The entry of new institutions helps to preserve the vitality of the community banking sector, fill important gaps in local banking markets, and provide credit services to communities that may be over- looked by other financial institutions.

The FDIC is supportive of the formation of new financial institutions and welcomes applications for deposit insurance. To help promote understanding of the de novo application and supervisory process, this article provides an overview of trends in de novo formation; the process by which the FDIC reviews applications for deposit insurance; the supervisory process for de novo institutions; and steps the FDIC is taking to support de novo formations.

Trends in De Novo Formation

Recent FDIC research on new bank formation since 2000 highlights both the economic benefits of de novo banks and their vulnerability to economic shocks.1 Of the more than 1,000 new banks formed between 2000 and 2008, 634 institutions were still operating as of September 2015, holding $214 billion in total loans and leases. FDIC researchers also found that the failure rate of banks established between 2000 and 2008 was more than twice that of small established banks—consistent with previous research that found de novo banks to be susceptible to failure under adverse economic conditions. These findings underscore the importance of promoting the formation of new banks and establishing an effective application process and supervisory program that will ensure new banks adopt appropriate risk-management practices and enhance their prospects for long-term success.

de novo formation has always been cyclical. A drop in de novo activity also occurred after the last financial crisis in the 1980s and early 1990s, when de novo bank formation declined to historically low levels before recovering as economic conditions improved. Notable surges in de novo activity occurred during economic upswings in the early 1960s, early 1970s and early 1980s. Following the banking crisis of the 1980s and early 1990s, de novo activity surged again in the mid-1990s and the early 2000s.

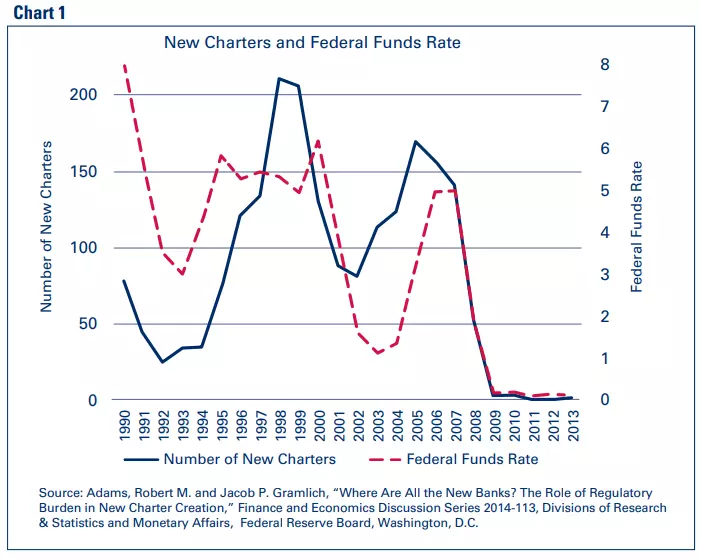

Even with the recovery in community bank earnings following the recent financial crisis, low interest rates and narrow net interest margins have kept bank profitability ratios (return on assets and return on equity) well below pre-crisis levels, making it relatively unattractive to start new banks. Recent research by economists at the Federal Reserve suggests that economic factors alone—including a long period of zero interest rates—explain at least three quarters of the post-crisis decline in new charters, as illustrated in Chart 1.2 If this model is accurate, one would expect the rate of new charters to rise as interest rates normalize.

Yet there may be tentative signs of an uptick in interest in forming de novos even though interest rates remain at historically low levels. Over the past several quarters, the FDIC has seen indications of increased interest from prospective organizing groups in filing applications for new insured depository institutions.

Application Process for Deposit Insurance

Section 5 of the Federal Deposit Insurance Act (FDI Act) requires any proposed depository institution seeking Federal deposit insurance to file an application with the FDIC.

Before filing an application, the FDIC encourages organizing groups for proposed new depository institutions to participate in a pre-filing meeting. This meeting frequently occurs with staff in the FDIC regional office that will receive the application. During a pre-filing meeting, FDIC staff explains the application process, including general timelines for application processing as well as any special information needs and other matters unique to the proposal. The goal is to inform applicants about the necessary information for their filing to facilitate the review process.

Application Requirements

FDIC rules and regulations describe the application requirements in detail.3 Proposed new depository institutions apply for Federal deposit insurance by filing an Interagency Charter and Federal Deposit Insurance Application form (Application) with the appropriate FDIC regional office.4 The Application collects information that the chartering authority and the FDIC will need to evaluate the charter and insurance applications, respectively. The Application requests information on seven main topics: an overview of the proposed institution’s operations; its business plan and proposed policies; details on its management team, including its board of directors; a description of the type and amount of capital to be raised, including any plans for employee stock ownership plans or stock incentives; how the institution will meet the convenience and needs of the community to be served; a description of the premises and fixed assets at inception; a description of the information systems to be used by the institution; and any other relevant information.

