled between the first half of 2007 and the first half of 2008 before retreating in the second half of the year (see Chart 3).

Rising Interest Rates

Typically, farming is a low-margin operation, and rising interest rates can constrain farmers' debt-servicing capacity. Interest rates have been at decades-lows for much of the past decade, and low financing costs sometimes cloud the determination as to whether good performance results from strong operations or lower debt costs. Moreover, rising interest rates exert downward pressure on farmland values, which is the most significant asset of many farming operations.

Geopolitical Risks

Domestically, the agricultural sector faces "stroke of the pen" uncertainties involving several federal programs, including the potential for a reduction in the United States Department of Agriculture's Farm Program payments, an increase in capital gains taxes, and a reduction or elimination of federal supports to the ethanol industry. Other sources of uncertainty for agriculture include the effects of environmental regulations, water allocation, and pressure from animal activist groups.

Looking beyond U.S. borders, this sector must be prepared to deal with the uncertainties surrounding global market conditions and international trade issues, such as free trade and bio-security. Since 2003, less than a handful of U.S. cases of Bovine Spongiform Encephalopathy, or "Mad Cow" Disease, have resulted in significant foreign bans on U.S. beef imports, adversely affecting the U.S. cattle industry. Similarly, concerns about H1N1 Influenza, or "Swine Flu," hurt pork producers during 2009.

Decline in Farmland Values

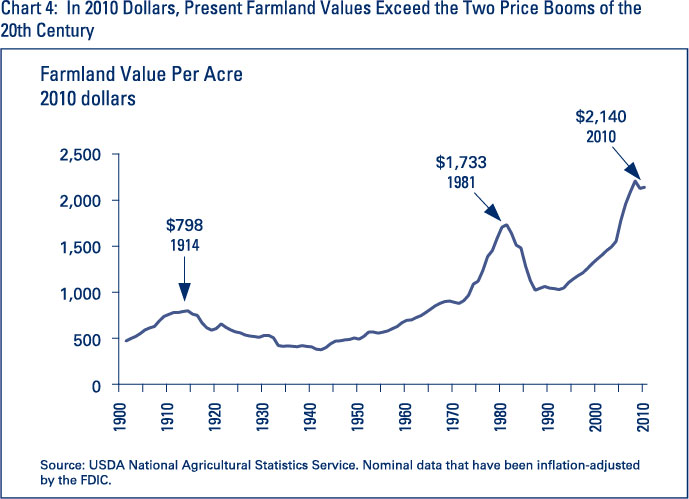

When farmland is owned, it is the principal farm asset on an agricultural producer's balance sheet. However, when rented, it represents a significant expense. Nationally, farmland values have risen more than 50 percent since 2000 (in inflation-adjusted dollars) and are at historic highs (see Chart 4).

During the twentieth century, there were only two other periods of similar increases in farmland values, and both were followed by declines of more than 40 percent. A drop in farmland values likely would accompany any significant decline in farm income, causing collateral margins to tighten at the same time repayment capacity falls. Depending on how much collateral margins tighten relative to underwriting standards, lenders could view farmland's collateral protection as an insufficient secondary repayment source.

These health hazards have the potential to negatively affect much of the agricultural sector and, by extension, the operations of a large number of farm banks. As it is not feasible in many instances for farm banks to diversify away their concentrated agricultural risk, careful management of that risk is necessary.

Management focus on best practices can help mitigate these risks4

Robust credit concentration risk management begins at the bank level, includes sound agricultural lending practices, and considers any associated third-party risks. The strong practices described below are not a list of formal supervisory requirements. They reflect the authors' observations about the factors successful agricultural lenders consider in managing their agricultural credit exposure. The application of these practices should be commensurate with the scope and complexity of a bank's operations.

Agricultural Credit Underwriting and Administration

Management should establish prudent, time-tested lending policies and reporting mechanisms. Robust credit portfolio reporting systems should provide timely, detailed information about agricultural concentrations; for example, reports should be created that stratify the agricultural portfolio by crop production versus livestock production, cow/calf versus feeder program, etc.

The credit review process and risk-rating system should allow for the early identification of problem signals, for example, weakening profitability, increasing leverage, and declining collateral margins, and the credit department should perform appropriate financial analysis and collateral inspections. Institutions should ensure experienced personnel are available to effectively manage any increase in problem loans and loan workouts.

In addition, credit officers should perform appropriate cash flow analysis, including stress testing; require and understand marketing programs, hedging activities, and insurance programs; and appropriately structure loan terms. The following best practices will help ensure a robust and effective agricultural credit underwriting and administration function.

