The assessment of capital adequacy is one of the most critical aspects of bank supervision. In completing this assessment, examiners focus on a comparison of a bank's available capital protection with its capital needs based on the bank's overall risk profile.

Bank management must likewise continuously evaluate capital adequacy in relation to risk. In recent years, many banks have adopted advanced modeling techniques intended to improve their ability to quantify and manage risks. These modeling techniques frequently incorporate the internal allocation of "economic capital" considered necessary to support risks associated with individual lines of business, portfolios, or transactions within the bank. As a result, economic capital models can provide valuable additional information that bankers and examiners can use in their overall assessment of a bank's capital adequacy.

As will be discussed later, economic capital models or similar risk and capital adequacy assessment processes are important to banks adopting the revised Basel framework. But revisions to capital regulations have not been the driving force behind the development of these models as such methodologies have been in use for more than ten years at some of the nation's largest banks. Economic capital has also become a useful and sometimes necessary tool for other insured institutions. Several regional banks and some community banks have developed or are exploring implementation of economic capital models with more banks likely to do so in the future. This article provides an introduction to the concept of economic capital, describes the relationship between economic capital and the revised Basel framework, and discusses examiner review of economic capital models as a part of the supervisory assessment of capital adequacy.

Economic Capital

Economic capital is a measure of risk, not of capital held. As such, it is distinct from familiar accounting and regulatory capital measures. The output of economic capital models also differs from many other measures of capital adequacy. Model results are expressed as a dollar level of capital necessary to adequately support specific risks assumed. Whereas most traditional measures of capital adequacy relate existing capital levels to assets or some form of adjusted assets, economic capital relates capital to risks, regardless of the existence of assets. Economic capital is based on a probabilistic assessment of potential future losses and is therefore a potentially more forward-looking measure of capital adequacy than traditional accounting measures. The development and implementation of a well-functioning economic capital model can make bank management better equipped to anticipate potential problems.

Conceptually, economic capital can be expressed as protection against unexpected future losses at a selected confidence level. This relationship is presented graphically in Chart 1.

Expected loss is the anticipated average loss over a defined period of time. Expected losses represent a cost of doing business and are generally expected to be absorbed by operating income. In the case of loan losses, for example, the expected loss should be priced into the yield and an appropriate charge included in the allowance for loan and lease losses.

Unexpected loss is the potential for actual loss to exceed the expected loss and is a measure of the uncertainty inherent in the loss estimate.1 It is this possibility for unexpected losses to occur that necessitates the holding of capital protection.

Economic capital is typically defined as the difference between some given percentile of a loss distribution and the expected loss. It is sometimes referred to as "unexpected loss at the confidence level."

The confidence level is established by bank management and can be viewed as the risk of insolvency during a defined time period at which management has chosen to operate. The higher the confidence level selected, the lower the probability of insolvency. For example, if management establishes a 99.97 percent confidence level, that means they are accepting a 3 in 10,000 probability of the bank becoming insolvent during the next twelve months. Many banks using economic capital models have selected a confidence level between 99.96 and 99.98 percent, equivalent to the insolvency rate expected for an AA or Aa credit rating.

The primary value of economic capital and the reason that banks have already adopted such methodologies is its application to decision making and risk management. Specifically, the use of such models can:

- contribute to a more comprehensive pricing system that covers expected losses,

- assist in the evaluation of the adequacy of capital in relation to the bank's overall risk profile,

- develop risk-adjusted performance measures that provide for better evaluation of returns and the volatility of returns,2 and

- enhance risk management efforts by providing a common currency for risk.

The following example illustrates how each of these potential uses could be applied at a bank.3 This example describes only credit risk quantification and its translation to economic capital for commercial lending activities. Obviously risks are evident in activities other than commercial lending, and commercial lending itself involves numerous risks in addition to credit risk.4 Banks that use economic capital models generally identify and quantify all types of risk across all lines of business throughout the bank.

