In recent years, Wall Street firms, brokers and financial advisors have stepped up efforts to interest consumers and investors in a unique market segment - Senior Life Settlements (SLS), which when packaged into securities are sometimes known as "death bonds." As outlined in this article, while these products may offer brokers and other middlemen the opportunity for high commissions, they carry significant risks to consumers and investors. Bankers should be aware of the substantial risks associated with any involvement with these products, and that absent specific authorization from their primary federal regulator any investment in them would be impermissible.

An SLS is a transaction in which an individual, generally between 65 and 79 years of age (Senior), sells his or her life insurance policy to a third-party investor, usually through a broker, for an amount less than the policy's face value, but greater than the net cash surrender value. The investor becomes responsible for paying the future premiums and, upon the death of the Senior, receives the policy's death benefits.

An SLS may appeal to a consumer who can no longer afford the premiums or is strapped for cash. For an investor, the potential profit depends on the purchase price and the amount of future premiums paid to keep the policy in force. If the death benefit exceeds the sum of the purchase price plus the aggregate future premiums and any other fees (all appropriately adjusted for the time value of money), the investor will profit; if not, the investor will suffer a loss. Essentially, the investor is betting on mortality by taking a financial interest in another person's demise. As morbid as this may sound, life settlements are a growing market and have garnered considerable interest on Wall Street.

This article provides an overview of the development of the SLS market and discusses the risks associated with these transactions to financial institutions, investors, and consumers, including the potential for fraud. In addition, a case study highlights an example where an FDIC insured institution's involvement in SLS transactions contributed to its failure.

Development of the SLS Market

In 1911, the United States Supreme Court case of Grigsby v. Russell 1 established that it was a policy owner's right to transfer an insurance policy, thus opening the door to life settlements. Transfers of insurance policies grew significantly during the 1980s, when AIDS patients and other terminally ill policyholders sold their life insurance policies to obtain cash to offset mounting medical bills and improve the quality of life in their final days. These transactions were known as viatical settlements, from the Latin word viaticum or "provisions for a journey." However, over time, viaticals became less profitable due to medical advances that extended the life expectancy of AIDS patients. In addition, allegations of fraud relating to the sale and marketing of these products were widespread. Life settlement providers then turned to a new group of policyholders – Seniors.

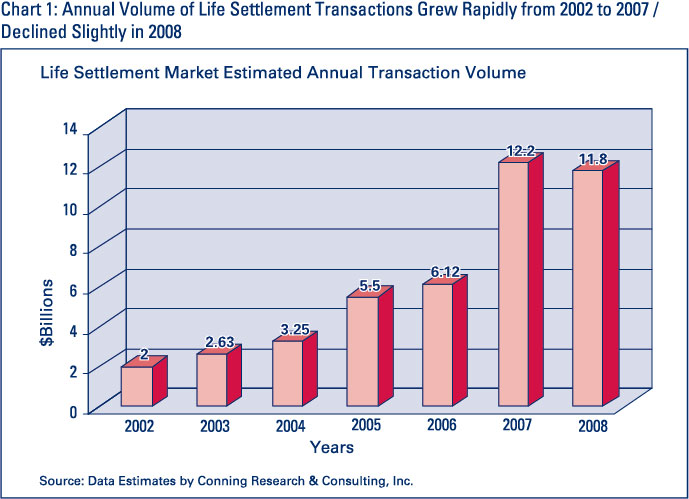

As shown in Chart 1, the estimated annual volume of life settlement transactions (policies changing hands) in the United States rose from $2 billion in 2002 to almost $12 billion in 2008, bringing the total outstanding to $31 billion at the end of that year.2 The rate of growth leveled in 2007, as the recession constrained cash available to fund policy purchases. Also, the major life expectancy underwriters revised their methodologies and assumptions, which resulted in longer life expectancies, casting doubt on the valuation of existing portfolios and further reducing investor interest. However, life settlement providers and trade groups predict a return of capital to the SLS market in 2010, although investment banks may be playing a smaller role.3 According to a National Underwriter article, more regulatory scrutiny, heightened consumer awareness, and a return of buyers to the market are likely developments for the settlement business in 2010.4

