Introduction

The Federal Deposit Insurance Corporation (FDIC) and other regulators conduct numerous on-site examinations every year. The information gleaned from the examination process can assist in the prioritization of supervisory resources and the identification of issues for further attention. This article summarizes the initial results of a process the FDIC has implemented to enhance its ability to synthesize and analyze the complex and multi-dimensional information being generated by the examination process.

The FDIC implemented the Credit and Consumer Products/Services Survey (Survey) in October 2009 to supplement the collection of more traditional examination information and provide a means to marry this information with other data for horizontal analysis. The Survey replaced an FDIC underwriting survey introduced in 1995 and includes a series of questions to examiners to assess the level of risk and quality of underwriting practices associated with these credit products: construction and development (C&D), commercial real estate (CRE), commercial and industrial (C&I), 1-4 family residential mortgages, home equity, consumer, credit cards, agriculture, and reverse mortgages. The Survey also extends beyond underwriting practices and solicits information about new and evolving activities and products, local market conditions for CRE loans, funding practices, and consumer compliance issues.

The more comprehensive data collected in the new Survey will enable additional forward-looking analyses on a wider variety of areas. One of the underlying strengths of the new Survey is the ability to join Survey data together with other existing sources. These data sources include: financial (Call Report, Uniform Bank Performance Report (UBPR), etc.); economic (unemployment, real estate and commodities trends, etc.); consumer (credit score trends, housing loan demand, etc.); and examination data (ratings and adverse classification trends, etc.). These combined data sets will enable richer analysis of changing trends and products and how they might affect financial institutions and consumers.

The Survey is completed by examiners at FDIC-supervised banks of all types and sizes across the country; however, the vast majority result from examinations of smaller community banks. The broad base of topics covered by the Survey – combined with its emphasis on the examiner's evaluation of risks being taken on by the institution – make the information a good complement to surveys conducted by other bank regulatory agencies, such as the Federal Reserve Board's senior loan officer survey of larger domestic banks and U.S. branches of foreign banks and the Office of the Comptroller of the Currency's (OCC) annual underwriting survey of examiners on commercial and retail lending standards and credit risk at the largest national banks.1

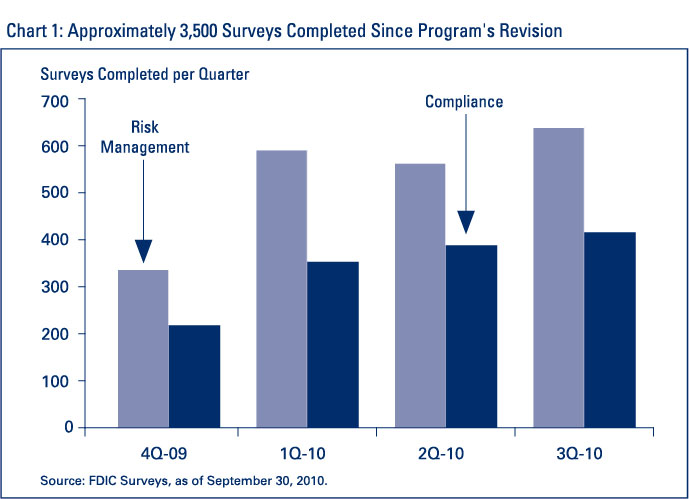

Through September 30, 2010, more than 2,100 Surveys have been completed based on findings from risk management examinations and nearly 1,400 have been completed based on findings from consumer compliance examinations. (See Chart 1 for information on the number of Surveys completed by quarter.)

The FDIC plans to review and analyze Survey data on an ongoing basis and provide insights on how evolving economic conditions and resulting operational strategies are affecting the risk profiles of insured institutions. Based on analysis of recent survey results, this article summarizes areas of particular interest to regulators and bankers.