Example: Economic Capital Allocation for Commercial Credit Risk

At its most fundamental level, credit risk is associated with loan losses resulting from the occurrence of default and the subsequent failure to collect in full the balances owed at the time of default.5 Expected credit losses associated with default can therefore be determined from parameters associated with the likelihood of a loan defaulting, or an estimate of the probability of default (PD) during a defined time period, and the severity of loss expected to be experienced in the event of a default, or an estimate of loss given default (LGD). Naturally, this ratio would be applied to a measure of estimated exposure at default (EAD) to convert loss expectations to dollar amounts. The resulting formula:

Expected losses ($) = PD(%) * LGD(%) * EAD($).PD and LGD parameter estimates are drawn from the bank's historical performance or from a mapping of internal portfolio risk assessments to external information sources for PD and LGD parameters. This requires that banks have in place processes that enable them to periodically assess credit risk exposures to individual borrowers and counterparties with robust internal credit rating systems that reflect implicit, if not explicit, assessments of loss probability. Definitions of credit grades should be sufficiently detailed and descriptive to clearly delineate risk level between grades and should be applied consistently across all business lines.

For example, a bank could have a ten grade credit rating system with associated one-year probabilities of default drawn from their historical default experience within each grade as shown in Table 1. In this example, the historical default rate experienced for loans internally graded as a "6" has been one percent, which is approximately equivalent to the long-term default frequency associated with an S&P credit rating of BB.

| Table 1: Example Obligor Grades and Associated Default Probabilities | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Internal Loan Grade | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Average Probability of Default | 0.03% | 0.06% | 0.10% | 0.25% | 0.50% | 1.00% | 2.50% | 8.00% | 22.00% | 100.00% |

| Mapping to External Ratings | AA | A | BBB+ | BBB | BB+ | BB | B+ | B | CCC | D |

Estimates for loss severity in the event of default could likewise be constructed. LGD grades assigned to loans are often associated with factors such as loan type, collateral type, collateral values, guarantees, or credit protection such as credit default swaps.6

Pricing Implications: A credit facility which is the same in all other respects may be priced differently based on its expected loss.7 Table 2 shows expected losses for three different borrowers with the same loan structure and collateral support resulting in a 40 percent loss severity in the event of default. The higher risk credit grade has five times the expected loss of the lower risk credit grade.

| Table 2: Expected Loss | |||||

|---|---|---|---|---|---|

| Loan Grade | PD | * | LGD | = | Loss |

| 5 | 0.50% | 40% | 20 basis points | ||

| 6 | 1.00% | 40% | 40 basis points | ||

| 7 | 2.50% | 40% | 100 basis points | ||

If a bank made middle market loans which fell into the three grade bands shown in Table 2, but priced most of these loans with an implicit loss expectation of 50 basis points, the bank is overcharging stronger borrowers and undercharging weaker borrowers. One potential result is that the bank could end up with stronger borrowers exiting the bank and find its loan pool progressively weaker and portfolio returns inadequate for losses experienced.

Although such a highly quantitative process may appear somewhat foreign to many bankers, a form of probability of default estimates is considered in the use of consumer FICO scores or banks' own internal loan scorecards. Furthermore, many banks, including many community banks, are already relating this type of analysis to their allowance for loan and lease loss determination.

Capital Adequacy: The allocation of economic capital to support credit risk begins with similar inputs to derive expected losses but considers other factors to determine unexpected losses, such as credit concentrations and default correlations among borrowers. Because borrower defaults are not perfectly correlated, the default risk of a credit portfolio is less than the sum of the risks contained in the underlying loans. Economic capital credit risk modeling therefore measures the incremental risk that a transaction adds to a portfolio rather than the absolute level of risk associated with an individual transaction. Complex models are required to derive this measure of portfolio loss volatility and translate that into an associated economic capital charge.

