During the past ten years, the nation's community banks have benefited from stable credit markets and relatively easy access to sources of liquidity. However, recent disruptions in the credit and capital markets have increased the challenges of liquidity planning for many institutions. Negative media coverage has heightened concerns among some bank customers about the safety of deposits. Emerging liquidity problems are particularly problematic for FDIC-insured institutions that rely on liability and off-balance sheet liquidity sources. These developments have reinforced the importance of effective bank liquidity management systems1 and have prompted the Federal Reserve and the FDIC to take steps to ease liquidity pressures on banks.

The Winter 2007 issue of Supervisory Insights featured "Liquidity Analysis: Decades of Change," an article that highlighted the increased use of wholesale funding, off-balance sheet funding sources, and the importance of effective liquidity management. This article builds on those concepts by highlighting in detail some of the unique features and risks associated with various liquidity sources. The article evaluates how a bank's liquidity position can be adversely affected by deteriorating financial conditions and offers suggestions for developing an effective liquidity contingency plan.

Setting the Stage for a Liquidity Problem

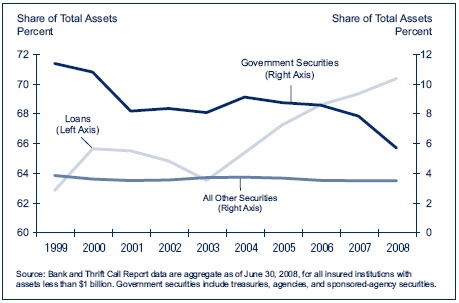

Liquidity problems facing community and regional banks can be attributed to a basic structural change during the past decade. Although asset-based liquidity management continues to be used by many community banks, most institutions have transitioned toward a liability-oriented structure. The desire for earnings and capital growth has encouraged banks to move to an asset structure more heavily weighted in profitable, but less liquid, asset classes (see Chart 1). This includes, for many community institutions, high concentrations in acquisition, development, and construction lending. The combination of a less liquid asset mix and increasing use of liability-based liquidity strategies has increased liquidity risks and required more careful management scrutiny.

Chart 1: The Shift Toward Higher-yielding Assets Continues Among Community Institutions

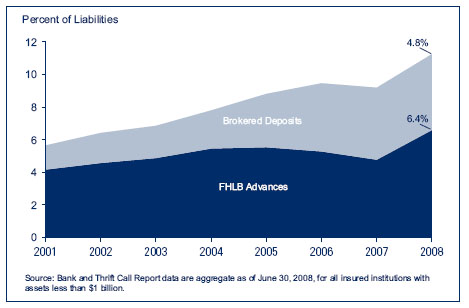

Community banks continue to struggle with attracting low-cost, stable deposits to fund growth. Although most institutions try to attract a large dollar volume of retail deposits, the challenges of deposit disintermediation and market competition have forced bankers to identify alternative funding sources. Advances in technology and greater access to liquidity markets have provided institutions with more funding options (see Chart 2).

Chart 2: Rapid Loan Growth Among Community Institutions Has Prompted an Increase in the Use of Certain Noncore Funding Products

Examiner observations indicate that many banks have established only rudimentary liquidity policies and contingency funding plans as part of the overall asset/liability management function. Monitoring ratios are often limited to a static analysis that depicts a point-in-time snapshot of the liquidity position. Comprehensive cash flow analyses that identify sources and uses of funds are rare. For example, a recent review of a multibillion dollar institution revealed that the sources-and-uses report tracked wholesale funding sources but did not incorporate retail cash flows. In many cases, contingency planning policies lack procedures based on bank-specific stress events, are not regularly updated to reflect current market conditions, and are not tested to ensure the accuracy of the assumptions.

A Liquidity Crunch

With this as background, we can analyze how the deteriorating financial condition of an institution can cascade into severe liquidity pressures. One or more scenarios can precipitate such problems:

- Home price depreciation affects local markets.

- Speculative residential development projects stall.

- Planned commercial real estate projects fail to materialize.

- A slowing economy reveals fraudulent activities.

- Expansions into new markets or products result in operational losses.

- External events, such as a natural disaster or a systemic liquidity problem, disrupt markets.

Asset quality problems in the loan portfolio are the most common precursor to liquidity issues. Deteriorating asset quality typically depletes earnings and core capital as additional loan loss provisions are required and write-downs to investments and other real estate occur. An increase in nonperforming assets also pressures interest income and cash flow. Finally, overhead expenses begin to rise due to higher legal, operational, administrative, and staffing costs.