General Underwriting and Credit Trends

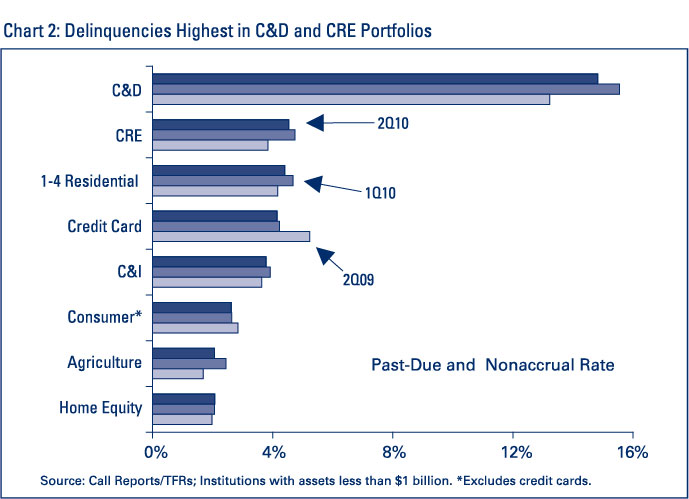

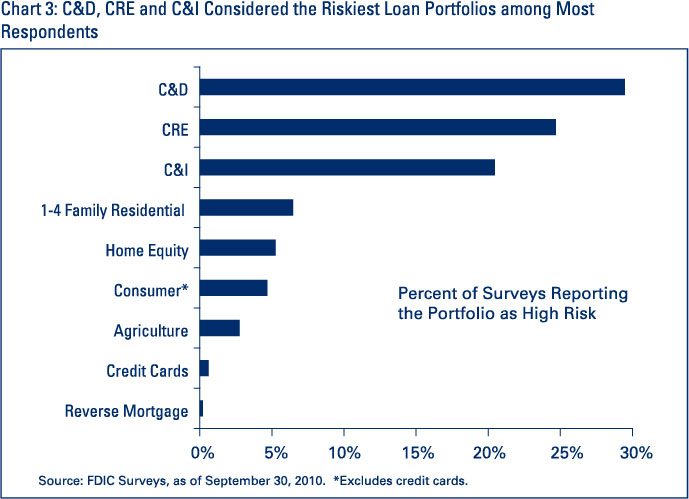

Overall, Survey responses tend to confirm portfolio performance metrics that appear in other published industry reports, such as the FDIC's Quarterly Banking Profile. As reflected in Chart 2, delinquency rates are highest in C&D loans while Chart 3 shows that Survey respondents are reporting credit risk at the highest level in C&D portfolios. The level of credit risk associated with non-C&D commercial real estate and C&I lending also is considered high at many institutions.

Not surprisingly, Survey results indicate that certain weak underwriting practices have contributed to elevated levels of credit risk; these practices include:

- funding C&D projects on a speculative basis;

- funding loans without consideration of the borrower's repayment ability via global cash flows;

- failing to verify the quality of alternative repayment sources; and

- using appraisal values that appear unrealistic when current economic conditions or trends in real estate prices are weakening.

Survey data suggest that many institutions with concentrations in CRE loans would benefit from stronger portfolio management. Specifically, 45 percent of the Surveys for institutions with CRE concentrations (focused primarily on a subset of institutions with CRE loans exceeding 300 percent of total capital) indicate management of that portfolio segment is less than satisfactory. Further, compliance with interagency CRE guidance is considered poor or weak at 39 percent of the institutions in this subset. Appropriately, institutions exhibiting material weaknesses in this group have been assigned a composite "3," "4," or "5" under the Uniform Financial Institutions Rating System (UFIRS).2

Although portfolios with weak underwriting and poor loan administration were first affected by the downturn in the economy and the nation's real estate markets, stressed market conditions now are pressuring even prudently underwritten loans. For example, approximately 90 percent of the Surveys for banks with CRE loan concentrations describe local real estate conditions as "sluggish," "very weak," or "distressed." These same Surveys also tend to suggest that a strong turnaround in market conditions in the near term is unlikely as approximately 80 percent report deteriorating property values. In addition, more than 90 percent describe the inventory of unsold CRE property in their markets as "excess supply" or "saturated."

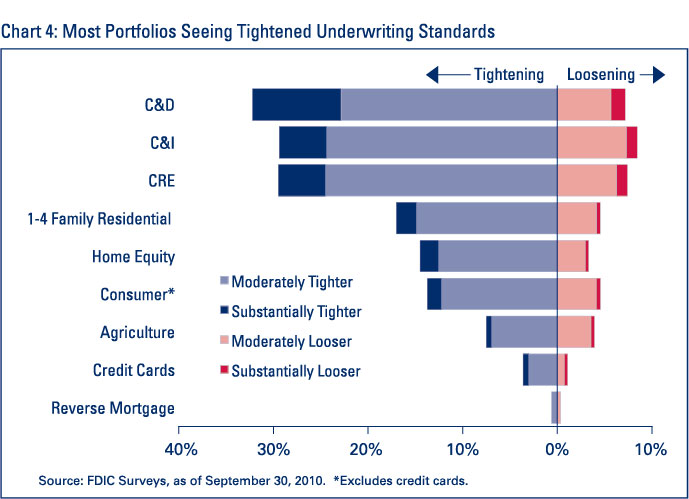

As detailed in Chart 4, Survey results to date indicate most insured institutions have reacted to adverse market conditions by tightening underwriting standards. Specifically, tighter standards are being applied in the areas of maximum size of credit lines, maximum maturity of loans or credit lines, spreads of loan rates over banks' cost of funds, loan covenants, and collateral requirements.