Applicants must answer all questions in the form and provide supporting information setting forth the basis for the applicant’s conclusions. In cases where information is not available at filing time, the FDIC will determine whether the information is necessary to begin the evaluation of the application. If additional information is needed, the FDIC will send the applicant a written request identifying the items needed. If not, the FDIC will deem the application substantially complete and begin its review and evaluation of the proposal.

Statutory Conditions

Since 1935, governing statutes have required that the FDIC consider specific factors when evaluating applications for deposit insurance. The current statutory factors, set forth in Section 6 of the FDI Act, include:

- The institution’s financial history and condition;

- The adequacy of its capital structure;

- Its future earnings prospects;

- The general character and fitness of its management;

- The risk presented by the institu- tion to the Deposit Insurance Fund;

- The convenience and needs of the community to be served by the institution; and

- Whether the institution’s corporate powers are consistent with the purposes of the FDI Act.5

Evaluation of the Application

While these statutory factors serve as the foundation of the Application, the FDIC Statement of Policy on Applications for Deposit Insurance provides guidance to FDIC staff and the industry about the FDIC Board’s expectations for staff’s evaluation of the statutory factors.6 Evaluation of the Application is carried out at both the field office level and regional office level, and is coordinated by a regional office case manager, who is assigned responsibility for the ongoing supervision and monitoring of the institution once it opens for business.

At the field office level, an examiner from the local area will review the Application and then meet with the organizers and proposed directors to ascertain their understanding of the responsibilities they are taking on as directors, their abilities to execute the business plan, and their commitment to the proposed bank. The examiner documents the findings relative to each of the statutory factors and opines as to whether the criteria under each area has been met. The examiner submits this report to the assigned case manager.

At the regional office level, the case manager reviews the examiner’s report for accuracy and consistency with FDIC policy. The case manager prepares a summary of the major findings of the examiner’s report as it relates to each of the statutory factors, and concludes with a recommendation for action: conditional approval or denial. The recommendation is considered by regional management in consultation with management of the FDIC’s Division of Risk Management Supervision in Washington (the division), and it is acted upon by the region, the division or the FDIC Board of Directors, depending upon the application characteristics.7

Conditions of Approval

The FDIC imposes certain standard conditions on all institutions that are granted Federal deposit insurance.8 These conditions include such items as minimum initial capital, minimum ongoing capital requirements for the three-year de novo period, minimum fidelity bond insurance coverage, and financial statement audit requirements during the de novo period.

The FDIC may also impose non-standard or prudential conditions on a case-by-case basis. Typically, nonstandard conditions are used when the FDIC determines, through the examiner’s review and the case manager’s summary, that additional controls are appropriate or necessary to either mitigate risks that are unique to the proposal or to ensure that actions or activities in process at the time of approval are completed before insurance becomes effective. The most common nonstandard conditions require FDIC approval of business plan changes, employment agreements and stock option plans, bank policies, and additional directors or officers.

The majority of nonstandard conditions are in effect only during the three-year de novo period. However, nonstandard conditions may be imposed for any length of time that is deemed necessary to mitigate the relevant risk. For example, certain monoline institutions are subject to heightened supervisory expectations to mitigate risks associated with engaging in a single line of business.

Supervisory Approach to De Novos

The FDIC’s Risk Management Manual of Examination Policies describes the supervision program for de novo institutions. The Manual states that newly chartered and insured institutions are to have a limited scope examination (visitation) within the first six months of operation and a full scope examination within the first twelve months of operation. Subsequent to the first examination and through the third year of operation, at least one examination is to be performed each year. The goal of the close supervisory attention in an institution’s formative years is to help ensure its success.

In August 2009, the FDIC imposed nonstandard conditions in extending from three to seven years the period during which de novo state nonmember banks were subject to higher capital maintenance requirements and more frequent examinations. The FDIC also required de novo state nonmember banks to obtain prior approval from the FDIC for material changes in business plans (FIL 50-2009). These nonstandard conditions were put into place at that time because institutions insured less than seven years were overrepresented among the bank failures that began in 2008, with many of the failures occurring during the fourth through seventh years. Out of 1,042 de novo institutions chartered between 2000 and 2008, 133 (12.8 percent) failed, representing more than double the failure rate of 4.9 percent for established small banks.9 Moreover, a number of de novo institutions pursued business plan changes during the first few years that led to increased risk and financial problems while failing to have adequate controls and risk management practices. Given the ongoing improvement in post-crisis industry performance, the FDIC recently rescinded this policy, returning to a three-year de novo period in April 2016.