As asset quality problems emerge, the level of regulatory oversight can be expected to intensify, and the potential for negative publicity may increase. Financial information on all financial institutions is readily available to the public each quarter. Publicly held financial institutions are required to notify the U.S. Securities and Exchange Commission (SEC) when significant events occur. For other banks, credit-sensitive providers will review significant Call Report amendments. In addition, formal enforcement actions or capital directives are made public. This information increases the likelihood that negative media attention, Internet blogs, or rumors within the community will erode the confidence of bank customers.

Management often is not prepared to cope with severe liquidity pressures. They likely have little experience dealing with liquidity problems and are focused primarily on resolving asset quality issues. If management has contributed to the asset quality problems or other operational weaknesses, it is not unusual for senior bank officers to leave as liquidity problems begin to develop. Key operations personnel also may leave the institution as problems emerge. A leadership vacuum can hamper the development and implementation of an effective response to liquidity problems.

A liquidity run on an institution typically is not characterized by Depression era-type lines circling a bank. Examples of activities that suggest a liquidity run could be occurring include:

- Automated teller machines, electronic banking services, and wire transfers are used to rapidly transfer monies out of an institution.

- Public deposits require increased collateral pledges or move to banks that are perceived as safer.

- Time deposit customers are willing to incur early withdrawal fees to access their funds.

- Uninsured depositors withdraw or remove funds to eliminate exposed amounts.

A bank that is experiencing rapid deposit outflows faces an immediate need for liquidity. However, the potentially higher cost of obtaining additional funds may further exacerbate operating losses. If the situation is severe, a liquidity failure may occur, even though the institution has not breached the capital threshold that triggers a presumption that the regulators will close it.

Strategies for Mitigating Liquidity Risks

Management should be alert to signs of liquidity problems. As these warning signs emerge, management should consider a range of options.

A critical first step in addressing potential liquidity problems is to understand the bank's operations and attempt to retain the current deposit base. Regardless of branch network size, management must have systems in place to solicit feedback from branch managers and monitor branch activity. Management should train branch managers and customer service representatives on how to communicate with depositors, including advising customers on how to properly title deposits and ensuring that they have an accurate understanding of their deposit insurance coverage. In particular, depositors should be made aware of the recent temporary increase in deposit insurance to $250,000 and the potential for full coverage of non-interest-bearing transaction accounts.2

Branch managers should understand their markets and quickly identify irregular deposit trends. Management should regularly communicate with operations personnel, perform daily cash flow analysis, and consider hiring a public relations firm to handle media inquiries and assist in developing strategies for communicating with depositors and the public.

Correspondent bank relationships likely will change as a bank's financial position deteriorates. Correspondent banks may require collateral to secure lines of credit. Management should review these contracts, as the correspondent bank may have the authority to cancel the line entirely. Even if a correspondent does not cancel the line, at best, these short-term unsecured lines are stop-gap measures because of embedded restrictions on borrowing or on the number of consecutive days a line can be used. A bank's ability to sell federal funds also could be affected, as the correspondent bank or purchasing banks may decide to limit exposures to an institution with known capital problems.

In some cases, correspondent banks will no longer process cash letters. For example, after reviewing an amended Call Report, one bank's main correspondent and clearing agent notified the bank that it would no longer lend to the institution on an unsecured basis. The bank was forced to enter into a repurchase agreement (using remaining unpledged securities) to ensure that the correspondent would continue to provide processing services. Situations like these can result in a scramble for an alternative correspondent banking relationship at the least opportune time.

Federal Reserve Banks can serve as a liquidity option by providing access to the Discount Window.3 This option also requires collateral documentation. Further, the FRB may move distressed banks from a primary to secondary credit program, which has various restrictions on borrowing from the Discount Window, along with the inability to bid on Term Auction Facility and Treasury Tax and Loan funds. Certain restrictions also can be placed on the bank's correspondent account when using the FRB for check clearing activities. The FRB likely will implement real-time monitoring and may increase the amount of required funds to process cash letter transactions, further constraining the amount of available liquidity.