Table 3 shows an example of credit risk economic capital allocations (credit risk only) determined using the PD and LGD parameters previously discussed and a model translation of those parameters into a credit risk capital charge.8 The bank's obligor grades and associated PDs are shown at the top of this table. The bank's facility grades and associated loss severity estimates are shown on the left-hand side of the table. The associated capital charges represent the dollar amount of capital needed to support a $100 one-year maturity commercial loan based on parameter inputs (such as the PD estimate) and model assumptions (such as default correlations).

| Table 3: Example Economic Capital Allocations ($) for $100 1-Year Maturity Commercial Loan | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Facility Grades and Associated Loss Given Default |

||||||||||

| Obligor Grades and Associated Default Probabilities | ||||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | ||

| 0.03% | 0.06% | 0.10% | 0.25% | 0.50% | 1.00% | 2.5% | 8.00% | 22.0% | ||

| A | 10% | $0.13 | 0.23 | 0.33 | 0.62 | 0.93 | 1.30 | 1.84 | 2.84 | 4.05 |

| B | 20% | 0.27 | 0.46 | 0.66 | 1.23 | 1.85 | 2.61 | 3.67 | 5.69 | 8.10 |

| C | 30% | 0.40 | 0.69 | 1.00 | 1.85 | 2.78 | 3.91 | 5.51 | 8.53 | 12.14 |

| D | 40% | 0.54 | 0.91 | 1.33 | 2.46 | 3.71 | 5.21 | 7.35 | 11.38 | 16.19 |

| E | 50% | 0.67 | 1.14 | 1.66 | 3.08 | 4.64 | 6.51 | 9.18 | 14.22 | 20.24 |

| F | 60% | 0.81 | 1.37 | 1.99 | 3.70 | 5.56 | 7.82 | 11.02 | 17.06 | 24.29 |

| G | 70% | 0.94 | 1.60 | 2.32 | 4.31 | 6.49 | 9.12 | 12.86 | 19.91 | 28.33 |

| H | 80% | 1.08 | 1.83 | 2.66 | 4.93 | 7.42 | 10.42 | 14.69 | 22.75 | 32.38 |

| I | 90% | 1.21 | 2.06 | 2.99 | 5.55 | 8.35 | 11.72 | 16.53 | 25.60 | 36.43 |

Credit economic capital allocations for a non-defaulted $100 one-year maturity commercial loan using this model would range from as low as 13 cents to as high as $36.43. Everyone intuitively expects increased risk to be associated with lower-quality graded loans or loans with higher loss severity, but the allocation of economic capital estimates the level of risk associated with a particular grade band and differentiates risk among bands.

For example, commercial loans graded as a 5 or a 6 with an LGD of 40 percent in the table above would not likely be subject to regulatory classification or criticism; i.e., both credits would be "pass" credits. However, the economic capital allocations show a considerable difference in the inherent risk between these loans. A $100 one-year maturity commercial loan that is graded a 6 would receive a $5.21 credit economic capital allocation compared with a $3.71 allocation for a similar loan graded 5, an approximately 40 percent increase in estimated risk.

Risk-Adjusted Performance Measures: Economic capital is also used to evaluate risk-adjusted performance; without some quantification of risk associated with an activity, it is not possible to measure performance on a risk-adjusted basis. Several techniques have been developed with two such approaches that incorporate economic capital allocations demonstrated below:

- Risk Adjusted Return On Capital (RAROC), a percentage measure of performance = Economic Net Income / Economic Capital Allocation

- Economic Profit, or Shareholder Value Added (SVA), a dollar measure of performance = Economic Net Income - (Economic Capital Allocations * Hurdle Rate)9

Assume that a bank is considering the performance of two loan portfolios: Portfolios X and Y, with Portfolio X assumed to be higher risk and producing a higher return relative to Portfolio Y (see Table 4). Using internal grading parameters and economic capital modeling for credit risk, management can strengthen its evaluation of the risk return trade-off of the two portfolios.10

| Table 4: Example Risk-Adjusted Performance Measures | ||

|---|---|---|

| Portfolio X | Portfolio Y | |

| Portfolio Balances | $100,000,000 | $100,000,000 |

| Net Income before Losses* | $1,400,000 | $1,100,000 |

| Loan Parameters: | ||

| - PD | 0.50% | 0.25% |

| - LGD | 50% | 40% |

| - EL (in bps) | 25 | 10 |

| Expected Losses | $250,000 | $100,000 |

| Income after Expected Losses | $1,150,000 | $1,000,000 |

| Economic Capital (credit only)** | $4,640,000 | $2,460,000 |

| RAROC | 24.8% | 40.7% |

| Economic Profit (10% hurdle rate) | $686,000 | $754,000 |

| * Net income before losses = loan interest + fees + soft dollars - funding costs - operating costs. ** Determined from the exonomic capital charges shown in Table 3. |

||

Please note, this example considers only credit risk. Bank management would incorporate assessments of other risks in determining risk-adjusted performance.