As an investment tool, securitized SLS are touted as offering an attractive investment feature: they are uncorrelated assets, meaning their performance is not directly tied to typical market influences. After all, death rates do not rise or fall based on the stock market. By purchasing a securitized pool, the argument goes, an investor can spread the risk over a large and diversified group of SLS contracts. However, critics question their investment viability due to the financial risks, lack of transparency, and limited number of successful transactions. Also, some industry observers believe significant growth in the securitization market can only be achieved with a favorable rating from a credit rating agency. However, rating life settlement securitizations presents many challenges, and in fact very few have been rated.5

In February 2010, the American Council of Life Insurers issued a policy statement recommending that the securitization of life settlements be banned, largely because securitizations could heighten fraudulent activity associated with Stranger Originated Life Insurance (STOLI). STOLI is the initiation of a life insurance policy for the benefit of a person who, at the time of the policy's creation, has no insurable interest.

Although SLS transactions present a number of legal issues, insurable interest is paramount. In its simplest terms, an insurable interest means that anyone who takes out a policy must have an interest in the insured person staying alive (rather than hoping to cash in on the insured's death). The principle of insurable interest is a matter of state law. A high-profile case in New York federal court frames the question as follows: Does state law prohibit an insured from procuring a policy on his own life and immediately transferring the policy to a person without an insurable interest, if the insured never intended to provide insurance for a person with an insurable interest? On November 17, 2010, in a 5-2 decision, the court ruled that nothing in state law prevented such a practice at the time the policies were sold.6 It is important to note that this decision applies only in New York and, effective May 18, 2010, New York changed its insurance laws regulating permissible life settlement contracts to prohibit STOLI. The new laws also prohibit, with certain exceptions, anyone from entering into a life settlement contract for two years after the issuance of a policy. As a result, the application of the Kramer decision is limited to policies in existence before May 18, 2010.

Regulation of the SLS Market

SLS are complex financial transactions that involve both insurance and securities elements, and most states have enacted regulations governing these products through their insurance or securities regulatory entities. The National Association of Insurance Commissioners developed a model uniform law that has been adopted in one form or another by at least 44 states.7 The law addresses licensing requirements, requires annual reporting, sets standards for a reasonable return to the person selling an insurance policy, and prohibits certain practices such as paying finders fees to an insured's physician. However, although it provides sample informational brochures for consumers and investors, the model regulation does not prescribe their use. The Life Insurance Settlement Association (LISA) provides an overview of state laws on its website at https://www.lisa.org/regulations_overview.

Some SLS transactions fall under the purview of federal securities laws enforced by the U.S. Securities and Exchange Commission (SEC). If the life insurance policy being sold is a security (typically, a variable life insurance policy) or if the policy will be securitized, the SEC has jurisdiction. In July 2009, the Financial Industry Regulatory Authority, Inc. (FINRA)8 published Regulatory Notice 09-42 reminding investment firms that variable life settlements are securities transactions subject to federal securities laws and all applicable FINRA rules.9 However, whether other SLS transactions fall under federal securities laws is unclear, and the courts have not reached a uniform answer.

Growth in the life settlement market and the potential dangers posed to consumers has resulted in additional regulatory and legislative scrutiny. In 2009, the life settlement market was the subject of congressional hearings and an investigation by the U.S. Senate Special Committee on Aging.10 In addition, a Life Settlement Task Force was established by the SEC in September 2009 to understand the range of issues presented by the life settlements market and to partner with other regulators to ensure the existence of adequate regulatory oversight and identify potential regulatory gaps.11

Risks to Investors

SLS transactions, when considered purely as investments, present a number of financial risks that must be understood by investors and consumers considering selling their policies (see Table 1).