Banks with high levels of wholesale funding must be aware of potential liquidity problems. The FHLB system is a primary provider of wholesale funding to community banks; these lines generally are secured by blanket liens on certain types of mortgages or mortgage-backed assets. In recent months, the FHLBs have made changes to risk rating programs4 that could affect an institution's borrowing capacity based on significant financial events, regulatory examination findings, or regulatory enforcement actions. Generally, access to FHLB lines is restricted as a bank's capital position deteriorates, and the bank's deposits at the FHLB might be frozen as a potential offset to these lines. The FHLB also might refuse to renew advances at maturity, accelerate the repayment of advances due to a covenant breach, increase collateral requirements, or reduce funding lines.5 Requirements to pay advances early could seriously constrain cash flow. Additional collateral requirements can limit a bank's ability to sell certain assets. Increased scrutiny and requests for physical custody of loan collateral will require greater management attention. Banks requesting access to the FHLB or increased lending must be prepared to dedicate substantial time and resources to completing applications and providing collateral documentation.

Although brokered deposits can serve as a reliable funding source when a bank is in good financial condition, this source can disappear quickly if the market believes an institution is in trouble and might be at risk of failure. An adverse change in perception may result in a liquidity crisis. Should capital erode, the bank may fall below the Well Capitalized6 threshold under the Prompt Corrective Action rules.7 Institutions designated as Adequately Capitalized must then apply to the FDIC for a waiver before they can accept, renew, or roll over any brokered deposit.8 The FDIC grants waivers on a case-by-case basis, depending on the bank's financial and operational condition. Approval of a waiver in many cases is conditioned on an institution's credible plan to limit growth, reduce its risk exposure, and return to a Well Capitalized position.

The FDIC cannot grant a waiver for a bank that is falling below the Adequately Capitalized level. Banks also are restricted in the deposit rates they may offer. Rates that exceed certain levels are considered a brokered deposit under FDIC Rules and Regulations.9 As a result, this rate-based restriction could reduce the availability of funding alternatives as a bank's capital condition deteriorates.

Many banks use Internet listing services as alternatives to brokered deposits. These deposits are not considered brokered unless the bank is less than Well Capitalized and the rates offered exceed the guidelines established in the brokered deposit regulations.10 An institution can obtain Internet deposits relatively quickly; however, recent market events have revealed limitations in this funding source. The number of Internet depositors is relatively small compared with the overall market, and the funds available from this source are limited, as each Internet depositor typically caps the amount placed at any one institution. If Internet deposits are part of an institution's liquidity plan, management should establish agreements with listing services and periodically acquire Internet deposits to test the viability of this liquidity source.

Banks facing liquidity problems often consider the benefits of selling assets (securities and loans) to generate additional cash and reduce the overall asset base. However, management should consider the downside risk of this strategy. In the case of the securities portfolio, management may discover that securities listed as available-for-sale may be needed to pledge additional collateral to secure public funds or other borrowing lines. For example, one institution initially was required to pledge collateral for public funds at 25 percent of the average public funds balance. After the examination results required significant Call Report amendments, the public entity increased the collateral requirement to 125 percent of the average balance. With no additional collateral available, the bank was forced to use cash as collateral to retain the deposits. Finally, as recent events have demonstrated, a plan to sell securities as a source of liquidity depends for its effectiveness on the credit quality and marketability of these securities.

Traditionally, loans are not as marketable as securities, and distressed loans are even less marketable. Bids may be severely discounted given the bank's stressed condition, and a deteriorating capital position may prevent the institution from realizing the sale. Finally, due diligence for loan sales requires time and effort. If bank management considers this option, establishing business relationships and completing initial due diligence is important. Asset sales or nonrecourse loan participations may negatively affect interest income, but they can also provide short-term liquidity.

As banks facing liquidity difficulties identify options for improving cash flow, the continued funding of loan commitments and lines of credit may impede effective liquidity management. During the past several months, some financial institutions have reduced or suspended home equity lines of credit and limited funding on other types of off-balance-sheet items to preserve cash. Bank management must consider how funding obligations could affect future liquidity and provide guidance in policies to address this issue.11

Developments Supporting Bank Liquidity

In light of recent liquidity events, federal programs have been implemented to bolster consumer confidence in the banking system and the marketplace.

On October 3, 2008, President George W. Bush signed the Emergency Economic Stabilization Act of 2008,12 which temporarily raises the basic limit on federal deposit insurance coverage from $100,000 to $250,000 per depositor. The legislation did not increase coverage for retirement accounts; this limit remains at $250,000. The legislation provides that the basic deposit insurance limit will return to $100,000 after December 31, 2009.

