The U.S. senior citizen population is growing. Between 1990 and 2000, the number of individuals at least 65 years of age increased from 31.2 million to nearly 35 million. Many more are reaching the minimum social security retirement age; by 2010, more than 50 million people in this country will be at least 62 years old.1 Life expectancies are lengthening, creating the need for retirement income to last longer than in previous generations. However, according to the U.S. Government Accountability Office, "Efforts to increase personal savings outside pension arrangements seem to have had only marginal success."2 As a result, older people who need additional funds to cover general living expenses are turning to the reverse mortgage lending market in greater numbers.

Historically, the largest investment of the average American household is its primary residence. A recent study by the American Association of Retired Persons (AARP) indicates that more than 80 percent of households over the age of 62 own their own home, with an estimated value of $4 trillion.3 Until recently, equity in these homes has not been tapped, but now it represents a likely source of retirement income and an opportunity for significant growth in the reverse mortgage lending industry. This article describes the features of reverse mortgage loan products, identifies key consumer concerns, and provides an overview of potential safety and soundness and consumer compliance risks that lenders should be prepared to manage when implementing a reverse mortgage loan program.

What Is a Reverse Mortgage?

Reverse mortgage loans are designed for people ages 62 years and older. This product enables seniors to convert untapped home equity into cash through a lump sum disbursement or through a series of payments from the lender to the borrower, without any periodic repayment of principal or interest. The arrangement is attractive for some seniors who are living on limited, fixed incomes but want to remain in their homes. Repayment is required when there is a "maturity event" that is, when the borrower dies, sells the house, or no longer occupies it as a principal residence.

Almost all reverse mortgage lending products are nonrecourse loans: Borrowers are not responsible for deficiency balances if the collateral value is less than the outstanding balance when the loan is repaid. This situation, known as crossover risk, occurs when the amount of debt increases beyond (crosses over) the value of the collateral.

Reverse mortgages are fundamentally different from traditional home equity lines of credit (HELOCs), primarily because no periodic payments are required and funds flow from the lender to the borrower. The servicing and management of this loan product also differ from those of a HELOC. (See Table 1 for a comparison of reverse mortgage loan products and HELOCs.)

Table 1

| Features of Reverse Mortgage and HELOC Products | ||

|---|---|---|

| Reverse Mortgage | HELOC | |

| Collateral/security interest | Borrower remains owner of home; lender takes security interest. | Borrower remains owner of home; lender takes security interest. |

| Flow/access to loan funds | Several options, including periodic payments to borrower and draws on the total available credit. | Borrower draws funds as necessary. |

| Interest, fees, and charges | All up-front and periodic fees are added to the loan balance. Interest continues to accrue on the outstanding balance until repayment at the end of the loan. | Depending on the program, borrower may pay fees outside closing or by adding them to the unpaid balance. Interest and fees are assessed on outstanding balance until repaid. |

| Repayment | No periodic payments of principal or interest. One payment is due when borrower dies, sells the house, or no longer occupies it as a primary residence. | Payments vary by program. Generally, HELOCs feature monthly interest-only payments for a set period of time, followed by flexible principal and interest payments until the maturity date. |

| Maximum loan amount | Some programs allow the maxi-mum loan amount to grow over time (see description later in text of Home Equity Conversion Mortgage). | May vary by program, but most establish the maximum amount based on combined loan-to-value ratio at the time of origination. |

| Loan suspension | Unused loan proceeds may not be suspended by the lender. | Subject to Regulation Z requirements, unused lines of credit may be suspended in response to delinquent payments or significant decline in collateral value. |

Evolution of the Reverse Mortgage

Reverse mortgages have been available for more than 20 years, but consumer demand has been relatively weak because of uncertainty about how this product works. Consumers often ask the following questions:

- Can I retain the title to my house?

- What happens if the loan balance exceeds my home's value?

- Will I be able to bequeath my home to my heirs?

Financial institutions have been slow to enter the reverse mortgage lending market because of the unique servicing and risk management challenges. For example, when the reverse mortgage was first introduced, banks were wary of booking potentially long-term loans that increase over time, do not have a predefined, scheduled repayment stream, and for which there was no established secondary market. Lenders also faced uninsured crossover risk.