Initially, bank management may have been inclined to select Portfolio X, based on simple return characteristics, as shown below. On a risk-adjusted basis, however, Portfolio Y is the preferred alternative. Although Portfolio X produces higher expected book and economic net income, the volatility of Portfolio X's return (i.e., risk) is not adequately compensated for in comparison to Portfolio Y. Portfolio Y generates a higher RAROC and results in a greater economic profit on a significantly lower economic capital allocation.11

| Income after Expected Losses | $1,150,000 | $1,000,000 |

| Flat Capital Charge (e.g., 8%) | $8,000,000 | $8,000,000 |

| Return on Equity | 14.4% | 12.5% |

Although the decision reached in this example resulted in lower overall credit risk, economic capital models are not designed to always favor strategies that produce lower risk. Economic capital should be viewed as a tool to enhance risk identification and selection. Decisions resulting in the acceptance of higher credit risk can be expected to occur when supported by transaction level returns that compensate for higher risk or increased portfolio diversification benefits.

Risk Management: The implications for loan pricing, capital analysis, and risk-adjusted performance measures relate directly to risk management, but economic capital, as a common currency of risk, can provide additional potential applications to the risk management process. For example, some banks use credit economic capital allocations in place of or in addition to more traditional credit hold limits based on notional exposures which may not fully capture factors such as potential loss severity, default correlations with the rest of the credit portfolio, or maturity effects on default probability.12

The preceding example focused on credit risk. But similar assessment and quantification efforts can help banks identify, monitor, and manage other risks in other lines of business as well.

The effectiveness of a bank's risk management practices is an important consideration in the supervisory evaluation of an institution and directly influences the regulatory assessment of capital adequacy. Strong risk management practices can compensate in part for higher levels of inherent risk in a bank's business activities. Recognizing this relationship, the revised Basel capital framework promotes the adoption of stronger risk management practices throughout the banking industry by incorporating industry advances in risk modeling and management into regulatory capital requirements.

Economic Capital and Basel II

The revised Basel framework seeks to create more risk-sensitive regulatory capital requirements in order to address concerns that the regulatory capital measures established by the 1988 Basel Accord do not adequately differentiate risk, and to reduce regulatory capital arbitrage activities which have eroded the relevance of current risk-based capital measures at some institutions. Many industry participants and observers have associated economic capital with the calculation of minimum regulatory capital requirements under the first pillar of the revised framework and the supervisory review process under the second pillar. As discussed below, however, economic capital and regulatory capital under the revised framework are not synonymous.

The First Pillar—Minimum Capital Requirements

The calculation of minimum regulatory capital under the revised framework relies heavily on certain inputs from the bank's assessment of its individual risk profile. For example, the calculation of the capital charge for credit risk considers the distribution of a bank's specific credit exposures among internally assigned PD and LGD grades. The translation of that risk profile into a capital charge, however, is consistent for all institutions. The required inputs follow specific slotting criteria and are applied against regulatory risk weight curves which are the same for all institutions.13 This need to ensure consistency necessarily creates differences between a bank's internal capital allocations and the minimum regulatory capital charge.

Potential differences also exist in the inputs used. For example, in its economic capital model, a bank may use a long-term estimate of LGD that covers all economic cycles, but for regulatory capital purposes, the LGD estimate should reflect economic downturn conditions for exposures where loss severities are expected to vary substantially with economic conditions.14