In addition, on October 14, 2008, the FDIC announced the creation of the Temporary Liquidity Guarantee Program (TLGP)13 as part of a broader government effort to strengthen confidence and encourage liquidity in the nation's banking system. The TLGP has two components. One guarantees newly issued senior unsecured debt of the participating organizations, within limits, issued between October 14, 2008, and June 30, 2009. The TLGP also provides full coverage for non-interest-bearing transaction deposit accounts, regardless of dollar amount, until December 31, 2009. Institutions may opt out of one or both programs.14

Recent Supervisory Guidance

Bank failures that have occurred during the past year, along with media coverage about perceived weaknesses in the financial system, have heightened the public's awareness of the existence of deposit insurance coverage and the need to monitor deposit balances. Community banks that are not experiencing liquidity pressures are now more aware of the importance of preparing in advance for the possibility of a liquidity run. As a result, the development and implementation of a contingency funding plan (CFP) is critical for all financial institutions.

In August 2008, the FDIC issued Liquidity Risk Management, which urges an institution's board of directors to establish a formal CFP policy that adopts quantitative liquidity risk limits and guidelines.15 This policy should address:

- Discrete or cumulative cash flow mismatches or gaps (sources and uses of funds) over specified future short- and long-term time horizons under both expected and adverse business conditions. Often, these are expressed as cash flow coverage ratios or specific aggregate amounts.

- Target amounts of unpledged liquid asset reserves expressed as aggregate amounts or as ratios.

- Asset concentrations, especially with respect to more complex exposures that are illiquid or difficult to value.

- Funding concentrations that address diversification issues, such as dependency on a few large depositors or sources of borrowed funds.

- Contingent liability metrics, such as amounts of unfunded loan commitments and lines of credit relative to available funding. The potential funding of contingent liabilities, such as credit card lines and commercial back-stop lending agreements, should also be appropriately modeled and compared with policy limits.

Further, the board of directors should use liquidity measurement tools that match their funds management strategies and provide a comprehensive view of an institution's liquidity risk. Risk limits should be approved by an institution's board and be consistent with the measurement tools used. Pro forma cash flows should show the institution's projected sources and uses of funds under various liquidity scenarios, identify potential funding shortfalls or gaps, and include assumptions that consider a wide range of outcomes. The liquidity measurement system also should include scenario analysis to assess the viability of different funding options.

This FDIC guidance further notes that an effective CFP does the following:

- Defines responsibilities and decision-making authority so that all personnel understand their roles during a problem-funding situation.

- Includes an assessment of the possible liquidity events that an institution might encounter.

- Details how management will monitor for liquidity events, typically through stress testing of various scenarios in a pro forma cash flow format.

- Assesses the potential for triggering restrictions on the bank's access to brokered and high-cost deposits, and the effect on the bank's liability structure.

- Identifies and assesses the adequacy of contingent funding sources. The plan should identify any back-up facilities (lines of credit), the conditions and limitations on their use, and the circumstances in which the institution might use such facilities. Management should understand the various legal, financial, and logistical constraints—such as notice periods, collateral requirements, or net worth covenants—that could affect the institution's ability to use back-up facilities.

The need for an effective CFP is particularly important for banks that rely on brokered deposits. As noted in Chart 2, brokered deposits as a percent of liabilities at FDIC-insured institutions has risen from 1.1 percent as of June 30, 1999, to 4.8 percent at June 30, 2008.16 Although brokered deposits can be a viable source of funding for certain institutions, management must consider the potential impact on renewing, accepting, or rolling over brokered deposits should capital fall below established limits. The CFP should outline steps for accessing practical and realistic funding alternatives if funding options are reduced.

Other items management should consider for the CFP include:

- A comprehensive communication strategy for dealing with external inquiries and internal training needs.

- An evaluation of the need for additional liquidity expertise to effectively implement the plan.

- A program to regularly test liquidity sources, including actually borrowing on current lines of credit to ensure that they are valid.

- A review of contracts for provisions that may allow funds providers to limit or cancel access to liquidity lines.

- Continual monitoring of wholesale funding sources to understand any changes in guidelines or collateral requirements.

Conclusion

In the current challenging environment, bank liquidity planning is becoming paramount. Although many banks have traditional contingency credit lines, established liquidity sources can quickly disappear when funding is most needed; in the worst cases, the result may be bank failure. Further, even if an institution can weather a liquidity storm, ineffective funds management decisions could irreparably impair earnings. A comprehensive, well-designed liquidity contingency plan can help bank -management effectively navigate a liquidity crisis.