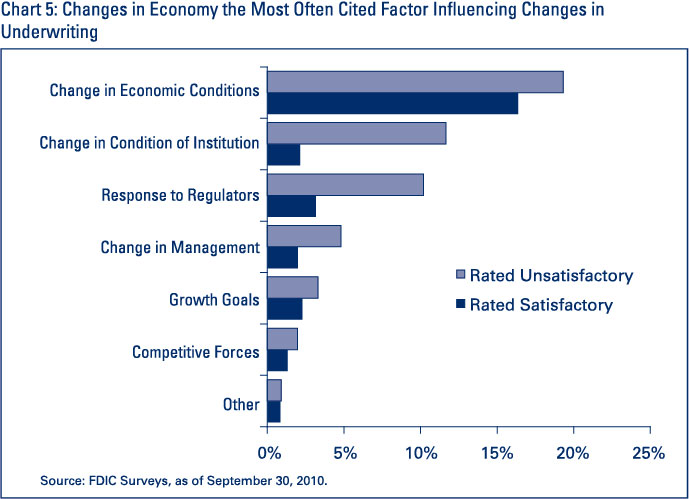

As reflected in Chart 5, Survey data indicate that underwriting practices were modified most frequently in response to changing economic conditions. Appropriately, institutions exhibiting material weaknesses and identified as a composite "3," "4," or "5" under the UFIRS also tended to tighten standards as a means of strengthening their financial condition.

Even with this shift toward more conservative underwriting practices, banks are attempting to find an appropriate balance when working with existing customers who may be under stress. For example, the Survey results note significant renewal activity regarding commercial, CRE, and C&D loans and, in some cases, these renewals were made without the bank obtaining a material principal reduction. Although the lack of principal reduction is not generally a desired practice on a widespread basis, such actions can be in the borrower's and lender's best interest when appropriately reported and designed to maximize recovery of problem credits. In this regard, Survey results indicate the loan workout processes at many of these institutions were determined acceptable overall suggesting that, for the most part, institutions are trying to prudently work out troubled credits.

At this point, examiners view current underwriting practices for most institutions as "generally conservative" to "about average" for all credit types. Direction of any future changes will vary by institution, with much depending on economic conditions in the institution's markets along with its overall financial condition.

Out-of-Territory Lending

The Survey results also have provided insights into other lending activities, such as out-of-territory lending. Although out-of-territory lending can potentially diversify an institution's portfolio and reduce concentration risk, the Survey data indicate that some banks increased their overall risk profiles because of the loan types booked through this type of lending. Twenty-seven percent of all risk management examination Surveys report frequent or common out-of-territory lending in commercial, residential, or consumer portfolios. The overwhelming majority (89 percent) of out-of-territory lending activity was reported in commercial/CRE (includes construction and development) portfolios with considerably less activity identified in residential and consumer portfolios.

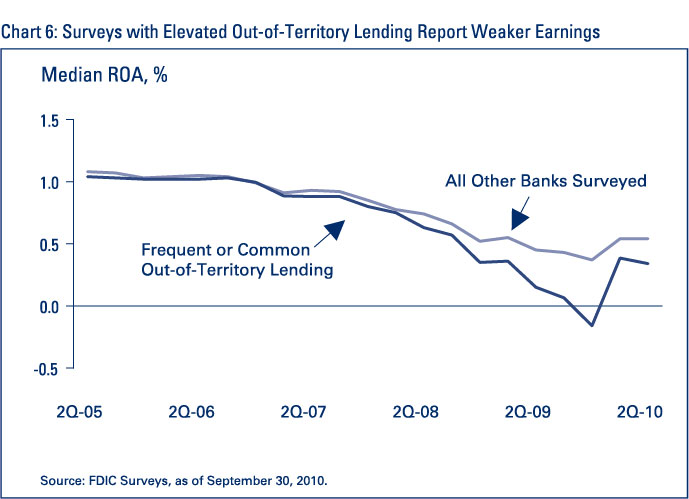

Institutions captured in the Survey that exhibit frequent or common out-of-territory lending activity tended to have higher levels of credit risk and looser overall underwriting standards, particularly in C&D portfolios. Chart 6 shows that during the recent crisis, these banks tended to reflect weaker earnings performance.