Table 1

| Risks to Investors in SLS Transactions |

|---|

| Longevity Risk – The risk that the insured’s actual life span exceeds the projected life span. Longevity risk is affected by medical advances in the treatment of serious illnesses. The longer the life of the insured individual, the lower the investor’s return. |

| Legal Risk – SLS transactions often involve complex legal structures and incorporate numerous documents that impact the legal validity of the underlying assets and appropriate conveyance of the death benefit to an investor. These structures also may require appropriate perfection of security interests in several state jurisdictions. |

| Contestability Risk – The risk associated with the issuing insurance company’s right to rescind a policy within the two-year contestability period. |

| Rescission Risk – This risk relates to the doctrine of insurable interest. An insurance company may rescind a policy when it suspects a lack of insurable interest. |

| Funding Risk – The risk that the investor may have insufficient funding capacity to pay future premiums and other holding costs. |

| Liquidity Risk – The lack of transparency in the SLS market creates difficulty in determining the fair value of a life settlement asset. The uncertainty in the market may hamper the ability of an investor to dispose of the investment at a reasonable price, if needed. |

| Litigation Risk – The risk that the insured’s family members (heirs) or previous beneficiaries will file legal action and the potential financial impact to the investor. |

| Regulatory Risk – The risk that new limitations or restrictions will be placed on SLS transactions, negatively impacting their value or marketability. |

Special Risks to Financial Institutions

A number of financial institutions report receiving loan applications from investors wanting to finance SLS transactions. Bankers also have reported a few instances where they have been approached with proposals to either hold SLS directly as securities or as part of a "troubled loans for securitized SLS swap" transaction. Investments in SLS are speculative and have not been approved as permissible by either the Federal Deposit Insurance Corporation or the Office of the Comptroller of the Currency. Any bank considering such an investment must apply for permission prior to doing so12 and should expect significant questions about whether the risks could be sufficiently mitigated to warrant granting such permission.

A financial institution that acts as an investment advisor, whether through a networking arrangement, trust department or as a registered advisor,13 and recommends a SLS or any other financial product that performs below customer expectation or has an undisclosed risk could create customer dissatisfaction or harm and potentially damage the reputation of the institution. In our judgment, the reputational risks associated with this product are unquantifiable but severe. Bankers should also be cognizant of third-party risk, which stems from a broker or settlement provider engaging in inappropriate sales practices, and compliance risk associated with consumer protection regulations, such as Privacy of Consumer Financial Information14 and The Health Insurance Portability and Accountability Act of 1996 (HIPAA) Privacy and Security Rules.15

The case study Bank Financing of SLS Investments that concludes this article demonstrates the gravity of risks faced by institutions that become involved in SLS transactions.

Risks to Consumers

Financial institutions should be alert to the aggressive marketing tactics of some life settlement providers and brokers. As more life settlement providers enter the market, competition to find policyholders increases. As incentive, commissions paid in connection with life settlements can be quite high (up to 30 percent of the purchase price). This incentive has prompted some life settlement providers to aggressively encourage financial service providers to canvass their books of business for Seniors or other eligible customers who may be interested in selling their life insurance policies in the secondary market, regardless of whether they need to sell or have previously considered surrendering or allowing the policy to lapse. Accordingly, in its August 2006 Notice to Members,16 the National Association of Securities Dealers (NASD) noted its concern that aggressive marketing tactics, fueled by high commissions, may lead to inappropriate sales practices in connection with these transactions.

Against this backdrop, financial advisors should encourage consumers to carefully consider their ongoing life insurance needs before entering into SLS transactions, as their policy remains in force and may affect their ability to obtain additional life insurance. The FINRA has issued an investor alert17 that identifies questions a consumer should ask when deciding to sell a life insurance policy, including:

- Is the life settlement broker or provider licensed? A growing number of states require that life settlement companies and brokers be licensed.18

- Is there pressure to make a quick decision? A legitimate investment professional will provide clear answers and allow ample time to make an informed decision.

- What are the transaction costs? What is a fair and competitive sales price? There is no transparent secondary market for life insurance policies, so it is difficult to determine if a fair price is being offered. Consumers should ensure bids are obtained from several SLS providers.

- How will personal information be protected? When a life insurance policy is sold, the insured is required to authorize the release of medical and other personal information. The consumer should ensure procedures are in place to protect the confidentiality of the data.

- What is the impact on your survivors? Carefully consider the need for current income against the financial needs of survivors now and in the future. Legitimate life settlement brokers/providers will require the beneficiary to acknowledge and consent to the transaction.19

- What are the tax consequences? Before entering into a life settlement, a tax professional should be consulted.