- For significant borrowers, develop a baseline cash-flow scenario predicated on realistic production estimates, attainable commodity prices, and most likely input costs. Shock or stress test the baseline cash flow by substituting price extremes for commodity prices, input costs, and interest rates.

- Segment the loan portfolio based on the stress test results, for example: (1) producers who are profitable under almost any realistic scenario; (2) producers who may experience negative cash flows under difficult circumstances but can service resulting carryover debt when prices or expenses normalize; and (3) producers who only cash flow under a best-case scenario.

- Implement mitigation strategies where needed. For example, for borrowers falling into group 3 above, develop timely exit strategies. Place borrowers in category 2 on an internal loan watch list and determine if credit enhancements, such as Farm Service Agency (FSA) guarantees, are available to manage risk. According to information appearing on the USDA/FSAWeb site "FSA-guaranteed loans provide lenders (e.g., banks, Farm Credit System institutions, credit unions) with a guarantee of up to 95 percent of the loss of principal and interest on a loan. Farmers and ranchers apply to an agricultural lender, which then arranges for the guarantee. The FSA guarantee permits lenders to make agricultural credit available to farmers who do not meet the lender's normal underwriting criteria."5

- Establish and enforce reasonable repayment terms and do not lend beyond a borrower's capacity to service debt structured under appropriate terms. Control loan disbursements and review loan disbursements against borrower-prepared budgets and cash-flow projections. Review incoming borrower deposits and compare them to borrower-prepared budgets and cash-flow projections. Discuss any major deviations in income or expenses with the borrower and take appropriate remedial actions if necessary.

- When taking collateral, maintain prudent collateral margins to provide appropriate protection and a secondary source of repayment. Sound, documented valuation of collateral values should accompany collateral margin analysis. Collateral valuation should consider the sustainability of current market values over the term of the loan and, when in question, valuations should be appropriately discounted.

- Require borrowers to carry levels of insurance appropriate to their risk profiles. Crop Revenue Coverage and Revenue Assurance products provide price-floor protection and minimize risks of not being able to deliver crops as contracted. These types of insurance coverage are important components of a viable marketing strategy.

- Encourage borrowers to protect their profits using sound sales marketing programs and hedging tools to lock in crop and livestock prices and favorable input costs. The bank should evaluate the program's appropriateness, monitor hedging account activities to ensure consistency with the original marketing plan, and develop sufficient funding sources to meet margin demands.

- Meet with financially distressed borrowers during the operating season and revisit the initial cash-flow projections, and perform on-site collateral inspections. Document these meetings and inspections and consider the risk that financially troubled borrowers might sell or transfer portable collateral, such as grain, livestock, and machinery, without the bank's approval.

- Hold borrowers accountable for discretionary spending, such as family living expenditures and capital purchases that exceed budgeted limits.

- Do not advance funds or release sales proceeds to pay other creditors without first determining the borrower can service his debt. Do not advance funds for a new production cycle until reasonable assurance exists that current operating season debt will be repaid or a determination is made that the level of new carryover debt is an acceptable risk. The lender should document this analysis and decision-making process in the credit file.

Mitigating Third-Party Risk

Finally, agricultural credit concentrations require prudent oversight of borrowers' third-party risk. Agricultural producers typically prepay for inputs before the beginning of the operating season and then market production to a relatively small number of entities, such as grain elevators, feedlots, and ethanol plants. Therefore, farmers routinely face substantial third-party risk regarding the delivery of prepaid inputs and the sale of product. As an example, during 2008, ethanol producer VeraSun entered bankruptcy and repudiated contracts for delivery of millions of bushels of corn from local corn growers, forcing growers to sell their crops on the open market at much lower market prices.

Third-party risk has the potential to jeopardize the viability of agricultural borrowers. To help mitigate this risk, banks should:

- specify acceptable concentration limits in the Loan Policy for exposure stemming from related repayment sources, whether it is a direct loan customer, a third party, or a combination of the two.

- develop appropriate strategies for managing agricultural concentration levels, including a contingency plan to reduce or mitigate concentrations when adverse market conditions emerge.

- review borrower credit files to identify all significant third parties that provide services to or purchase products from the borrower including, but not limited to, an elevator, ethanol plant, or feedlot that purchases large quantities of grain; or a supplier that provides a large volume of prepaid operating inputs to local farmers.