However, the market changed in 1988 when the Federal Housing Administration (FHA) launched the Home Equity Conversion Mortgage Insurance Demonstration, a pilot project that eventually was adopted permanently by the U.S. Department of Housing and Urban Development (HUD).4 The outcome was the Home Equity Conversion Mortgage (HECM), a commercially viable loan product with strong consumer protections. For example, the HECM requires prospective borrowers to complete a pre-loan counseling program that explains the nature of reverse mortgages, including the risks and costs.5

In addition, the HECM is a nonrecourse credit that protects consumers from crossover risk. HECMs carry FHA insurance, which protects lenders from this risk. HECMs have maximum loan amounts based on the location of the collateral (the house). (See Table 2 for details.)

Table 2

| Features of HECMs and Proprietary Programs | ||

|---|---|---|

| HECM | Proprietary Programs | |

| Who grants the loan? | FHA-approved lenders. | Individual lenders. |

| What is the maximum loan amount? | Primarily based on the age of the youngest borrower. For all HECMs insured after November 5, 2008, the maximum loan amount is $417,000. The limit is higher in identified high cost areas in Alaska, Hawaii, Guam, and the Virgin Islands. In these areas, loans may exceed the national limit up to 115 percent of the area median price or $625,500, whichever is less.6 | Lender's discretion. Generally these are jumbo loans designed to fill the market niche for borrowers who want loans above the HECM limit. |

| How are funds drawn? | Borrowers have five options: 1. Fixed monthly payments 2. Fixed monthly payments for a set period 3. Line of credit, drawn for any amount at any time 4. Combined fixed payments and a line of credit 5. Combined fixed payment term and a line of credit | Lender discretion—programs vary. |

| Does overall loan cap grow over time? | Yes. HECM allows the loan to grow each year. For example, the unused loan balance is increased by the same rate as the interest charged on the loan. Therefore, for the unused portion of the loan, the total loan amount continues to grow. | No. |

| What happens if the value of the house becomes less than the amount of the loan? | FHA insures the difference. The borrower (or borrower's heirs) will not be responsible for shortages if the value falls below the outstanding balance. The borrower pays FHA insurance premiums during the term of the loan; these premiums are added to the loan balance. | Anecdotal market data suggest that most current programs are nonrecourse loans. However, programs vary and may be subject to limits under state laws. Lenders bear the risk of collateral shortages. |

| What are the costs and fees? | Origination fee: maximum of 2 percent of the first $200,000 plus maximum of 1 percent of amounts over $200,000. The overall cap is $6,000. The minimum is $2,500, but lenders may accept a lower origination fee when appropriate. Mortgage insurance (2 percent initial plus .5 percent annually). Monthly servicing fee: $30. Other traditional closing costs (appraisal, title, attorney, taxes, inspections, etc.). | Lender discretion. |

In some cases, individuals with high value homes desire loans that exceed HECM maximums. This demand led to the development of private, proprietary programs through which consumers can obtain alternative loan products if they need access to higher equity amounts. However, crossover risk is a concern with these proprietary programs, as no insurance is available to cover potential collateral deficiencies. Generally, in these private programs, greater risk translates into higher costs for consumers—lenders must price products to cover the risk of repayment or loss. (See Table 2 for a comparison of HECMs and proprietary programs.)

The need for higher HECM loan limits was addressed as part of the Housing and Economic Recovery Act of 2008 (HERA), signed into law on July 30, 2008. The HERA effectively raised the maximum HECM loan amount from a range of $200,160— $362,790 to a new nationwide ceiling of $417,000, by tying the limit to the national conforming limits for Freddie Mac. (Higher limits are allowed in certain, designated high cost areas, as noted in Table 2.) Given that the maximum amounts were only recently changed, the impact on the demand for proprietary jumbo loans is not yet known.

In addition to HECMs and proprietary programs, Fannie Mae previously offered the Home Keeper reverse mortgage loan program. This product featured many of the same consumer protections as the HECM, including the counseling requirement, as well as generally higher maximum loan amounts. However, the program did not capture a large segment of the market, and Fannie Mae terminated it in September 2008 subsequent to the new loan limits allowed under the HERA.