Finally, given the risks involved, consumers should seek legal advice before signing any agreements to ensure a SLS transaction is in their best interest.

The Potential for Fraud in SLS Transactions

The North American Securities Administrators Association (NASAA), which represents state securities regulators, previously listed life settlements among the top 10 investor traps.20 The NASAA specifically identifies Ponzi schemes, fraudulent life expectancy evaluations, inadequate premium reserves that increase investor costs, and false promises of large profits with minimal risk. Other types of fraud identified in the SLS industry are clean-sheeting (applying for a life insurance policy without disclosing a life-threatening illness) and dirty-sheeting (when a healthy person provides false medical information indicating he or she has a life threatening illness). In addition, in the case of wet-ink policies (new life insurance policies sold immediately after being issued – before the ink is dry), the applicant commits fraud on the application by claiming he or she needs life insurance for estate planning purposes. One type of wet ink policy is STOLI.21

STOLI has many variations but only one purpose: to allow an investor without an insurable interest to initiate and profit from a life insurance policy on a stranger. The mainstream insurance industry strongly opposes STOLI, arguing it is fraud for a person to buy a policy with only a profit - and not insurance - motive. STOLI is prohibited or statutorily restricted in many states.

The Case Study discussed below demonstrates the negative impact that the legal and other risks discussed above can have on a financial institution.

Bank Financing of SLS Investments - A Case Study

This case study is based on actual events and involves a failed bank that granted loans secured by SLS contracts.22 Although SLS were not the sole cause of the institution's failure, this case study underscores the significant risks associated with these investments.

Big Venture Bank (Bank) was a $100 million rural community bank. Bank officers and directors expanded the institution's business strategy to include a venture capital component. Management converted its parent company to a financial holding company and established several subsidiaries to engage in venture capital financing activities.

One target investment was a local manufacturing company, Big Mountain Manufacturing (Big Mountain). Big Mountain appeared to have a good product; however, it did not have funds to commence production, and the Bank previously had granted a loan to the company in an amount close to its legal lending limit. As concern mounted over Big Mountain's economic survival and the repayment of its significant debt to the Bank, Bank management began searching for funding alternatives. They chose Senior Life Settlements.

The Bank's plan was two-fold. As a short-term solution, the Bank would extend a credit facility (aggregating 125 percent of the Bank's capital) secured by SLS contracts to five of Big Mountain's directors at $3 million each. Twenty percent of the loan proceeds (aggregating $3 million) were provided to the borrower group to inject into Big Mountain. As a long-term solution, Bank management, with the aid of Wall Street investment advisors, would underwrite and issue a $600 million SLS securitization transaction (consisting of 500 policies with an aggregated death benefit of $1.6 billion, including the underlying policies associated with the Bank's SLS loans). Once the deal closed, $15 million of the sales proceeds from the securitization (part of the securitization's venture capital component) would be provided to Big Mountain for operating capital and debt restructure, including the Bank's direct loan. The plan was designed to make the Bank whole on its loans, recognize large fee income from the securitization process, and sufficiently capitalize the local manufacturing company.

The structure of the credit facility was a Series Limited Liability Company (LLC) arrangement whereby a separate LLC was established for each of the five borrowers. Each LLC owned seven trusts, and each trust owned one universal life insurance policy on a senior individual. The owner and beneficiary of the underlying policy was the trust. The original beneficiary of each trust was the insured's family member. After the interest was purchased by the investor, the beneficial interest in each trust was transferred from the family member to the LLC. Each original trustee was then replaced by a common trustee engaged by the Bank. This structure was used in an attempt to preserve insurable interest and facilitate the transfer of interest to an investor. Each LLC granted the borrower an irrevocable security interest in all its assets (i.e., the beneficial interest in each trust), which the borrower pledged to the Bank as collateral.

The five LLCs purchased 35 trusts (and 35 policies) with an aggregate death benefit of $32 million. The policies were issued by 17 insurance companies to seniors residing in 12 states. The LLCs, in an attempt to shelter their risks, subscribed to a master agreement which served as a profit-sharing mechanism. In the event any of the LLCs received death benefits on policies in a greater proportion than other LLCs, the contracts would be shifted among the LLCs to level the playing field.