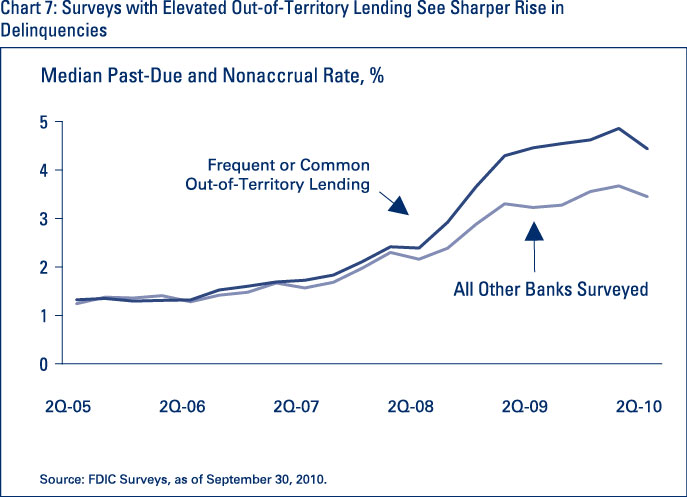

At the same time, past-due loan rates reported by institutions identified as having elevated out-of-territory lending activity have risen more steeply since 2008 (see Chart 7), and almost two-thirds of these institutions are rated "Unsatisfactory."3 Further, Material Loss Reviews indicate that out-of-territory lending has played a role in several bank failures during this economic cycle.4

Before engaging in out-of-territory lending, institutions should ensure the infrastructure is in place to monitor and administer these loans. The infrastructure should include an assessment of how stress conditions may affect this portfolio segment. Further guidance is available as part of the Loan Participation section of the Risk Management Manual of Examination Policies.5

Trends Likely to Affect Compliance Programs

As institutions seek new and diversified sources of income and ways to reduce operating costs, management must consider how any operational changes or introduction of new products may affect consumers. A review of recent Survey results identifies the following trends with implications for an institution's consumer compliance program.

Third-Party Risk

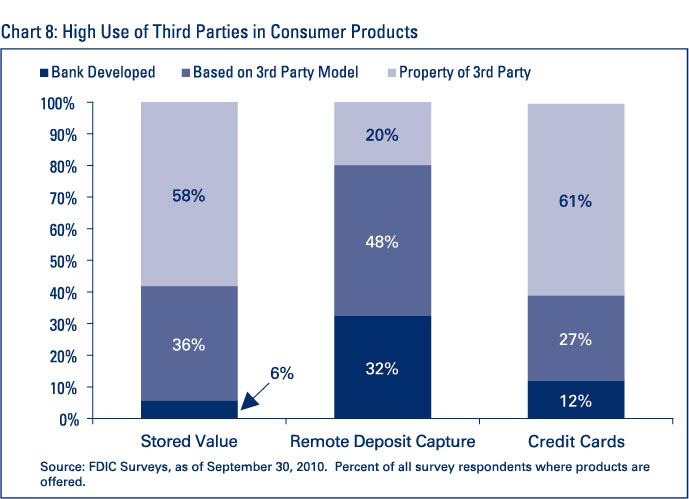

Compliance-related Survey data show a relatively high use of third parties to deliver consumer products and services. For example, the Survey shows that 40 percent of institutions offer credit cards, of which more than half (61 percent) are the asset of a third party, and another 27 percent are based on third-party models or programs (see Chart 8). Third parties also are prevalent in the delivery of stored value cards; 19 percent of institutions surveyed offer these products, of which 94 percent involve a third party. Remote deposit capture frequently involves third parties; in fact, 68 percent of institutions that offer this service report the use of a third party.

The use of third parties can provide a cost-effective way for institutions to offer a variety of products and services. However, these relationships must be managed to ensure consumers are protected from practices that may be deemed unfair or deceptive. Recent public enforcement cases involving Unfair or Deceptive Acts and Practices (UDAP) concern institutions' failure to properly manage third-party risk which can create significant financial liabilities and increase reputation risk. In 2008, the FDIC published guidance containing principles that institutions should consider when managing significant third-party risk exposure. The guidance encourages institutions to implement controls that consider such factors as the complexity, magnitude, and nature of the third-party arrangements.6

Reverse Mortgages

An increasing number of institutions are considering entering the reverse mortgage market, becoming involved as a direct lender or through participation in some stage of the lending process, such as referring applications to specialized lenders. Currently, the market is dominated by the Home Equity Conversion Mortgage (HECM) program – a federal government loan program operated by the U.S. Department of Housing and Urban Development (HUD). Some lenders also offer "proprietary" reverse mortgage programs which have different requirements and cost structures.