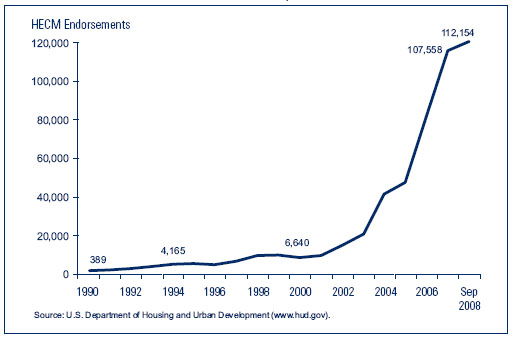

Overall, even with the emergence of proprietary programs, more than 90 per-cent of reverse mortgages are HECMs, and the number of HECMs has increased steadily since 2004. During HUD's 2007 fiscal year, 107,558 HECMs were insured by the FHA, an increase of more than 40 percent over the previous year.7 As of September 2008, more than 112,000 HECMs had been insured by the FHA during the calendar year (see Chart 1).

Chart 1: HECM Endorsements Have Increased Dramatically Since 2004

Consumer Issues

Reverse mortgages benefit consumers by providing a nontaxable source of funds. This is particularly attractive to seniors who have limited, fixed incomes but high amounts of home equity. These loans can enable some people to continue living in their homes, which may not have been feasible without this additional source of cash. However, this loan product is not for everyone, and potential borrowers should carefully assess the pros and cons before taking on a reverse mortgage.

The report Reverse Mortgages: Niche Product or Mainstream Solution? published by the AARP Public Policy Institute in late 2007 presents information about consumers who obtained reverse mortgages, as well as those who opted not to pursue them after completing the required pre-loan counseling.8 Survey respondents cited many reasons for deciding not to pursue a reverse mortgage. The following represent the three most-cited reasons: the high cost (63 percent); respondents found another way to meet financial needs (56 percent); or respondents determined that the loan was not necessary given the individual's financial position (54 percent).9

The results of this study highlight key consumer considerations, such as the importance of pre-loan counseling, which may provide information about other programs better suited to a borrower's needs. For example, local lenders and community organizations may offer low-cost home improvement loans for seniors. In some cases, consumers might find they are better off financially if they sell their property rather than refinance an existing loan with a reverse mortgage.

Lenders also face risks associated with the various consumer issues, including those identified in the AARP survey. For example, there is a potential for reputation risk, and perhaps even legal risks that could result from aggressive cross-marketing of other financial products, such as long-term annuities. Some financial service providers encourage reverse mortgage borrowers to draw funds to purchase an annuity or other financial product. Interest begins to accrue immediately on any funds drawn from the reverse mortgage, and borrowers may lose other valuable benefits, such as Medicaid. For example, funds that are drawn and placed in deposit accounts or non-deposit investments would be included in the calculation of the individual's liquid assets for purposes of Medicaid eligibility.

Aggressive cross-selling is considered predatory by many consumer advocates. In fact, the HERA specifically prohibits lenders from conditioning the extension of a HECM loan on a requirement that borrowers purchase insurance, annuities, or other products, except those that are usual and customary in mortgage lending, such as hazard or flood insurance. These prohibitions apply to HECMs but not to products in a proprietary lending program—a fact consumers should consider when choosing a reverse mortgage product.

Another potentially predatory practice is equity-sharing requirements, which are contractual obligations for borrowers to share a portion of any gain—or, in some cases, equity—when the loan is repaid. These provisions mean additional, sometimes substantial, charges that the consumer or the consumer's estate is obligated to pay, thus reducing the consumer's share of his or her home value. Such provisions are prohibited in the HECM program but were a component of early reverse mortgage programs developed in the 1990s. A person who chooses a proprietary program should carefully review contracts for the existence of these provisions.

Table 3

| Safety and Soundness Concerns in Reverse Mortgage Lending | |

|---|---|

| Issue | Description |

| Property appraisals | Lenders must ensure that property appraisals are conducted in accordance with the requirements of the appraisal regulations in Part 323 of the FDIC Rules and Regulations. |

| Real estate lending standards | Lenders must comply with Part 365 of the FDIC Rules and Regulations, which requires insured state nonmember banks to adopt and maintain written policies that establish appropriate limits and standards for extensions of credit that are secured by liens on or interests in real estate, or that are made for the purpose of financing permanent improvements to real estate. |

| Third-party risks | Lenders must manage potential risks associated with third-party involvement. This is particularly relevant to situations in which lenders either conduct wholesale activities or act as brokers or agents themselves. For additional details, refer to "Guidance for Managing Third-Party Risk" (FDIC Financial Institution Letter FIL-44-2008, June 6, 2008), https://www.fdic.gov/news/inactive-financial-institution-letters/2008/fil08044.html. |

| Servicing complexity | Specialized loan servicing functions must be implemented, including processes for disbursing proceeds over extended periods of time and monitoring maturity events that will necessitate repayment. |

| Securitization and liquidity | Although a secondary market for reverse mortgage lending exists, it is relatively new, and financial institution expertise in this area may be limited. |

| Collateral | Lenders/servicers must ensure that collateral condition is maintained during the term of the loan. |

Regulatory and Supervisory Considerations

Given the downturn in traditional 1–4 family mortgage lending, reverse mortgages may become an attractive product line for some institutions. However, these loans can include complex terms, conditions, and options that could heighten consumer compliance and safety and soundness risks.