The proceeds of the Bank's loans were used to purchase the underlying insurance policies, pay fees, inject capital into Big Mountain, and establish a three-year reserve for interest payments, fees, and future insurance premiums. Table 2 summarizes the use of proceeds, including the sizable unfunded commitment. The loans were set up with seven-year maturities, with quarterly interest payments during the first three years followed by quarterly principal and interest payments until maturity.

Table 2

| Big Venture Bank - SLS Loan Proceeds | ||

|---|---|---|

| Purpose | Amount | Percent of Total |

| Funded Portion | ||

| Purchase Beneficial Interest of Trusts (Cost of Policies) | $3,000,000 | 20.0 |

| Fees Associated with the Purchase | 60,000 | 0.4 |

| Up Front Fees to Service Company under Servicing Agreement | 625,000 | 4.2 |

| Advance to Pay Current Premiums Due on Policies | 325,000 | 2.1 |

| Venture Capital Component for Investment in Big Mountain | 3,000,000 | 20.0 |

| Total Funded Portion | $7,010,000 | 46.7 |

| Unfunded Commitment | ||

| Future Premium Payments on Underlying Policies (3 year reserve) | $5,415,000 | 36.1 |

| Interest Reserve on Credit Facility (3 year reserve) | 2,025,000 | 13.5 |

| Fees to Service Company under Servicing Agreement (3 year reserve) | 550,000 | 3.7 |

| Total Unfunded Portion | $7,990,000 | 53.3 |

| Total Credit Facility | $15,000,000 | 100 |

In SLS transactions, active administration of the collateral and continued payment of policy premiums is critical and requires a number of administrative services.23 In this instance, these services were provided by a Bank affiliate (Service Company) for an initial up front fee and quarterly servicing fees, all of which were to be funded by the loan proceeds.

Loan Underwriting Deficiencies

The Bank's SLS credit facility was selected for review by FDIC examiners due to its size and the unique characteristics of the loan structure and underlying collateral. Examiners criticized Bank management for failing to perform the pre-funding due diligence necessary to understand the significant risks inherent in these transactions. The following loan underwriting deficiencies were identified, all of which impacted credit quality:

- Inadequate Due Diligence of Legal Issues - Management did not confirm that all transactions complied with state and federal regulations. Several critical documents tracing the transactions from inception were missing or unavailable. Management did not obtain independent legal opinions related to the structure of these transactions, perfection of the Bank's collateral position in the various state jurisdictions, the contestability risk associated with the underlying policies (each policy was within the two-year contestability period), or the rescission risk related to insurable interest. Refer to Table 1 for information regarding these risks.

- Unpredictable Cash Flow - Cash flow in SLS transactions depends on the amount of the policy's death benefits and can be impacted by various risks, including longevity risk (the risk the insured individual will outlive the life expectancy in the actuarial model). Management did not consider whether the 35 insured individuals comprised a sufficiently large pool to correlate with the actuarial tables and assumptions used in its actuarial model.

- Lack of Independent Mortality Analysis - Management did not perform a loan-level analysis that considered the specific characteristics of each underlying policy, including age of the insured, medical history, and condition. A mortality profile that included a summary of the pertinent medical conditions and a determination of life expectancy should have been conducted by a medical underwriter. The analysis also should have included assumptions for medical advances that could impact mortality rates. Moreover, cash flow should have been stressed under a number of reasonable mortality scenarios to analyze longevity risk.

- Funding Risk - The carrying costs (interest, premiums, and fees) associated with this structure is significant. If cash flow was impacted by longevity risk, carrying costs would have significantly increased. Further, many of the underlying policies had premium structures that escalated as the insured aged. The unfunded portion of the credit facility was sufficient to accommodate the projected carrying cost for only three years.

- Borrowers Lacked Equity and Financial Capacity - Each borrower was essentially a passive participant with no equity in the structure. Repayment terms were extremely liberal, as the borrowers were not required to make any out-of-pocket payments for three years. Interest payments, administrative fees, and premiums were all advanced on the line of credit. Moreover, the loans were primarily funded on the projected cash flow from the deaths of the seniors with little consideration given to the borrowers' financial strength or cash flow, which was nominal. The borrowers did not establish cash reserves to fund the cost of holding the investment, and no additional collateral was pledged.