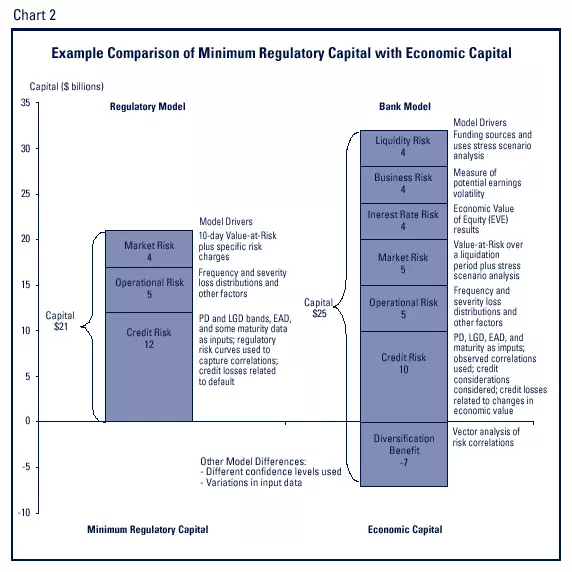

More fundamentally, the risks captured under regulatory and economic capital differ. The regulatory capital charge captures only credit, market, and operational risk. Furthermore, the regulatory capital calculation does not fully address certain aspects of these risks, such as credit concentration risk. As previously discussed, economic capital models generally address all risks arising from the bank's business activities.

Economic capital also typically incorporates a diversification benefit which is not considered in the regulatory capital calculation. This diversification benefit is a top-line measure of how changes in the risk associated with each business activity occur in relation to changes in risk in all other activities.

Chart 2 provides a graphic example of some of the potential differences between regulatory capital under the revised Basel framework and economic capital at a hypothetical bank. In this example, total economic capital allocations are higher than the regulatory minimum capital charge. While this typically may be expected to be the case, in some instances a bank could reasonably have lower economic capital allocations than regulatory capital requirements depending on the specific risk characteristics of the bank and the significance of the diversification benefit.

As demonstrated by the above discussion, a bank is not required to have a fully functional economic capital model to develop the necessary inputs for the calculation of the minimum regulatory capital charge. These inputs generally can be determined independent of any comprehensive risk measurement and management process. However, the second pillar of the revised framework creates a more direct link to a bank's own risk and capital adequacy assessments.

The Second Pillar-Supervisory Review Process

The second pillar establishes a regulatory expectation for the evaluation of how well banks assess their own capital needs. The second pillar does not explicitly require banks to adopt economic capital models. It does, however, establish an expectation for banks to perform a comprehensive assessment of the risks they face and to relate capital adequacy to these risks.15

Furthermore, the bank's own capital analysis is expected to encompass all risks, not only those risks captured by the minimum regulatory capital calculation. The revised Basel framework describes three areas not addressed in the minimum capital calculation that should be specifically considered under the second pillar:

- Risks that are not fully captured under the first pillar, such as credit concentration risk

- Risks that are not considered under the first pillar, such as interest rate risk, and

- Factors external to the bank, such as economic conditions.16

The supervisory qualification and ongoing validation of a bank's compliance with regulations implementing the revised framework will necessarily incorporate review of a bank's risk quantification efforts and capital analysis. While there is no supervisory requirement for economic capital methodologies to be employed in this process, many large institutions appear likely to use their economic capital models to demonstrate capital adequacy in relation to risk under Pillar 2.

Supervisory Review of Economic Capital

Regulators expect certain large or complex banks to perform appropriate risk quantification and capital analysis regardless of whether the bank is subject to the revised Basel framework. This is particularly important at banks where more traditional capital adequacy measures may not adequately capture the inherent risk of their business activities, such as at banks heavily engaged in securitization activities. An economic capital model is one tool available for such analysis.

At banks where economic capital models are used, considerable supervisory effort is focused on the process. Examiners consider both the adequacy of economic capital processes and the results of such processes in their supervisory evaluation of the bank. Furthermore, as discussed later in this article, examiners may find it beneficial to modify certain traditional examination procedures to more fully evaluate risk management practices associated with the economic capital process and other risk modeling techniques.

Process Review

When properly used, economic capital models can improve risk management and the evaluation of capital adequacy. However, these models can suffer from data limitations, erroneous assumptions, inability to sufficiently quantify risks, and potential misuse or misunderstanding of model outputs. Examiner assessment of the appropriateness of a bank's capital adequacy analysis, potentially including economic capital methodologies, can be a consideration in the supervisory evaluation and rating of bank management. Institutions found to have material weaknesses in their methodologies may be directed to strengthen risk measurement and management capabilities.