The recent downturn in the housing market has impacted the reverse mortgage market, primarily due to declining property values. As of August 31, 2010, HECM activity is down approximately 30 percent from a year ago.7 However, as housing markets begin to stabilize, reverse mortgage lending may rebound. For smaller institutions, entry into this market could involve relationships with third parties, particularly reverse mortgage lending specialists operating on a regional or national level. Anecdotal comments from Survey respondents suggest many institutions are investigating relationships with third parties as a means of offering these products to their customers.

Regardless of how an institution is involved in this type of lending, a range of consumer protection and regulatory compliance issues must be managed; these include, among others, the cross-selling of other financial products, equity-sharing agreements, and aggressive marketing. In addition, compliance with consumer regulations, such as Truth-in-Lending, fair lending, etc., must be ensured.8 The Federal Financial Institutions Examination Council (FFIEC) recently released guidance to help institutions identify and manage these risks.9

Remote Deposit Capture Services

In addition to lending activities, the Survey results show that other non-credit products and services are evolving. As of September 30, 2010, approximately 38 percent of compliance-related Surveys indicate that institutions offer remote deposit capture (RDC) services. Anecdotally, many smaller institutions have begun to offer this service only for business customers. Many cost-effective RDC technologies, including smart phone applications, are now in the marketplace and poised to gain ground in the consumer market. Institutions' compliance management systems will need to manage risks relating to Check 21 (Regulation CC) compliance, UDAP (clear fee and program disclosures) as well as risk management, information technology, and Anti-Money Laundering/fraud. Due to expected growth in this product line, the FFIEC issued RDC guidance in January 2009 to outline appropriate risk management processes to measure and monitor risks with this service, including oversight of third parties.10

Conclusion

Overall, Survey results show that banks are responding to ongoing economic and competitive challenges in a variety of ways, for example, by tightening underwriting standards and making use of third-party service providers to offer new and innovative products. These operational changes can affect an individual institution's risk profile and its ability to effectively manage the resulting consumer compliance risks. The analysis of data gathered through this Survey will continue to help the FDIC understand how effectively bank safety-and-soundness and compliance risk management systems are keeping pace with these changes.

Jeffrey A. Forbes

Senior Examination Specialist

jforbes@fdic.gov

David P. Lafleur

Senior Examination Specialist

dlafleur@fdic.gov

Paul S. Vigil

Senior Management Analyst

pvigil@fdic.gov

Kenneth A. Weber

Senior Quantitative Risk Analyst

kweber@fdic.gov

1 The Federal Reserve Board contacts senior loan officers at up to 60 large domestic banks and 24 large U.S. branches of foreign banks as frequently as six times a year. This survey collects qualitative and quantitative information on credit availability and demand along with new developments and changes in lending practices. The OCC conducts an annual underwriting survey to assist in monitoring commercial and retail lending standards and credit risk at the largest national banks. In 2009, OCC examiners completed the survey on 59 banks with assets of at least $3 billion.

2 Under the UFIRS, each institution is assigned a composite CAMELS rating based on an evaluation and rating of these component factors: adequacy of Capital, quality of Assets, capability of Management, quality and level of Earnings, adequacy of Liquidity, and Sensitivity to market risk.

3 An Unsatisfactory rating is defined as having a CAMELS composite rating of "3," "4," or "5."

4 In accordance with Section 38(k) of the Federal Deposit Insurance Act, if failure of an insured institution causes the Deposit Insurance Fund to incur a material loss, the Inspector General of the appropriate federal banking agency must review the agency's supervision of the institution and make a written report (referred to as a Material Loss Review) to the agency.

5 FDIC Division of Supervision and Consumer Protection's Risk Management Manual of Examination Policies http://www.fdic.gov/regulations/safety/manual/section9-1.html#part5.

6 "Guidance for Managing Third-Party Risk," FIL-44-2008, June 6, 2008. http://www.fdic.gov/news/news/?financial/2008/fil08044.html.

7 U.S. Department of Housing and Urban Development, "HECM Endorsement Summary Reports," September 1, 2010. http://www.hud.gov/pub/chums/f17fvc/hecm.cfm.

8 David P. Lafleur, "Reverse Mortgages: What Consumers and Lenders Should Know," Supervisory Insights, Winter 2008, p. 14. http://www.fdic.gov/regulations/examinations/supervisory/insights/siwin08/si_win08.pdf.

9 Federal Financial Institutions Examination Council, "Reverse Mortgage Products: Guidance for Managing Compliance and Reputation Risks," August 16, 2010. http://www.ffiec.gov/press/pr081610.htm.

10 "Risk Management of Remote Deposit Capture," FIL-4-2009, January 14, 2009. http://www.fdic.gov/news/news/financial/2009/fil09004.html.