- Liquidity Risk - Management did not adequately analyze the availability of a secondary market before engaging in these transactions. The SLS market is still emerging, with a limited secondary market (especially for contestable contracts) and a lack of transparency, which posed significant liquidity risk for the institution and the borrowers should they want to dispose of the collateral. The lack of transparency in the pricing of life settlements and the fees earned by intermediaries, coupled with the lack of standardization of the general methods for predicting life expectancies, contribute to capital markets uncertainties relative to the value of life settlement transactions. Bank management should have engaged independent, licensed life settlement providers to determine an estimated market value based on the specific characteristics of the individual transaction. Management also should have ascertained the financial strength of each insurance company.

- Unrealistic Exit Strategy - The Bank's ultimate repayment source - the proposed $600 million SLS securitization – never materialized. The unique structure of the bond caused the underwriting process to become severely protracted and subject to continual delays and legal setbacks.

Regulatory Treatment and Impact on the Bank

The Bank failed to obtain regulatory approval before establishing its SLS credit facility. Given the highly speculative nature of these investments, legal risk, unpredictable cash flow, funding risk, questionable collateral position, liquidity risk, and numerous other unmitigated risks, the SLS credit facility did not meet the test of a prudent extension of credit. Consequently, once examiners became aware of the activity, they adversely classified the credit facility, placed each loan on nonaccrual, required a significant allocation to the allowance for loan and lease losses (ALLL), and instructed that any future advances, which were previously contracted, be immediately charged-off through the ALLL.

Within an 18 month period, the write-downs associated with this credit facility and other loan losses exhausted the Bank's capital and resulted in its failure. The FDIC as receiver of the Bank holds these assets and is attempting to liquidate them.

Conclusion

Substantial financial risks, aggressive and deceptive sales practices fueled by the opportunity for promoters to collect high commissions, STOLI deals, and fraud cast a dark cloud over the SLS industry. Accordingly, bank and securities regulators continue to consider the application of additional federal and state laws to life settlements and market intermediaries. Bankers, investors, and consumers being approached with proposals to enter into life settlement transactions should exercise caution and carefully consider all risks associated with these transactions. Bankers should also consider whether such activity is likely to be permitted by their supervisor, regardless of potential mitigating actions.

Steven E. Chancy

Examiner

schancy@fdic.gov

Deborah L. Thorpe, CFE

Examiner

dthorpe@fdic.gov

Michael R. Tregle

Counsel, Legal Division

mtregle@fdic.gov

The authors acknowledge and thank Chad M. Wilgenbusch, Student Intern, Legal Division, Memphis, Tennessee, for his valuable contribution to this article. Mira N. Marshall, Chief, Compliance Policy Section, Washington, D.C., also made substantial contributions to the article.

1 Grigsby v. Russell, 222 U.S. 149 at 156 (1911).

2 Data obtained from Conning Research & Consulting, an independent insurance industry analysis firm in Hartford, Connecticut.

3 In January 2010, Goldman Sachs shut down its life settlements provider (Longmore Capital) approximately one month after discontinuing its tradable mortality index (QxX). Credit Suisse downsized its Life Finance Group in February 2010.

4 "Feature: Experts See A Happy Year for Settlements," by Trevor Thomas, published on the National Underwriter Web site only on January 11, 2010. National Underwriter is available at http://www.lifeandhealthinsurancenews.com/Exclusives/2010/1/Pages/Feature-Experts-see-a-happy-year-for-settlements.aspx?k=Life+Settlements. The Aite Group, LLC, Boston, MA, also has forecast a rebound in the life settlement business as noted by Trevor Thomas in a January 29, 2010 National Underwriter item available at http://www.lifeandhealthinsurancenews.com/News/2010/1/Pages/Aite-Group-Life-Settlement-Business-Will-Rebound.aspx?k=Life+Settlements.

5 News and industry reports show that only one life settlement securitization has been rated in recent years. In early 2009, American International Group (AIG) securitized a pool of life settlement policies with a face value of approximately $8.4 billion; this was an internal transaction between two units of AIG. A.M. Best Company, a credit rating organization serving the financial services industries, rated the securitization but did not publicly release the rating as this was a private transaction.