FDIC Actions To Support the Formation of New Institutions

The FDIC continues to monitor developments with respect to the formation of new banking institutions and recently announced a number of initiatives to support the efforts of viable organizing groups. These initiatives, which began in 2014, support the development, submission, and review of proposals to organize new institutions.

In November 2014, the FDIC issued Deposit Insurance “Questions and Answers” (Q&As) to help applicants develop proposals to obtain Federal deposit insurance. In issuing the Q&As, the FDIC addressed concerns raised by commenters through the decennial regulatory review process required by the Economic Growth and Regulatory Paperwork Reduction Act (EGRPRA). The Q&As provide additional transparency to the application process and augment the FDIC’s Statement of Policy on Applications for Deposit Insurance. Topics addressed in the Q&As include pre-filing meetings, processing timelines, capitalization, and initial business plans.

In March 2015, the FDIC provided an overview of the deposit insurance application process during a conference of state bank supervisory agencies. This session was followed by an interagency training conference hosted by the FDIC in September 2015 to promote coordination among state and Federal regulatory agencies in the review of charter and deposit insurance applications. Supervisory participants in the conference included the FDIC, state banking agencies, the Federal Reserve System, and the Office of the Comptroller of the Currency.

As mentioned earlier, on April 6, 2016, the FDIC reduced from seven years to three years the period of enhanced supervisory monitoring of newly insured depository institutions. The FDIC had established the seven- year period during the financial crisis in response to the disproportionate number of newly insured institutions that were experiencing difficulties or failing. In the current environment, and in light of strengthened, forward- looking supervision, the FDIC determined it was appropriate to return to the three-year period.

Also, in April 2016, the FDIC supplemented its previously issued Deposit Insurance Q&As to address multiple issues related to business plans. The FDIC intends to issue additional Q&As as needed to help organizing groups understand specific aspects of the deposit insurance application process.

The FDIC is preparing a publication designed to serve as a practical guide for organizing groups from the initial concept through the application process; it also will include post-approval considerations. The publication will focus on those issues that frequently have been identified as obstacles to the FDIC’s ability to favorably resolve the statutory factors enumerated in Section 6 of the FDI Act that are applicable to the FDIC’s approval of Federal deposit insurance applications. This resource will address topics such as developing a sound business plan, raising financial resources, and recruiting competent leadership, each of which helps to ensure that every new institution is positioned to succeed. The FDIC plans to have this publication available later this year.

The FDIC has designated professional staff within each regional office to serve as subject matter experts for deposit insurance applications. These individuals are points of contact to FDIC staff, other banking agencies, industry professionals, and prospective organizing groups. They serve as an important industry resource to address the FDIC’s processes, generally, and to respond to specific proposals.

Finally, the FDIC is planning outreach meetings in several regions around the country to ensure that industry participants are well informed about the FDIC’s application review processes and the tools and resources available to assist organizing groups.

Conclusion

In conclusion, the current economic environment with narrow net interest margins and modest overall economic growth remains challenging for U.S. banks and the establishment of de novo institutions. The FDIC is committed to working with and providing support to groups with an interest in organizing a bank. As outlined earlier, the FDIC continues its efforts to provide interested organizing groups with a clear path to forming a new insured depository institution.

Applications staff in the Division of Risk Management Supervision

1 Lee, Yan and Chiwon Yom, “The Entry, Performance, and Risk Profile of de novo Banks,” FDIC Center for Financial Research Working Paper 2016-03, April 2016. https://www.fdic.gov/analysis/cfr/2016/wp2016/2016-03.pdf.

2 Adams, Robert M. and Jacob P. Gramlich, “Where Are All the New Banks? The Role of Regulatory Burden in New Charter Creation,” Finance and Economics Discussion Series 2014-113, Divisions of Research & Statistics and Monetary Affairs, Federal Reserve Board, Washington, D.C.

http://www.federalreserve.gov/econresdata/feds/2014/files/2014113pap.pdf.

3 The procedures governing the administrative processing of an application for deposit insurance are contained in part 303, subpart B, of the FDIC’s rules and regulations (12 CFR part 303).

4 https://www.fdic.gov/formsdocuments/f6200-05.pdf.

5 12 U.S.C. § 1816.

6 63 Fed. Reg. 44756, August 20, 1998, effective October 1, 1998; amended at 67 Fed. Reg. 79278, December 27, 2002.

7 For example, authority to act is retained by the FDIC Board of Directors on applications for institutions that are more than 25 percent foreign-owned or controlled, institutions that share common ownership with a foreign institution without a common parent company, institutions organized as industrial loan companies, and institutions that would raise unique or unprecedented policy matters.

8 These standard conditions are contained in a Resolution of the FDIC Board of Directors dated December 2, 2002, delegating authority for action on certain application matters, including applications for Federal deposit insurance. See https://www.fdic.gov/regulations/laws/matrix/.

9 Lee and Yom. April 2016.