- determine the volume and nature of business conducted with third parties and perform due diligence of these third parties. Whenever possible, due diligence should include a financial statement review.

- determine the existing aggregate exposure. For example, if the bank loans $1 million to a local supply dealer that has also taken on $10 million in prepaid expenses from farmers financed by that institution, $11 million of direct and indirect exposure should be assigned to that dealer.

Capital and the Allowance for Loan and Lease Losses

In any given agricultural operating season, geographic pockets typically will experience some type of stress – most often weather related. However, as indicated by the previous discussion of health hazards, the potential exists for widespread stress in the agricultural lending sector. Capital exists to absorb unexpected losses. Given the relatively undiversified loan portfolios of farm banks, these institutions typically operate with capital ratios that well exceed regulatory minimums.

When managing agricultural credit concentrations, the Allowance for Loan and Lease Losses (ALLL) levels should be evaluated in light of these potential hazards. As the first line of defense against expected losses associated with problem credits and loans and leases more generally, a properly funded and managed ALLL is critical. Institutions should ensure:

- consistency with Generally Accepted Accounting Principles (GAAP) and relevant supervisory guidance, such as the December 13, 2006 Interagency Policy Statement on the ALLL.

- a review of the adequacy of the ALLL is conducted at least quarterly, including an analysis of the collectability of the agricultural loan portfolio and other exposures.

- the ALLL level covers estimated credit losses on individual impaired loans and estimated credit losses in the remaining loan portfolio.

- that as the volume of noncurrent loans and internally criticized credits becomes elevated, a commensurate increase in the ALLL level is considered.

Conclusion

The FDIC recognizes the importance of the agricultural sector to a large segment of the U.S. banking industry, particularly in the nation's heartland, where one of every two institutions is considered a farm bank. Agricultural credit concentrations among these banks and thrifts are common. Although agricultural conditions have been strong for many years, and the outlook remains favorable, the industry is cyclical and faces potential health hazards.

Reviewing lending processes and strengthening them as appropriate will help insulate farm banks against any problems in the agricultural sector. The best practices discussed in this article relating to agricultural credit underwriting and administration, strategies for mitigating third-party risk, and maintaining appropriate levels of the ALLL are policies and procedures that farm banks can incorporate now into their operations to mitigate concentration risk in the agricultural loan portfolio.

Richard D. Cofer, Jr.

Regional Manager

Division of Insurance and Research

rcofer@fdic.gov

Allen E. McGregor

Supervisory Examiner

Division of Supervision and Consumer Protection

amcgregor@fdic.gov

1 As of September 30, 2010, there are 1,583 farm banks operating in the United States. The FDIC defines a farm bank as an insured institution with at least 25 percent of its loans concentrated in agricultural production or farmland-secured lending. Thrift Financial Reports do not show these data; therefore, FDIC data on farm banks are limited to Call Report filing institutions, which are primarily commercial banks.

2 Eighty-four percent of farm banks are concentrated in 10 states (percentages are of U.S. total): Iowa (15.9%), Nebraska (10.9%), Kansas (10.7%), Illinois (10.5%), Minnesota (9.8%), Texas (7.1%), Missouri (6.4%), North Dakota (4.6%), Oklahoma (4.3%), and South Dakota (3.9%).

3 Elwynn Taylor, Professor/Climatologist, Department of Agronomy, Iowa State University. Based on the results of long-term tree-ring studies, the longest drought-free period in central/eastern North America is 23 years. See www.extension.iastate.edu and click on "Weather."

4 Information included in this section is based on existing supervisory guidance and the authors' informed perspective. Refer to Part 364, Appendix A, "Standards for Safety and Soundness." Additional guidance is available in these FDIC publications:

- "Analysis and Classification of Agricultural Credits," FIL-61-96, https://www.fdic.gov/news/inactive-financial-institution-letters/1996/fil9661.html;

- FDIC Risk Management Manual of Examination Policies, Section 3.2, http://www.fdic.gov/regulations/safety/manual/section3-2_toc.html;

- 2001 FDIC Policy Statement on Allowance for Loan and Lease Losses Methodologies and Documentation for Banks and Savings Institutions, http://www.fdic.gov/regulations/laws/rules/5000-4650.html#fdic5000psalll; and

- 2006 Interagency Policy Statement on the Allowance for Loan and Lease Losses, http://www.fdic.gov/regulations/laws/rules/5000-4700.html#fdic5000interagencypso.

5 See http://www.fsa.usda.gov/FSA/webapp?area=home&subject=fmlp&topic=gfl.