6 Kramer v. Lockwood Pension Services, Inc, et al., 653 F.Supp2d 354, S.D.N.Y. September 1, 2009. (Question certified to the New York Court of Appeals by the U. S. Court of Appeals for the Second Circuit, January 21, 2010.) The New York Court of Appeals heard oral arguments in the case on October 12, 2010.

7 Viatical Settlements Model Act and Viatical Settlements Model Regulation. Copies of the model laws are available from National Association of Insurance Commissioners: http://www.naic.org/store_pub_legal.htm#model_laws. A copy of the Viatical Settlements Model Regulation is available on the LISA Web site.

8 The FINRA, formed in 2007 as successor to the National Association of Securities Dealers, is the largest independent regulator for securities firms doing business in the United States.

9 The FINRA's Regulatory Notice 09-42 is available at https://www.finra.org/rules-guidance/notices/09-42.

10 In April 2009, the U.S. Senate Special Committee on Aging held a hearing entitled, "Betting on Death in the Life Settlement Market – What's at Stake for Seniors?" Details of this hearing can be found at https://www.aging.senate.gov/hearings/betting-on-death-in-the-life-settlement-market-whats-at-stake-for-seniors, and details of the related Committee investigation are available at https://www.aging.senate.gov/press-releases/kohl-calls-for-better-regulation-more-transparency-of-life-settlement-market. In September 2009, the House Financial Services Subcommittee on Capital Markets, Insurance, and Government Sponsored Enterprises held a hearing entitled, "Recent Innovations in Securitization." Details of this hearing are available at https://financialservices.house.gov/calendar/eventsingle.aspx?EventID=231744.

11 The Life Settlement Task Force is discussed in SEC Chairman Mary L. Schapiro's address before the Solutions Forum on Fraud, October 22, 2009, at http://www.sec.gov/news/speech/2009/spch102209mls.htm.

12 See Section 24 of the Federal Deposit Insurance Act; 12 C.F.R. Part 362 (Activities of Insured State Banks and Insured Savings Associations); 12 C.F.R. Part 1 (Investment Securities).

13 See Final Regulation R: Exceptions and Exemptions for Banks from the Definition of "Broker" (FIL-92-2007, Oct. 25, 2007), https://www.fdic.gov/news/inactive-financial-institution-letters/2007/fil07092.html and Securities Activities of Banks: Exceptions and Exemptions for Banks from the Definition of "Broker" (FIL-89-2008, Sept. 10, 2008), http://www.fdic.gov/news/news/financial/2008/fil08089.html.

14 12 C.F.R. Part 332.

15 See U.S. Department of Health and Human Services Summary of the HIPAA Privacy Rule: http://www.hhs.gov/ocr/privacy/hipaa/understanding/summary/index.html; see also FDIC Compliance Manual, VIII-6.8 – 6.11 (Fair Credit Reporting Act Examination Procedures, Section 604(g) Protection of Medical Information).

16 The NASD August 2006 Notice to Members is available at www.finra.org/web/groups/industry/@ip/@reg/@notice/documents/notices/p017131.pdf.

17 The FINRA investor alert is available at https://www.finra.org/investors/alerts.

18 The National Association of Insurance Commissioners Web site at http://www.naic.org/state_web_map.htm contains information for consumers and investors by state, including licensing information.

19 As a general rule, in the absence of a court order (usually arising out of a divorce proceeding), there is no legal right to be named as a beneficiary in a life insurance policy or trust. Some State laws allow former beneficiaries or heirs to challenge the validity of the sale of a policy following an insured's death, based on a variety of factors including lack of insurable interest, mental capacity of the insured, and applicable periods of contestability.

20 NASAA's top 10 investor traps for 2009 are discussed on its Web site at https://www.nasaa.org/5232/nasaa-identifies-top-10-investor-traps/?qoid=current-headlines.

21 Also known as Speculator-Initiated Life Insurance (SPINLIFE).

22 All names in this case study have been changed.

23 These administrative services include a tracking agent, collections manager, policy custodian, premium and claims administrator, and accounting services.