The supervisory approach used to evaluate a bank's economic capital process will necessarily vary based on the complexity of the institution and the extent of use of the economic capital process by bank management. Examination guidance on economic capital models is limited. Federal Reserve Board Supervisory Letter SR 99-18 and the second pillar of the revised Basel framework do not specifically address economic capital methodologies, but both documents describe the supervisory review of a bank's capital analysis process. Many of the principles discussed in these documents are included in the general review concepts examiners may want to consider that are discussed below.

Evaluate the adequacy of board and management oversight concerning economic capital. Management is responsible for understanding the nature and level of risks undertaken in the bank's activities and how these risks fit within the overall business strategy of the bank. To evaluate this oversight, examiners could review:

- specific board approval of risk tolerances and associated capital levels

- periodic economic capital reports provided to the board and senior management. Such reports should be sufficient to allow the board and management to evaluate risk exposures, determine that the bank holds sufficient capital relative to identified risk, and incorporate capital needs into the strategic planning process.

Determine that economic capital methodologies appropriately incorporate all material risks. At a minimum, this should include assessments of credit, market, operational, liquidity, and business risks. To make this determination, examiners could review:

- a mapping of data inputs to material exposures, ensuring accuracy and completeness

- documentation supporting the appropriateness of specific risk quantification techniques

- analysis supporting the reasonableness and validity of stress tests and scenarios used

- analysis and testing of model sensitivity to key assumptions and data inputs used

- model validation work, including, where appropriate, the evaluation of developmental evidence, process verification, benchmarking, and back-testing.

Evaluate the control environment. Controls should be in place to ensure the integrity of data inputs and the overall management process. In evaluating such controls, examiners could consider:

- the quality of management information systems, including the timeliness of incorporation of changes in the bank's risk profile

- internal or external audit program review of economic capital methodologies

- the corporate governance structure as it relates to risk management and economic capital.

Determine the extent to which the economic capital process is used in decision making, such as in setting risk limits or evaluating performance. Economic capital processes that are in place but not integrated with the institution's risk management procedures generally are ineffective.

Results Review

The results of economic capital models can provide examiners another tool in the supervisory evaluation of capital adequacy, enabling examiners to compare tangible capital levels (capital available to support risk) with economic capital levels (the bank's own measure of its risk). As has always been the case, an institution found to hold inadequate capital in relation to risk, regardless of the institution's compliance with minimum regulatory capital requirements, is expected to take appropriate actions to reduce risk or increase capital.

Banks generally operate with a capital cushion above the level of risk measured by the economic capital model, recognizing the imprecision inherent in such estimation and the need for the bank to be responsive to potential changes in conditions. Several factors can be considered in determining the appropriate cushion, including:

- the robustness of the bank's economic capital methodologies,

- the quality of data inputs, assumptions, and parameters,

- volatility of the business model,

- the composition of capital,17 and

- external factors, such as business cycle effects and the macroeconomic environment.

Incorporation into the Overall Supervisory Process

The development and implementation of risk models such as economic capital often represents a significant change in a bank's overall risk management philosophy and practices. Likewise, the overall supervisory process for banks adopting economic capital models can be affected as examination focus may shift more to process evaluation. Transactional testing would continue to figure prominently in the examination function, but the purpose of transactional testing may be redirected to validation.

For example, the earlier discussion of commercial lending credit risk highlights the need for examiners to focus on validating the accuracy of the loan grading process at all grade bands rather than concentrating their attention primarily on large or criticized facilities. The classification of individual loans becomes integrated with the evaluation of the bank's internal loan grading system.

Furthermore, economic capital results can provide useful information for risk-scoping. Examiners can incorporate the bank's risk quantification efforts and trends in economic capital allocations as another tool to better focus supervisory efforts on areas of high or increasing risk.

The use of economic capital and other risk modeling techniques is expected to continue to evolve and expand to more industry participants. Supervisory evaluations of banks are also changing to appropriately incorporate such advances by the industry.

Robert L. Burns, CFA, CPA

Senior Examiner, Large Financial Institutions

The author thanks numerous colleagues within the FDIC and at other regulatory agencies who provided invaluable edits, comments, and suggestions for this article.