Lloyd E. McIntyre III

Supervisory Examiner,

Scott Depot, WV

lmcintyre@fdic.gov

Peter A. Martino

Supervisory Examiner,

Tampa, FL

pmartino@fdic.gov

The authors acknowledge and thank the following people for their contributions to this article:

Louis J. Bervid—Senior Examination Specialist,

Washington, DC

Jeffrey A. Forbes—Senior Examination Specialist,

Chicago, IL

Franklin Gray—Chief,

Risk Management Applications Section,

Washington, DC

Kyle L. Hadley—Senior Capital Markets Specialist,

Washington, DC

Karen M. Hammer—Supervisory Examiner,

Los Angeles West, CA

Robert W. Lewis—Examiner,

Pensacola, FL

Robert B. Packard—Examiner,

Tampa, FL

Ronald Sims II—Financial Analyst,

Atlanta, GA

Bartow W. Smith, Jr.—Field Supervisor,

Charlotte, NC

1 See the FDIC's supervisory guidance and examination procedures regarding sound liquidity risk management in the FDIC Risk Management Manual of Examination Policies, Section 6.1—Liquidity. The evaluation factors for rating liquidity are described in the Uniform Financial Institutions Rating System.

2 Press Release. "FDIC Issues Interim Rule to Implement the Temporary Liquidity Guarantee Program". www.fdic.gov/news/news/press/2008/pr08105.html.

3 Federal Reserve Financial Services, Account Management Guide, www.frbservices.org. Information also available at www.frbdiscountwindow.org.

4 An example of an FHLB credit risk rating system matrix can be found at https://corp.fhlbatl.com/.

5 Kyle L. Hadley and Drew Boecher, "Liquidity Analysis: Decades of Change," Supervisory Insights Winter 2007. www.fdic.gov/regulations/examinations/supervisory/insights/siwin07/article01_liquidity.html.

6 For purposes of these restrictions (established under Section 337.6 of the FDIC Rules and Regulations) the terms "Well Capitalized," "Adequately Capitalized," and "Undercapitalized" shall have the same meaning to each insured depository institution as provided under regulations implementing Section 38 of the Federal Deposit Insurance Act.

7 Capital categories are defined in the FDIC Rules and Regulations, 12 CFR 325-Capital Maintenance, Subpart B-Prompt Corrective Action. www.fdic.gov/regulations/laws/rules/2000-4400.html.

8 Institutions that are Adequately Capitalized may apply to the FDIC for a waiver in accordance with FDIC Rules and Regulations, 12 CFR 337—Unsafe and Unsound Banking Practices, Section 337.6—Brokered Deposits. www.fdic.gov/regulations/laws/rules/2000-5900.html.

9 Banks that are considered Adequately Capitalized under the Prompt Corrective Action (PCA) standard must receive a waiver from the FDIC before they can accept, renew, or roll over any brokered deposit. They also are restricted in the rates they may offer on such deposits. Banks that are less than Well Capitalized under PCA standards may not offer rates of interest "significantly higher" than the prevailing market rate. Refer to FDIC Rules and Regulations, 12 CFR 337—Unsafe and Unsound Banking Practices, Section 337.6. www.fdic.gov/regulations/laws/rules/2000-5900.html.

10 Refer to FDIC Rules and Regulations, 12 CFR 337—Unsafe and Unsound Banking Practices, Section 337.6. www.fdic.gov/regulations/laws/rules/2000-5900.html.

11 Financial Institution Letter (FIL-58-2008). "Home Equity Lines of Credit Consumer Protection and Risk Management Considerations When Changing Credit Limits and Suggested Best Practices." www.fdic.gov/news/news/financial/2008/fil08058.html.

12 H.R. 1424—Emergency Economic Stabilization Act.

13 Press Release. "FDIC Issues Interim Rule to Implement the Temporary Liquidity Guarantee Program." www.fdic.gov/news/news/press/2008/pr08105.html.

14 On November 21, 2008, the FDIC Board approved for Federal Register publication the final rule for the TLGP. Changes were made to the interim rule published in the Federal Register on October 29, 2008 (73 Fed. Reg. 64179).

15 Financial Institution Letter (FIL-84-2008). "Liquidity Risk Management." https://www.fdic.gov/news/inactive-financial-institution-letters/2008/fil08084.html.

16 Bank and Thrift Call Report data for all insured institutions with assets less than $1 billion.