Financial institutions participate in the delivery of reverse mortgage loans in a variety of ways. Generally, the lender acts either as a direct lender or a correspondent (or broker) that refers applications to, or participates with, other lenders. Rather than developing the expertise in-house, small community banks might establish referral arrangements with other specialized lenders.

Regardless of the nature or extent of the institution's involvement in offering reverse mortgage products, management should be aware of the safety and soundness and compliance risks associated with this type of lending. Reverse mortgage lending is subject to many of the same underwriting requirements and consumer compliance regulations as traditional mortgage lending. Table 3 gives an overview of key safety-and-soundness issues, and Table 4 summarizes provisions of some of the federal consumer protection laws and regulations that apply to reverse mortgage lending.

In general, the same safety and soundness and consumer compliance regulations and requirements that apply to traditional real estate lending apply to reverse mortgage lending. However, reverse mortgages often present unique challenges and issues for institutions that plan to offer this product line for the first time. For example, management may need to amend operating policies and procedures to appropriately identify and manage the inherent risks, regardless of whether the institution offers reverse mortgages through direct lending or as a correspondent for other institutions.

Table 4

| Consumer Protection Laws and Regulations Applicable to Reverse Mortgage Products | |

|---|---|

| Truth in Lending Act (TILA), 15 U.S.C. 1601 et seq. / Regulation Z, 12 CFR 226 |

|

| Real Estate Settlement Procedures Act (RESPA), 12 U.S.C. 2601 et seq. / Regulation X, 24 CFR 3500 |

|

| Fair Lending (Equal Credit Opportunity Act, 15 U.S.C. 1691 et seq. / Regulation B, 12 CFR 202, and Fair Housing Act, 42 U.S.C. 3601et seq.) |

|

| Flood Insurance-National Flood Insurance Program, 42 U.S.C. 4001 et seq. |

|

| Unfair and Deceptive Acts or Practices (UDAP)-Section 5(a) of the Federal Trade Commission (FTC) Act, 15 U.S.C. 45(a) |

|

Conclusion

As the U.S. population continues to age and life expectancies lengthen, more people will be living longer in retirement and undoubtedly will need additional sources of long-term income. This scenario suggests that the demand for reverse mortgages will increase. Potential borrowers should weigh the pros and cons of this loan product for their particular financial situation, and lenders should take steps to ensure they understand how to identify and manage the risks associated with this product.

David P. Lafleur

Senior Examination Specialist

Division of Supervision and Consumer Protection

dlafleur@fdic.gov

1 U.S. Census Bureau, 2000 Census Population and Projections.

2 Retirement Income-Implications of Demographic Trends for Social Security and Pension Reform, United States General Accounting Office, July 1997, p. 7.

3 Donald L. Redfoot, Ken Scholen, and S. Kathi Brown, "Reverse Mortgages: Niche Product or Mainstream Solution? Report on the 2006 AARP National Survey of Reverse Mortgage Shoppers" (AARP Public Policy Institute, December 2007).

4 Redfoot, Scholen, and Brown, 2007, p. viii.

5 HUD partnered with the AARP Foundation's Reverse Mortgage Education Project to develop consumer-education materials and train and accredit financial counselors. For additional resources, see www.hecmresources.org/project/proje_project_goals.cfm.

6 "2009 FHA Maximum Mortgage Limits" (HUD Mortgagee Letter 2008-36, November 7, 2008).

7 National Reverse Mortgage Lenders Association, statistics as of July 2008.

8 Redfoot, Scholen, and Brown, 2007.

9 Percentages total to more than 100 percent because survey respondents could select more than one reason for not pursuing a reverse mortgage.

10 "Home Equity Conversion Mortgage (HECM) Program—Requirements on Mortgage Originators" (HUD Mortgagee Letter 2008-24, September 16, 2008).