1 Unexpected loss is often described as the volatility of loss around the average over time.

2 Risk-adjusted performance is typically measured at the business unit level, but can also be used to evaluate how individual business unit returns contribute to a bank's overall profitability and risk profile.

3 Specific methodologies, such as the use of a default-only measure of credit risk discussed in the example, should be viewed as potential approaches rather than as the only or best alternative.

4 Such as interest rate risk and operational risk associated with underwriting and servicing of loans.

5 The example describes a default-only perspective to derive a loss distribution; i.e., loan defaults create credit losses. Some banks have adopted a more robust perspective for credit loss which considers the probability distribution of obligor grade migration and resulting changes in the economic value of the loan; i.e., a decline in the credit quality of a loan regardless of any default creates credit losses.

6 Some banks consider guarantees and credit protection as substitutes for the borrower and therefore use guarantor or counterparty PDs in place of borrower PDs, while other banks retain the borrower PD and consider guarantees and credit protection in determining LGD.

7 Pricing models are considerably more complex than the simplistic approach shown in this example. This discussion is merely intended to show that expected losses are often built into the pricing of loans.

8 The credit economic capital allocations shown in the table were derived using the regulatory capital calculation for corporate credit exposures under the revised Basel framework. Refer to International Convergence of Capital Measurement and Capital Standards, June 2004 text, Basel Committee on Banking Supervision. As discussed later in this article, the regulatory capital calculation under the revised framework differs in important ways from economic capital methodologies, but is used for illustrative purposes in this example as a proxy for an economic capital methodology to avoid disclosing information about proprietary models used by any bank. The table includes nine obligor grades and nine facility grades; the tenth borrower grade previously discussed was for defaulted loans and is not shown as the methodology for estimating risk in defaulted exposures varies considerably among institutions.

9 The hurdle rate can be viewed as the firm-wide cost of capital. Returns above the hurdle rate add to shareholder value and those below, while perhaps profitable, detract from shareholder value.

10 In many banks, risk-adjusted performance measures are built into the determination of compensation for line of business managers and staff, directly influencing behavior at the business line level. Often, both a dollar level of risk-adjusted performance, such as SVA, and a percentage measure, such as RAROC, are used.

- Percentage measures of performance are often used because dollar measures may not provide sufficient information to distinguish between alternative acceptable investments. For example, two portfolios could produce the same dollar measure of risk-adjusted performance, but one could require substantially larger capital allocations.

- Dollar measures of performance may be used because managers might be inclined to reject an investment that would generate positive SVA if that investment generated a RAROC that was lower than their existing business line RAROC. For example a manager might choose to reject an otherwise desirable investment with a 20 percent RAROC if his line of business had an average RAROC of 25 percent.

11 Note that Portfolio X and Portfolio Y, when considering credit risk only, would be acceptable to management as both generate positive economic profit assuming a hurdle rate of 10 percent.

12 Intuitively, longer maturity loans to the same borrower entail greater credit risk; i.e., the default risk of a five year loan to a borrower, even a borrower of strong credit quality, is significantly greater than a six-month loan to the same borrower. However, traditional credit hold limits, such as notional exposures by loan grade, rarely capture this maturity effect. Credit economic capital allocations frequently adjust the one-year PD estimates for an obligor to reflect the differences in credit risk resulting from facility maturity.

13 The regulatory risk-weight curves serve as a proxy for default correlations, with the expected default experience among weaker commercial borrowers (credits with higher PDs) assumed to be less correlated with systemic risk (overall economic conditions).

14 Paragraph 468 of the revised Basel framework. International Convergence of Capital Measurement and Capital Standards, June 2004, Basel Committee on Banking Supervision.

15 Paragraph 732 of the revised Basel framework: "All material risks faced by the bank should be addressed in the capital assessment process. While the Committee recognizes that not all risks can be measured precisely, a process should be developed to estimate risk." International Convergence of Capital Measurement and Capital Standards, June 2004, Basel Committee on Banking Supervision.

16 Paragraph 724, International Convergence of Capital Measurement and Capital Standards, June 2004, Basel Committee on Banking Supervision.

17 This is particularly critical when considering the capacity of various elements of capital to absorb losses under stress scenarios.